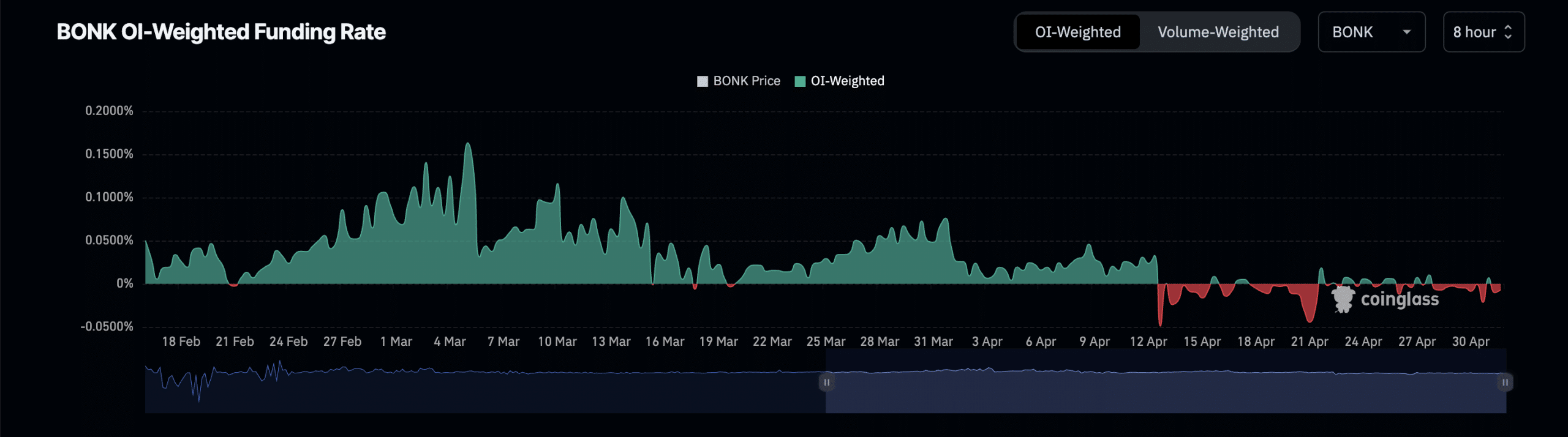

- BONK’s funding rates have been mostly negative since the 13th of April.

- Its price may decline further if bearish momentum climbs.

The recent decline in Bonk’s [BONK] value has been accompanied by negative funding rates in the meme coin‘s futures market, according to data from Coinglass.

Funding rates are a mechanism used in perpetual futures contracts to ensure the contract price stays close to the spot price.

When an asset’s futures funding rates turn negative, it suggests a strong demand for short positions. This is considered a bearish signal and a precursor to an asset’s price decline.

According to Coinglass data, BONK’s funding rate across crypto exchanges has been predominantly negative since the 13th of April.

Source: Coinglass

As of this writing, it was -0.0068%. This value shows that there are more traders in BONK’s futures market expecting its price to fall than traders buying the memecoin with the expectation of selling at a higher price.

A look at its futures open interest revealed a similar pattern of decline since 26th April. At press time, the memecoin’s futures open interest was $6 million, having declined by 33% in the last week.

An asset’s futures open interest refers to the total number of its futures contracts that have yet to be settled or closed. When it declines in this manner, it indicates an increase in the number of market participants exiting their positions without opening ones.

It is also regarded as a bearish signal.

What BONK might do next?

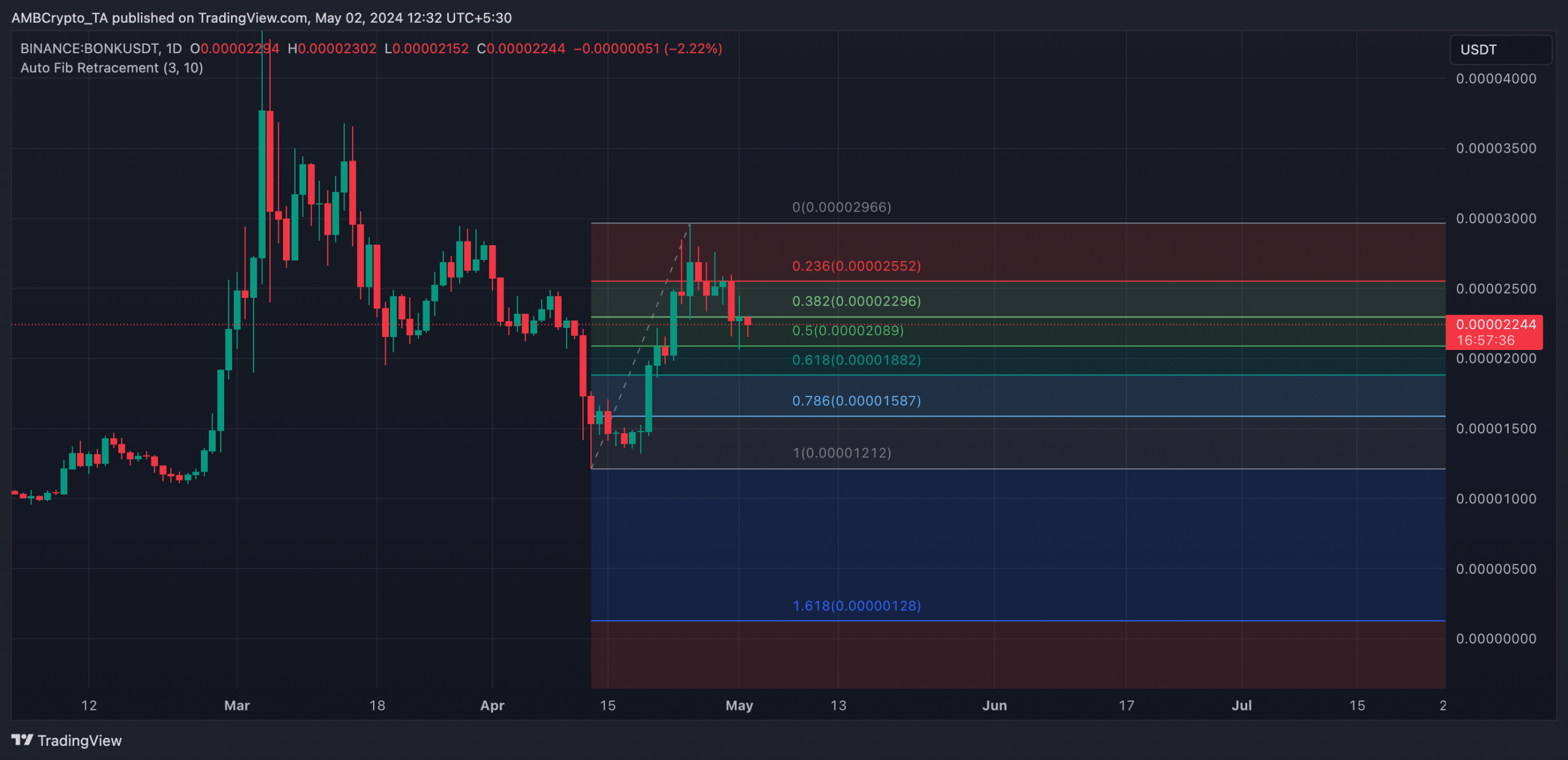

BONK witnessed a brief price rally between the 20th and 25th of April, which caused its price to rise above support.

By 25th April, the memecoin’s rally hit a snag as it could not break above resistance at $0.000029. After that, it trended downward to retest support.

However, due to the spike in bearish momentum, BONK broke below support to close at $0.000018 on 1st May.

Source: BONK/USDT on TradingView

If bear power continues to climb, the meme coin may experience a further decline to exchange hands at $0.000015. Should the bulls fail to regain control at this point, BONK’s price may slide further downward, forcing the memecoin to trade at $0.000012.

However, if bullish momentum spikes, the coin may retest support and rally toward reclaiming resistance at $0.000029.