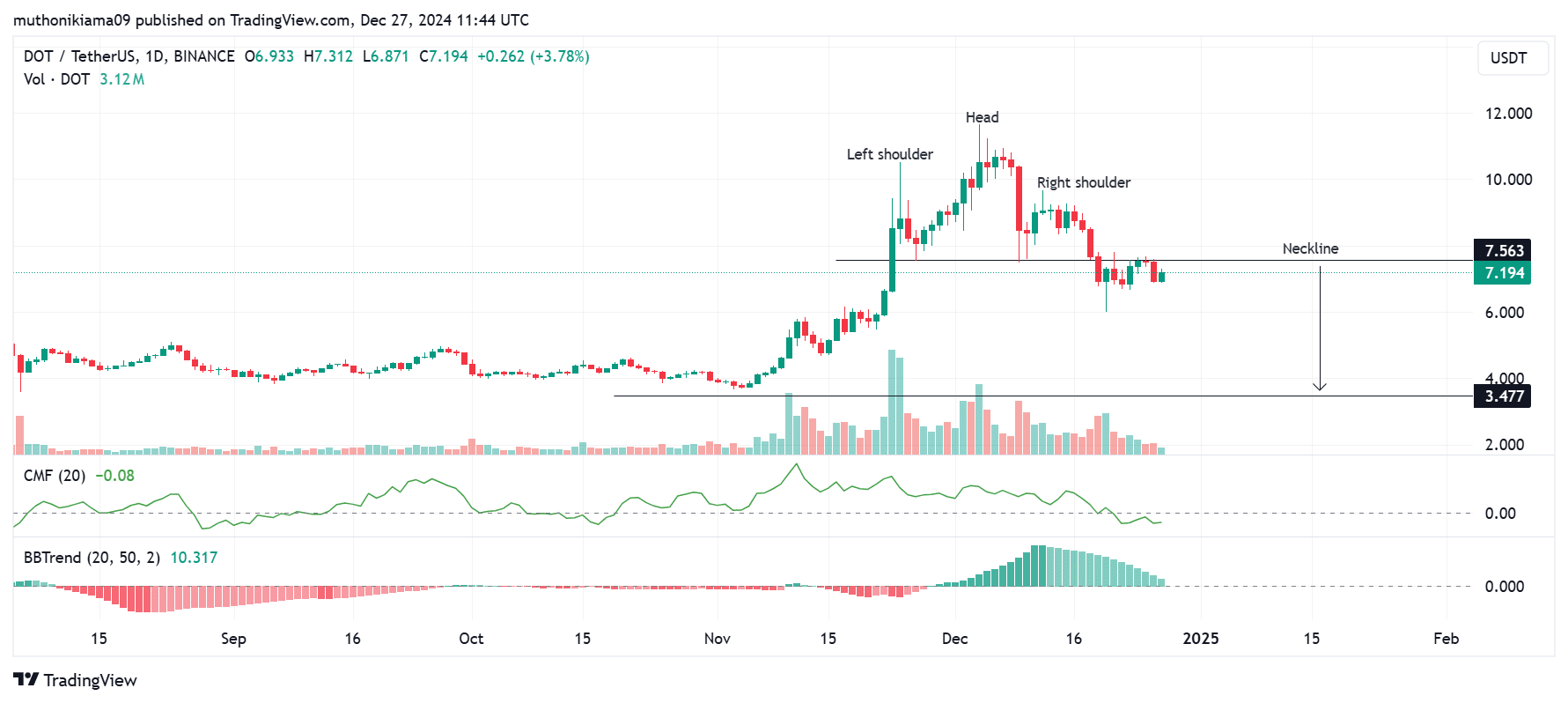

- Polkadot formed a bearish head and shoulders pattern on its one-day chart, which could precede a drop to $3.47

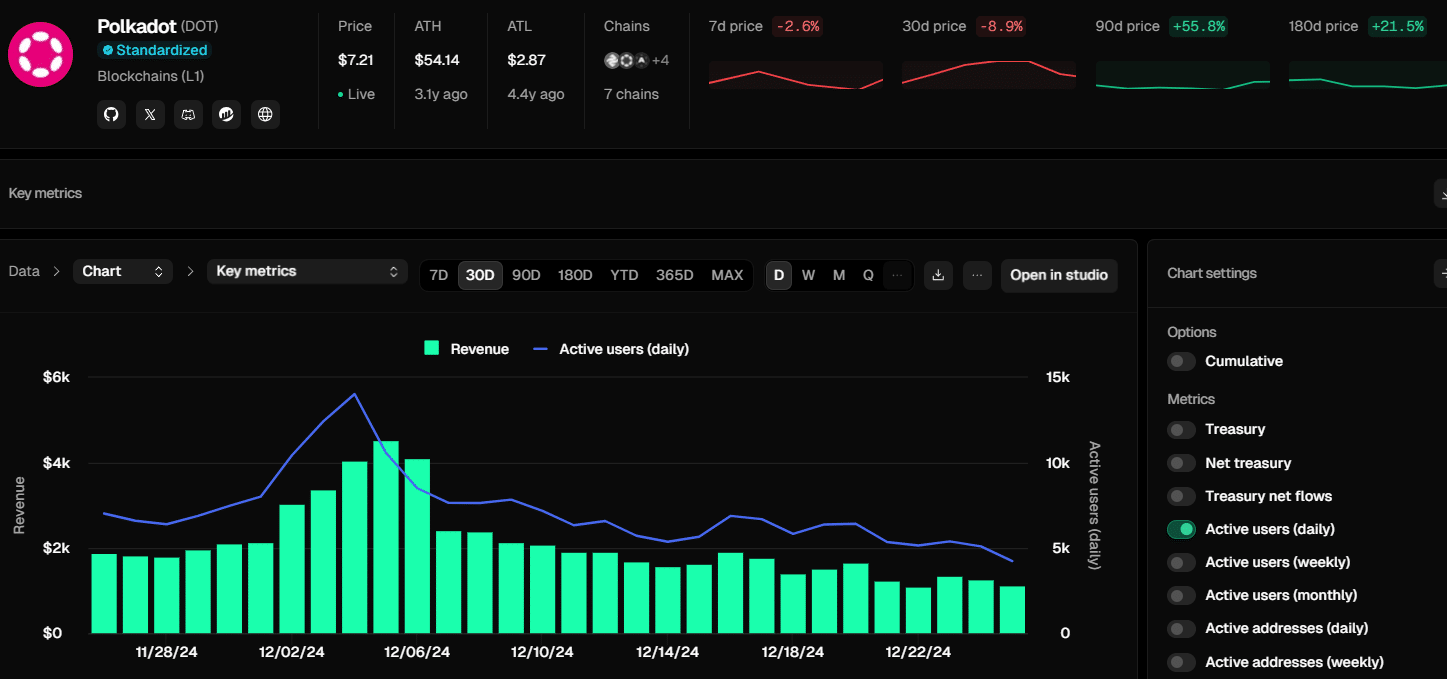

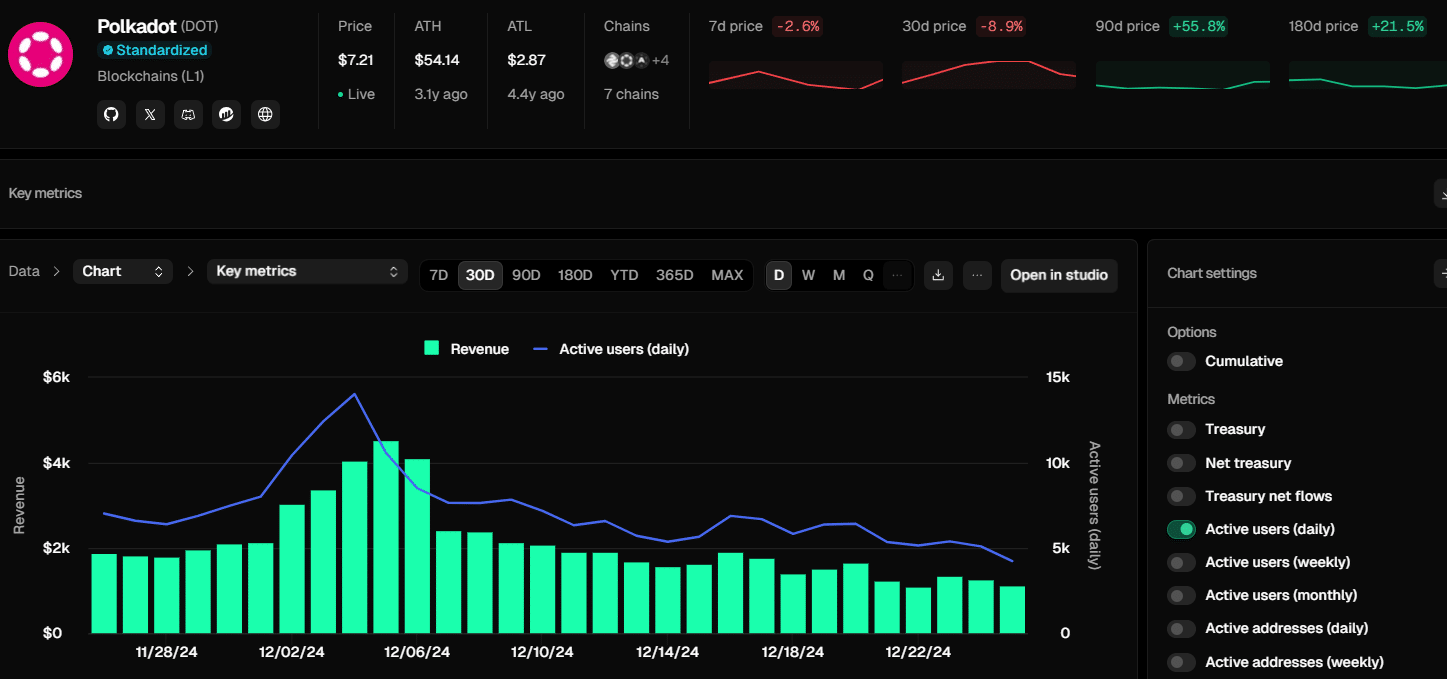

- Polkadot’s network activity has also declined significantly lately

Polkadot (DOT), at press time, was trading at $7.20 after gains of 2% in 24 hours. At the same time, the altcoin’s trading volume declined by 9% to $290M on the charts.

In fact, Polkadot has climbed by 16% in the last seven days. And yet, bearish signs seem to have emerged on the altcoin’s one-day chart recently – A sign that the price may be bound for a correction.

Polkadot forms a head and shoulders pattern

Polkadot formed a head and shoulders pattern on its one-day chart, a pattern which usually precedes a sharp bearish trend.

Following its recent gains, DOT was attempting to rally towards the crucial resistance at the neckline. However, it was rejected at this resistance level several times, suggesting that buyers have been inactive.

(Source: Tradingview)

If this resistance level holds strong and DOT is unable to break through, sellers will likely enter the market, triggering an over 50% drop towards $3.47.

The Chaikin Money Flow (CMF), which was tipping south, revealed that the selling pressure was higher than the buying pressure. This underlined a bearish momentum that could push DOT lower.

The fading histogram bars on the Bollinger Band Trend indicator also suggested the bullish momentum was weak. This could also pave the way for a downtrend, if buyers fail to re-enter the market.

Buyers are likely awaiting a decisive breakout above the neckline at $7.56 to enter new positions. If this happens, DOT could rally towards the next resistance level at $9.20.

Declining network activity could hinder gains

Polkadot’s network has witnessed a decline in activity, which could hinder gains. According to TokenTerminal, network metrics such as revenue and the number of users are now sitting on multi-week lows.

The number of daily active users on the network also dropped to 4,200 – The lowest level in 30 days. At the same time, daily revenues fell to $1,118, indicating that there are fewer people using the network.

(Source: TokenTerminal)

If the network fails to record an uptick in activity, it could strengthen the bearish trends. This will, in turn, push DOT prices lower on the charts.

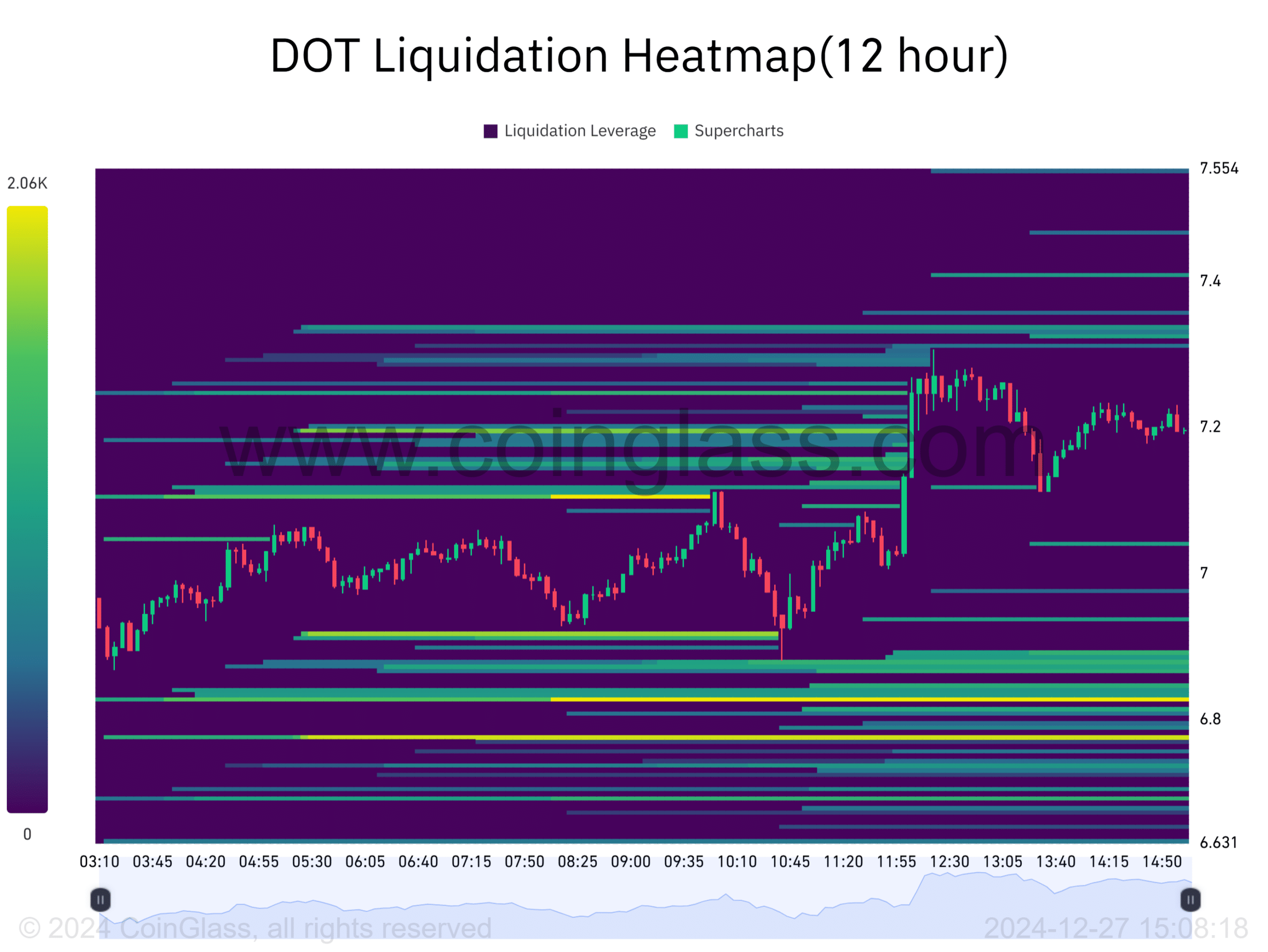

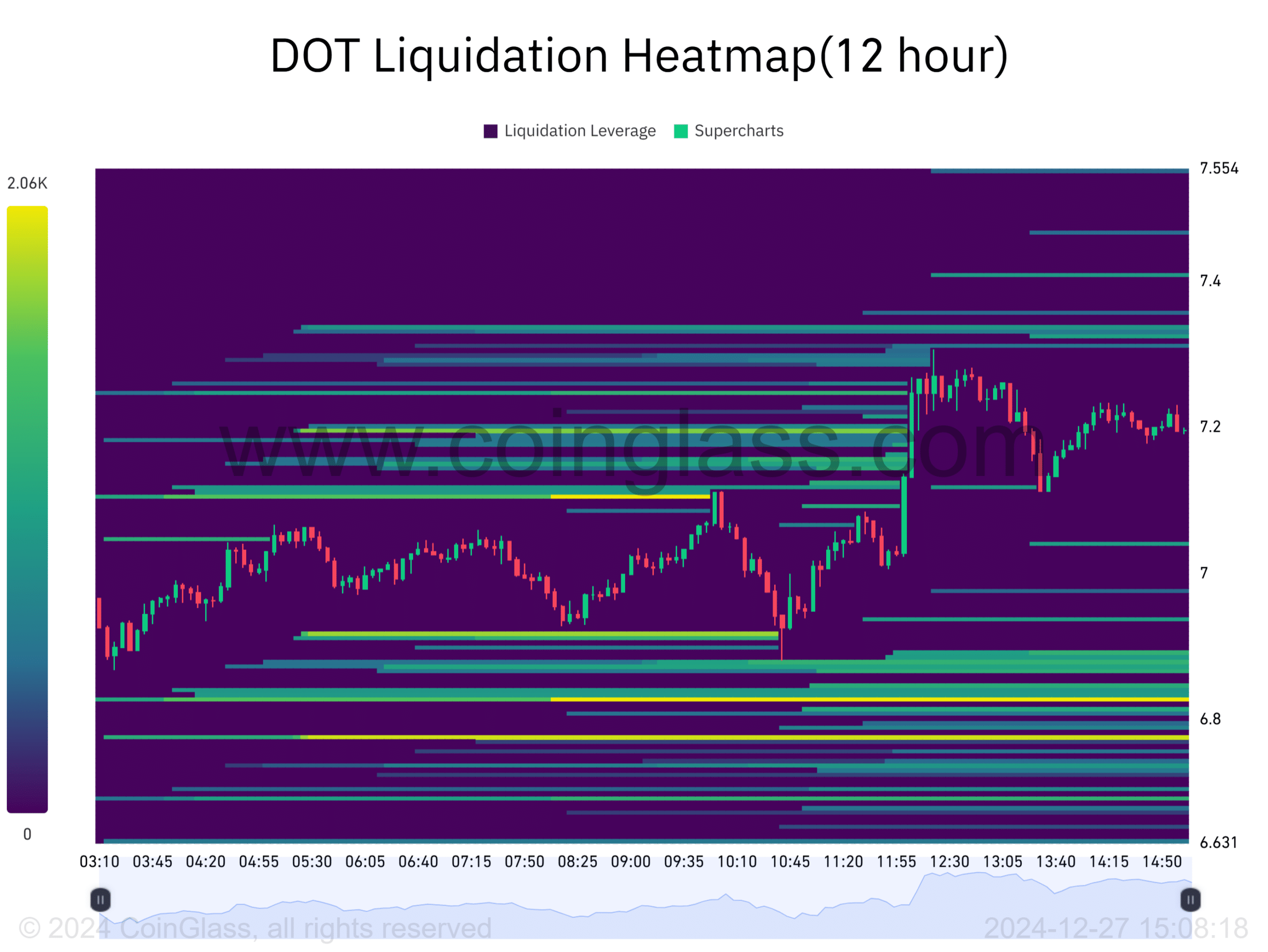

DOT’s liquidation heatmap suggests…

Polkadot’s liquidation heatmap revealed that there are no immediate liquidation levels closely above or below the press time price. If this scenario causes traders to not seek liquidity, it could result in the price consolidating.

(Source: Coinglass)

Nevertheless, there is a hot liquidation zone at $6.80, which means that if the price falls to this level, it could cause a cascade of long liquidations that could push the price even lower.