- Bitcoin breaks past key resistance levels, surpassing the 2015-2018 cycle’s high points.

- Institutional adoption and macroeconomic trends drive Bitcoin’s momentum toward a $100K target.

Bitcoin [BTC] has surged past a critical price milestone — surpassing key resistance levels that previously defined its cyclical behavior during the 2015-2018 bull market.

This latest breakout highlights the cryptocurrency’s resilience and growing maturity in a market that has evolved significantly since its early speculative days.

Unlike the dramatic peaks and valleys of the 2015-2018 cycle, Bitcoin’s current trajectory appears more measured, underpinned by stronger fundamentals and broader adoption.

With its price now exceeding levels that many believed would act as insurmountable resistance, questions arise about whether this surge marks the beginning of a new bull cycle — or even a run toward a six-figure valuation.

Breaking past historical cycles

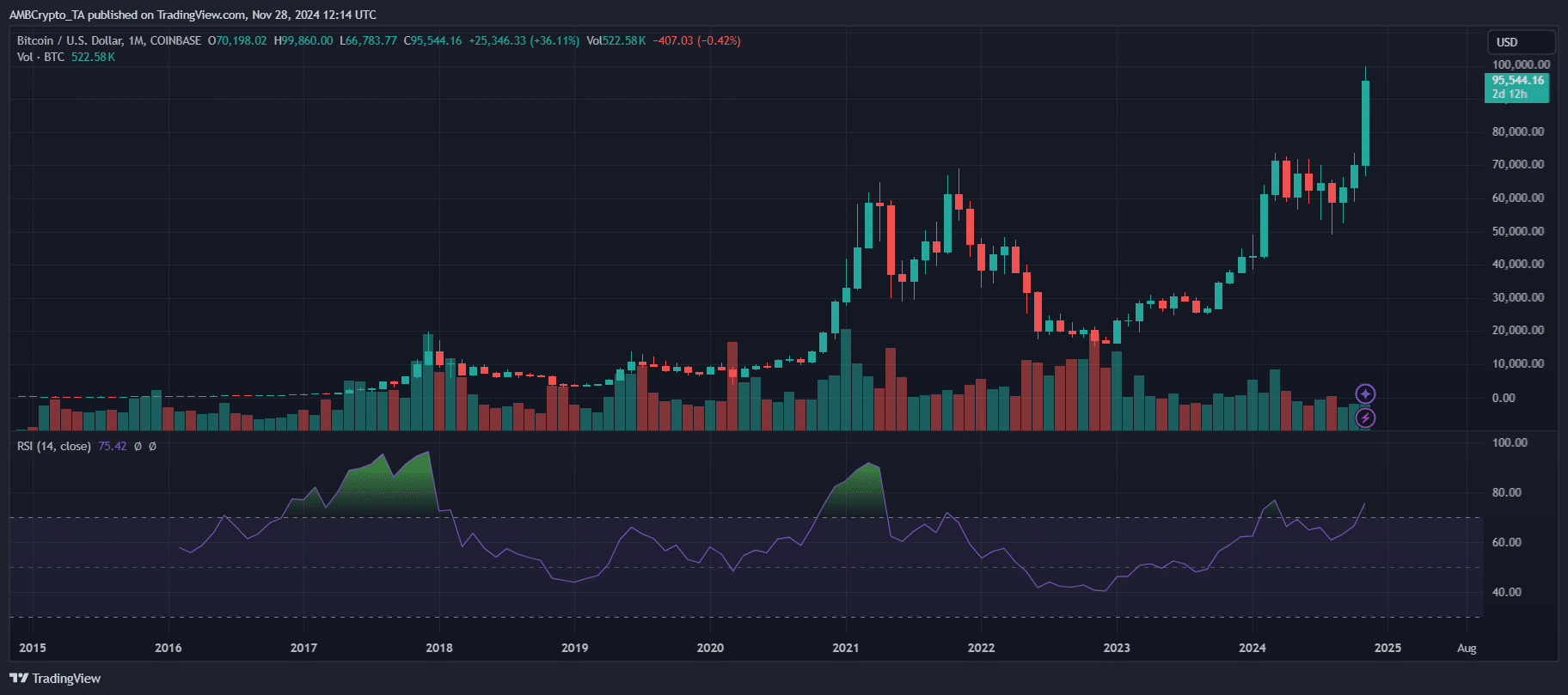

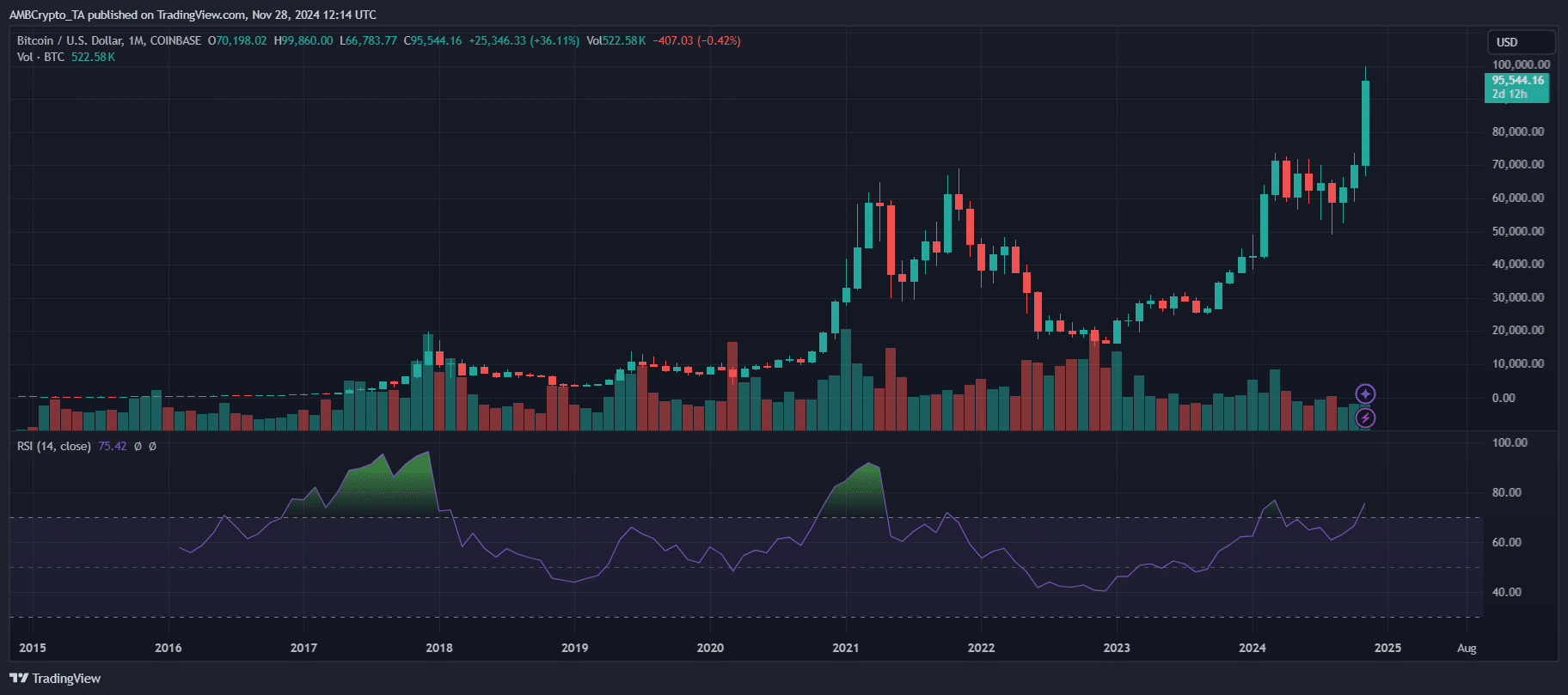

Bitcoin’s current cycle is progressing faster than its 2015-2018 counterpart. After peaking at $20,000 in 2017, Bitcoin took nearly three years to recover, consolidating at lower levels before its next bull run.

In contrast, the 2022 bottom has been followed by a much quicker rebound, with Bitcoin surpassing $50,000 within two years — nearly a year faster than the previous recovery.

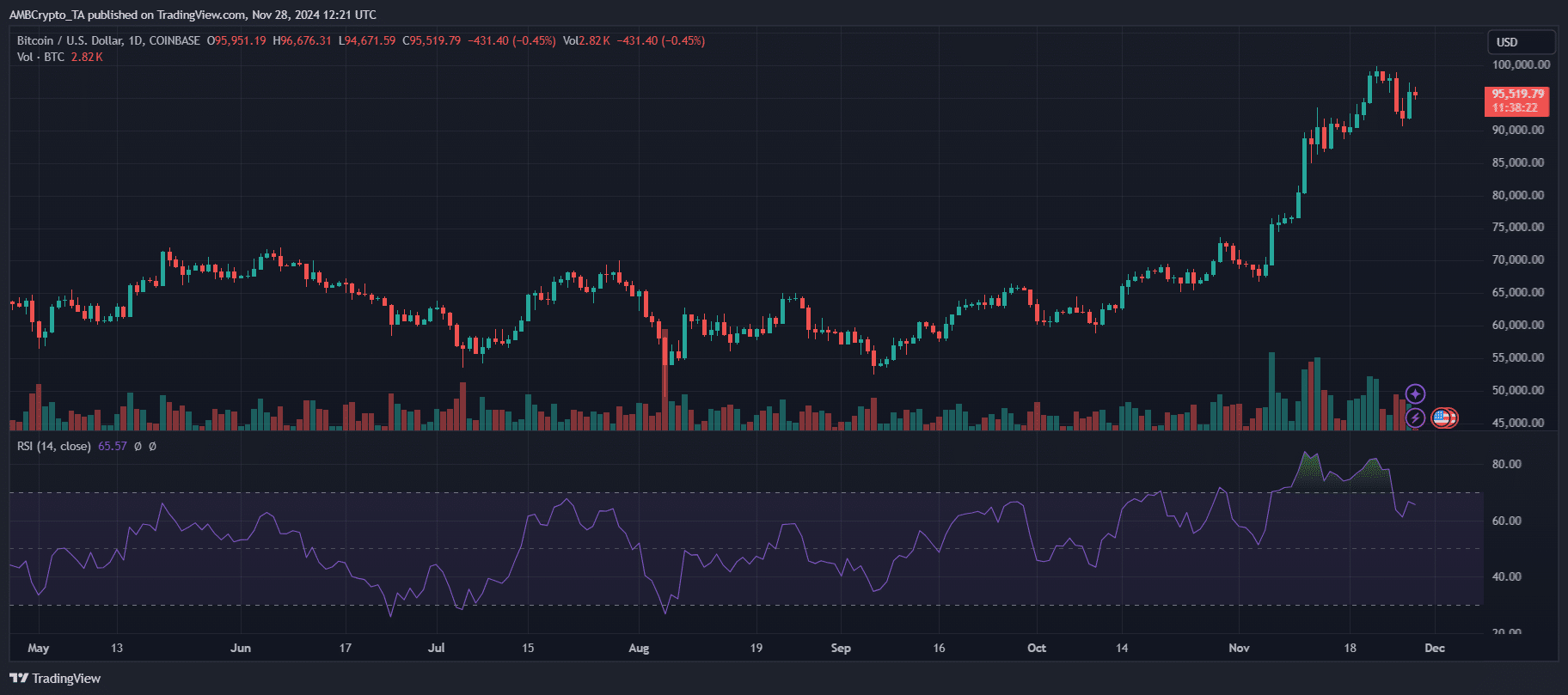

Source: TradingView

The chart shows Bitcoin maintaining momentum, with monthly RSI readings above 75 signaling strong bullish conditions.

Trading volumes have also exceeded those from the earlier cycle, reflecting increased market participation.

This milestone represents an 80% recovery from 2022 lows, supported by long-term holder accumulation and reduced exchange balances.

These on-chain shifts highlight stronger fundamentals compared to prior cycles, suggesting less speculative activity and more sustained growth. Bitcoin’s accelerated recovery sets it apart from historical patterns.