- Bitcoin surged past $70,000 as the Stablecoin Supply Ratio Oscillator highlighted high demand

- Open interest in Bitcoin climbed by 8.85%, suggesting potential for further bullish momentum

After weeks of struggling to break through the $70,000 resistance, Bitcoin finally surged past this critical level, trading at close to $72k at press time. The cryptocurrency’s recent price action garnered much attention, with the crypto climbing by 3.9% within the last 24 hours.

This rebound has come amid a general uptick in demand, indicated by various market metrics – A sign that investors are regaining confidence in Bitcoin.

For instance – BinhDang, an analyst on CryptoQuant, highlighted that demand for BTC is now seeing a revival, as underlined by the Stablecoin Supply Ratio Oscillator (SSRO).

Source: CryptoQuant

The SSRO measures Bitcoin’s market cap relative to stablecoins like USDT, USDC, BUSD, and others, offering insights into buying demand fueled by these stablecoins. According to BinhDang, the oscillator’s data pointed to a hike in stablecoin-fueled buying interest, a development seen similarly when Bitcoin bottomed out in late 2022.

At the time of writing, Bitcoin’s 90-day SSRO signalled a resurgence in quarterly demand, surpassing the positive 2-point mark. As the cryptocurrency enters November, the continuation of this demand—coupled with positive news in the macroeconomic landscape—could further strengthen Bitcoin’s position, potentially pushing it towards new highs.

Other key metrics show strengthening fundamentals

Beyond the crypto’s price movements, Bitcoin’s fundamental metrics have also been showing renewed strength.

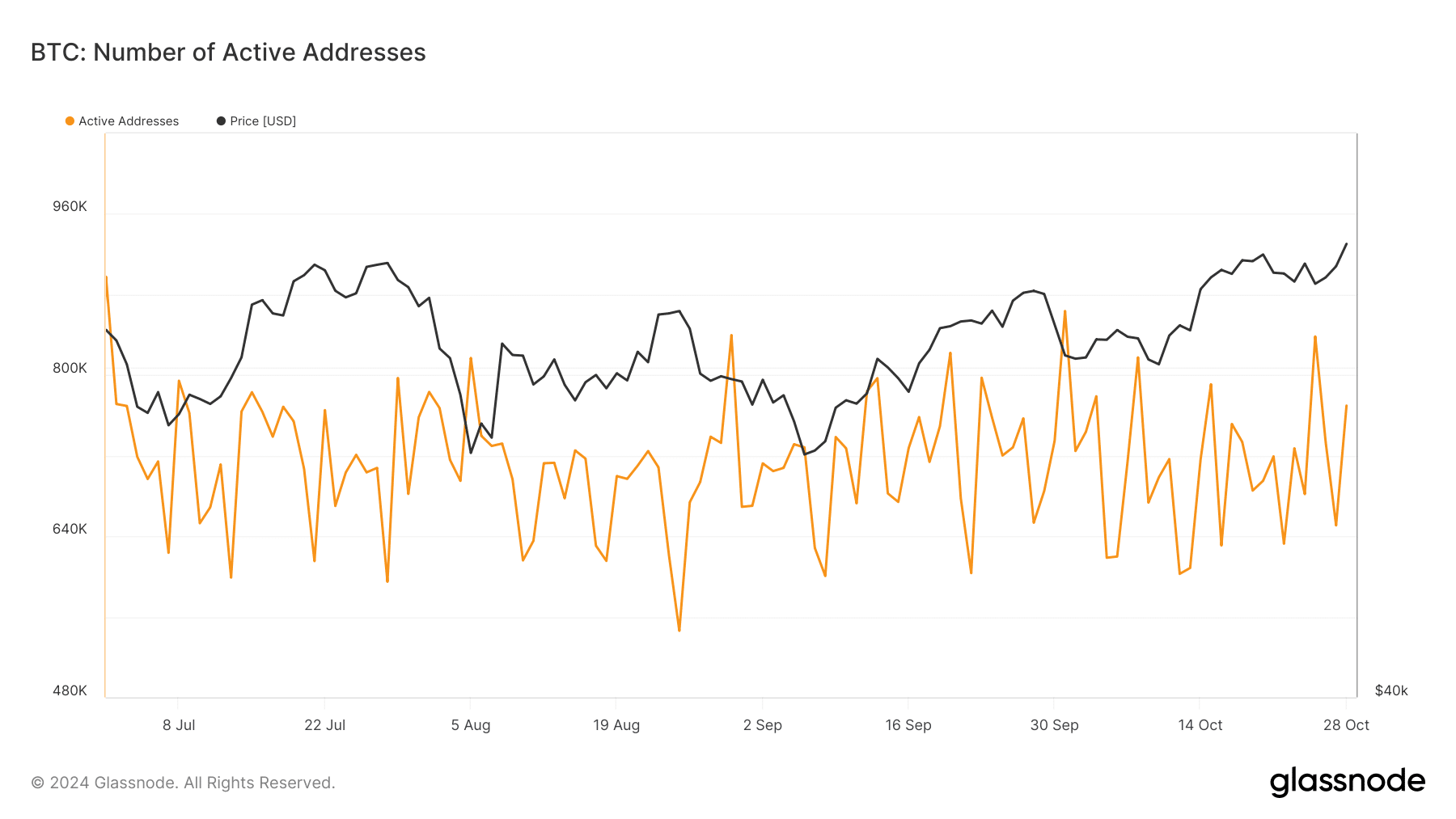

In fact, data from Glassnode indicated an increase in active BTC addresses over the past few weeks, suggesting that more participants are re-entering the market. As of late October, active addresses had surpassed 760,000, up from below 700,000 just days prior.

Source: Glassnode

This metric’s fluctuation highlighted shifting market engagement, with the latest uptick implying renewed interest, which often correlates with bullish price action. Greater activity across addresses means that more transactions are occurring on the BTC network, often a favorable indicator of rising demand and market activity.

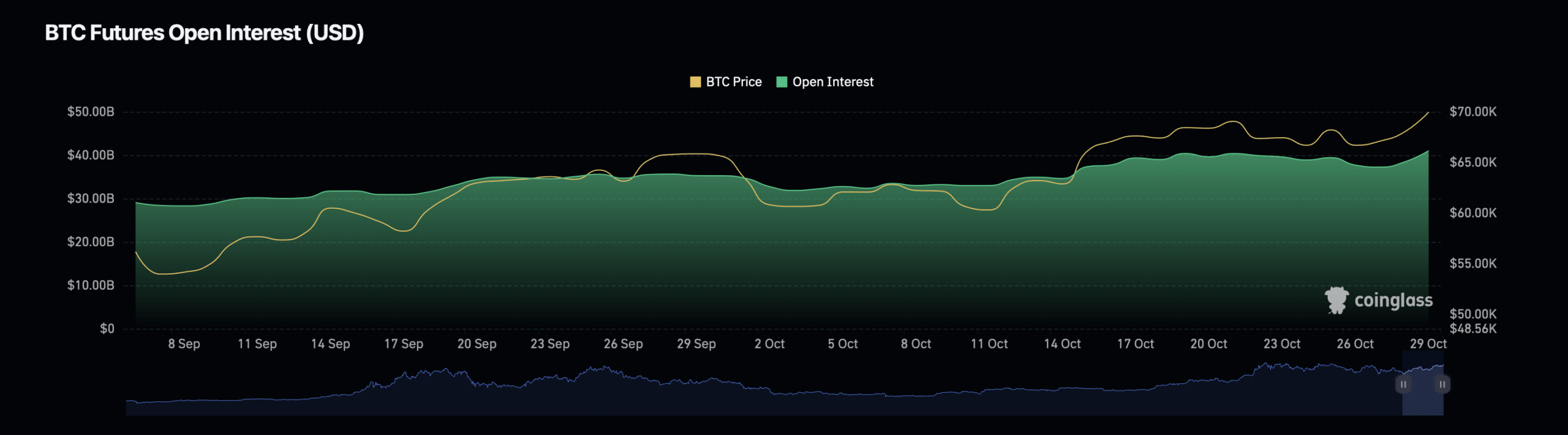

Simultaneously, Bitcoin’s Open Interest, as tracked by Coinglass, hiked by 8.85% to reach $42.56 billion. This surge in Open Interest—particularly notable as it rose by 118.55% in volume to $80.43 billion—demonstrated higher participation from Futures and derivatives traders.

Source: Coinglass

A rising Open Interest typically means that more capital is flowing into the market. This can create momentum and push prices higher as traders position themselves to capitalize on Bitcoin’s next potential move.