- Notcoin is in the spotlight today courtesy of its healthy ranking in the play-to-earn segment.

- NOT flashed a major trend pivot as whales re-accumulated after previously pushing down the price

Notcoin has been gradually gaining popularity and rising up the ranks lately. In fact, it was the 79th largest cryptocurrency by marketcap at press time. It ranked even better in the play-to-earn segment, which is one of the fastest growing crypto segments of 2024.

Notcoin was 3rd in Ben GCrypto’s list of the top 10 play-to-earn coins with a market cap of $897 million. However, it had the highest trading volume out of all the coins that were on the same list. This performance is a sign of Notcoin’s position and potential in the segment and its growing dominance.

Source: X

Hence, the question – Can this performance aid in Notcoin’s native cryptocurrency’s recovery? NOT has been on an overall bearish trend since June, with a sizeable, but short-lived bullish relief in July. The main reason for this performance has mostly been sell pressure from the market’s whales.

How Notcoin whales affected NOT’s price action

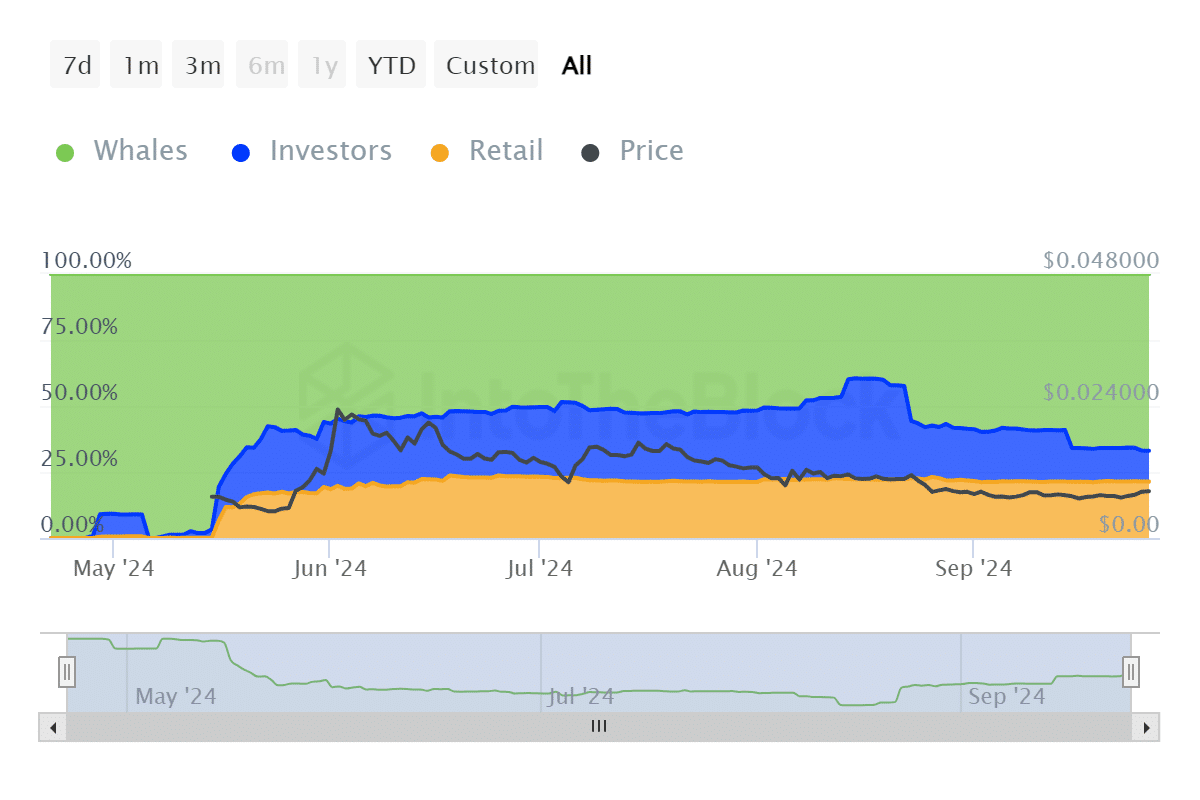

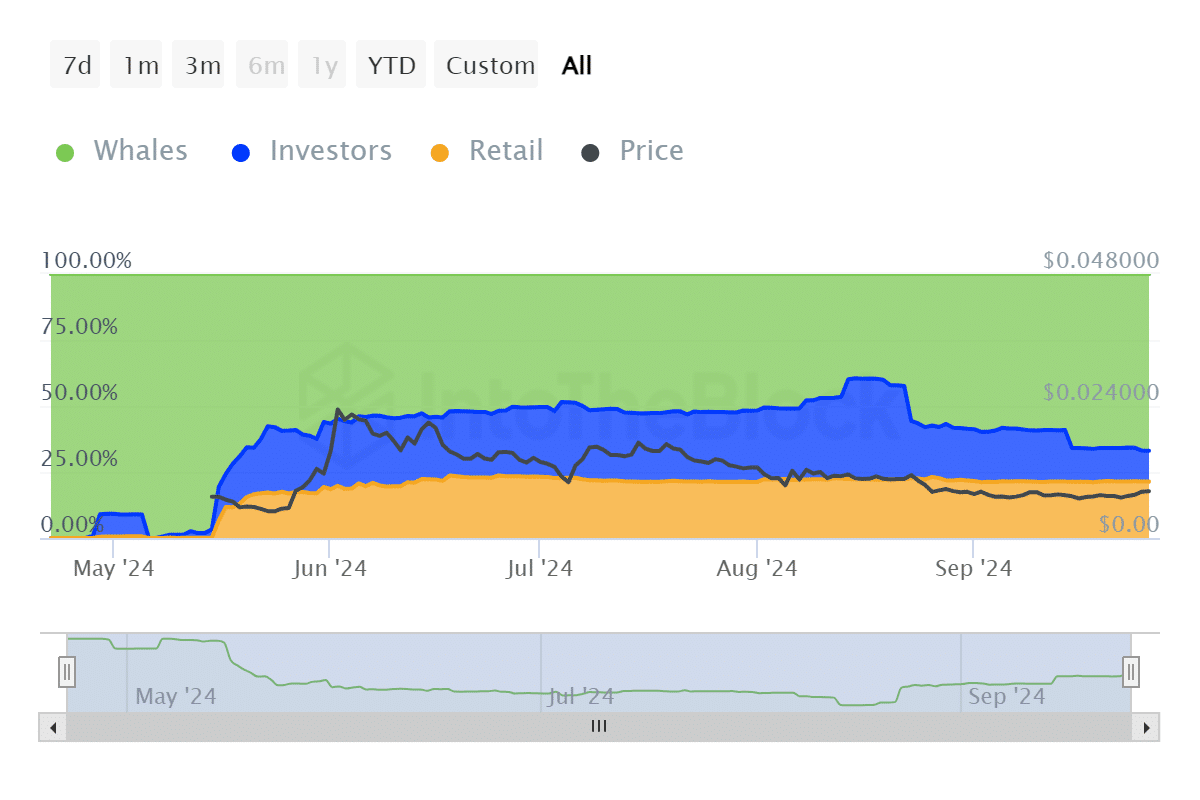

Historical concentration data revealed that whale holdings hit a low of 54.17 billion coins (52.17% of supply) on 14 June.However, whale holdings dropped to another low of 40.54 billion coins (39.6% of supply) as of 17 August. Simply put, whales have been contributing heavily to sell pressure.

Source: IntoTheBlock

The data also revealed that whales have been re-accumulating NOT since mid-August. Their balances, at press time, were at 68.58 billion coins (66.91%) on 26 September. This accumulation appears to have slowed down NOT’s decline.

Meanwhile, investor addresses registered significant outflows from over 22 billion coins in mid-June to just over 12 billion coins at press time. Retail addresses dropped by roughly 2 billion coins over the same period. This means whales had the biggest impact on the altcoin’s price.

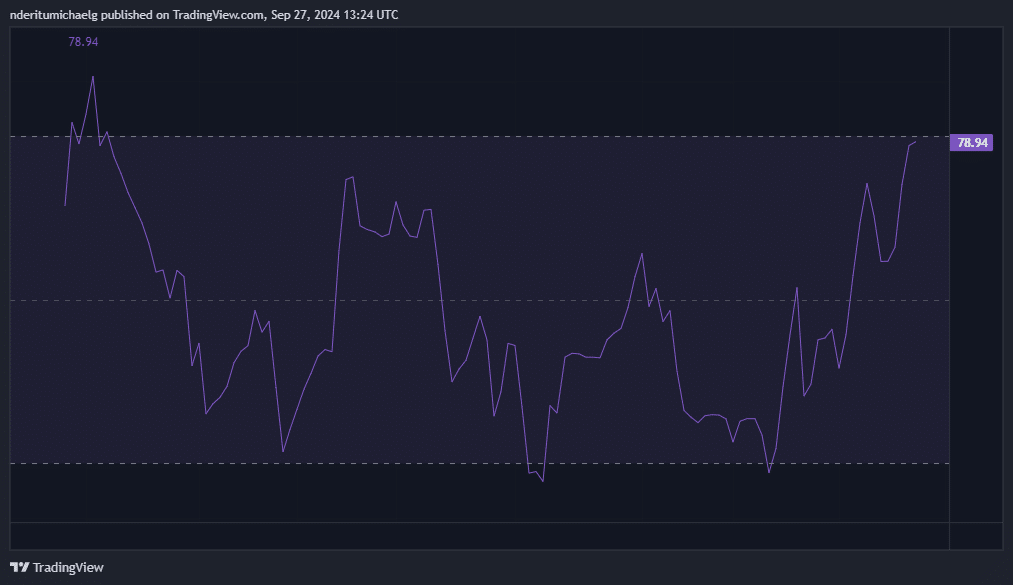

NOT’s sell pressure seemed to have levelled out within the $0.0071 price level this month. It demonstrated some bullish momentum this week, with price rallying by almost 40% in the last 5 days. In fact, the altcoin was valued at $0.0090 at press time.

Source: TradingView

NOT’s recent upside reflects whale activity, very much in line with the re-accumulation. The return of liquidity may put Notcoin on a path to more recovery in the next few weeks or months.

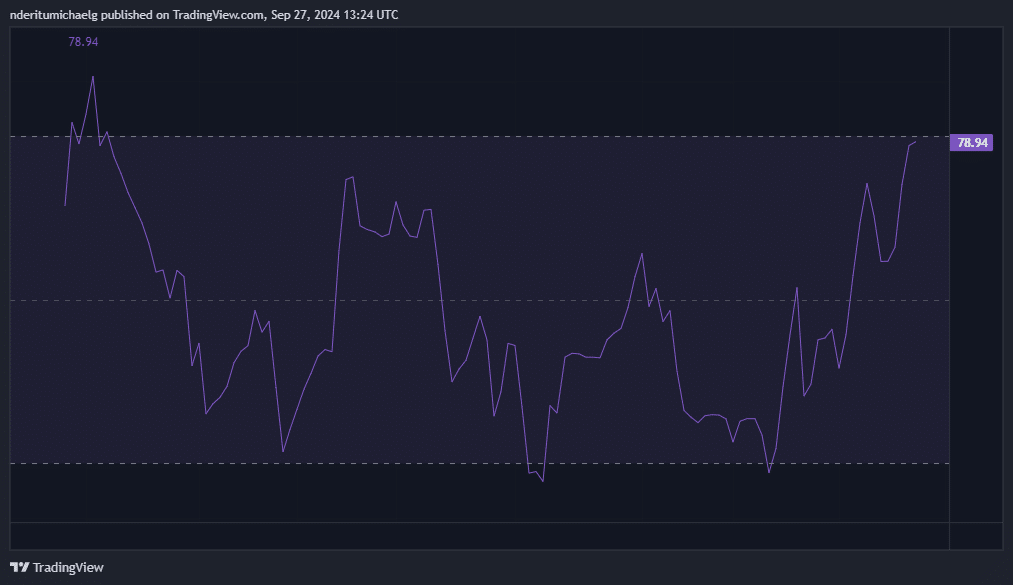

Finally, its money flow indicator revealed a strong liquidity resurgence so far this month.

Source: TradingView

NOT, at the time of writing, was trading at a 76% discount from its all-time-high, which may be seen as attractive. This liquidity resurgence, especially from whales, may reignite retail and investor demand. The next short-term price targets for NOT are $0.012 and $0.017.