- Saylor believes the world’s largest cryptocurrency is a ‘digital power’

- MSTR outperformed BTC during its most recent recovery

Some TradFi analysts criticized Bitcoin [BTC] recently, discrediting its use as a hedge after massive volatility pulled down its value by 15% on 5 August. And yet, Chairman of MicroStrategy Michael Saylor continues to defend the world’s largest digital asset’s volatility. Terming it the “price you pay” for its utility and liquidity, he said,

“The volatility is the price you pay in order to create billions of dollars of credit and liquidity at your fingertips all times, everywhere, for everybody.”

According to Saylor,

“No one who understands Bitcoin is afraid of the volatility.”

Saylor’s Bitcoin advice to governments

That wasn’t all though as Saylor also took a swipe at traditional finance’s (TradFi) inefficiency against Bitcoin. He commented,

“There’s a revolution in the global capital markets and traditional finance operates 19% of the time for 10% of the world. That makes it a 2% solution. #Bitcoin is a 100% solution. It’s not partisan; it’s just a good idea.”

For perspective, traditional finance exchanges like the NYSE halted equities trading over the past few weeks after reported glitches. On the contrary, Bitcoin has been up and online for over 99% of its existence.

Additionally, Saylor reinforced BTC as a ‘digital power’ that should be adopted by any government. In doing so, he equated it to nuclear and space power.

Bitcoin strategy trend

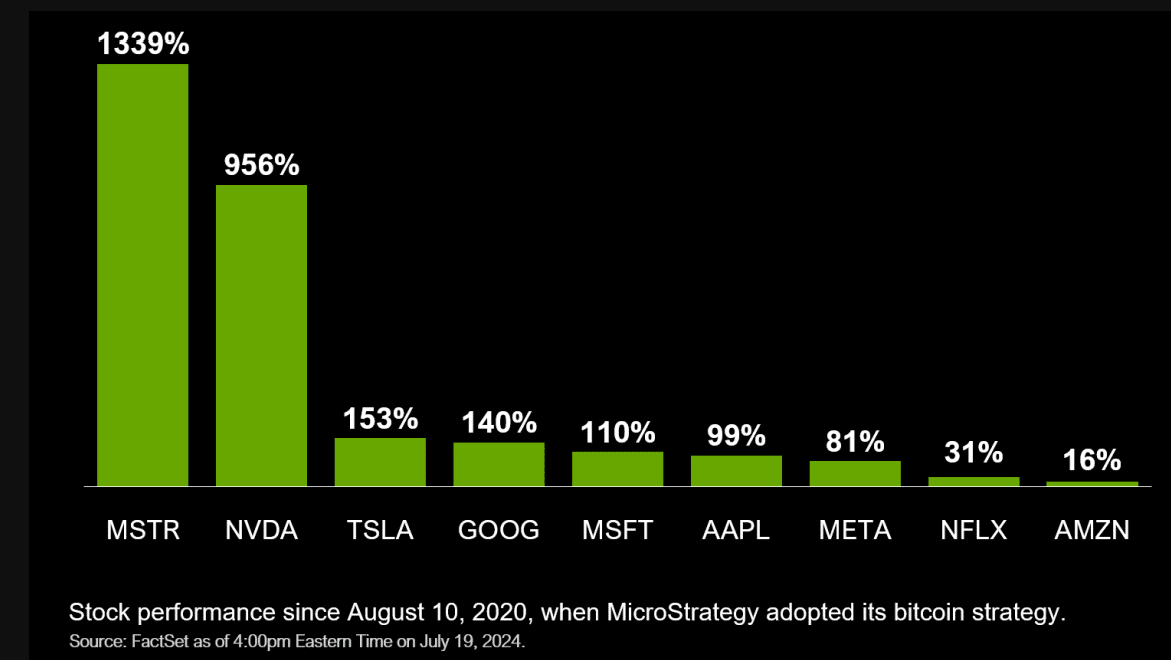

The executive echoed a similarly bullish sentiment in a recent Fox Business interview. According to the exec, his firm’s share, MicroStrategy (MSTR), outperformed everything because it adopted the Bitcoin strategy.

“MicroStrategy is outperforming everything since they adopted #Bitcoin…It’s crushed everything.”

In fact, MSTR has eclipsed all its peers, rallying by over 1000% since adopting the cryptocurrency back in 2020.

Source: Michael Saylor

As of August, MicroStrategy held over 226k BTC and planned to acquire another $2 billion worth of BTC. Saylor himself holds about $1 billion in BTC in an individual capacity and is ready to stash more too.

Interestingly, other firms have also adopted MicroStrategy’s Bitcoin strategy. In the United States, for instance, Block Inc., founded by Jack Dorsey and a parent firm to Cash App, is one of the corporations that have an active BTC strategy.

Overseas, Japanese investment firm Metaplanet is perhaps the most aggressive adopter of this strategy. The firm recently secured ¥1 billion to add more BTC to its portfolio. As a result, the firm’s TKO stock is now up +600% in year-to-date (YTD) performance (in Japanese Yen terms).

Over the same period, MSTR outperformed even BTC, at over 97%, against the digital asset’s 37%.

Meanwhile, MSTR’s stock effectively carried out the 10-1 stock split on 8 August, intended to make the stock more affordable. As a result, there would be 10 times more MSTR shares at a tenth of its previous value.

At press time, MSTR was trading at $135. It rebounded by 27% against BTC’s 12% over the last five trading days.

Source: Google Finance