- BNB Chain has seen incredible network traction, hitting 463.7M unique addresses.

- Overall, weak sentiment could drag BNB to $500 or below.

The Binance [BNB] chain has maintained the lead on key network growth, ranking first on total unique addresses in August. According to recent data, the chain’s unique addresses hit 463.7 million.

The chain also ranked fourth in total transactions, with 209 million transactions in July.

Source: Coin98

This indicated increased network traction, which isn’t surprising given the chain’s active Binance Launchpool and Launchpad projects. Interestingly, an uptick in the Binance network also coincided with its record price of $721 in June.

So, how has the recent network traction impacted BNB price performance?

BNB price analysis

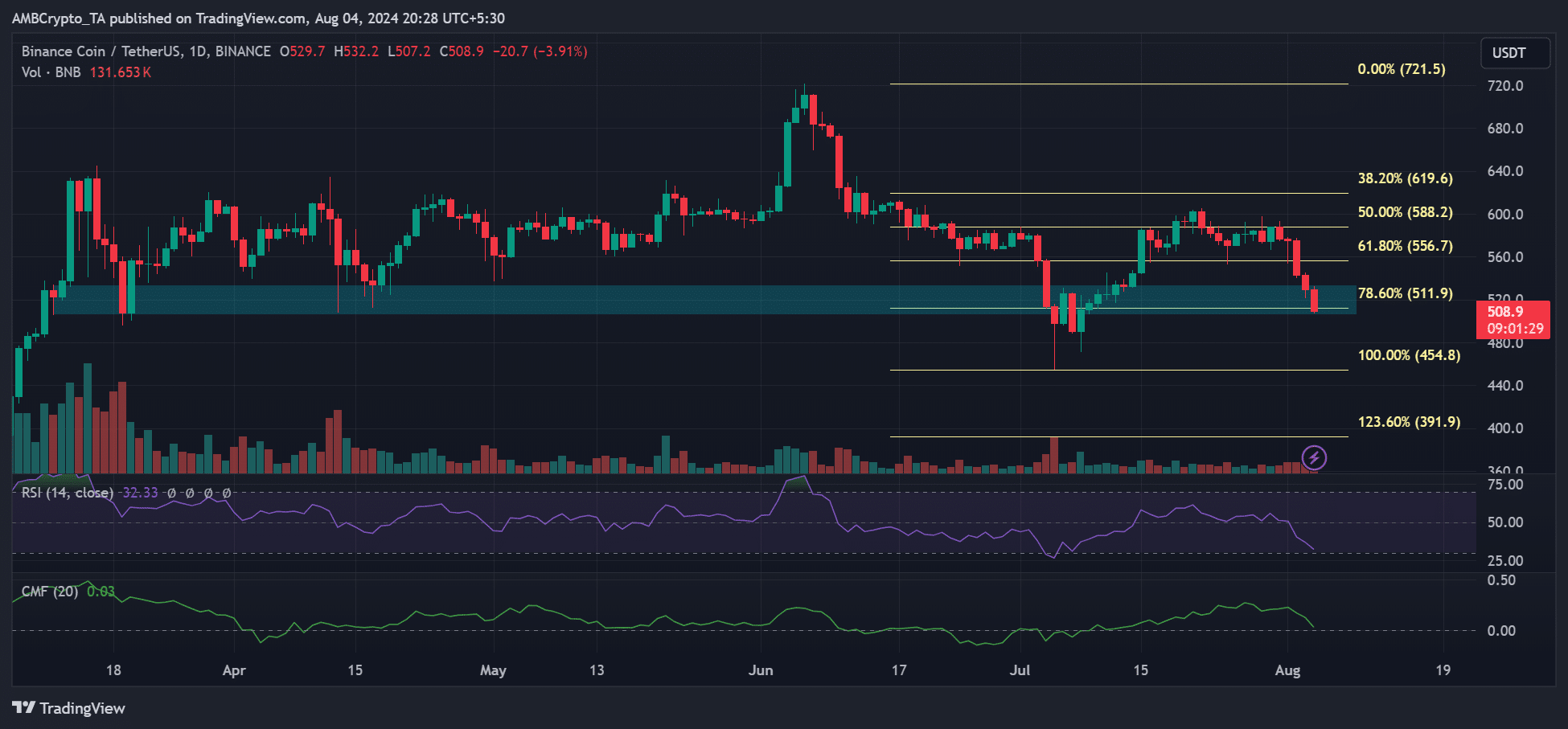

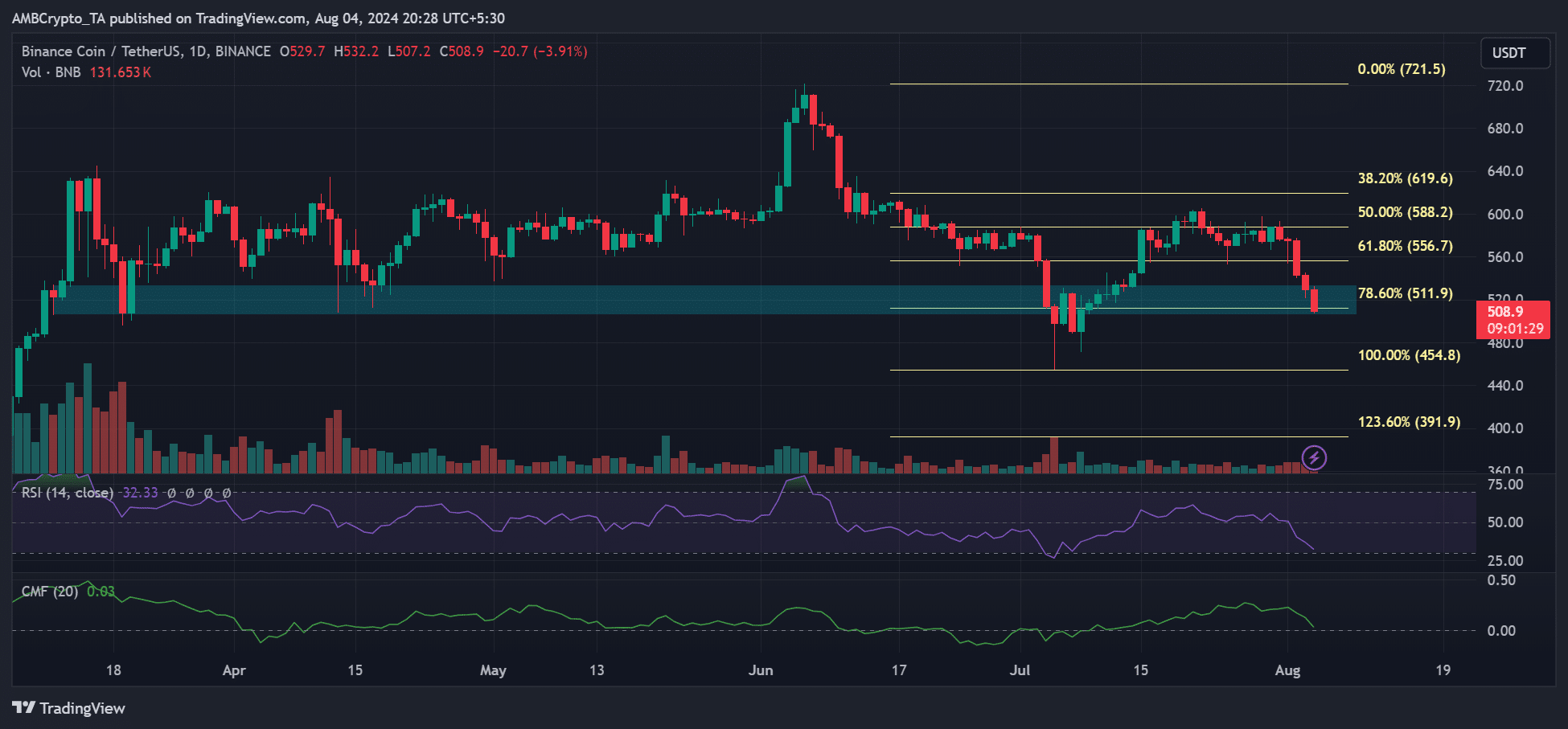

Source: BNB/USDT, TradingView

In the past week, BNB shed over 12%, dropping from $598 to near the psychological level of $500.

BNB’s downward pressure was part of a market-wide bloodbath induced by fears of the U.S. recession and tensions in the Middle East.

As such, recent network traction couldn’t ease the recent BNB price dump. If the bloodbath persists, BNB could breach the daily order block, marked cyan, above $505.

Should the support break, BNB could be dragged towards the July lows of $454.

Interestingly, the RSI (Relative Strength Index) had eased near oversold territory, meaning selling pressure could peak and reverse.

Similarly, the CMF (Chaikin Money Flow) declined but had not fallen below its average level, suggesting that outflows from BNB markets increased.

However, if it doesn’t break below the average level, especially if market sentiment improves, it could signal a likely price reversal.

Futures market status

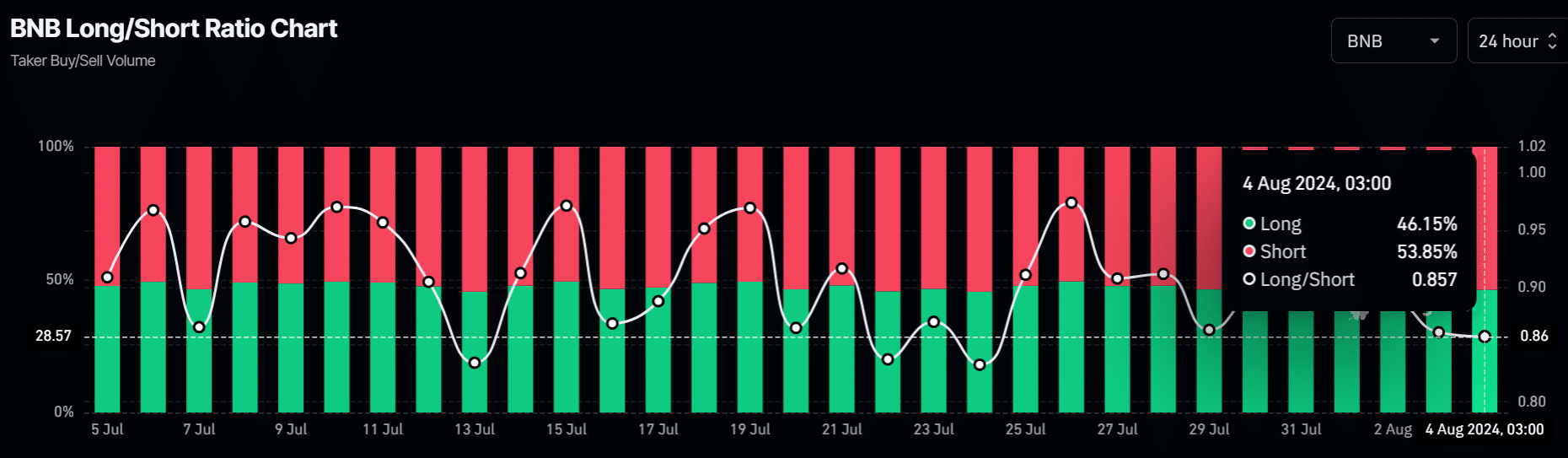

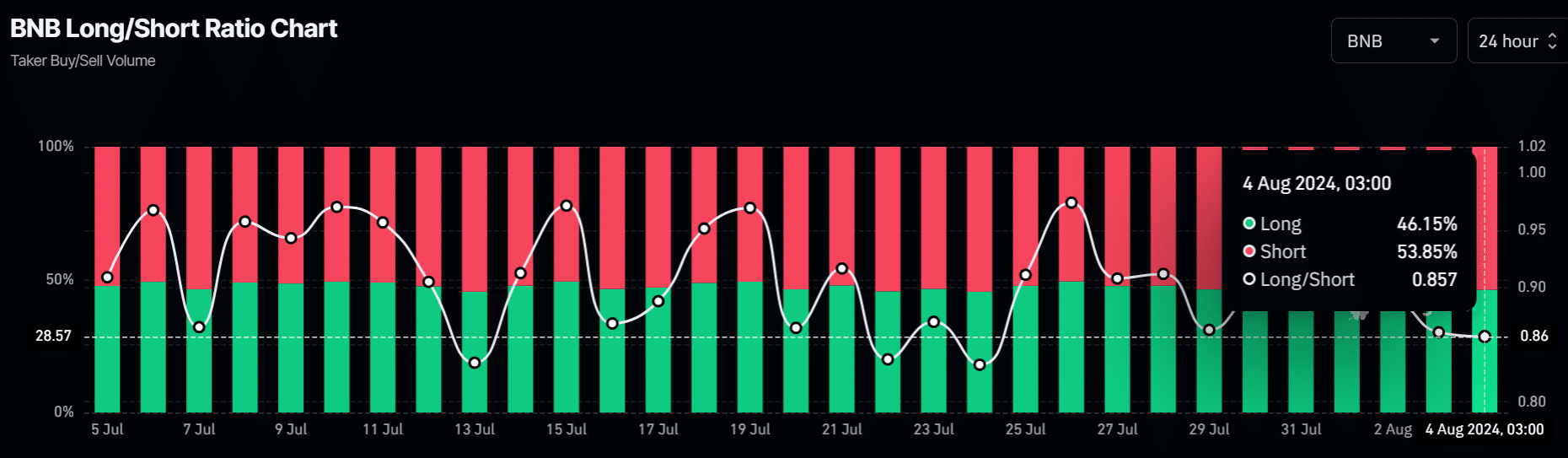

Like the massive dump on spot markets, as shown by the price charts, futures markets were also bearish on BNB. As of press time, 53.8% of leveraged traders were shorting the altcoin, against 46% of speculators who went long.

Source: Coinglass

Meanwhile, reports allege that tensions in the Middle East could escalate on the 5th of August. If so, the crypto market would react to the developments.

That said, the market sentiment was in extreme fear, which some, in normal circumstances, see as an opportunity to buy into the bloodbath.

However, gauging developments in the Middle East and the U.S. could be crucial before making moves.