- U.S. crypto users missed out on up to $5 billion in airdrops between 2020 and 2024 due to SEC-driven geofencing

- Lawmakers are urging the SEC to clarify its position on airdrops

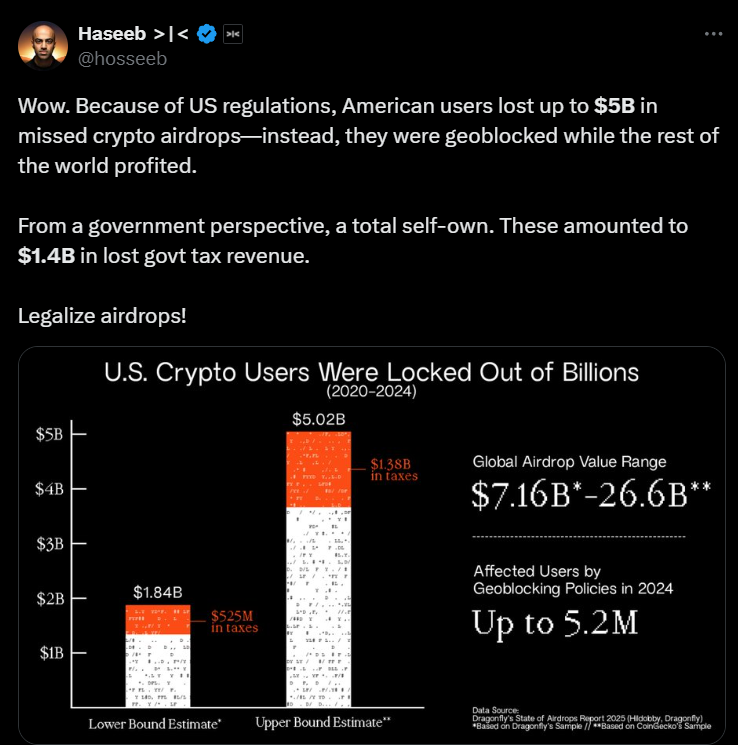

Over the past four years, millions of U.S. crypto holders have found themselves unable to participate in major airdrops, missing out on an estimated $5 billion in potential earnings.

A recent study from venture capital firm Dragonfly revealed that geoblocking policies, implemented by crypto projects to avoid U.S regulatory scrutiny, were responsible for these losses. These restrictions stem from ongoing legal uncertainty regarding whether airdropped tokens qualify as securities or not.

With the SEC also ramping up enforcement actions against crypto firms, many projects have taken a cautious approach by blocking U.S users outright. In fact, Dragonfly’s report estimated that between 1.84 million and 5.2 million active U.S users were affected by these restrictions in 2024 alone.

However, the financial impact of these restrictions extended beyond just individual investors.

$1.4 billion in lost tax revenue

The report also found that by preventing U.S users from claiming airdrops, the government forfeited an estimated $1.4 billion in tax revenue between 2020 and 2024.

The lost tax revenue stems from two primary sources – Personal income tax on airdropped tokens and corporate taxes that would have been generated by crypto projects operating in the U.S, instead of moving offshore.

Haseeb Qureshi, Managing Partner at Dragonfly, assessed,

“Airdrops were once the most democratic way to distribute tokens. Today, they’ve become a game of avoiding the SEC’s wrath.”

Source: X

One striking example is Tether, which reported $6.2 billion in profits in 2024 but paid no U.S corporate taxes due to its offshore incorporation.

Dragonfly’s “State of Airdrops Report 2025”, claimed,

“Tether, which reported $6.2 billion in profits in 2024 but is incorporated offshore, could have contributed approximately $1.3 billion in federal corporate tax and $316 million in state taxes if it had been fully subject to U.S. taxation.”

Regulatory uncertainty has led to an exodus of blockchain startups from the United States.

Startups seek friendlier shores

In 2024 alone, the SEC initiated 33 enforcement actions against crypto firms, with 73% involving fraud allegations and 58% tied to unregistered securities offerings. These actions have created a chilling effect on crypto innovation, with many projects preferring to avoid the U.S market altogether.

Jessica Furr, Counsel at Dragonfly, emphasized the unintended consequences of this approach.

“The SEC’s enforcement-driven regulatory stance has forced crypto projects to exclude U.S. users from airdrops, depriving them of billions in potential gains. Clearer guidelines are needed to prevent further economic loss.”

Furr’s remarks echo broader industry frustrations over the lack of clear legal frameworks for crypto assets – An issue that has pushed many blockchain developers to relocate overseas.

The regulatory challenges surrounding airdrops have caught the attention of lawmakers too.

Congress to the SEC – “Clarify or justify”

In September 2024, Patrick McHenry and Tom Emmer sent a letter to SEC Chair Gary Gensler, demanding clarity on whether airdrops should be classified as securities. The letter raised key questions about the SEC’s inconsistent approach, particularly in comparison to traditional reward programs like airline miles and credit card points.

“Given the SEC’s unwillingness to establish a regulatory framework in the United States, developers have been forced to block Americans from claiming ownership of a digital asset in an airdrop”.”

Geofencing—the practice of blocking users from specific jurisdictions—has become the default risk-avoidance strategy for crypto projects operating under regulatory uncertainty. According to a report by Variant, geofencing is often poorly implemented and results in unnecessary exclusion of users from legally compliant markets.

Jake Chervinsky, a legal expert in crypto regulation, believes that geofencing is a stop-gap measure rather than a long-term solution,

“Many companies geofence out of fear rather than necessity, leading to lost opportunities for both users and the government.”

The Variant report also suggested that a more structured compliance framework would allow crypto projects to serve U.S users while adhering to regulatory requirements.

What crypto leaders said to regulators

A16z Crypto, a major venture capital firm, published a policy recommendation for the SEC. The firm urged the agency to issue formal guidance on airdrops. It also called for clear exemptions for token distributions. These exemptions would apply to distributions that do not serve as fundraising mechanisms.

Scott Walker and Bill Hinman have proposed reforms to clarify airdrop regulations too.

They suggested creating eligibility criteria so airdrops are not classified as securities. Aligning airdrop rules with consumer reward programs would provide consistency and reduce regulatory confusion.

They also recommended safe harbor provisions to protect blockchain projects distributing tokens to their communities.

Will the SEC adapt or hold the line?

Lawmakers, industry leaders, and investors are increasing pressure for regulatory changes.

For instance – Alexander Grieve, VP of Government Affairs at Paradigm, shared that the firm met with Hester Peirce and SEC officials to discuss airdrop regulations.

Source: X

The SEC could introduce clearer guidelines to address ongoing uncertainties. Clearer rules would allow U.S investors to participate in airdrops without legal risks.

This would benefit both individuals and the broader economy.

For now, crypto projects remain cautious about including U.S users in airdrops. Hence, American investors continue to miss out on opportunities available to international participants.