- Bitcoin’s market balance somewhat unsettled due to excess long/short positions

- Geopolitical tensions are affecting Bitcoin’s price

The larger cryptocurrency market is experiencing a decline, with Bitcoin (BTC) leading this downward trend. While it hit a higher high of $66k towards the end of September, it was valued at just over $60k, at press time.

According to Hyblock Capital data, Bitcoin’s market balance is somewhat unsettled. As a result, BTC might be primed for another correction, particularly in the early stages of 2024’s last quarter.

This extreme investor behavior provides insight into potential market turning points. When there are excessive long or short positions, it means that the market balance is disturbed.

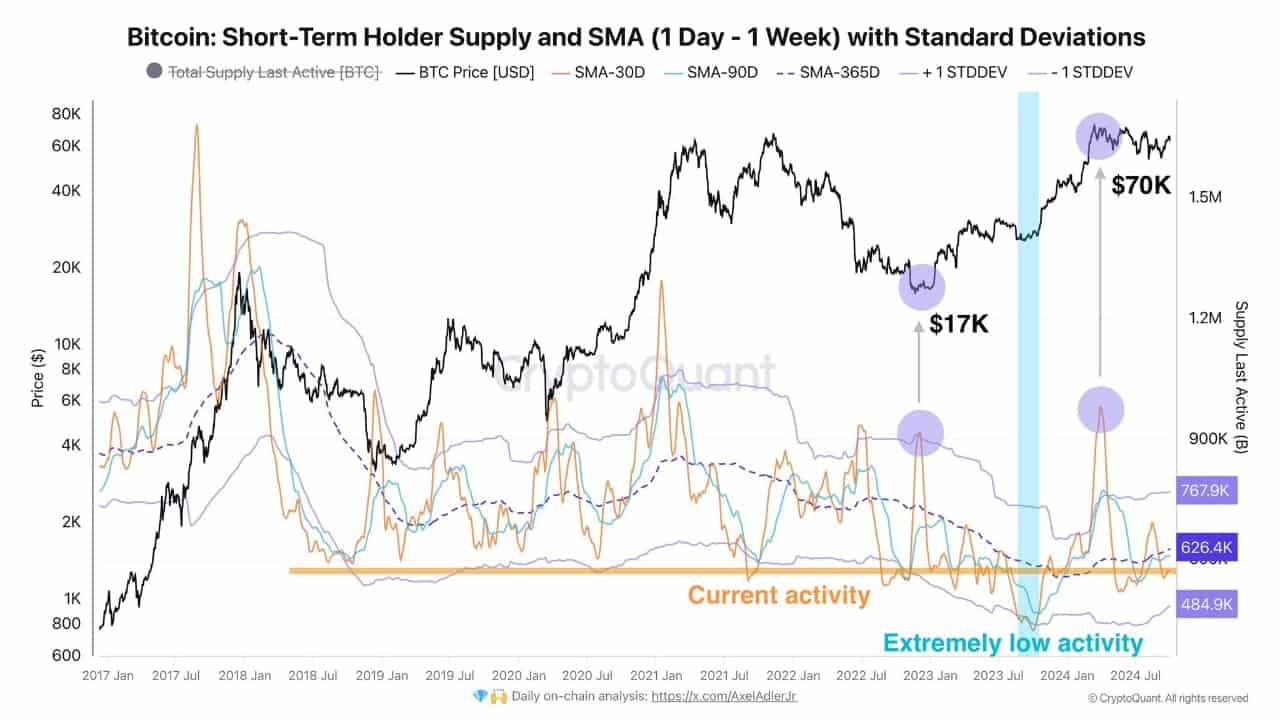

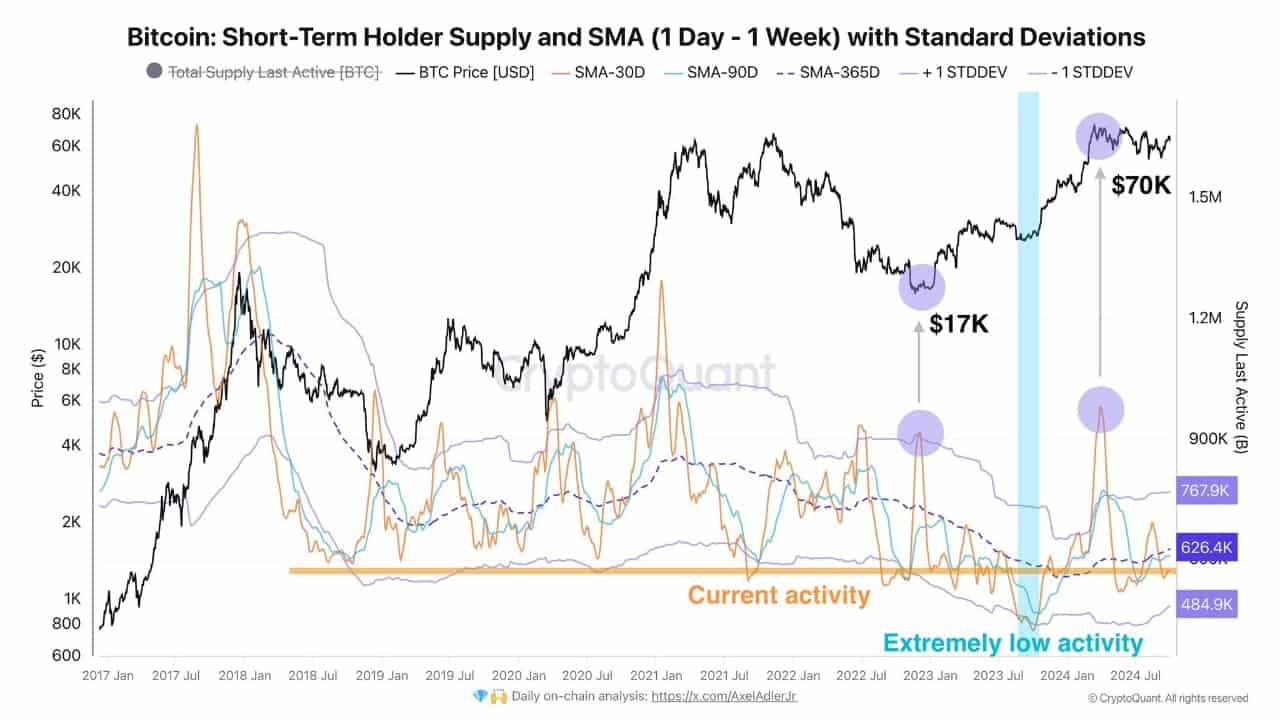

Source: CryptoQuant

Understanding market balance is crucial, as excessive long or short positions often signal potential corrections or trend reversals.

Many traders had anticipated a bullish trend, but current dynamics are steering the sentiment in another direction.

Bitcoin Short-Term holder supply

If short-term investors reduce their supply by 80,000 BTC, it could pave the way for a new bullish trend. This reduction would help stabilize the market, making it easier for Bitcoin to regain its footing.

In recent weeks, there has been an influx of supply flooding exchanges, contributing to downward pressure on Bitcoin’s price. At the time of writing, Bitcoin’s activity was trading below the 365-day SMA, reinforcing a bearish outlook.

Source: CryptoQuant

As supply increases while demand decreases, the price of BTC is likely to continue declining. This means that a correction may be imminent.

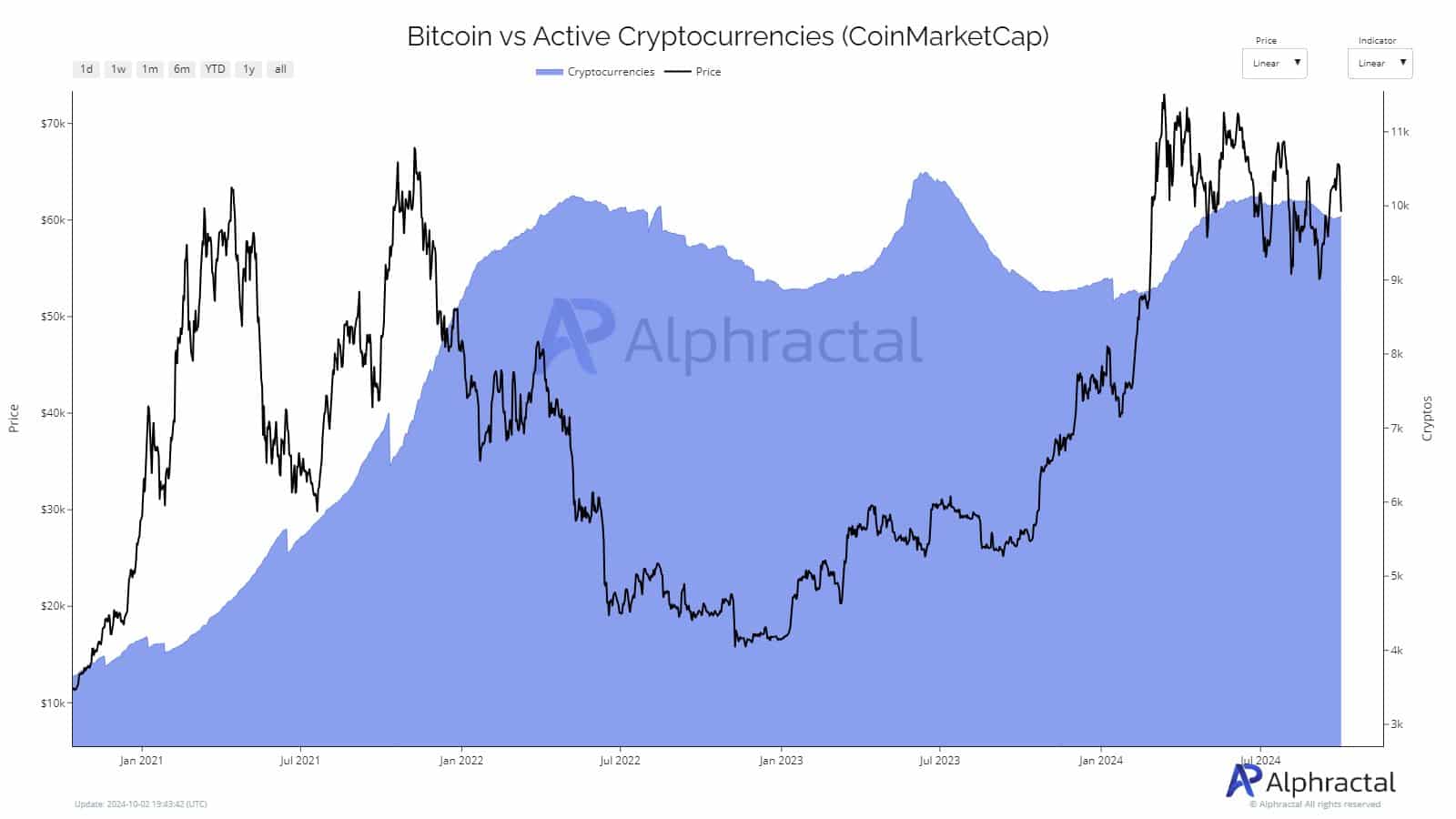

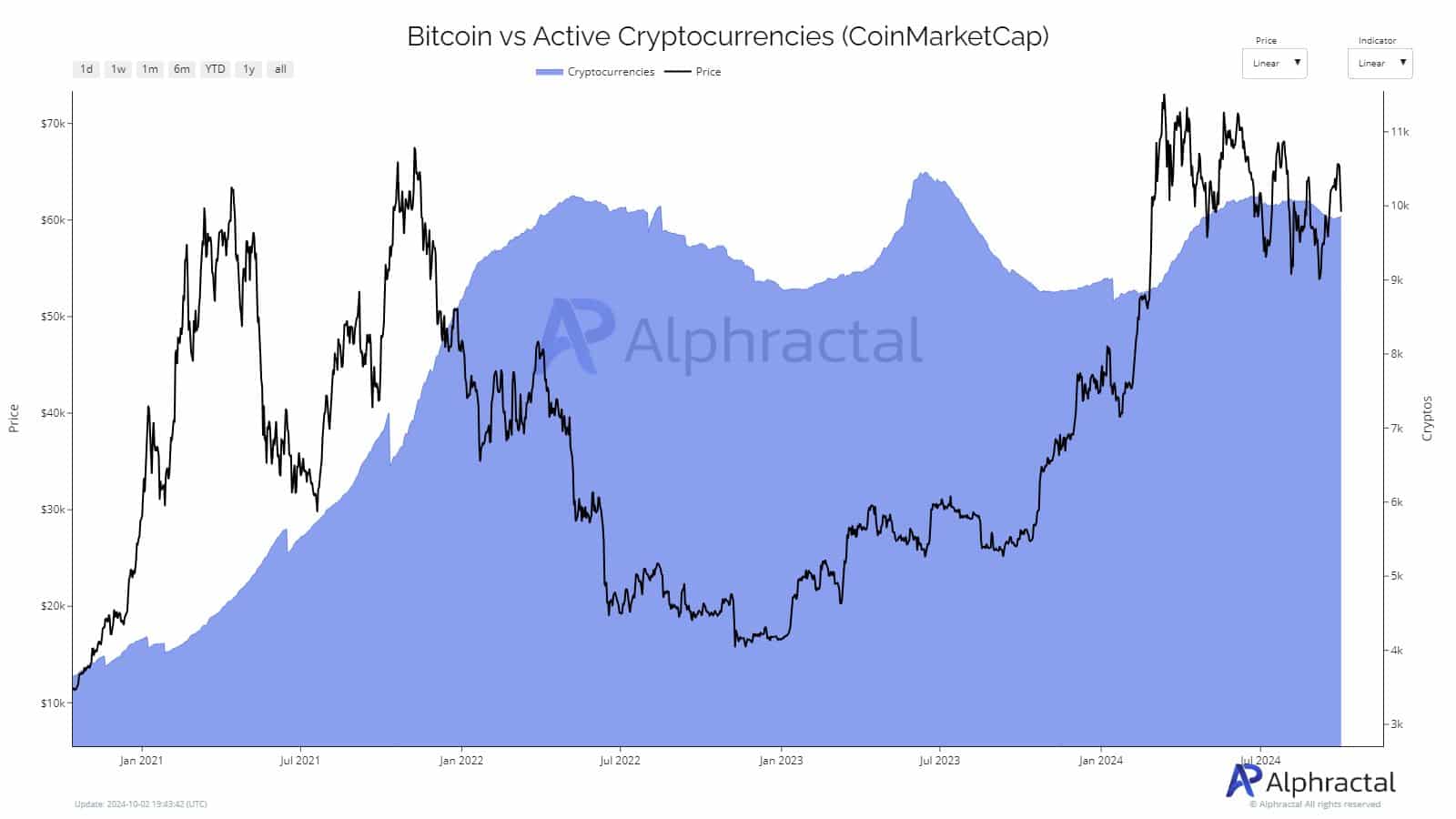

Interest in active cryptocurrencies

At the same time, the number of active cryptocurrencies has stagnated since the end of 2021. This lack of growth may be a sign of reduced interest in launching new projects.

Several factors can contribute to this trend, including market weakness and regulatory pressures. This situation is further indication that Bitcoin could be headed for a correction on the charts soon.

Source: Alphractal

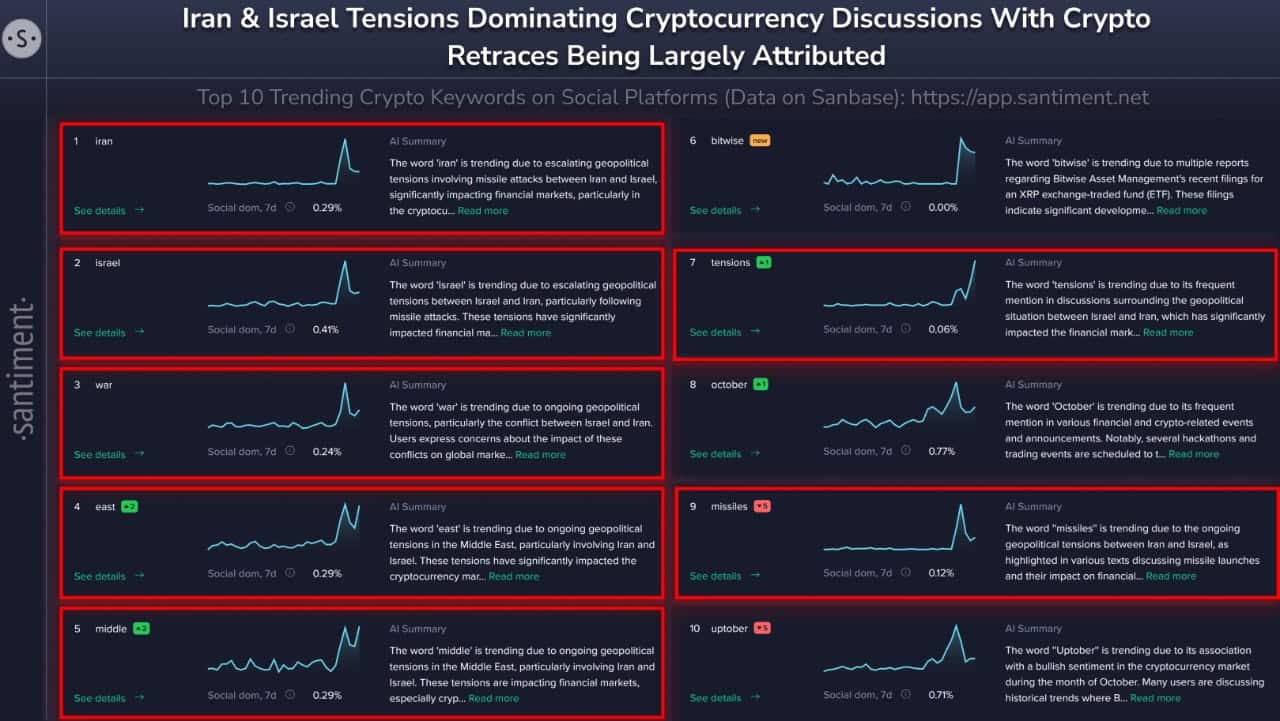

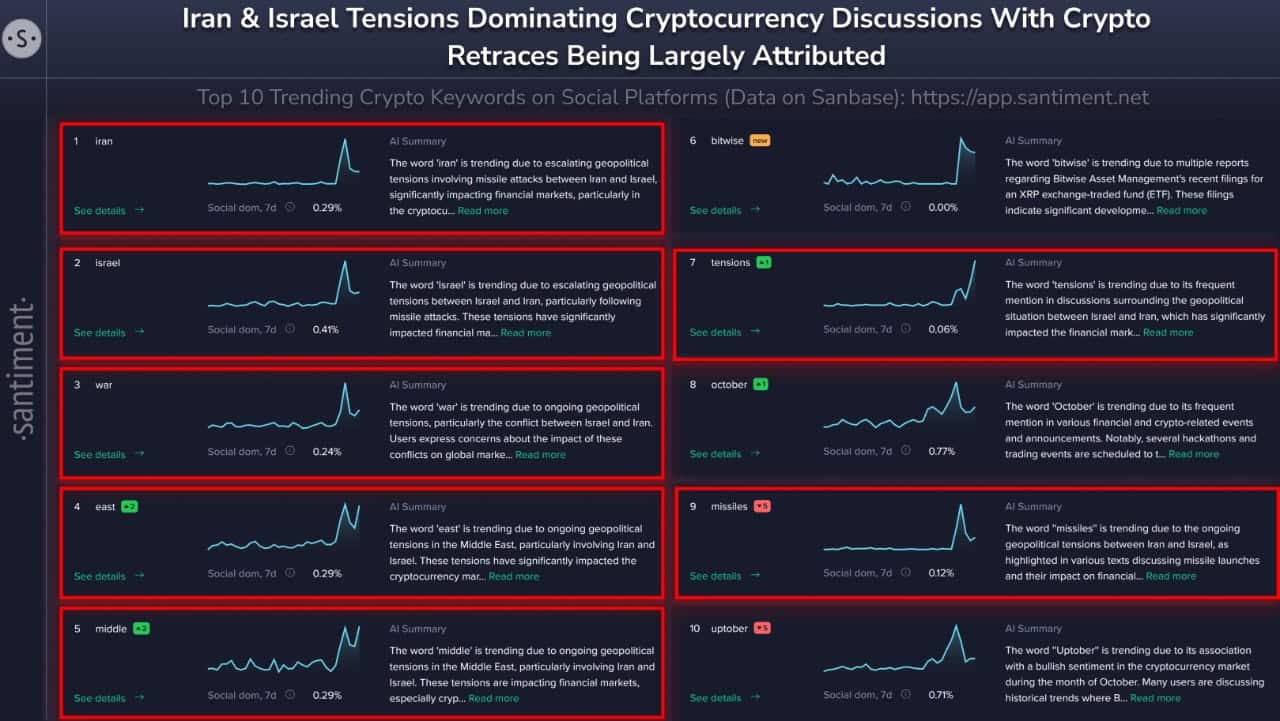

Global tensions affecting prices

Current geopolitical tensions, particularly the conflict between Iran and Israel, are influencing cryptocurrency prices too. In fact, historical data showed that during real-world conflicts, Bitcoin prices often see initial drops, followed by recoveries.

For instance, in October 2023, Bitcoin fell by 5% in the first four days. However, it then rebounded by 12% over the following nine days.

Source: Santiment

Similarly, during the Ukraine-Russia conflict in February 2022, BTC dropped 10% on the first day, but surged by 27% in the subsequent six days.

Given these patterns, it appears that Bitcoin is undergoing a correction, before a potential rally in the last quarter. However, can the unscarred whales help BTC hold above the $60k level now?

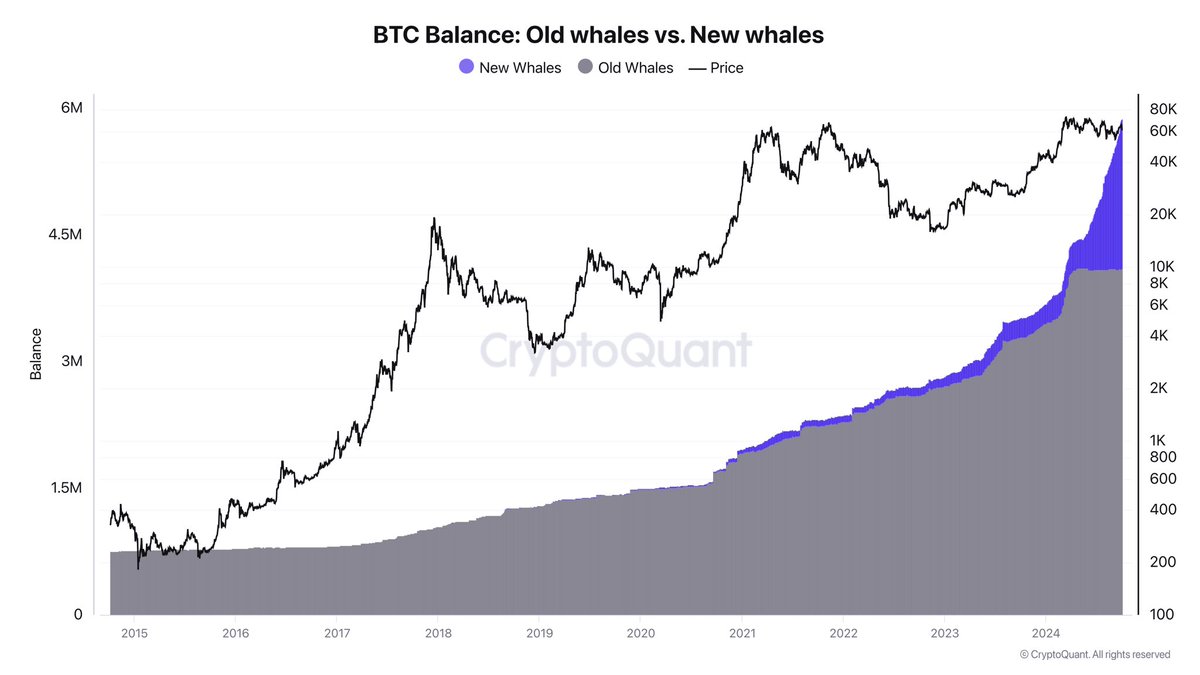

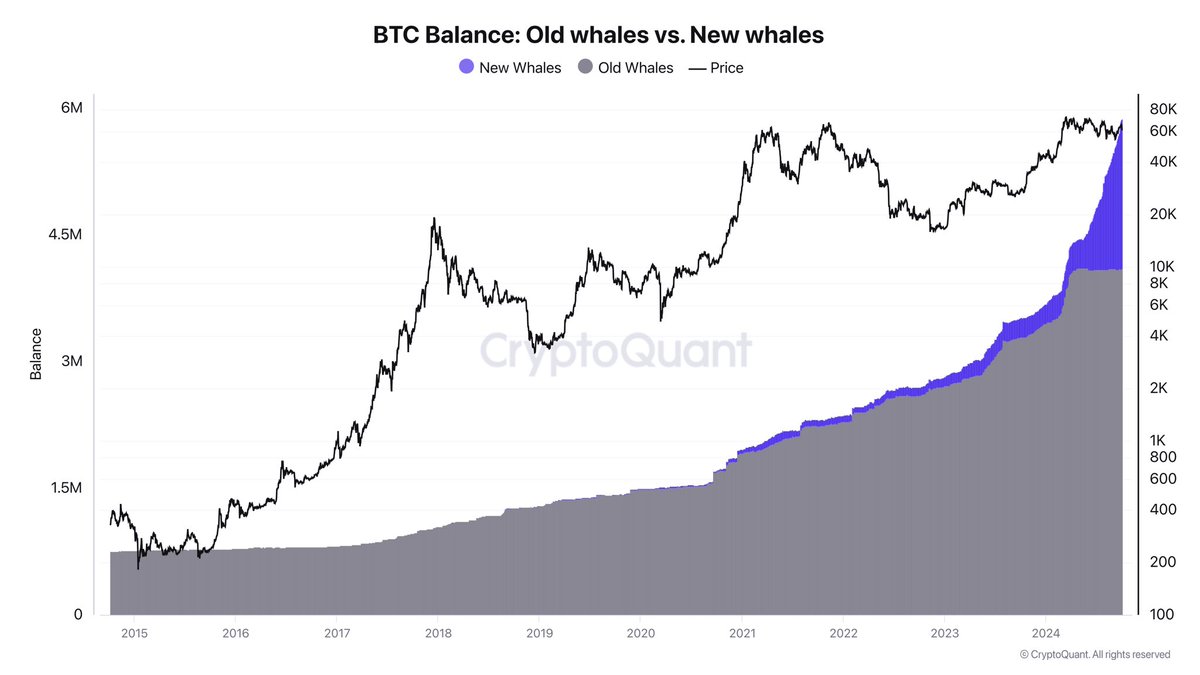

BTC’s whale activity

Despite current market volatility, both new and old whales remain unfazed. The movements in the Futures market are part of a broader strategy, one where real market changes occur through spot trading and over-the-counter (OTC) markets, as Ki Young Ju noted on X.

The flow of Bitcoin into custody wallets means that permanent holders are increasing their stakes. By doing so, they are supporting a bullish outlook for Bitcoin in the long run.

Source: CryptoQuant

In fact, CryptoQuant data revealed that older whales have been seeing minimal returns, while newer whales are aggressively accumulating Bitcoin.

This will potentially help BTC hold above the $60k level. Worth noting though that the bias is subject to the unpredictable nature of crypto markets.