- Bitcoin’s decentralization could be at risk as mining power becomes increasingly centralized

- The role of BTC ETFs in powering this shift cannot be overlooked

At the heart of the Bitcoin [BTC] network are miners with major BTC holdings. In today’s volatile market, keeping track of their reserves is more crucial than ever. Interestingly, the amount of BTC held in miner wallets has dropped to a yearly low of just 1.809 million.

While factors like rising mining difficulty, breakeven expenses, halving, and reduced rewards are often blamed, there may be a deeper shift at play. This shift could be eroding miners’ influence over the market as more investors flock to alternative investment vehicles like Bitcoin ETFs.

As a result, Bitcoin’s network risks becoming more centralized, raising the question – Is this a step forward or a setback for Bitcoin’s decentralized future?

Bitcoin’s decentralized future might be under threat

A year after the 2008 financial crisis, Bitcoin emerged as a game-changer, eliminating the need for financial middlemen. Over time, it has built a passionate community of ‘believers’ who see BTC not just as a digital asset, but as a powerful symbol of decentralization.

It’s no surprise that miners play a key role in making this vision a reality. In the 15 years since Bitcoin’s creation, individual miners have evolved into large companies, now holding significant amounts of BTC themselves.

Marathon Digital Holdings (MARA) is leading the way, with over 40k BTC in its reserves. While this is bullish for Bitcoin – driving up accumulation – it also signals a troubling trend – The growing centralization of mining power, now controlled by just a few key players.

The plot thickens as investors increasingly turn to mining stocks as an investment tool, closely tied to Bitcoin’s price. When Bitcoin drops, these stocks follow, leaving investors with losses.

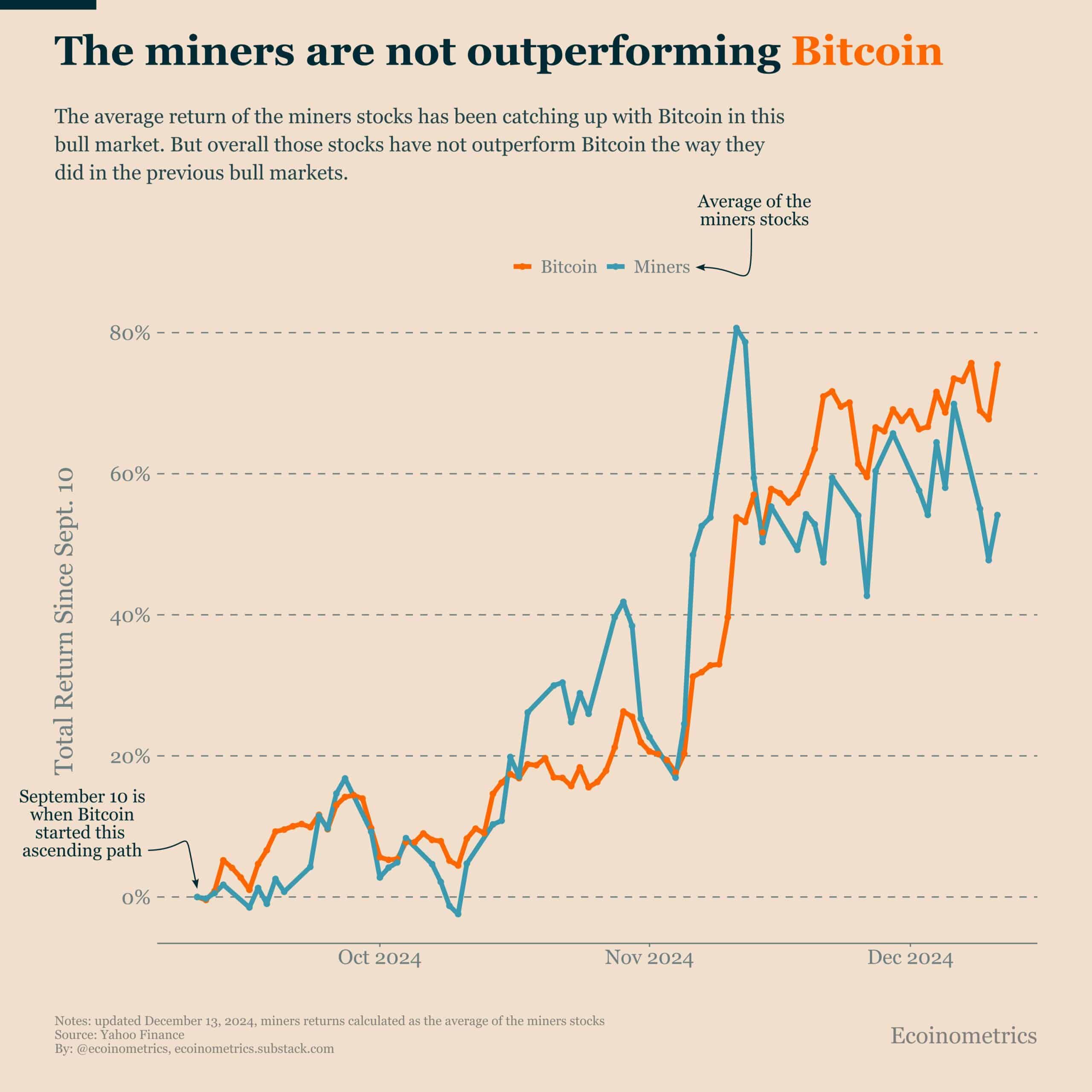

Source : Ecoinometrics on X

As ROI continues to shrink, more investors are pulling out, forcing mining companies to either sell off their Bitcoin holdings or shut down. This dynamic, in turn, directly or indirectly impacts Bitcoin’s price, adding yet another layer of volatility to the market.

A closer look at the chart above revealed an interesting pattern – The expected returns on Bitcoin holdings didn’t play out the way mining companies anticipated, particularly as Bitcoin neared the $100k mark.

In a typical scenario, this would have caused mining stocks to surge, attracting new investors eager for a slice of the action.

And yet, Marathon Digital Holdings (MARA) has been on a steady downtrend, signaling a shift in a market that demands deeper exploration.

What’s behind this change?

Since launching in January, Bitcoin ETFs have made it easier for both institutional and retail investors to gain exposure to Bitcoin without actually owning it.

This new investment vehicle removes the complexities of wallet management and mining. In fact, on the day the “Trump pump” began, $1.3 billion in inflows were recorded into Bitcoin ETFs.

Clearly, these newer players are quickly outpacing traditional mining stocks, offering a “less risky” route for investors eager to tap into Bitcoin’s potential.

Read Bitcoin [BTC] Price Prediction 2024-2025

But here’s the catch – This shift isn’t without its risks. As big institutions like BlackRock (IBIT) scoop up huge amounts of BTC, Bitcoin’s decentralized nature is starting to feel the strain. In fact, at last count, BlackRock held a staggering 530K BTC.

With such large players in the mix, their influence on Bitcoin’s price is undeniable. Investors need to stay sharp, exercise caution, and keep a close eye on their holdings moving forward.