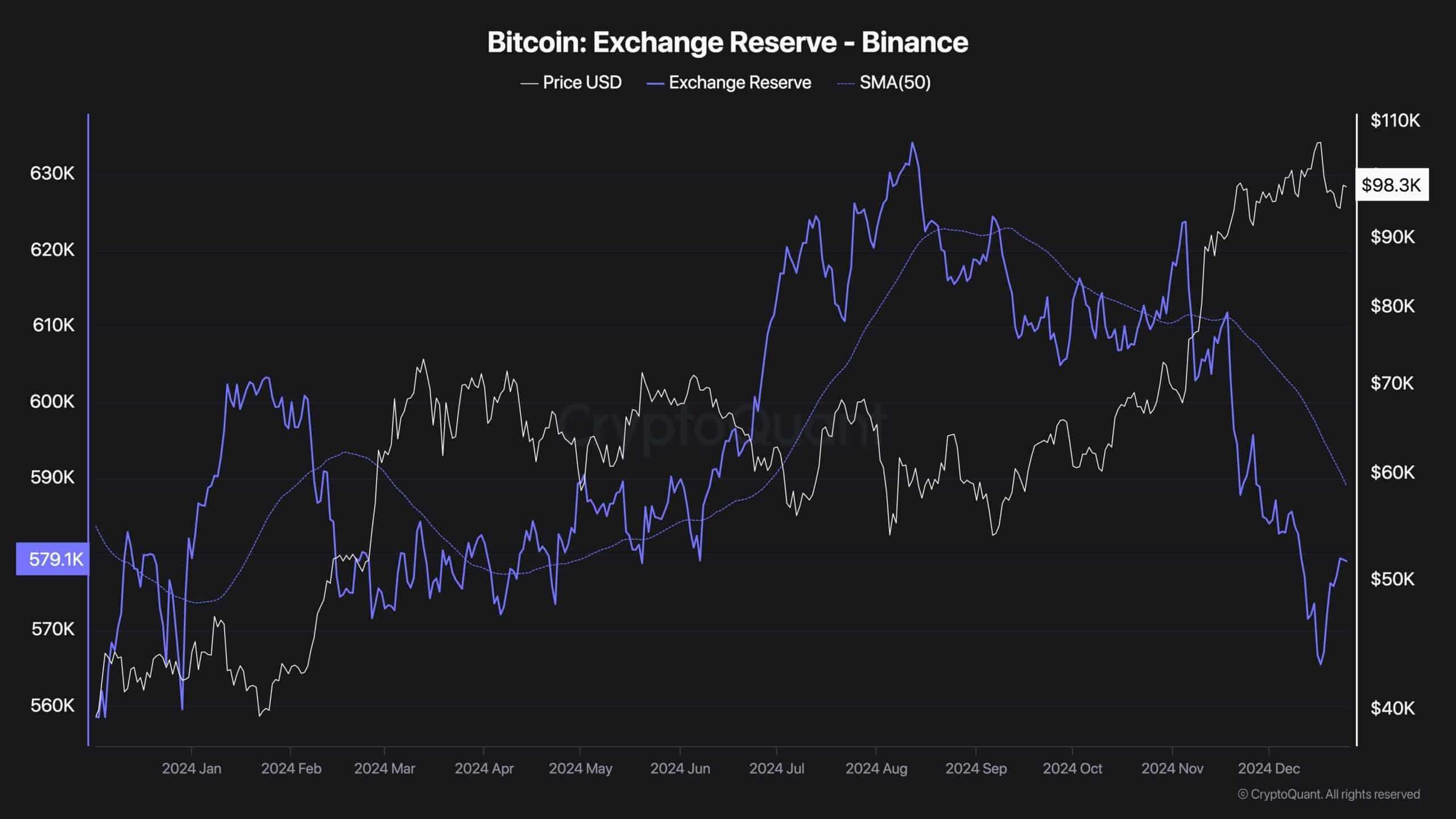

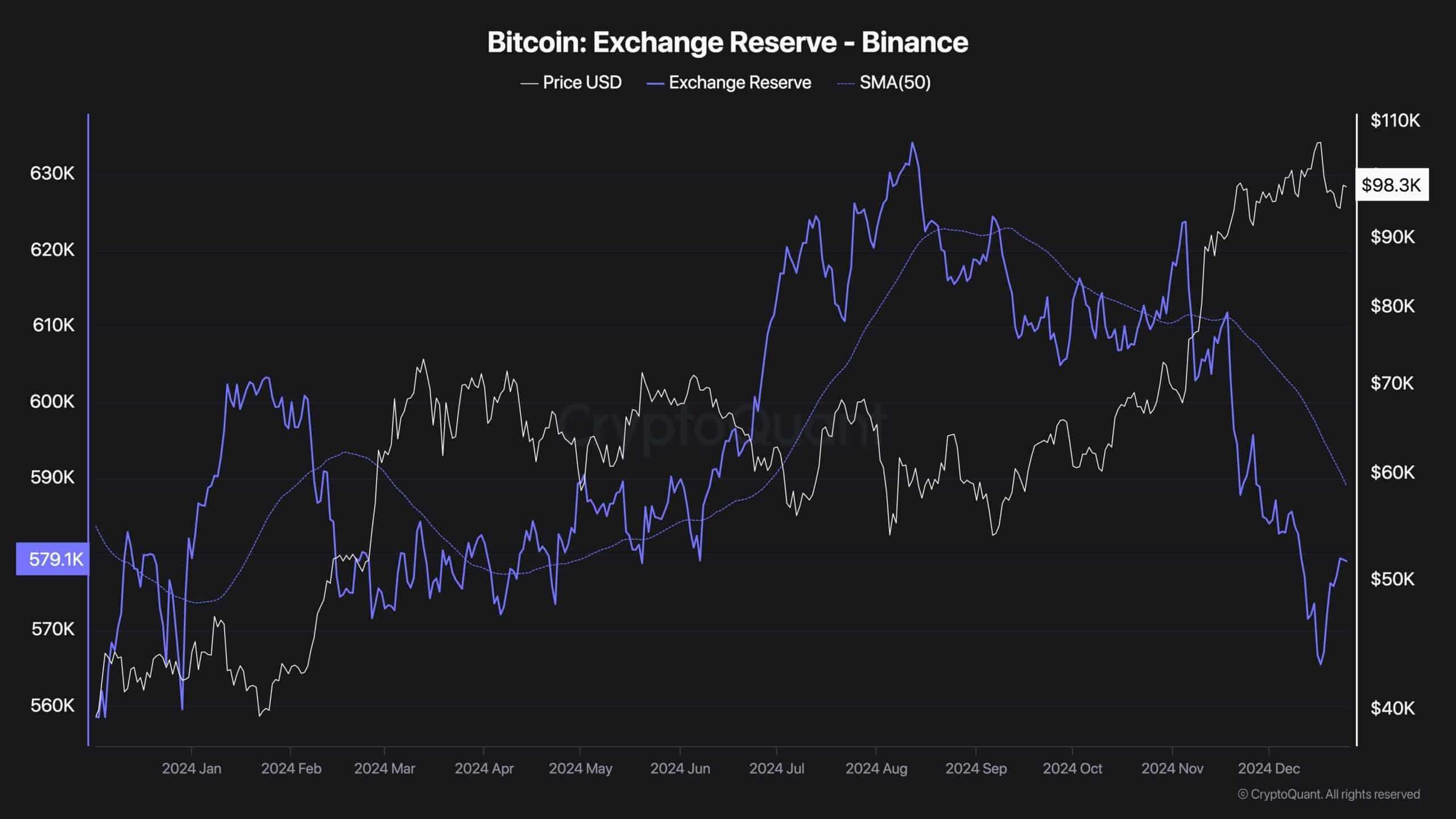

- Binance BTC reserve has dropped from over 630K BTC to 579K in four months.

- Can BTC climb above $105K amid looming demand shock?

Binance exchange Bitcoin [BTC] reserve has dropped to January 2024 lows, a trend that a CryptoQuant analyst deemed as a positive outlook for the asset in the long term.

Since August, the Binance reserve has declined from 630K BTC to nearly 580K BTC.

These low levels were last seen in January, just before US BTC ETFs went live and triggered a 90% pump, noted pseudonymous analyst Dark Fost.

Source: CryptoQuant

Bitcoin: More rally or price range?

The declining reserve meant that more BTC was moved from Binance for self-custody, indicating a potential price rally in the future.

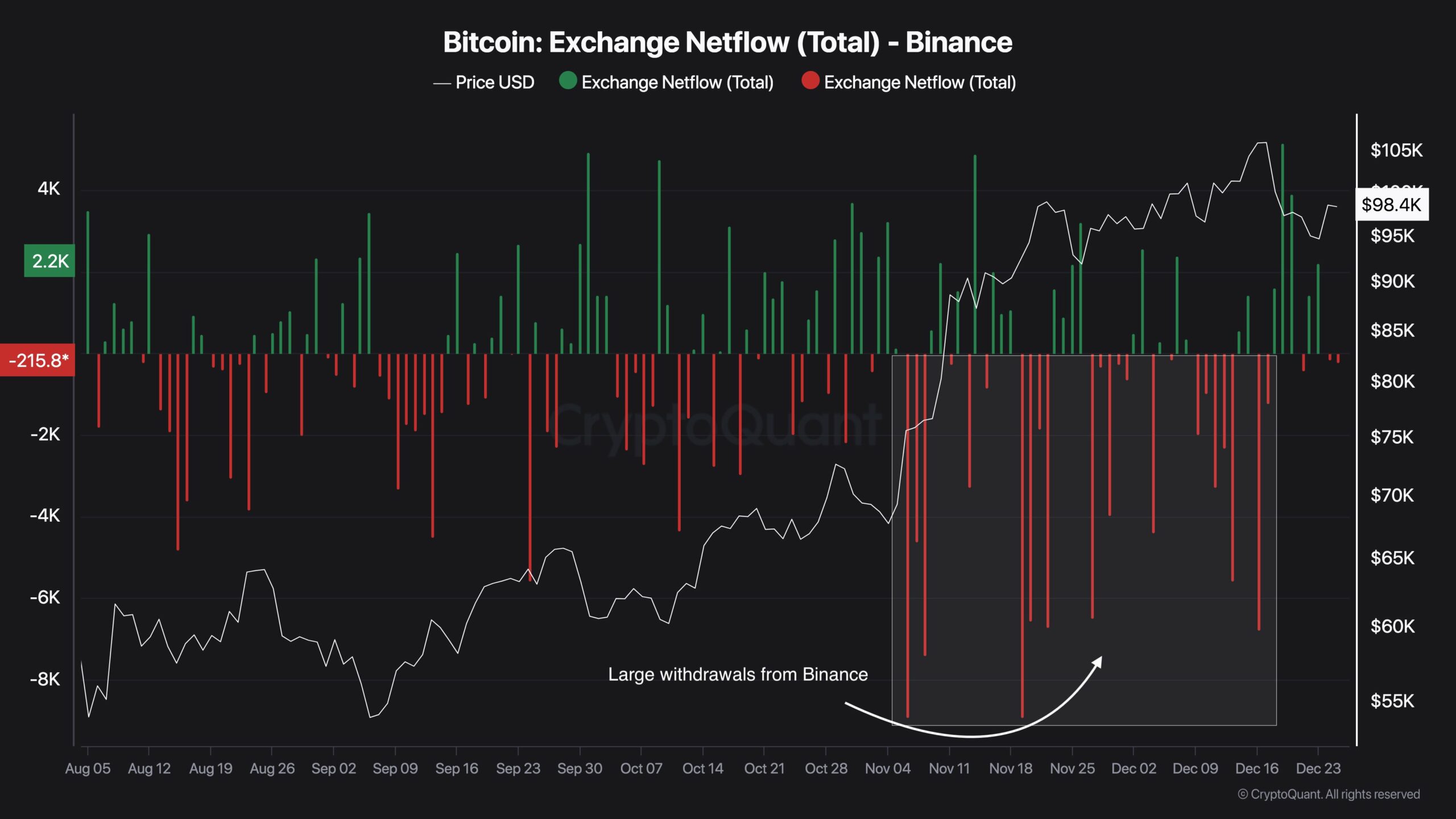

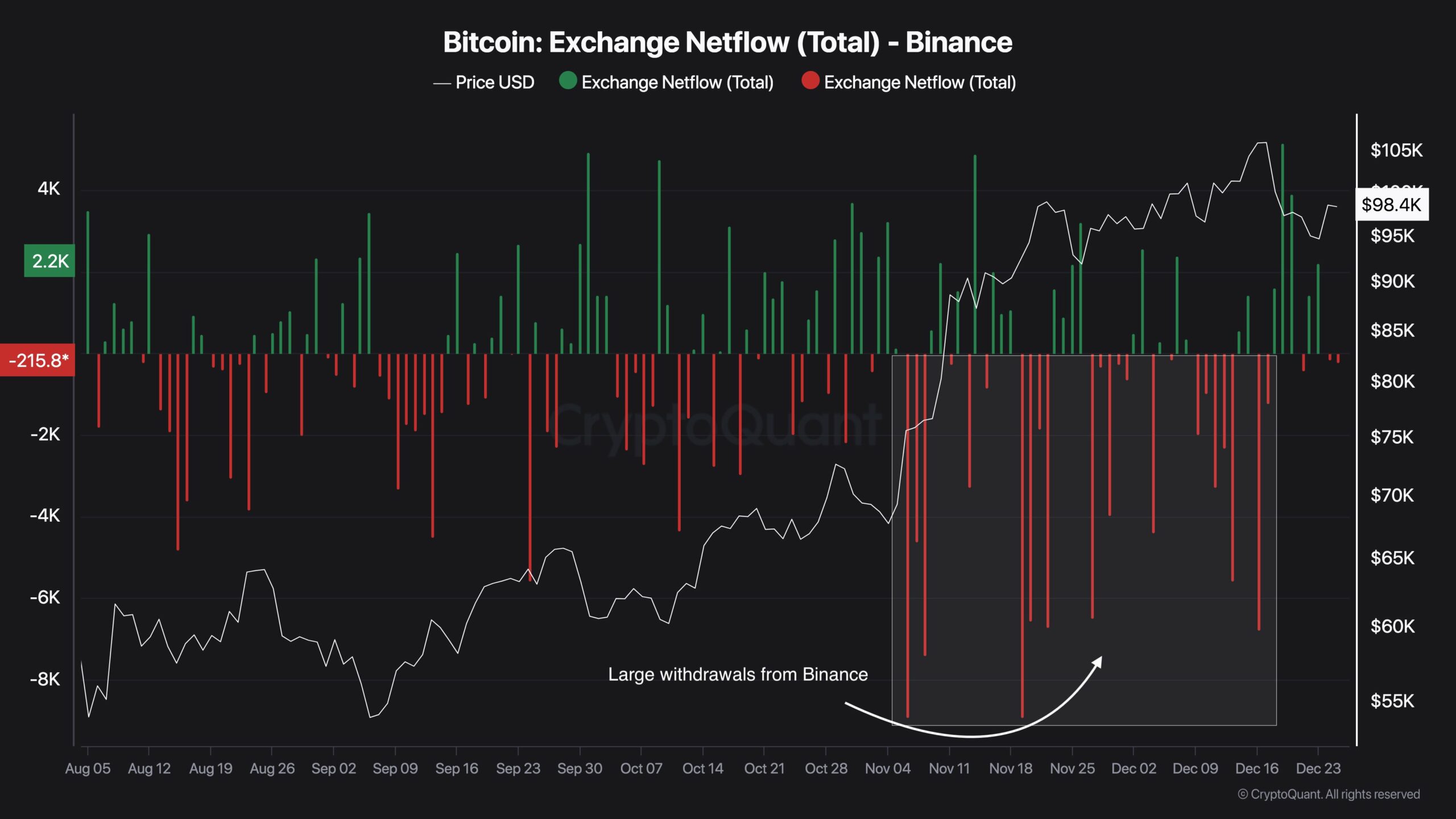

Fost added that the outflows reinforced BTC’s positive long-term prospect.

Source: CryptoQuant

Interestingly, the August-December decline in BTC reserve on the Binance exchange also coincided with the cryptocurrency pump to a record high of $108K.

So, with Christmas out of the way and the focus shifting to the upcoming Trump inauguration, what’s next for BTC?

Bitget Research chief analyst Ryan Lee expected BTC to remain range-bound between $94K-$105K, with a potential breakout after the holiday season. He said,

“The expected trading range for BTC this week is $94,000 – $105,000. The price is expected to exceed $105,000 after Christmas.”

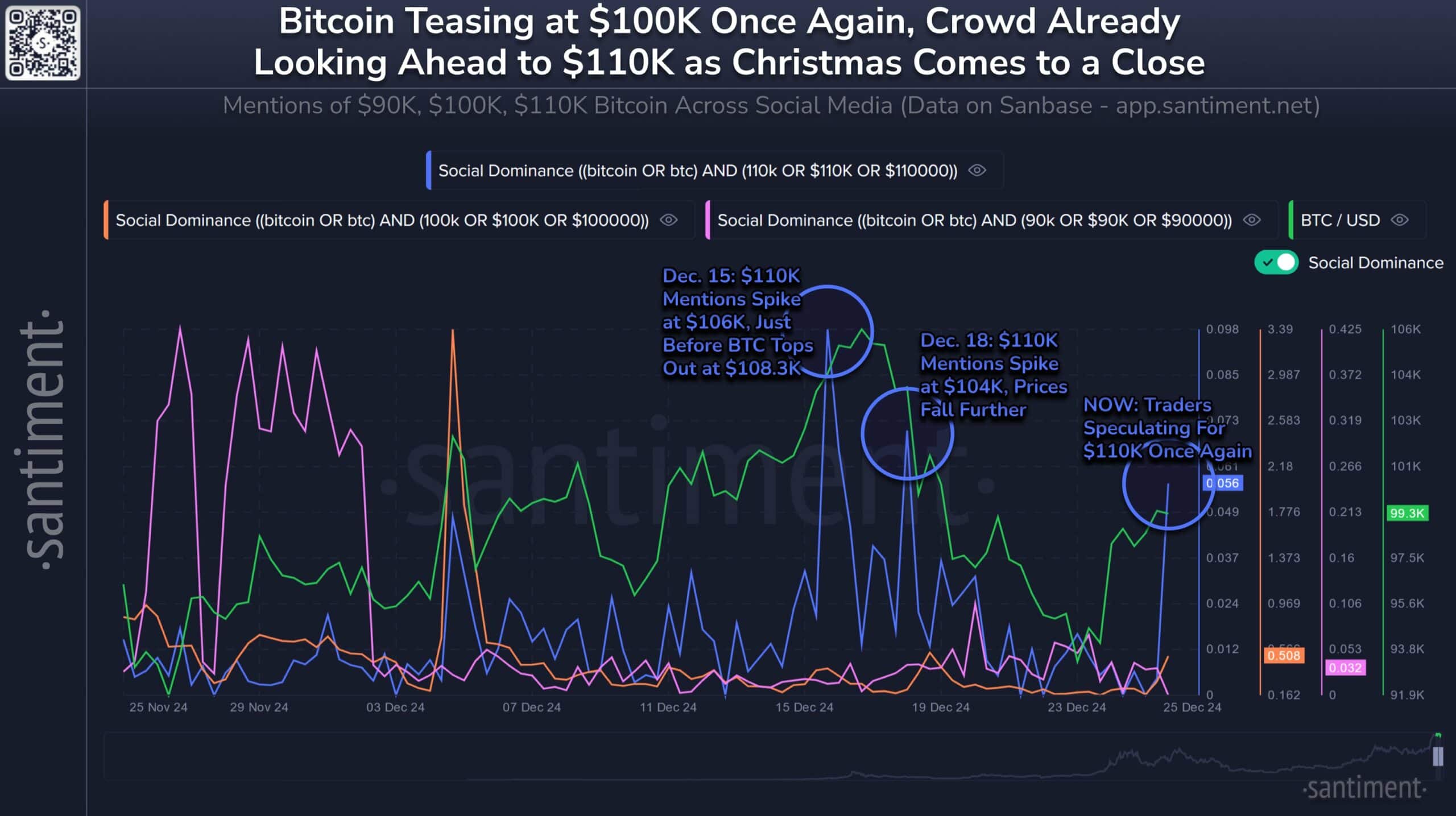

Since Christmas Eve, BTC has flirted with the $100K, increasing bullish calls for $110K in the past few hours.

But Santiment cautioned that a breakout to $110K would probably happen when people least expect it. The analytics firm stated,

“Traders are now swinging bullish once again, with speculation of $110K getting rampant. Historically, we will see $110K Bitcoin only after the crowd doesn’t expect it, as this image shows.”

Source: Santiment

As of writing, BTC was valued at $97.8K, about 10% away from its all-time high of $108.3K.