- Bitcoin must stay above $100K for the uptrend to continue.

- BTC has experienced a slight pullback over the past day, dropping by 2.55%.

After experiencing a sustained uptrend to hit $106K over the past day, Bitcoin [BTC] has retraced. In fact, of this writing, BTC was trading at around $102K. This marked a 2.55% decline on daily charts.

Prior to this drop, Bitcoin had been on an upward trajectory, hiking by 8.85% on weekly charts. Inasmuch, CryptoQuant analyst Crazyyblock suggested that Bitcoin must hold above $100K support level, and here’s why.

Why $100K is critical for Bitcoin

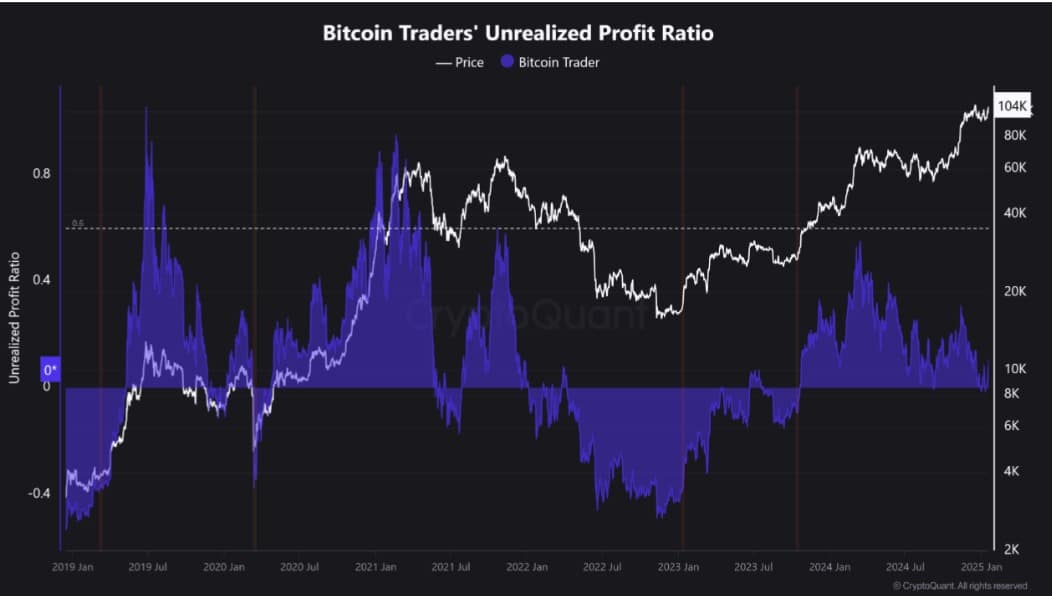

According to Crazyyblock, Bitcoin must hold above $100K, simply because the profitability of current holders now hinges on maintaining this level.

Source: CryptoQuant

A failure to hold this critical psychological level could result in panic selling or loss-induced liquidation among market participants.

This is because Bitcoin investors in this category are holders within 1 to 3-month age bands. The group is notorious for emotional selling, as they react swiftly to market changes, and so engage in short-term strategies.

Therefore, if Bitcoin fails to maintain a $100K support level, many of these participants might choose to sell even at a loss, creating potential selling pressure.

Thus, the king coin’s ability to defend this level will shape the market’s direction, making it a pivotal point for either an upward or downside.

Can BTC maintain the uptrend?

According to AMBCrypto’s analysis, Bitcoin remained in a bullish phase despite the recently witnessed pullback. Notably, the market conditions at press time pointed towards another upward movement.

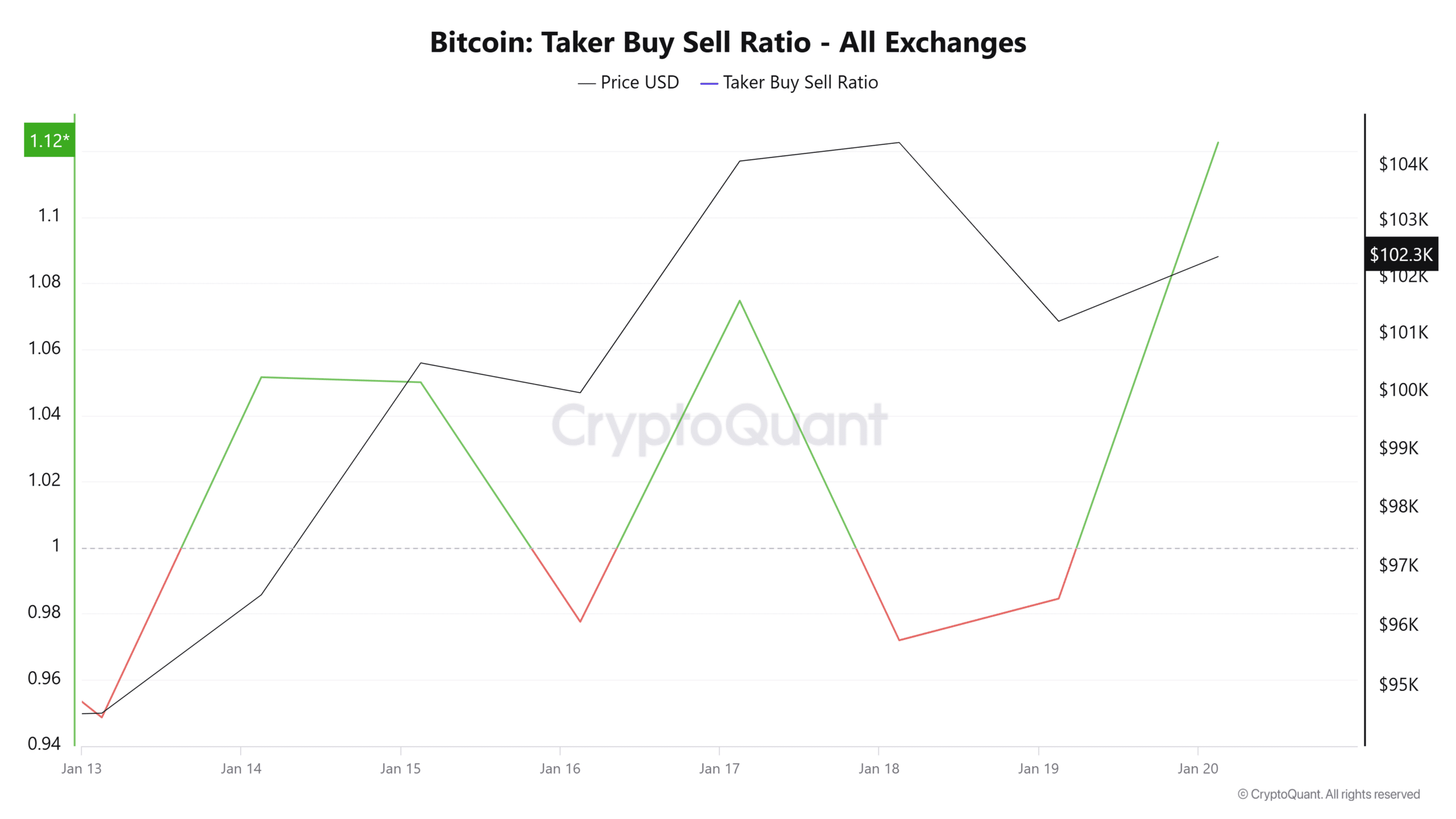

Source: CryptoQuant

For example, Bitcoin’s Taker Buy Sell Ratio remained at 1.12, suggesting that buyers were dominating the market. As such, there was higher buying pressure.

This reflected bullish sentiments as investors accumulated BTC, anticipating further gains.

Source: TradingView

At the same time, Bitcoin had started to experience strong upward momentum, as evident through the rising RVGI and ADR. At the time of writing, the RVGI had moved upward, since making a bullish crossover four days ago.

This signaled a strong upward momentum, as the bears seemed to lose the spark. Equally, Bitcoin’s ADR suggested that BTC was making more gains than losses.

Simply put, the recently witnessed decline seems like a mere market correction before attempting another uptrend. This is so because most market participants remain bullish and expect prices to rise.

Read Bitcoin’s [BTC] Price Prediction 2025–2026

Therefore, if the current sentiment holds, BTC will reclaim $105K and attempt a breakout above $106K, where it has faced multiple rejections.

However, if the correction prolongs, it might drop below $100K, resulting in a further dip to $98K.