- Market sentiment was bearish over the last four months as BTC faced consistent rejections from local highs

- Selling pressure has not abated and could force another major southbound move

Bitcoin’s [BTC] 2024 halving occurred on 19 April. Since then, however, the promised bull run is yet to materialize. At press time, the Crypto Fear and Greed Index had a reading of 46 – A sign of neutral sentiment.

On the weekly chart, Bitcoin continues to present a bearish structure, with BTC setting lower highs and lower lows since late May. Insights into stablecoin flows reinforced the bearish view of the crypto-market over the coming weeks.

Suspicions of a deeper price correction

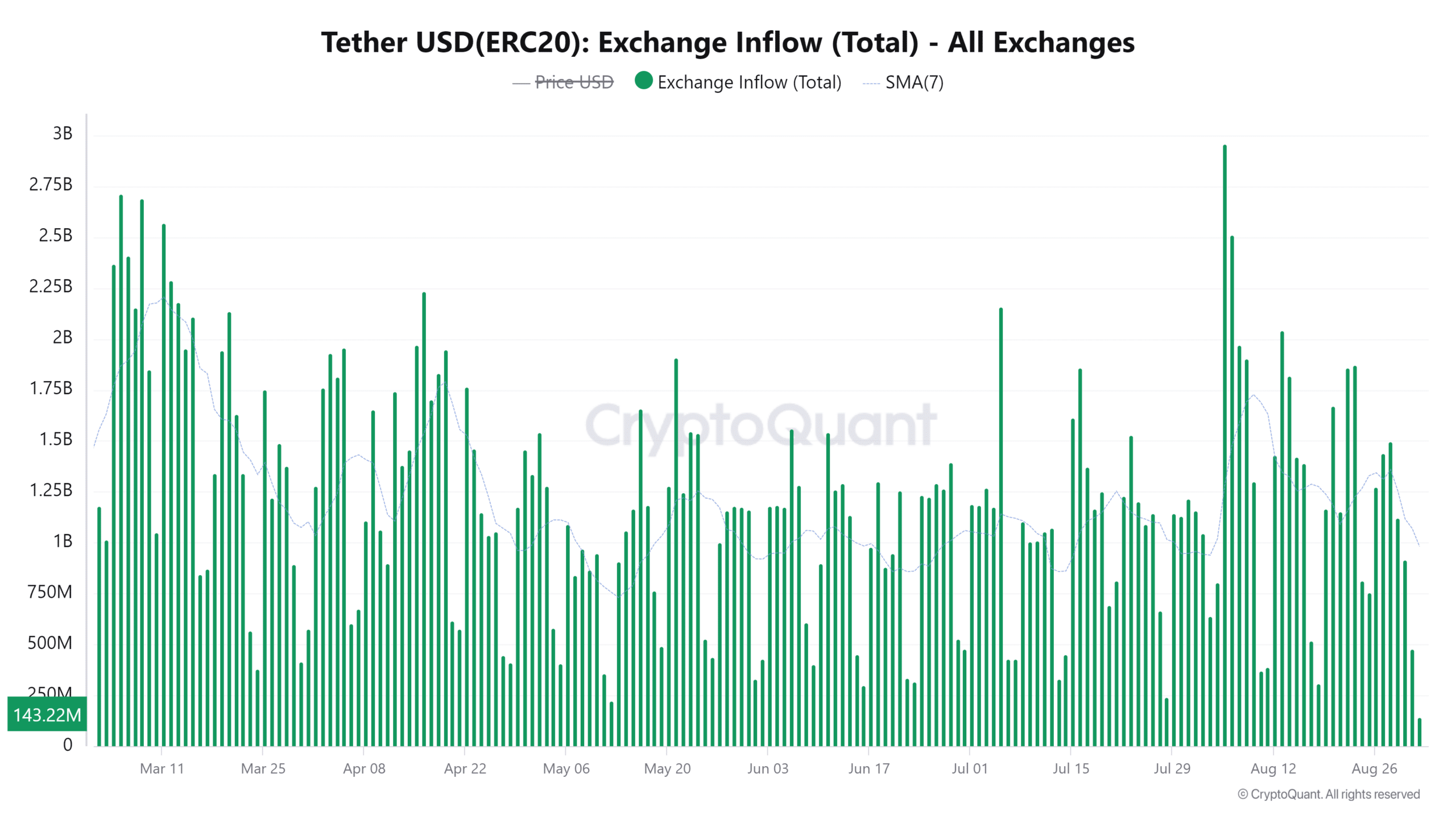

In a CryptoQuant Insights post, popular analyst theKriptolik noted that there has been a big decline in the inflows of Tether [USDT] to exchanges. AMBCrypto looked closely at the charts and found that the stablecoin exchange inflows were at a six-month low.

Source: CryptoQuant

When Bitcoin and the wider crypto market experience a large price drop, stablecoin inflows tend to ramp up by a large amount. This is indicative of buyers using the dip to add to their crypto holdings.

The most recent, sharp price drop occurred on 5 August when Bitcoin fell from $58.3k to $49k – A 15.9% drop. On that day, the stablecoin inflows stood at $2.9 billion.

Therefore, the fact that we saw unremarkable Tether exchange inflows when BTC fell below $60k can be interpreted as alarming news. It implied that smart money was waiting for a much deeper price drop before entering the market.

How low can the next move go?

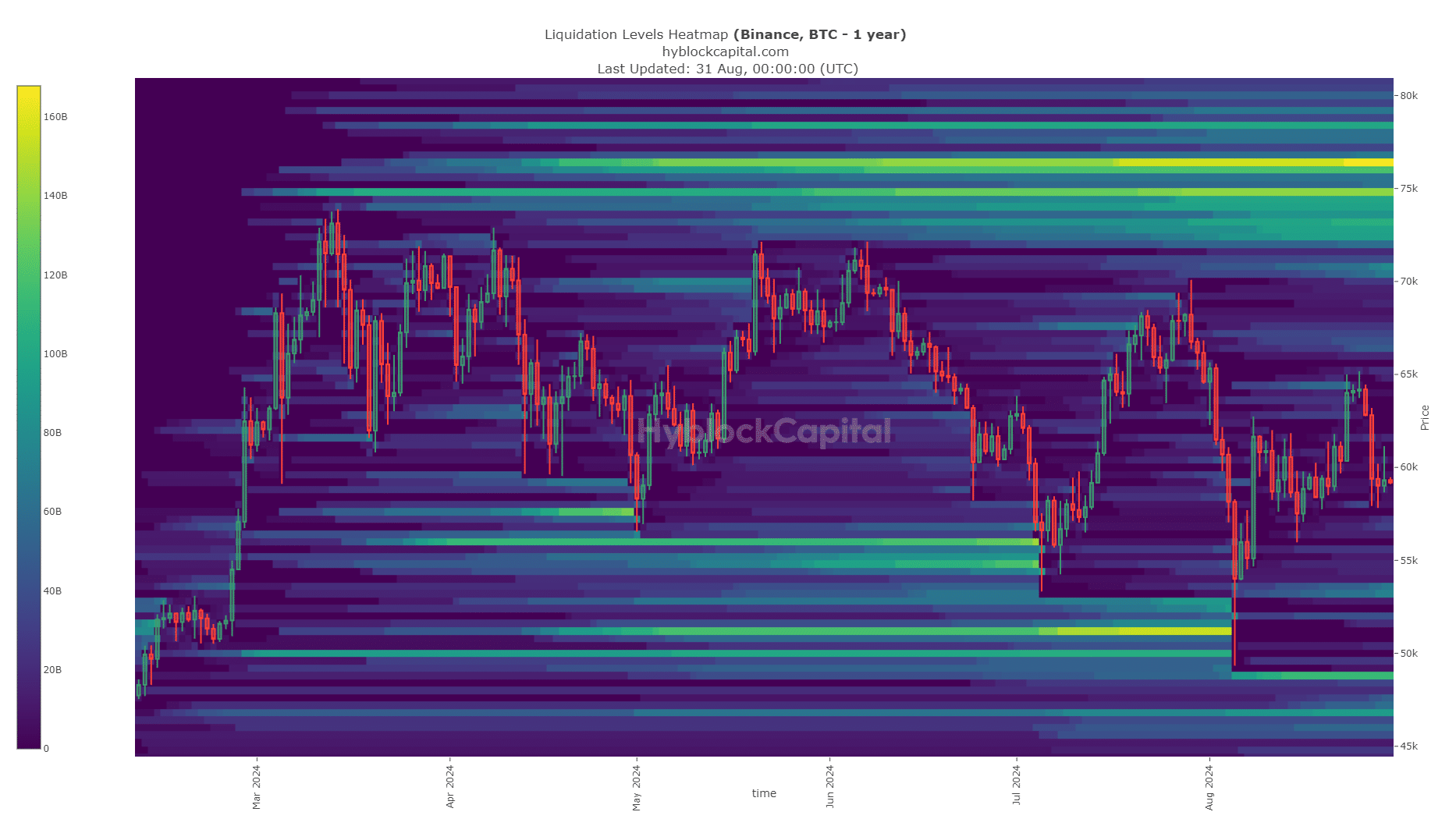

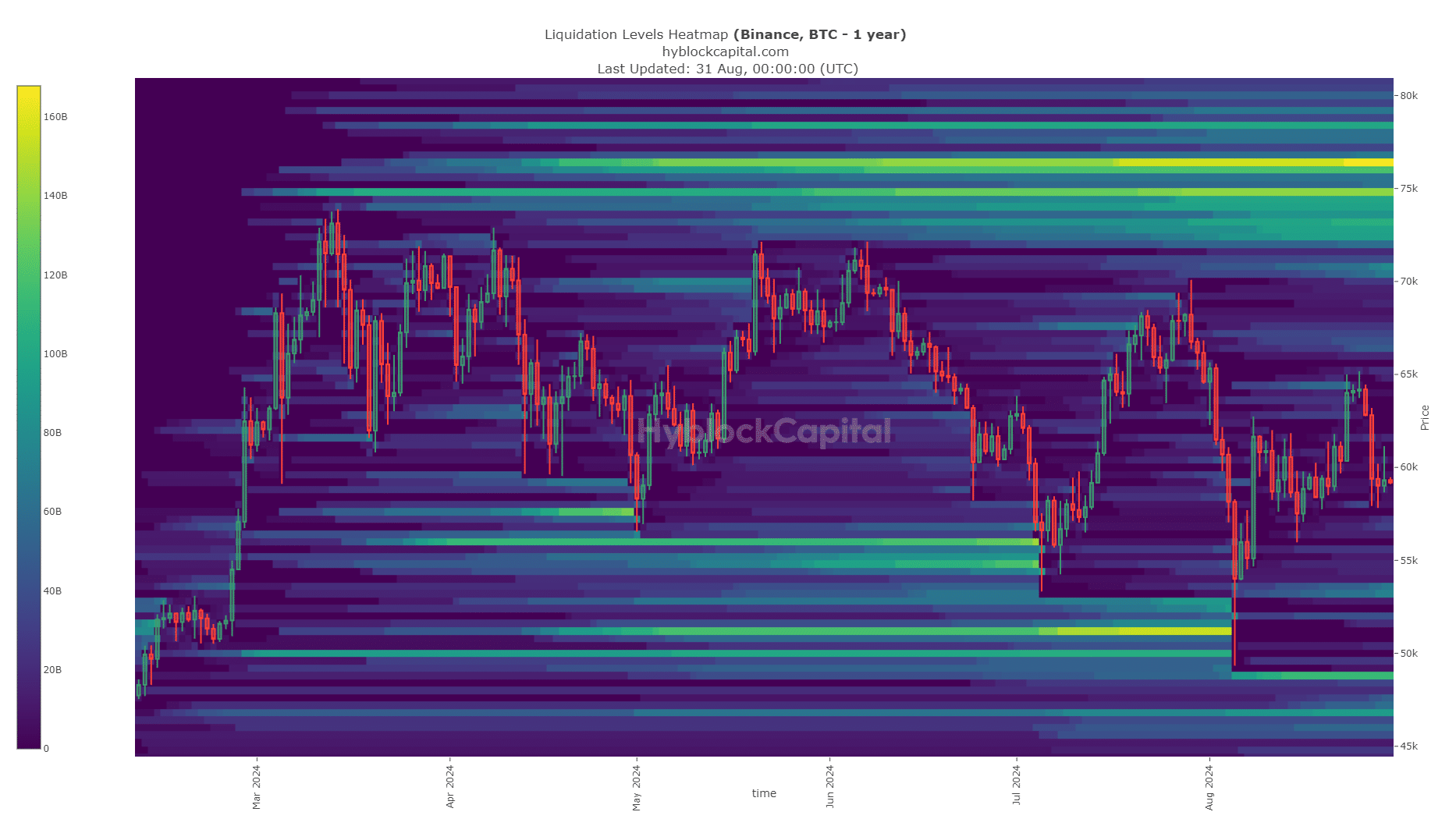

Source: Hyblock

AMBCrypto’s analysis of the liquidation heatmap revealed that the next significant magnetic zones for Bitcoin would be at $48.8k and $46.6k. Also, there seemed to be a pocket of liquidity at $53.6k. These levels would be the targets for BTC in case of a price drop below $56k.

Read Bitcoin’s [BTC] Price Prediction 2024-25

A recent report warned that a plunge below $56k could lead to a much deeper correction. The bull-bear market cycle showed bearish dominance, and the findings from the Tether exchange flows reinforced this bearish view.