Scammers often target house hunters, perceiving them to be easy targets because they are particularly eager for deals, given how large a share of one’s income is allocated toward purchasing a home.

In 2022, more than 40 million homebuyers and renters were cost-burdened in the U.S., given that they spent at least 30% of their income on housing, according to a CBS News analysis of U.S. Census Bureau data. At the same time, from 2018 to 2023, nearly 70,000 instances of real estate and home rental-related cybercrimes were reported to the the FBI, resulting in roughly $1.4 billion in losses to consumers, according to a CBS News tally of figures from the FBI’s Internet Crime Complaint Center.

The data illustrates that scammers are increasingly targeting Americans during the homebuying process, and preying upon their hopes for some financial relief when purchasing.

On social media platforms, scammers sometimes pose as representatives from government programs for low-income housing. For example, a waiting list posted on Facebook alleging to be for the federal housing choice voucher program, or Section 8 housing, was actually generated by scammers, a local news report from July found.

In scams such as these, unsuspecting homeseekers fill out a phony application they believe will land them on a waitlist, but really just feeds their personal data to criminals, who then use the information to commit fraud, according to the U.S. Department of Housing and Urban Development.

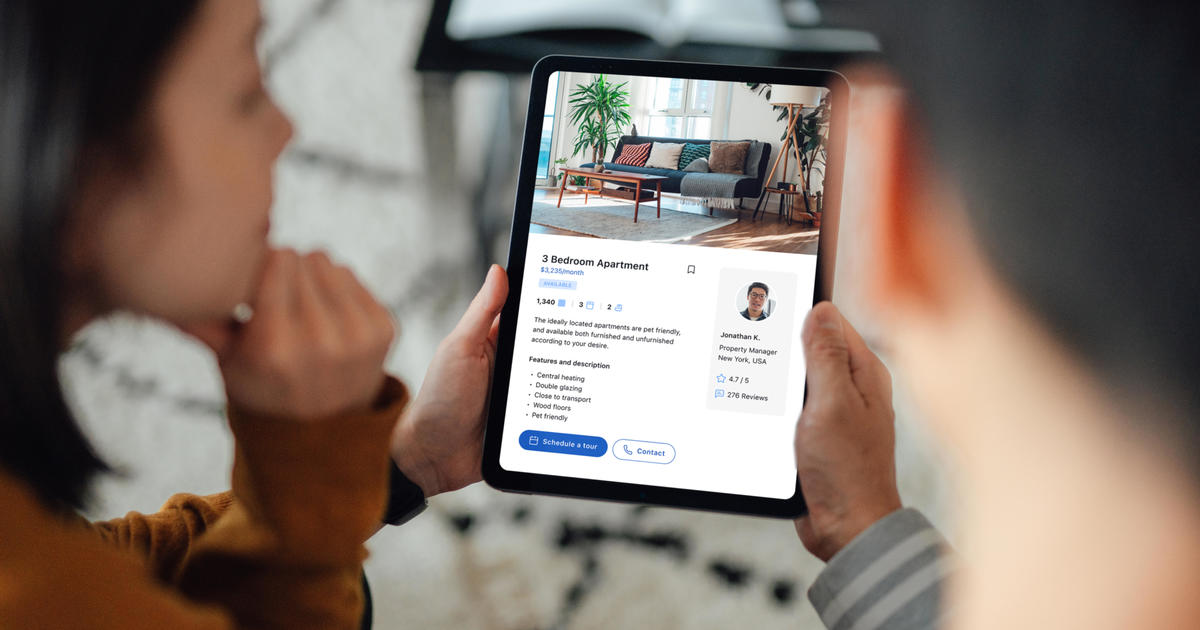

Fake housing listings from criminals posing as legitimate sellers are also proliferating online. The scams tend to promote unrealistically low prices on apartment rentals or homes using doctored images of residences. Known as seller impersonation fraud, the scam involves bad actors who impersonate real owners of homes, and steal victims’ cash by requesting up-front payment on far-fetched, fake deals.

In one such instance a Kansas couple found their $1 million-plus house was listed for sale on Zillow by scammers for a mere $10,200.

How to protect yourself

Here are five rules of thumb to follow to avoid being duped.

1. Research local home prices and compare listings: If you see an ad for a deal that appears too good to be true, it most likely is.

2. Ask the seller for official documentation of a listing and cross-check the information to ensure their contact information matches that of the property owner on an official website.

3. Be wary of sellers trying to pressure you to pay upfront before signing a housing agreement.

4. Always try to tour a property in-person to verify it’s real.

5. Make sure that any website, advertisement is authentic before clicking on links or filling out applications with sensitive information.