- Aave is showing positive momentum, driven by a 675% surge in Optimism user addresses.

- Transaction count has dropped while exchange reserves rise, signaling potential short-term selling pressure.

Aave [AAVE] has captured attention in the DeFi world, recording an astonishing 675% increase in user addresses on the Optimism network within just one week.

This growth has outpaced other major players like Chainlink and Raydium, raising the question of whether Aave is poised to break through resistance and kickstart a bullish rally into 2024.

But is this surge enough to propel the token to new highs?

How is AAVE performing in the current market?

At press time, AAVE was trading at $157.37, reflecting a modest 0.69% increase over the last 24 hours.

While this price action showed mild positive momentum, Aave’s explosive growth in adoption on Optimism may provide the foundation for a stronger upward push.

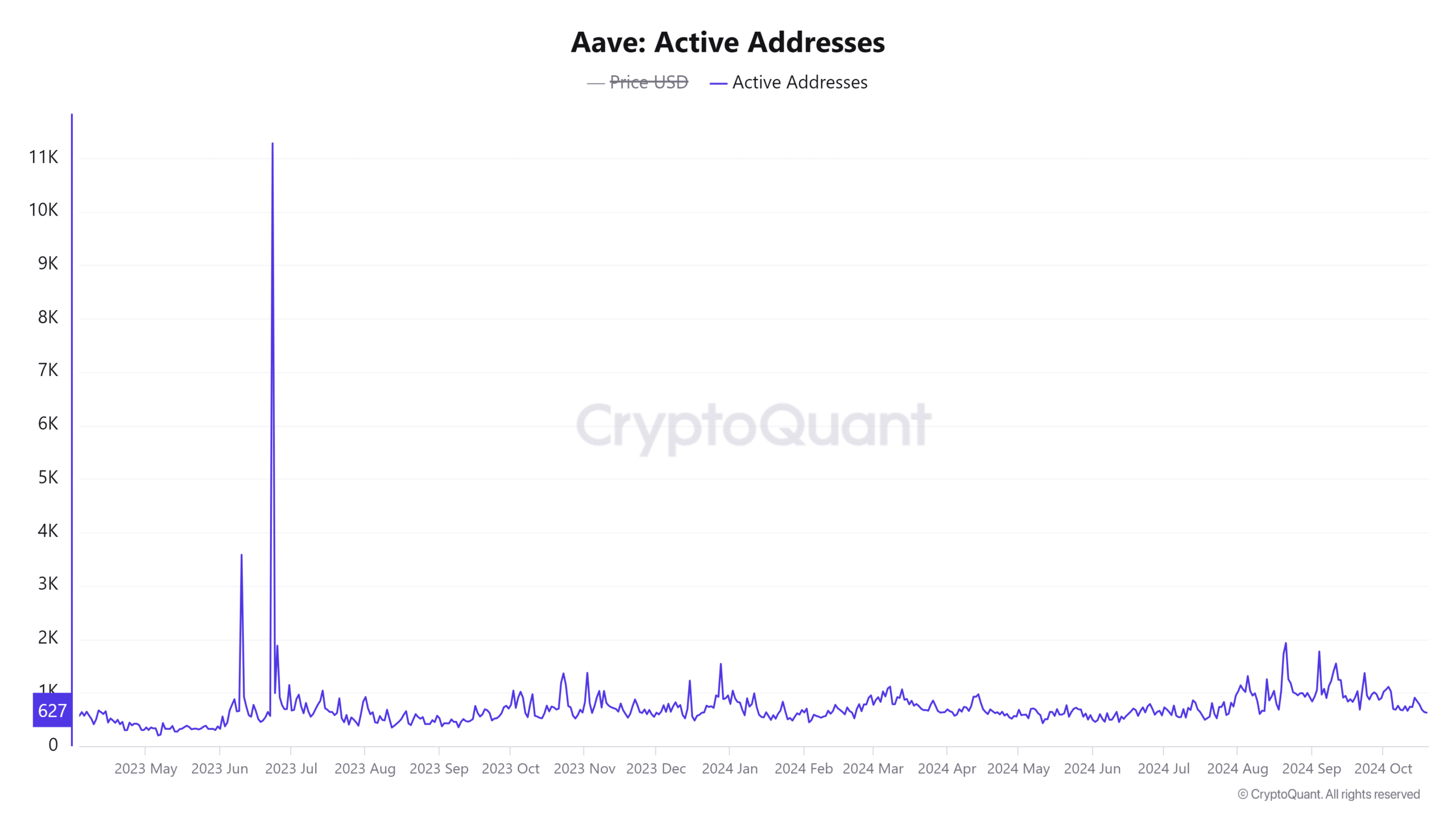

However, active addresses have surged by 18.75% in the last 24 hours, with 1,233 active wallets recorded.

This rise in active users indicated growing interest in Aave, but the market was still waiting for a decisive breakout to confirm sustained upward momentum.

Source: CryptoQuant

AAVE price chart: can it breach key resistance?

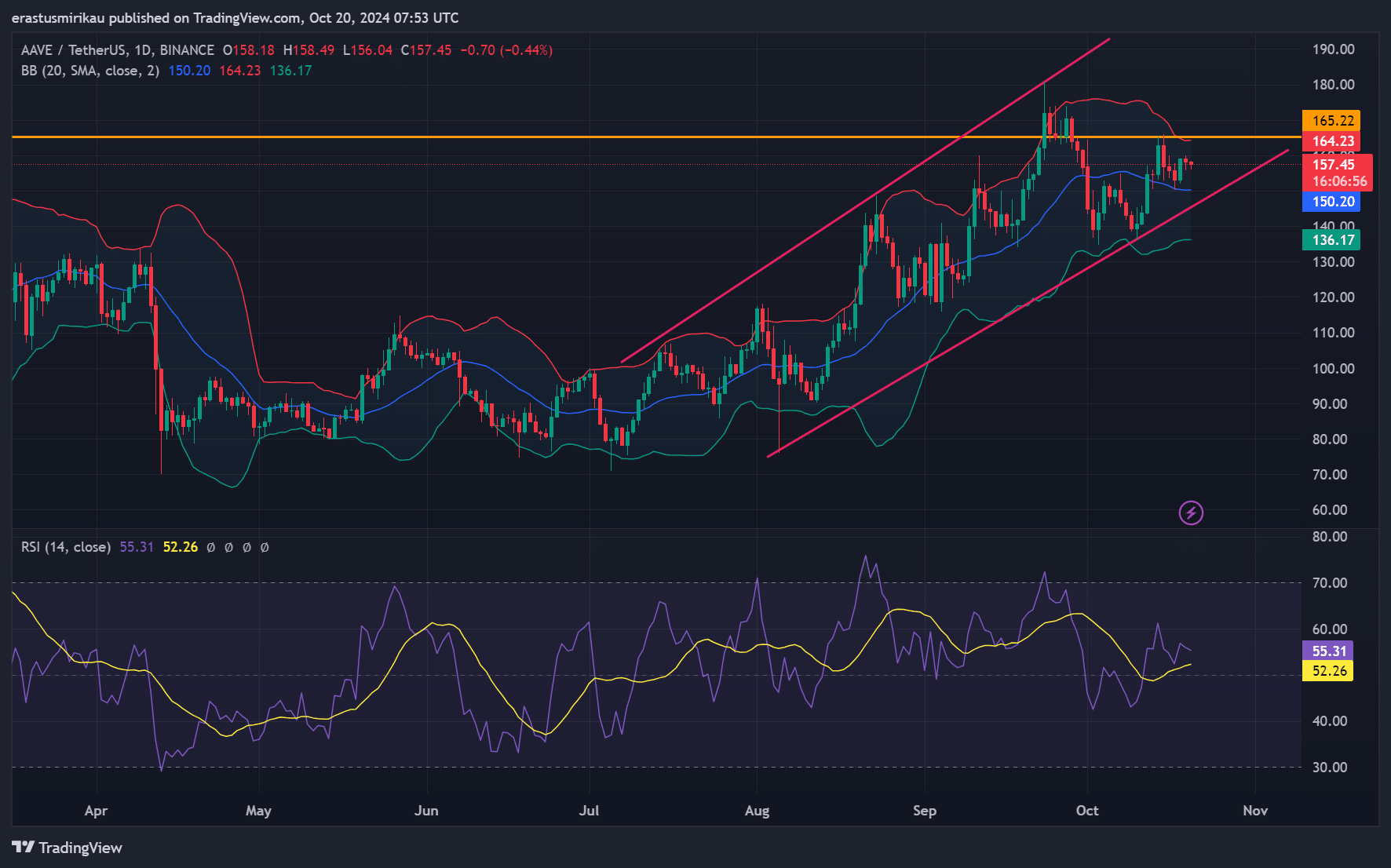

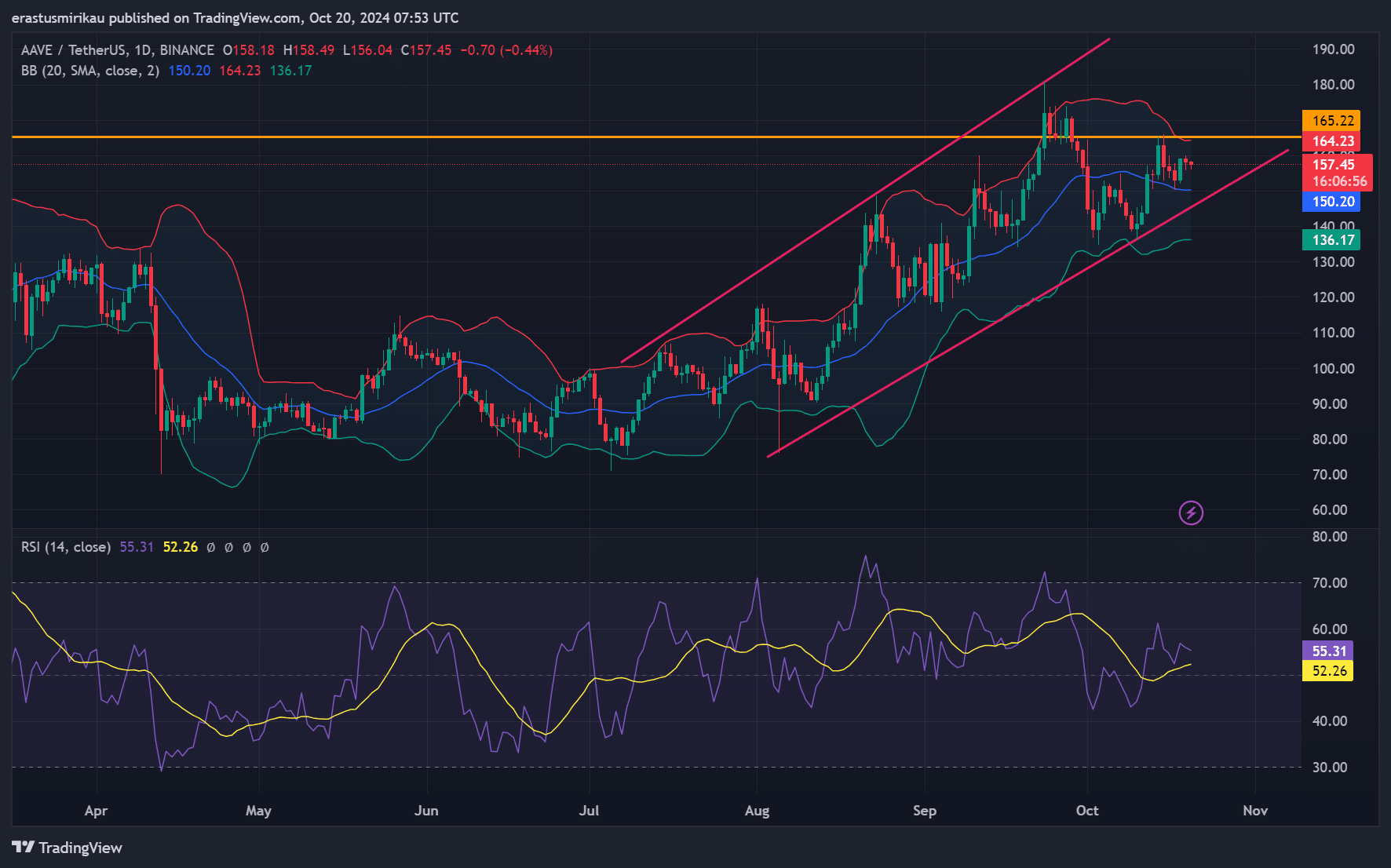

Looking at Aave’s daily chart, the token remains within a clear ascending channel.

A significant resistance level at $165.22 is preventing further upward movement, with the token struggling to close above this zone in recent trading sessions.

The RSI was sitting at 52.26 at press time, indicating neutral momentum, which suggests neither bulls nor bears have a decisive advantage.

Additionally, with AAVE trading above its 50-day simple moving average (SMA) at $150.20, the trend remains cautiously bullish. Therefore, breaking above the $165.22 resistance level is critical to sustaining the rally.

Source: TradingView

Are the transactions telling a different story?

Interestingly, the transaction count has declined slightly by 2.9% over the last 24 hours as per CryptoQuant data.

While this is a short-term drop, it could signal a period of indecision among traders as they wait for clearer market direction.

Additionally, this decline may hint that the surge in user addresses on Optimism hasn’t fully translated into higher transactional activity yet.

Exchange netflow shows mixed signals

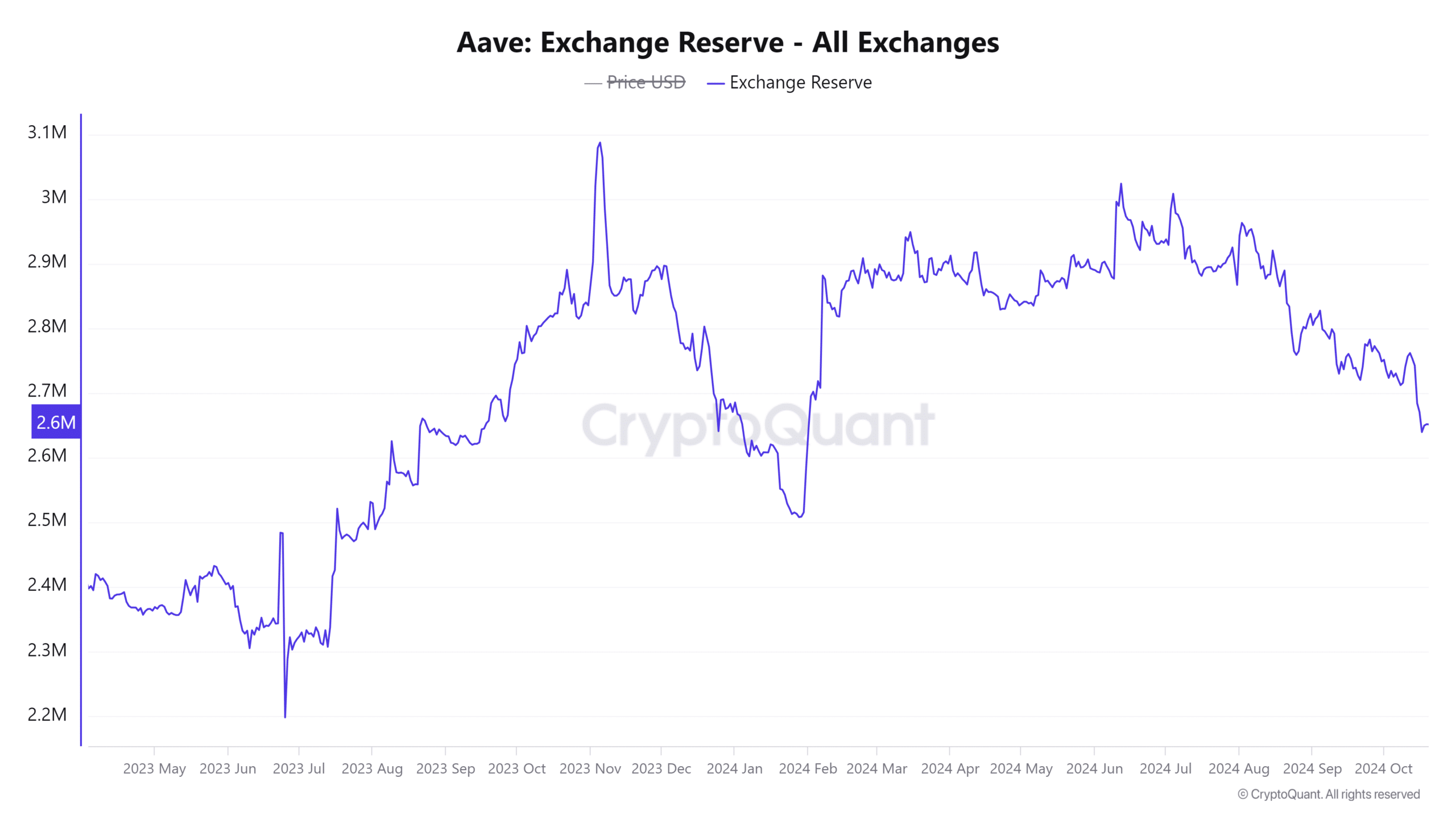

Examining the exchange reserves, which have increased to 2.6511M coins, reflects a 0.25% rise in the last 24 hours.

Generally, rising reserves on exchanges indicate increased selling pressure, as more tokens are being prepared for potential sell-offs. This could put downward pressure on it’s price in the short term if demand doesn’t keep up.

Source: CryptoQuant

Is Aave ready for the next rally?

While Aave’s bullish momentum, driven by its impressive growth on Optimism, suggests that a breakout could be imminent, several cautionary signals remain.

Read Aave’s [AAVE] Price Prediction 2024–2025

If it can break through the $165.22 resistance, it could spark a new rally.

However, the rising exchange reserves and falling transaction count indicate potential short-term challenges. Therefore, traders should remain vigilant as the market continues to develop.