- Bitcoin’s price movements in March 2025 have been more stable, compared to altcoins

- Divergence is a sign of Bitcoin’s maturity as a stable asset, while altcoins face greater speculative pressure

In March 2025, altcoins like Cardano [ADA], Solana [SOL], and XRP saw a sharp spike in realized volatility, with ADA hitting a record 150%, and SOL and XRP surpassing 100%.

Meanwhile, Bitcoin [BTC] also saw significant volatility, but it remained relatively subdued at 50% – Well below its historical highs.

Realized volatility reflects price variation over a set period. The hike in ADA, SOL, and XRP volatility is a sign of larger price swings, while Bitcoin’s volatility has remained relatively stable.

Altcoins as high-risk speculation

Compared to Bitcoin, altcoins are more susceptible to speculative trading, often driven by news, rumors, and community-driven momentum. This can lead to exaggerated price swings.

XRP has been particularly sensitive to regulatory news, with the ongoing SEC lawsuit contributing to erratic price movements.

During market uptrends, investors often shift capital from Bitcoin to altcoins in pursuit of higher returns, further amplifying altcoin volatility. While this volatility presents greater profit opportunities, it also increases the risk of significant losses.

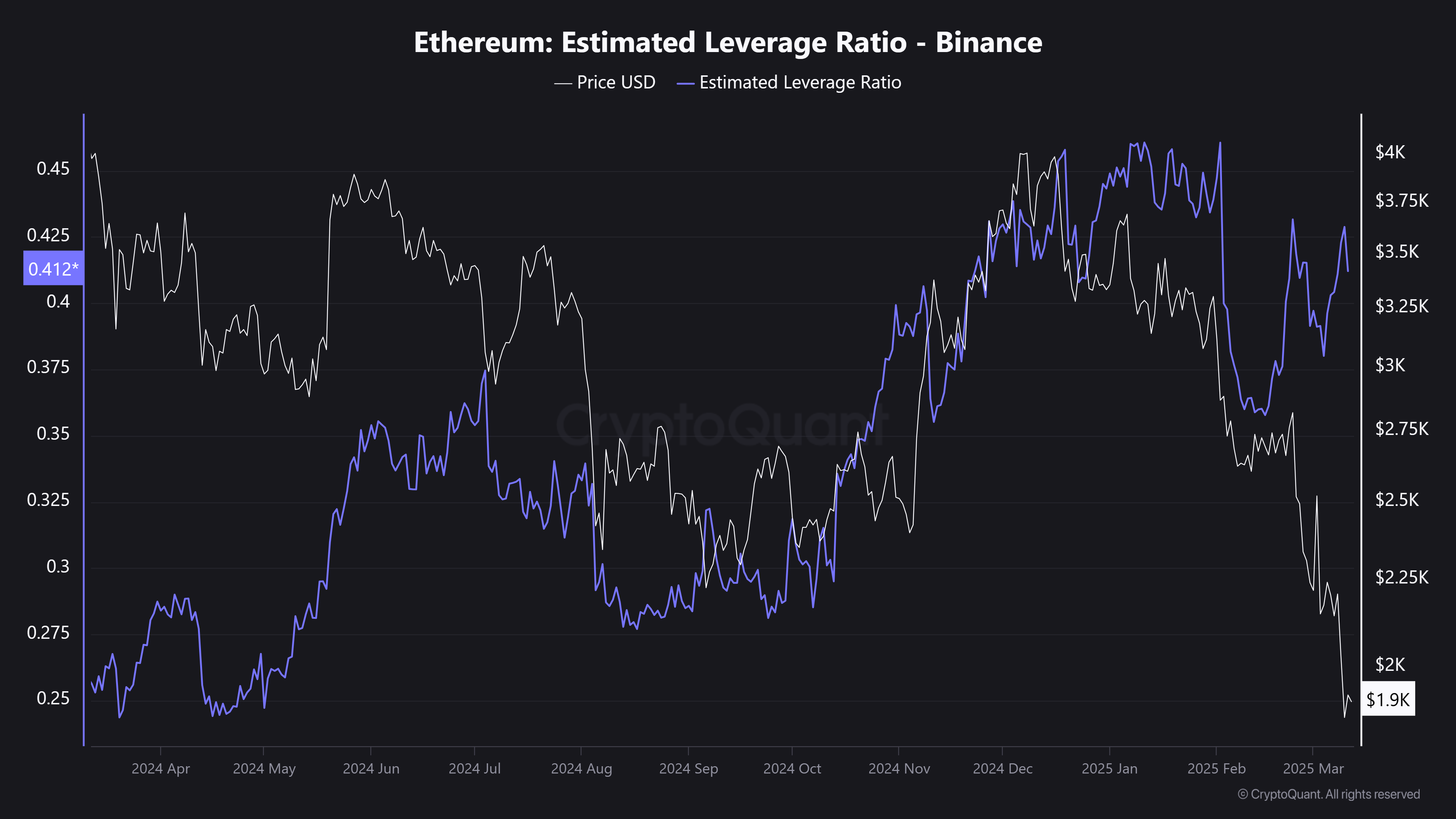

Ethereum (ETH) exemplifies this trend. Despite losing the $2,000 support for the first time since 2023 and exchange reserves rising, its Estimated Leverage Ratio (ELR) has surged to a monthly high. This is indicative of elevated risk exposure in derivatives markets.

Source: CryptoQuant

In other words, traders are aggressively leveraging positions on both sides, amplifying volatility – A classic “high risk, high reward” setup that could fuel sharp price swings.

This altcoin divergence is evident in price action as well, with ADA, SOL, and XRP breaking below key support zones and stuck in consolidation.

Increasing volatility is turning altcoin trading into a high-risk, speculative play.

However, is Bitcoin positioning itself as the more stable asset amid the growing uncertainty?

Bitcoin as a stable store of value

Historically, BTC has seen volatility spikes above 100%, but March 2025’s data seemed to hint at a more stable price structure.

While Bitcoin offers a safer haven with lower volatility, it also curtails short-term profit potential. This, unlike altcoins, where amplified risk brings the lure of higher rewards.

Does this reinforce Bitcoin’s role as a long-term holding? Well, volatility trends suggest it just might.

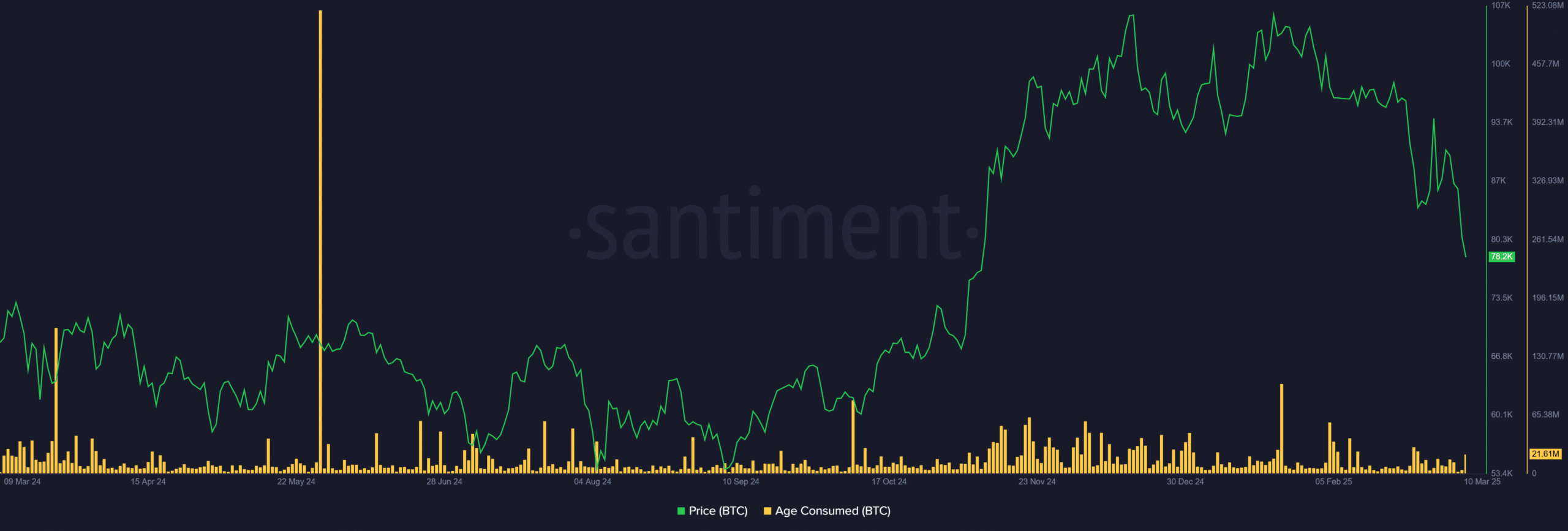

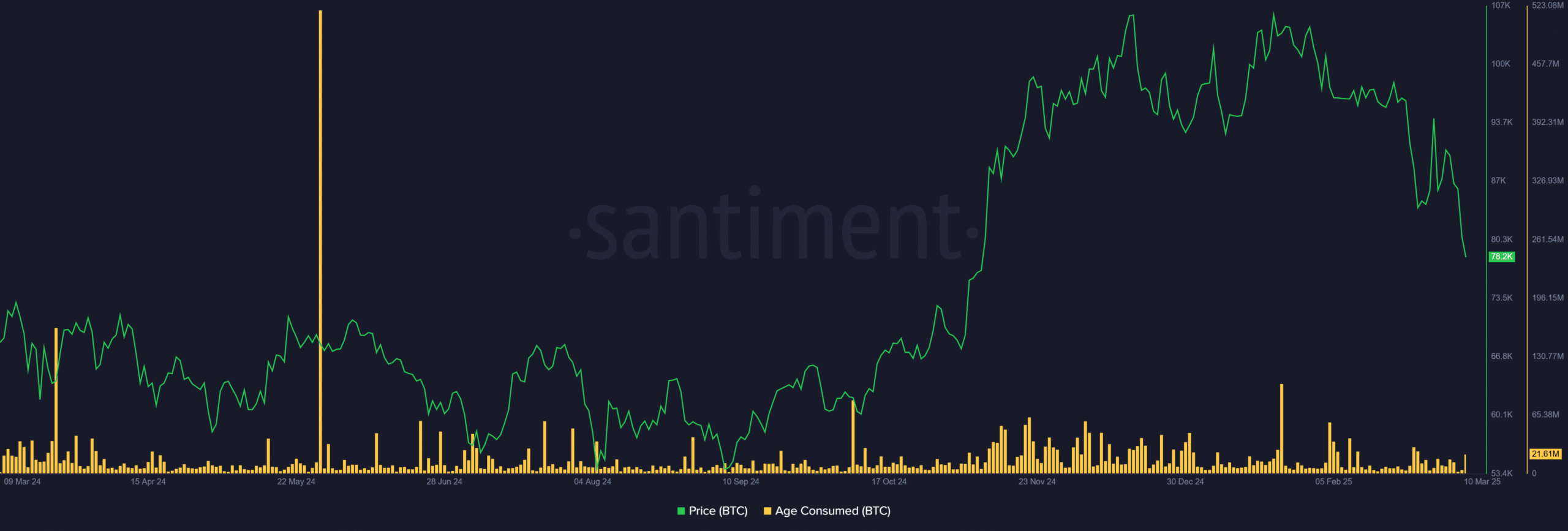

Meanwhile, the Age Consumed metric – tracking long-term holder movements – did not spike despite BTC plunging below $80k and erasing billions in market value.

Source: Santiment

This suggested that seasoned investors remain unfazed, reinforcing confidence in Bitcoin’s long-term trajectory.

Clearly, volatility trends are now shaping trading strategies.

With altcoins exhibiting higher risk-reward potential, they could dominate short-term speculation. All while Bitcoin continues to establish itself as the preferred long-term store of value.