- Examining the Cardano price prediction as ADA defends its $1 support.

- Massive liquidity at $1.0 and $1.25 could be ADA’s price magnets.

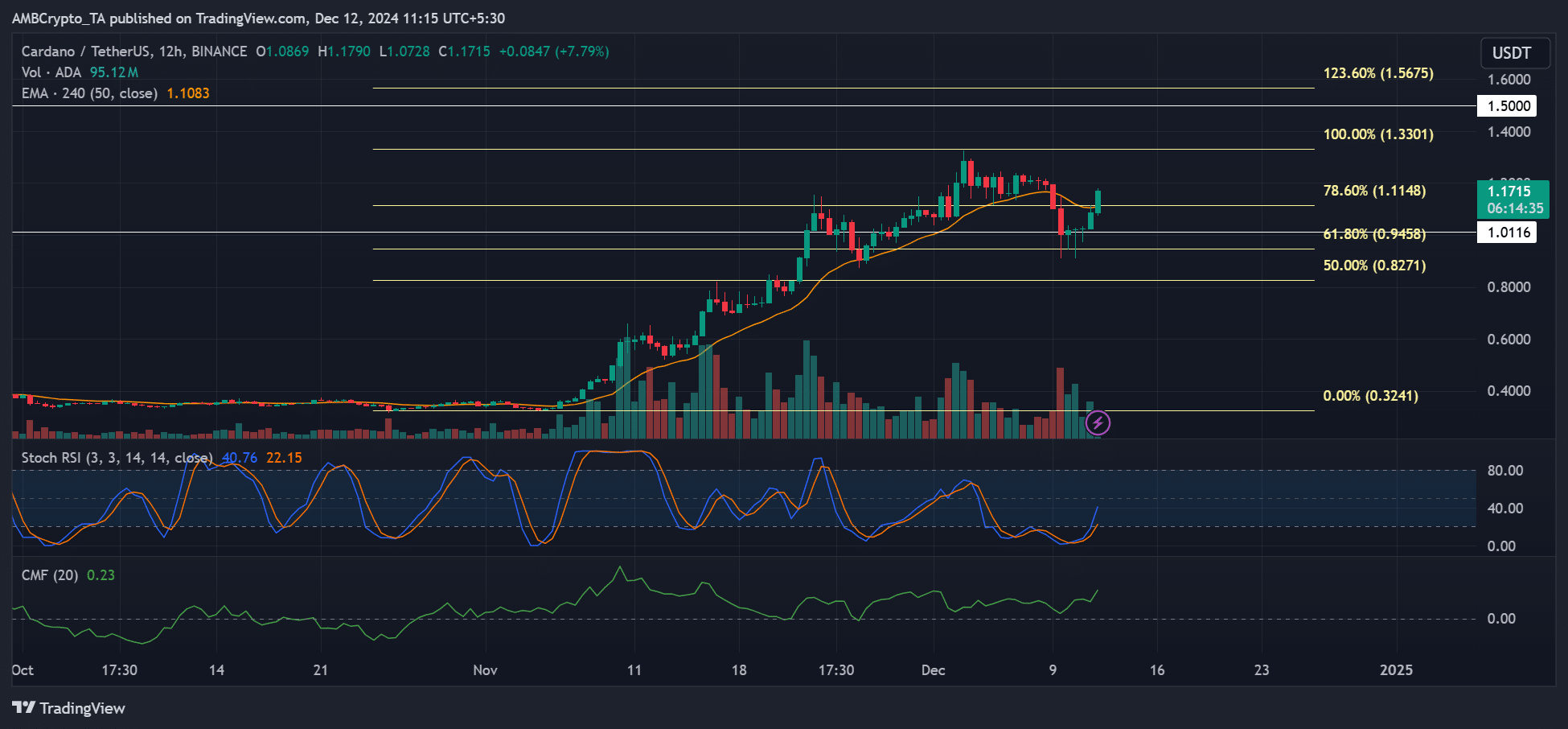

After an earlier week reset, altcoins recovered as Bitcoin [BTC] dominance (BTC.D) slipped from 57.8% to 56%. Cardano [ADA] saw renewed capital inflows, triggering nearly 30% recovery gains as of this writing.

ADA’s strong rebound

Source: ADA/USDT, TradingView

The rebound effectively reclaimed the 4-hour 50-EMA (Exponential Moving Average) and reinforced a short-term bullish trend.

However, bulls should consider key factors. A strong move could increase the odds of capturing a recent high of $1.3 or even the next target at $1.5.

In fact, if the 2021 pattern repeats, the $1.5 target could be a matter of ‘when’ as ADA continues defending the $1 support.

Source: ADA/USDT, TradingView

In 2021, ADA fluctuated between $1-$1.5 for several weeks before surging toward $3. If the trend repeats, $1.5 could be tapped.

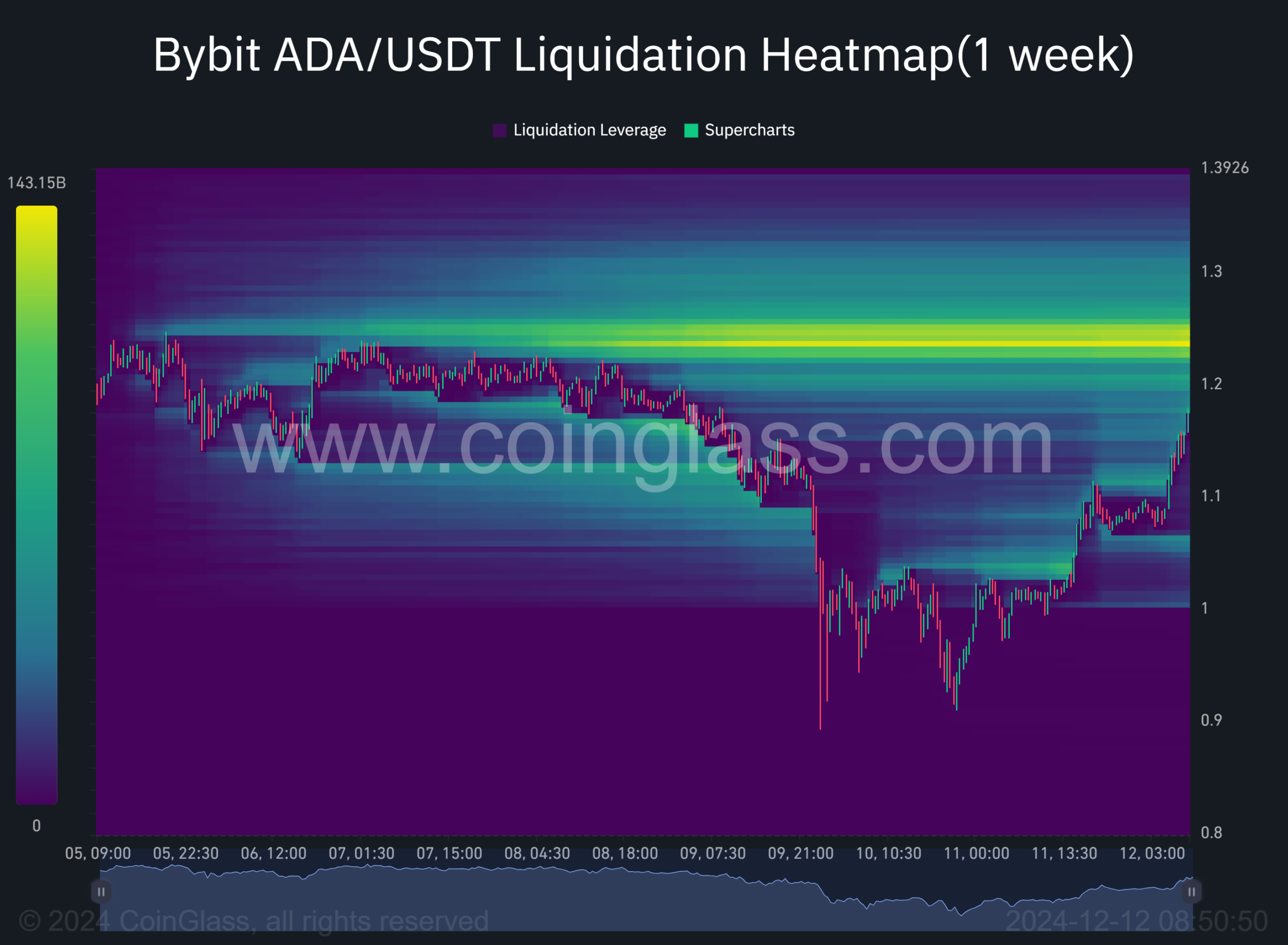

But the immediate target at $1.24 had a massive liquidity pool (leveraged shorts), which could attract price action but stall it if it fails to blast through.

Cardano key levels

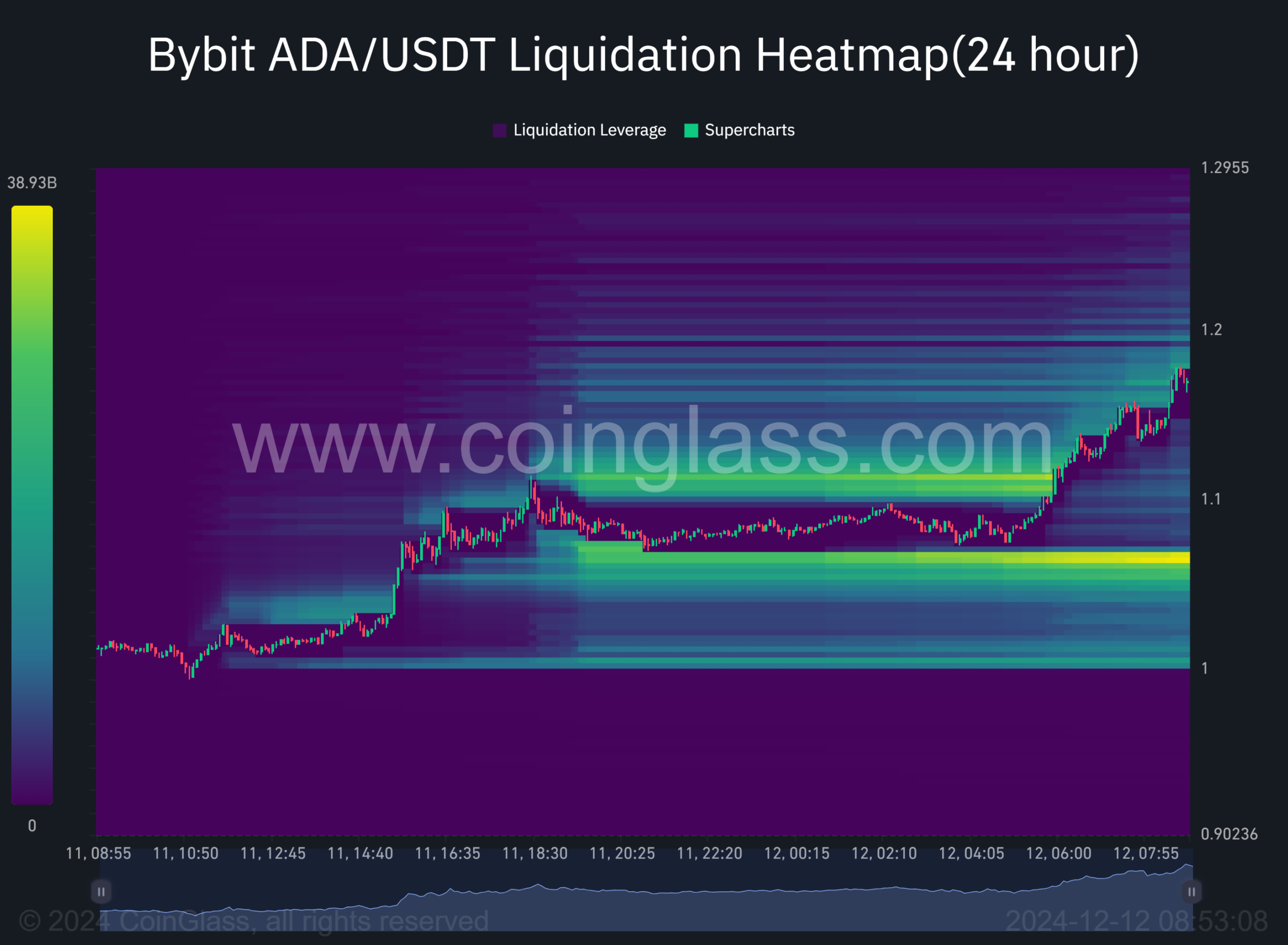

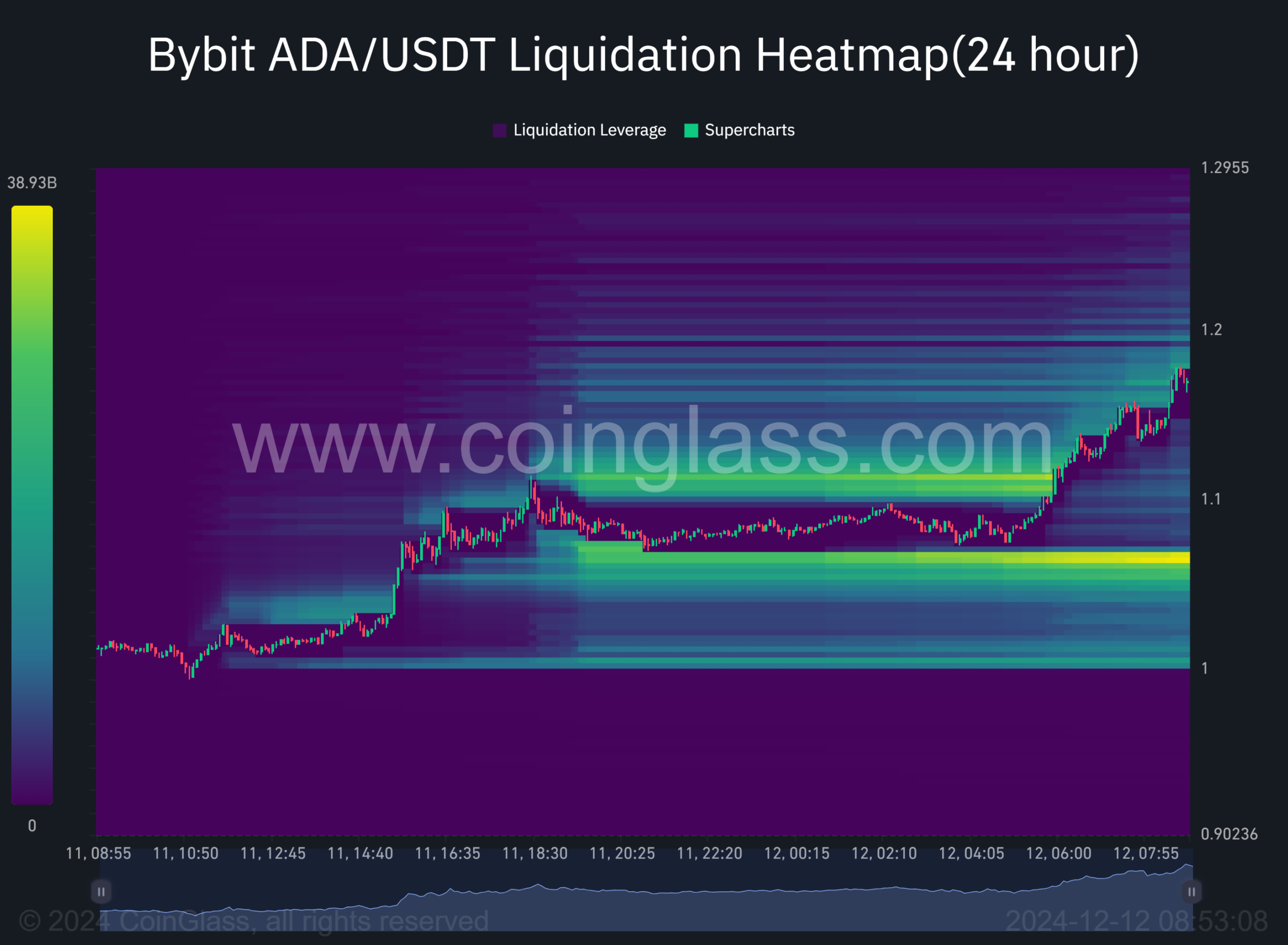

According to ADA’s liquidation heatmap on the Bybit exchange, the weekly charts had over $143B worth of leveraged short positions (bright orange levels) between $1.23 and $1.25.

This massive liquidity could attract price, but whether it will blast above it remains to be seen.

Source: Coinglass

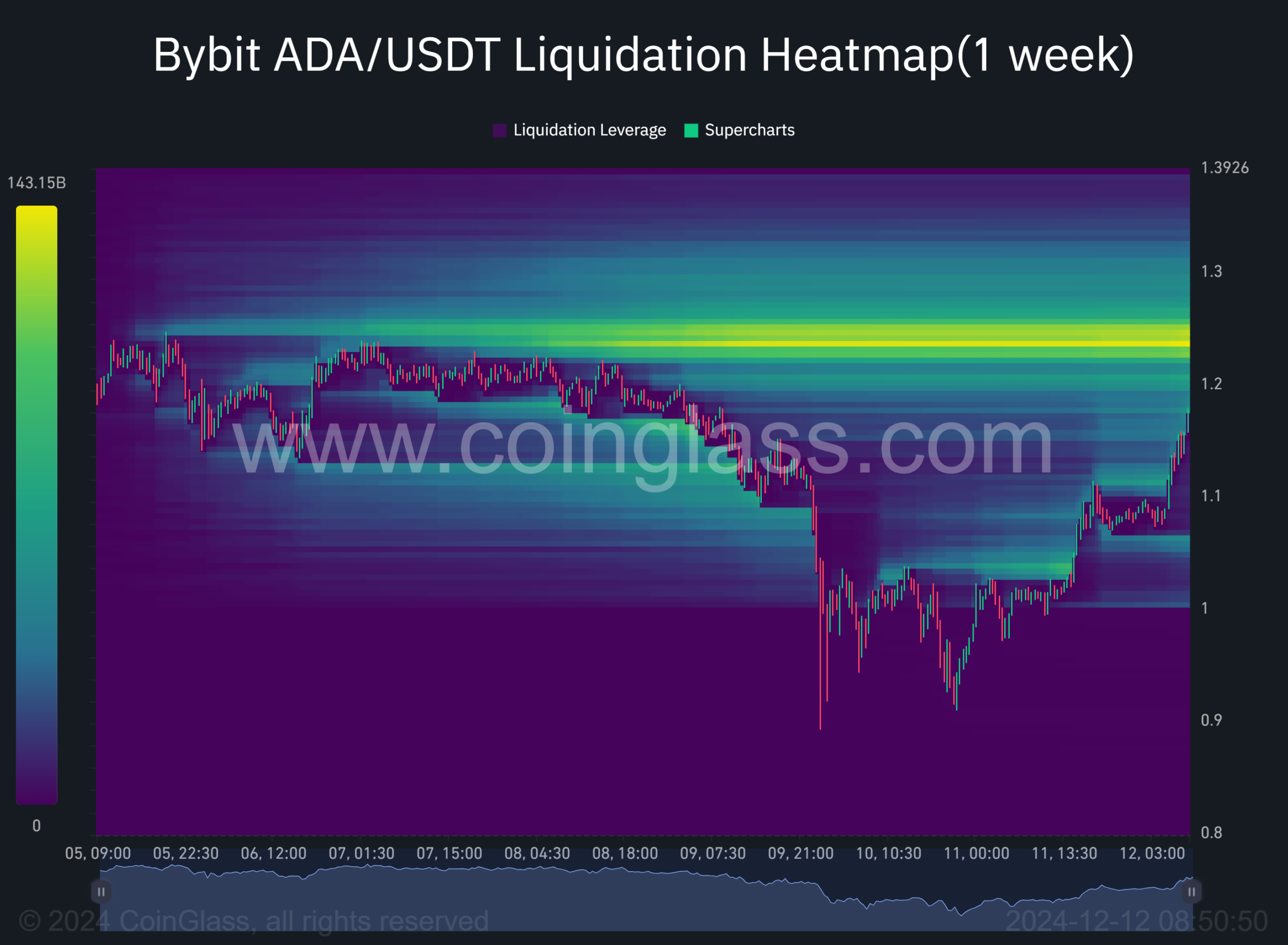

On the 24-hour chart, there was also considerable liquidity (over $40B) in leveraged long positions piled at $1.0.

Based on the liquidation heatmap, the $1.0 and $1.25 levels were key support and resistance levels.

Source: Coinglass

Read Cardano [ADA] Price Prediction 2024-2025

However, since price tends to follow liquidity, the closest liquidation level to the current price action was $1.23-$1.25.

The price could target $1.25 or $1.3 before sliding to $1.0 again. However, a short squeeze and strong move above $1.3 could make $1.5 reachable.

Disclaimer: The information presented does not constitute financial, investment, trading, or other types of advice and is solely the writer’s opinion