- NEIRO’s recent gains marked the beginning of what could be a major rally in the upcoming trading sessions

- Several technical indicators and market charts pointed to the possibility of a 151.18% price hike

Over the last 24 hours, NEIRO has been one of the market’s standout performers, with gains of 33.02% on the charts. This surge highlighted growing market interest, while also positioning NEIRO as the second-largest asset by percentage gains over the aforementioned timeframe.

According to an analysis from AMBCrypto, this bullish momentum is likely to continue, driving the price to even higher levels.

Symmetrical triangle strengthens bullish momentum

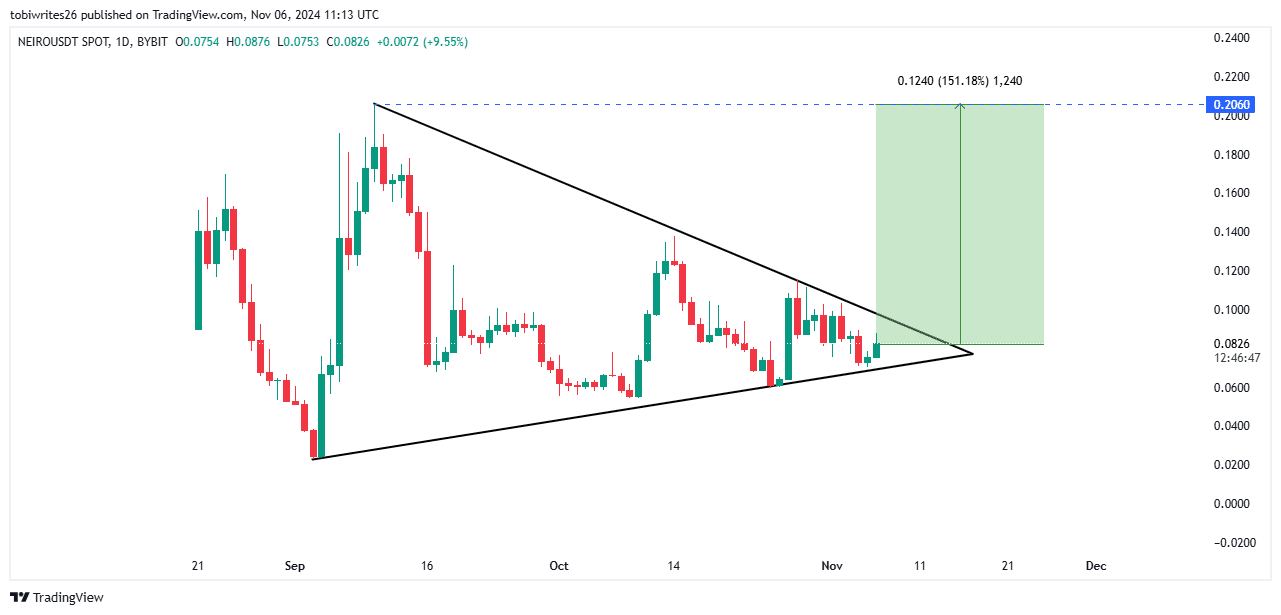

NEIRO, at the time of writing, was trading within a symmetrical triangle pattern, marked by converging support and resistance lines. This pattern is often a precursor to a breakout, one where the price moves towards the apex of the formation.

If this pattern is breached, NEIRO could note a significant rally, with the potential for a 151.18% surge. This might push the price to $0.2060 — The peak of the channel.

Source: Trading View

Owing to a remarkable 251.62% hike in trading volume over the past 24 hours, the probability of an impending rally is high. Especially as NEIRO breaks through this bullish pattern.

AMBCrypto’s analysis of other market metrics further confirmed that bullish sentiment continues to dominate. What this means is that the upward momentum might be set to persist, at least in the short term.

Additional bullish indicators emerge for NEIRO

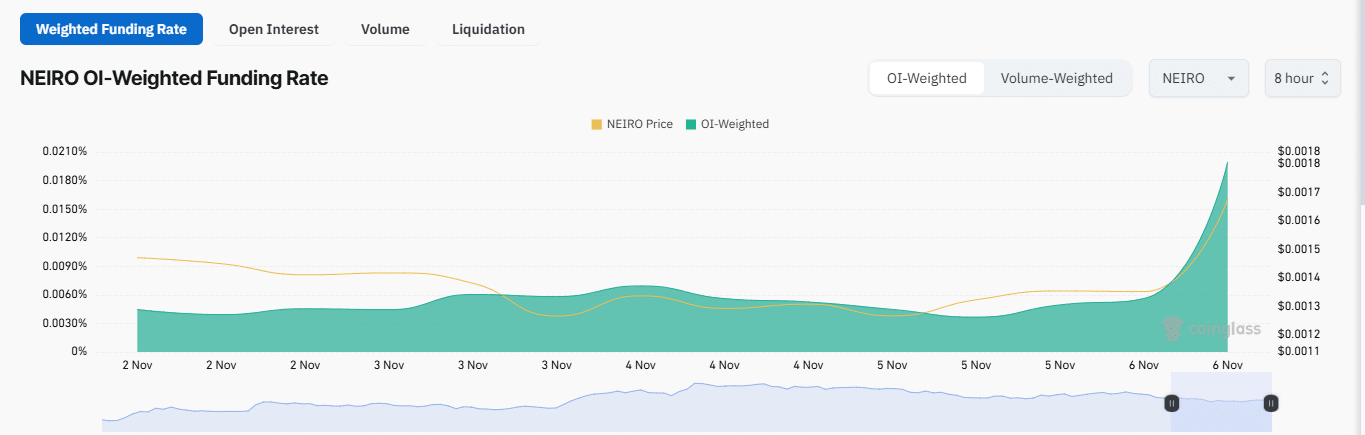

NEIRO also recorded a sharp uptick in its Weighted Funding Rate. According to Coinglass, the rate has risen by 0.0199% – A sign of strong bullish sentiment in the market.

Here, it’s worth noting that weighted funding rate represents the average funding rate across multiple exchanges, adjusted for each exchange’s trading volume or Open Interest. This provides a more accurate reflection of market sentiment for perpetual Futures contracts.

Source: Coinglass

Additionally, Open Interest, which measures the total value of unsettled derivative contracts for an asset, climbed by 52.30%, hitting $131.89 million. A hike of such significance highlighted the strength of the market, particularly among long traders.

If this trend persists, NEIRO may be set to breach its press time pattern and continue its upward trajectory.

Massive withdrawals signal positive sentiment for NEIRO

Finally, the market has seen significant outflows over the last seven days, placing NEIRO’s exchange balances in the negative – Another sign of bullish sentiment among investors.

With $30.07 million worth of NEIRO withdrawn during this period and the asset being moved to more secure wallets, the impact on NEIRO’s price trajectory is clear.