- BOME surged to $194M in Open Interest, leading other altcoins in liquidations and speculative trading.

- Consistent BOME outflows signaled potential accumulation as price spiked, triggering leveraged trading volatility.

BOOK OF MEME [BOME] recorded the largest liquidation spike in recent data, surpassing other altcoins, according to a report from Hyblockcapital on X (formerly Twitter).

Excluding major cryptocurrencies like Bitcoin [BTC], Ethereum [ETH], and Solana [SOL], BOME reached a total liquidation of 78.57K in a 15-minute window.

This placed it significantly higher than other altcoins’ liquidation within the aforementioned timeframe.

Source: X

Rapid price movements caught leveraged traders off guard, driving a surge in BOME’s liquidations and highlighting heightened volatility.

The volume of liquidations in such a short timeframe may indicate growing speculative activity in BOME trading.

BOME sweeps liquidity zones

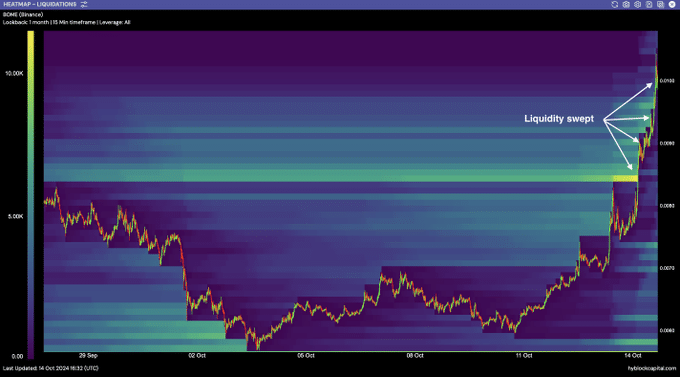

The heatmap for BOME/USDT over the past month shows multiple liquidity sweeps. The price moved through key liquidity zones, triggering a wave of stop-losses and forced closures.

This pattern can lead to increased volatility as traders’ positions are automatically closed, further driving price movement.

Source: X

The price chart indicated that these liquidity sweeps coincided with a sharp upward spike in BOME’s price. This suggests that the forced liquidations cleared out weaker positions, allowing for a more stable rally.

The combination of liquidity sweeps and price spikes often points to a market that is resetting itself after periods of volatility.

Net exchange outflows indicate…

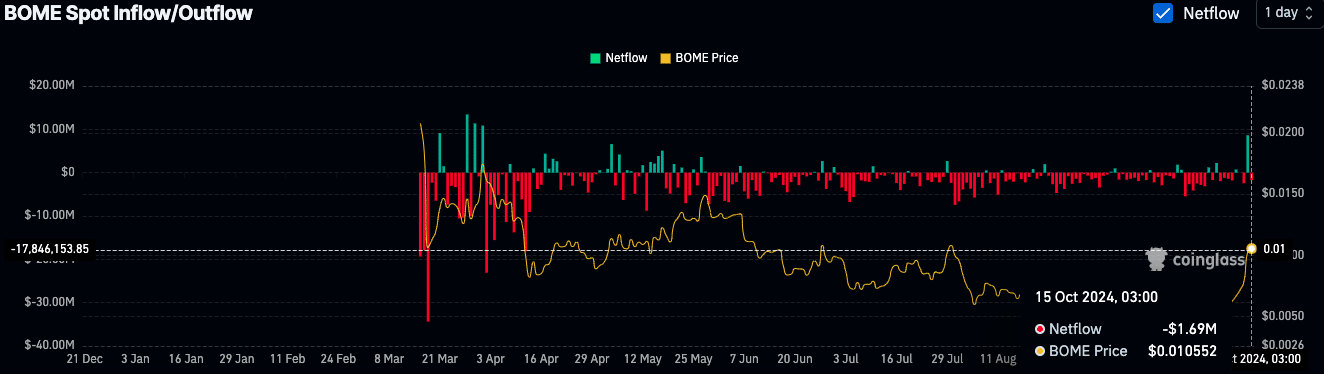

Recent data shows a net outflow of $1.69M in BOME on the 15th of October 2024, indicating that more BOME tokens were withdrawn from exchanges than deposited.

This trend of consistent net outflows over the past months could signal a period of accumulation, where holders are moving their tokens off exchanges, possibly for long-term storage.

Source: Coinglass

Despite the steady outflows, BOME’s price remained relatively stable, with occasional spikes.

The recent uptick in price to $0.01042 suggests that investors may be anticipating a further increase in value, possibly fueled by the accumulation of tokens and reduced selling pressure on exchanges.

Futures Open Interest sees substantial growth

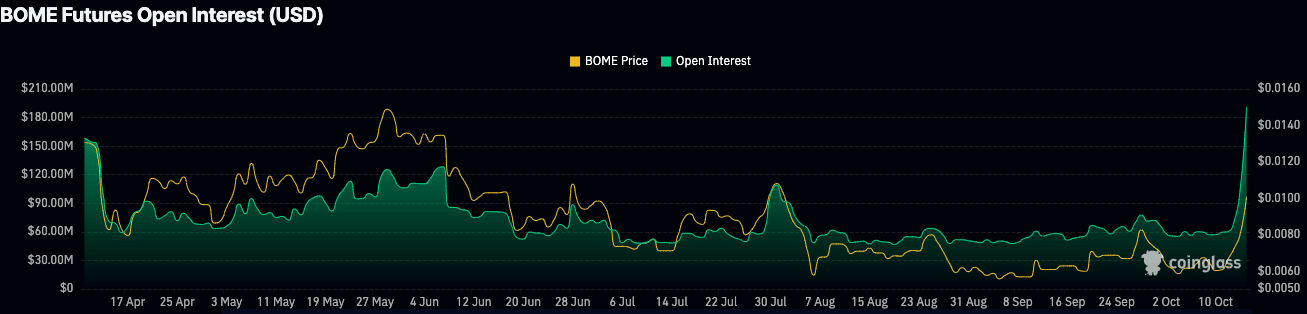

Coinglass data showed that BOME Futures Open Interest increased by 47.21%, reaching $194.33M as of the 15th of October.

This sharp rise in Open Interest indicated a surge in leveraged positions as traders took advantage of price movements.

Source: Coinglass

Paired with a 57.06% increase in trading volume, pushing it to $2.05B, reflected growing speculative activity in the market.

Read Book of MEME’s [BOME] Price Prediction 2024-25

The increase in Open Interest often leads to higher volatility, as a larger number of open positions means that more traders are exposed to potential price swings.

The recent price spike in BOME could result in even further market fluctuations as leveraged traders react to changing conditions.