- UNI struggles to break out of a downtrend despite Uniswap’s $2 trillion volume milestone.

- Technical indicators suggest a potential bounce, with rising open interest signaling market interest.

Uniswap [UNI] recently crossed a staggering $2 trillion in cumulative trading volume on Ethereum’s Layer 1 blockchain, underscoring its significance in the decentralized finance ecosystem.

However, UNI, the protocol’s governance token, remains in a downtrend, which has raised concerns among investors. Trading at $7.18, down 4.61% at press time, Uniswap faces a tough path to recovery.

The key question now is whether this milestone can ignite enough momentum to reverse Uniswap’s bearish trajectory.

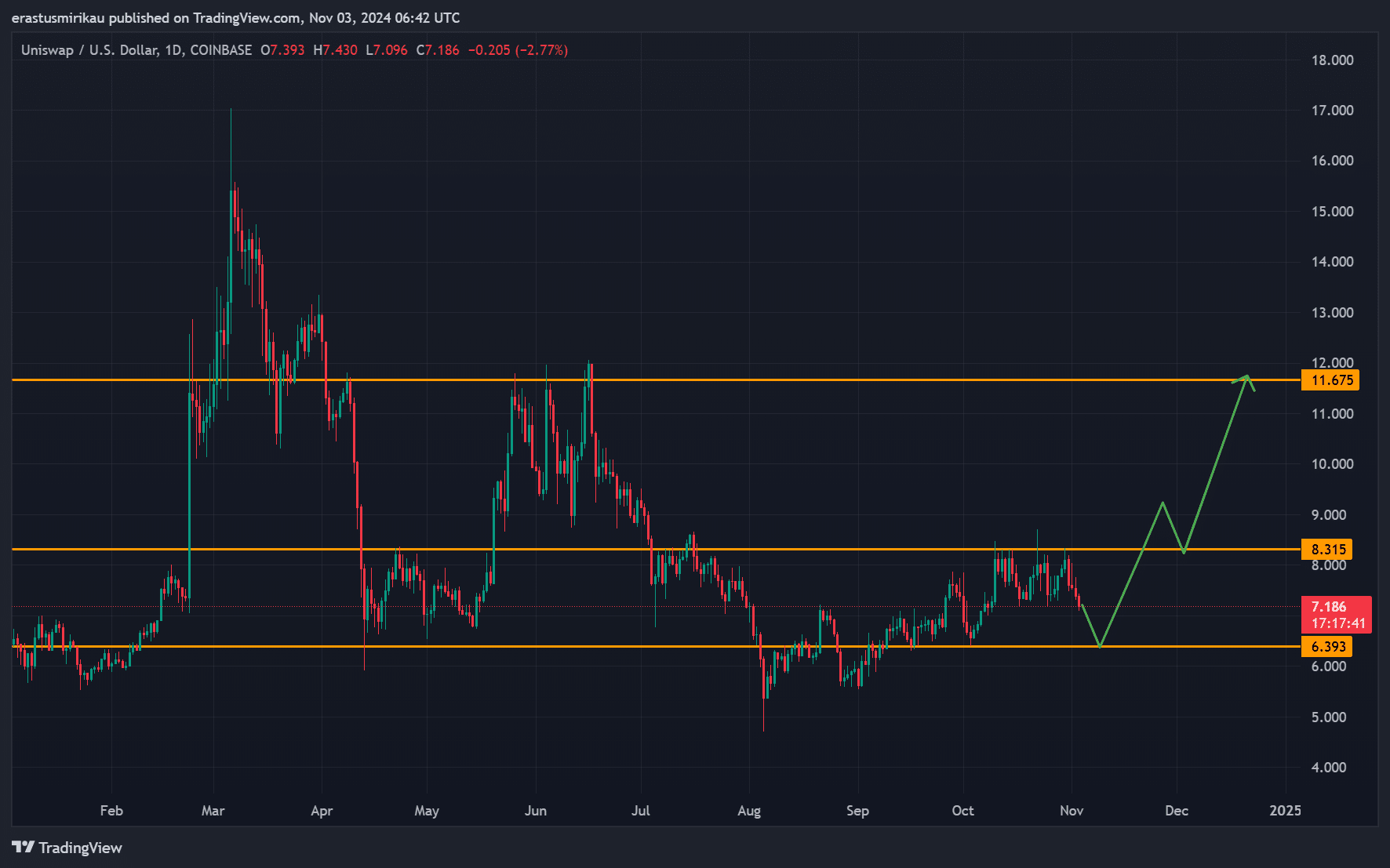

Key support and resistance levels for UNI

UNI’s price chart shows critical support and resistance levels that may shape its immediate future. The primary support level sits around $6.39, a vital area for halting further declines if sellers maintain pressure.

However, if UNI holds above this level, it may attract buyers and stabilize.

Additionally, Uniswap faces significant resistance at $8.31, a level it must break to confirm a recovery. A more ambitious target lies at $11.67, which could signal strong market confidence if reached.

Therefore, these levels are essential for investors looking for signs of a trend reversal.

Source: TradingView

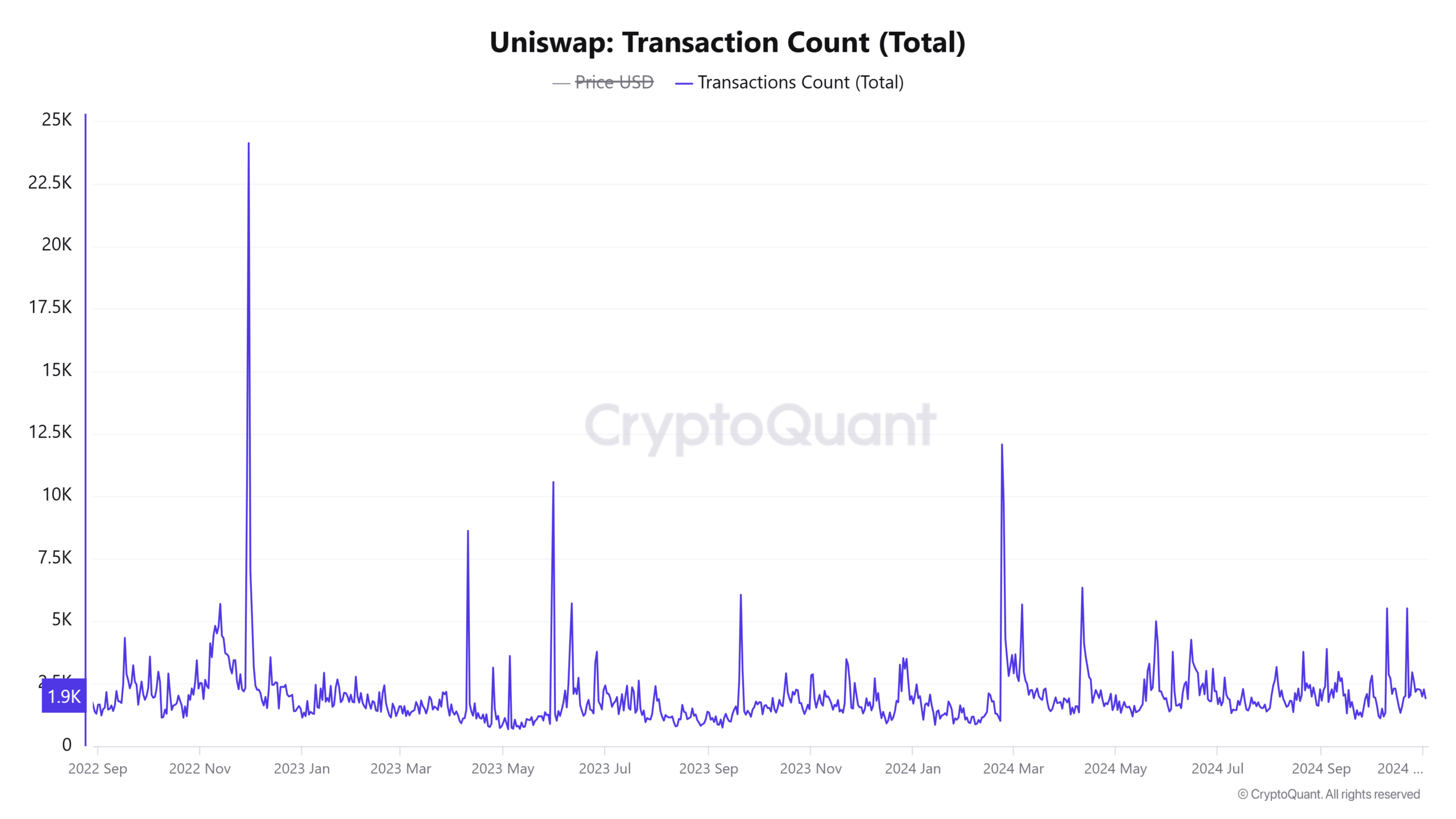

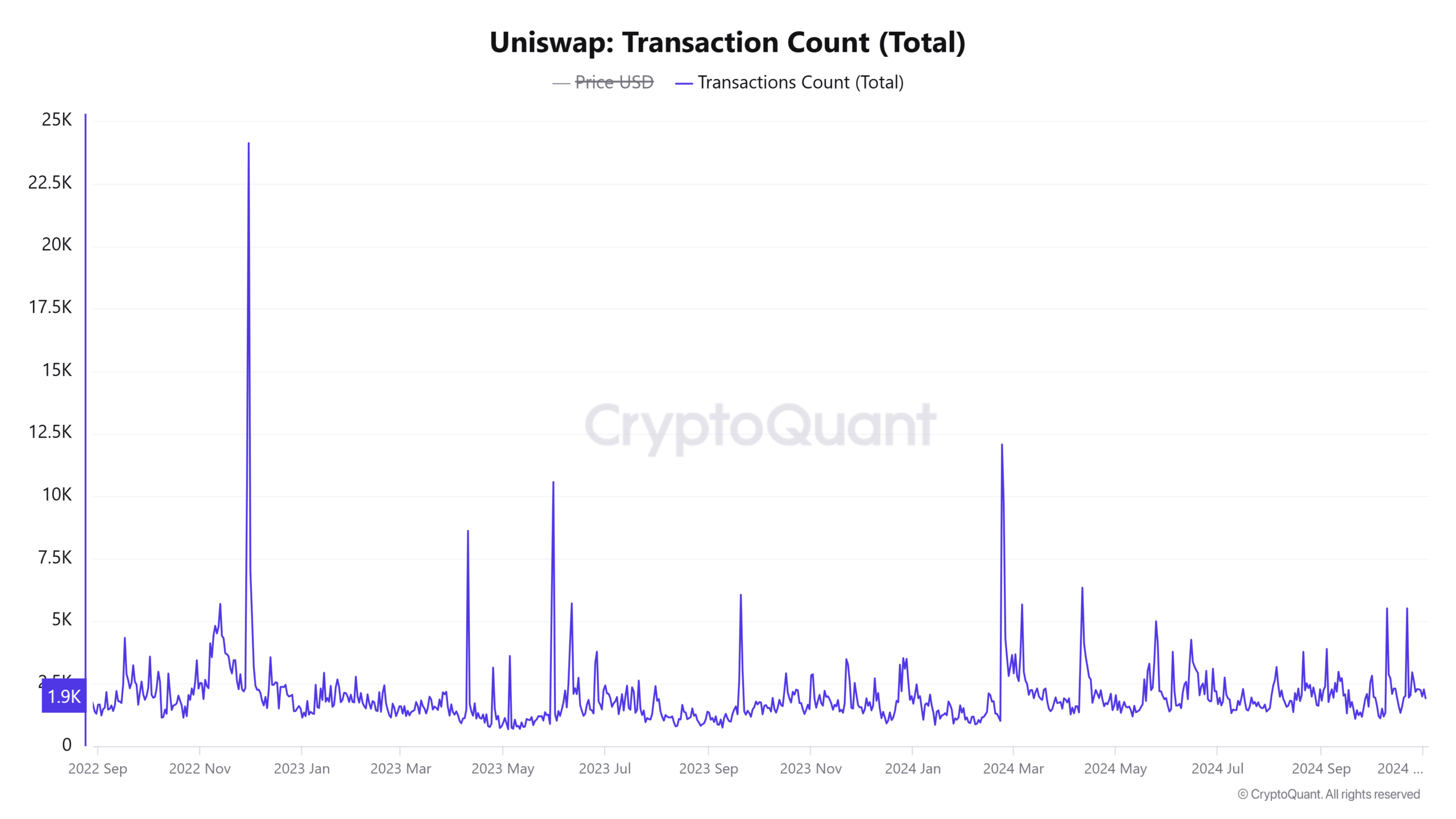

Transaction count analysis: Is activity indicating growth?

Uniswap’s transaction count has reached 1.838K, a 0.8% increase over the past 24 hours. Although modest, this uptick suggests consistent trading activity, which may help support UNI’s price.

Higher transaction volumes often correlate with increased liquidity, which could stabilize prices. Consequently, observing whether transaction growth continues will be critical in assessing whether Uniswap can regain strength in the short term.

Source: CryptoQuant

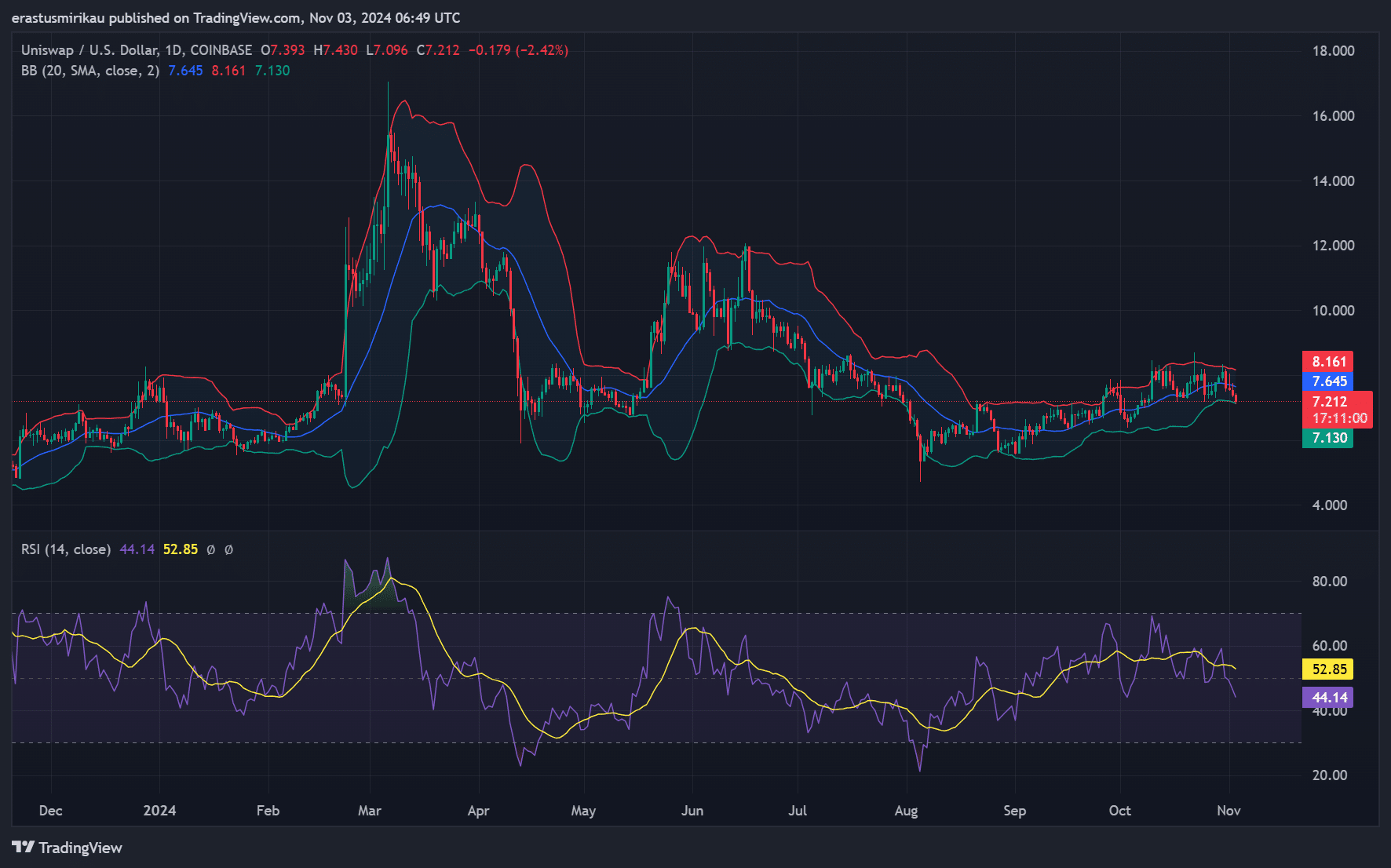

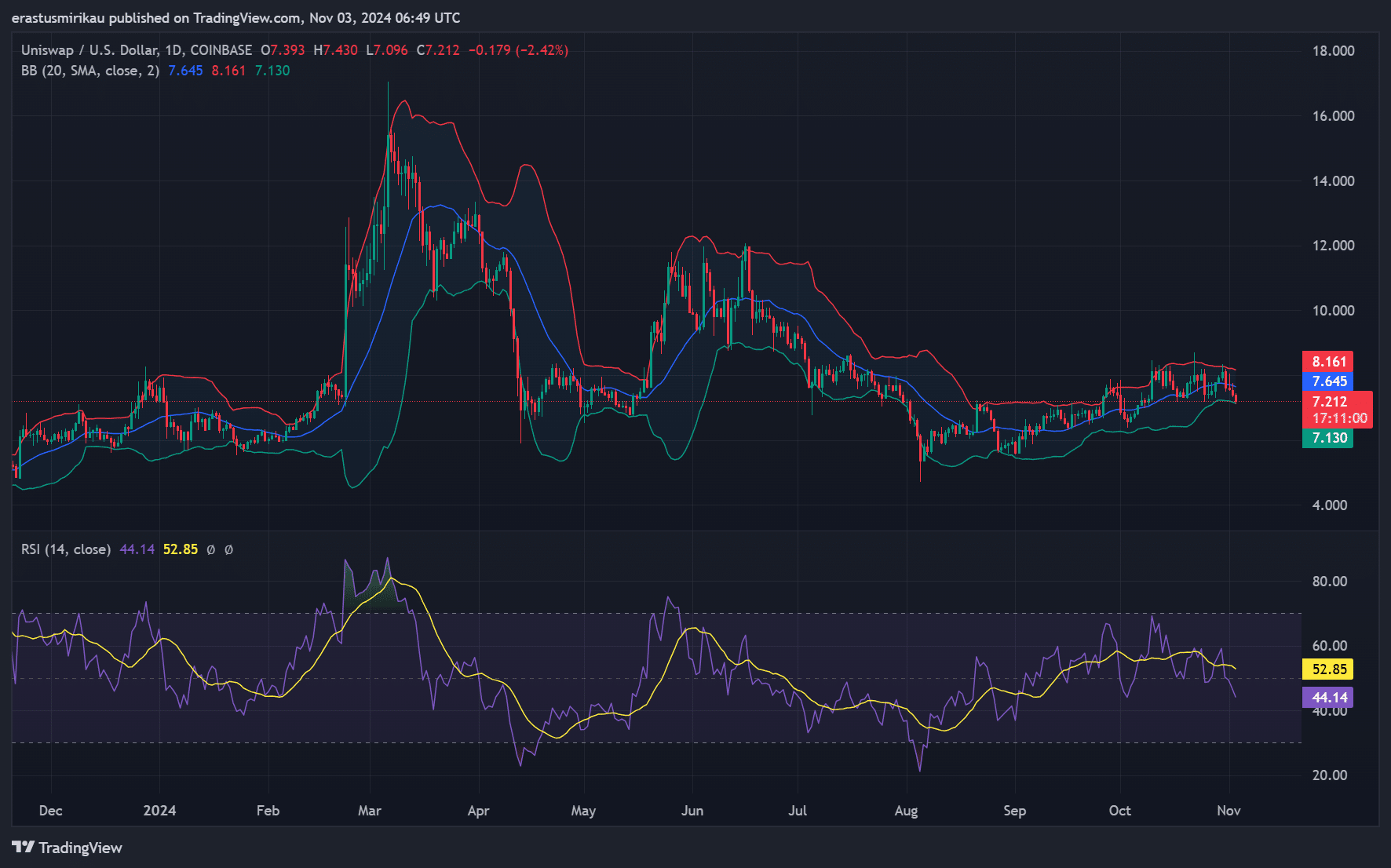

Technical indicators: Do Bollinger Bands and RSI signal a reversal?

Analyzing UNI’s technical indicators, particularly the Bollinger Bands and RSI, provides insights into potential price movement.

UNI currently trades near the lower boundary of the Bollinger Bands, signaling a potential oversold region. This could lead to a bounce if buying interest returns.

Meanwhile, the Relative Strength Index (RSI) sits at 44.14, which, while not oversold, suggests downward pressure. Therefore, if UNI fails to break past $8.31, any rebound may lack the momentum for sustained recovery.

Source: TradingView

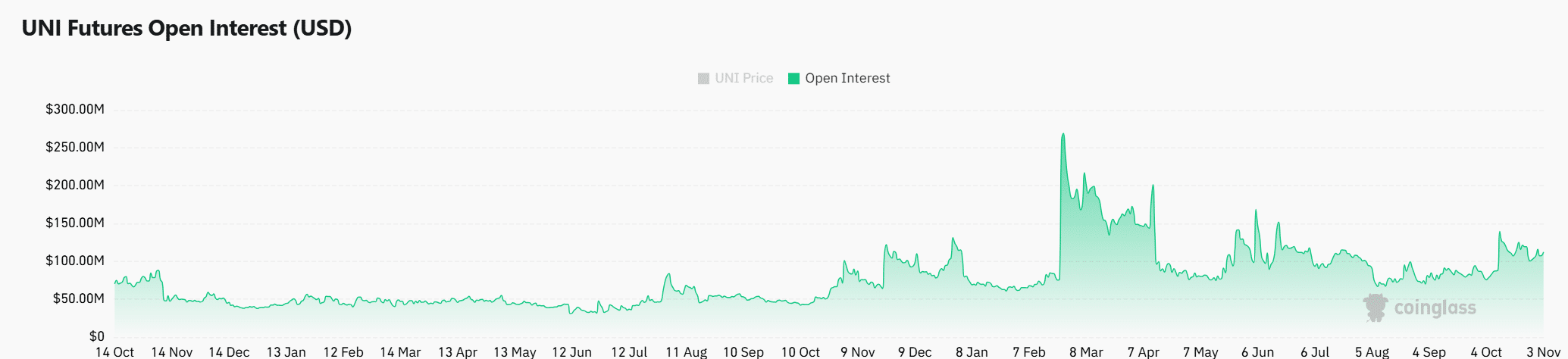

UNI market sentiment: What does rising open interest imply?

Market sentiment shows an increase in open interest, up 6.79% to $114.83 million, indicating growing trader engagement. This rise suggests anticipation of a potential price shift.

If UNI sustains this sentiment alongside volume growth, it could strengthen its chances of recovery.

Source: Coinglass

Is your portfolio green? Check out the UNI Profit Calculator

While Uniswap’s $2 trillion milestone highlights its strength, UNI’s recovery depends on breaking resistance and attracting more buyer interest.

Transaction growth and market sentiment will be crucial to watch in the coming weeks.