- XRP’s Open Interest dropped by 2.5% in the last 24 hours, indicating lower interest from investors

- There is a high possibility that XRP could fall by nearly 15%

Over the past few days, the sentiment across the cryptocurrency landscape has completely changed. While it seemed to be on the recovery road somewhat, the last few days have seen the market fall. In fact, over the last 24 hours alone, the wider crypto-market has fallen by over 3%.

That’s not all though as XRP whales have been offloading significant amounts of tokens to centralized exchanges (CEXs).

Whales offload $26.8 million of tokens

Blockchain transaction tracker Whale Alert revealed on X (previously Twitter) that whales have offloaded a significant 46.92 million XRP tokens worth $26.80 million over the last 24 hours.

However, this massive token transfer was carried out in two separate transactions. One whale transferred 26.72 million tokens to Bitstamp, while another transferred 20.2 million tokens to Bitso.

XRP price-performance analysis

As expected, this massive token dump on exchanges has created a lot of selling pressure.

At press time, XRP was trading near $0.56 following a price drop of 2.4% in the last 24 hours. Meanwhile, its trading volume also fell by 15%, indicating reduced participation from traders and investors.

All the bearish signs

Additionally, XRP’s Open Interest also flashed bearish signals as the same dropped by 2.5%.

In fact, according to the on-chain analytics firm CryptoQuant, exchange deposit addresses have risen by 2% in the last 24 hours. This rising deposit activity can be seen as a sign that investors are moving their holdings to exchanges, thus creating selling pressure.

Technical analysis and key levels

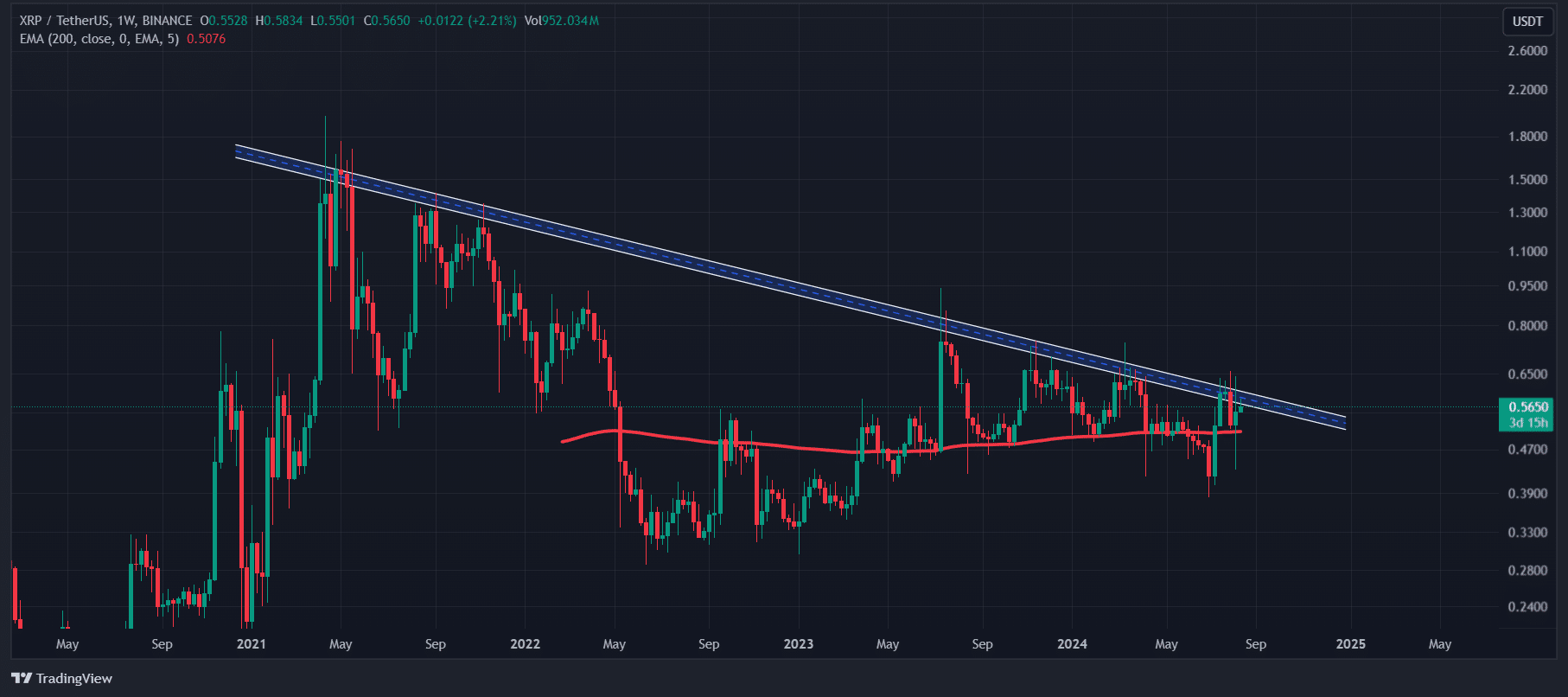

At the time of writing, XRP looked bearish as it had started declining after taking resistance from a descending trendline on the daily timeframe.

Since April 2021, XRP has hit this trendline five times, and each time, it has recorded a significant price decline on the charts.

Source: TradingView

This time, there is a high possibility that XRP could fall by nearly 15% to the $0.48 level.

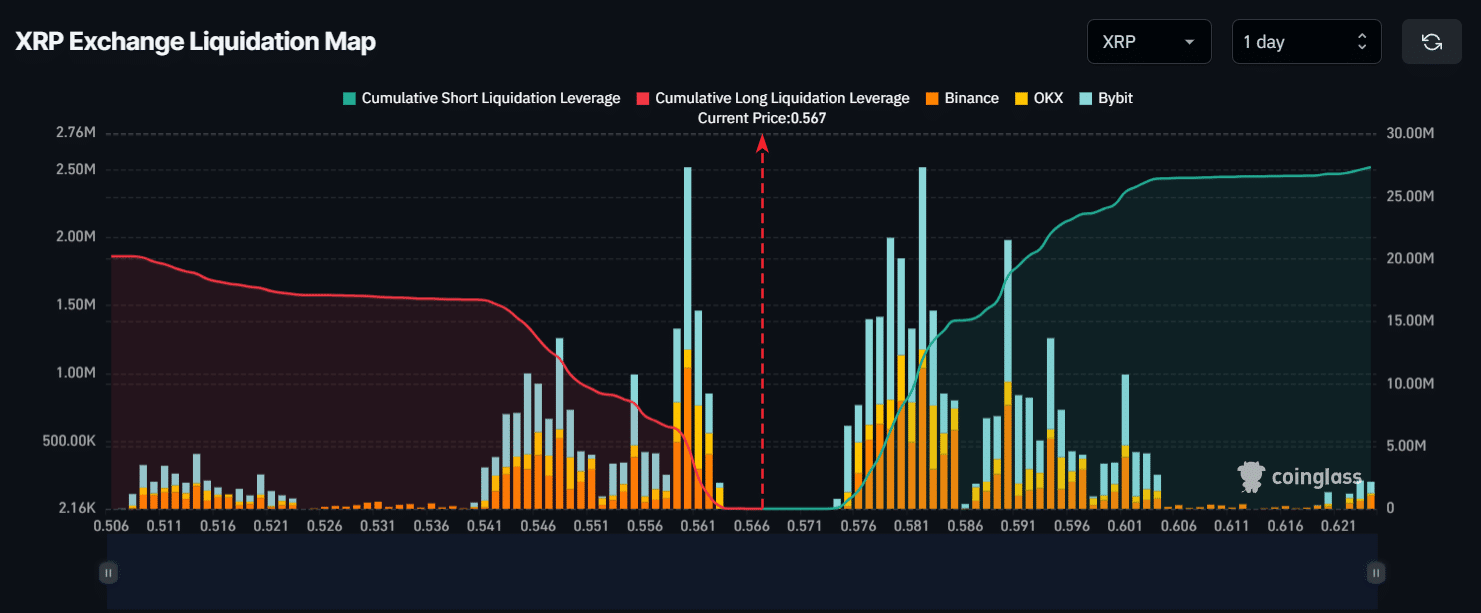

Major liquidation levels

At the time of writing, XRP’s major liquidation levels were near $0.56 on the lower side and $0.582 on the upper side.

Source: CoinGlass

If the sentiment remains bearish and XRP falls to $0.56, nearly $5.03 million worth of long positions will be liquidated.

Conversely, if the sentiment shifts and the price rises to $0.582, nearly $12 million worth of short positions will be liquidated.