When President Donald Trump made his tariff announcement on April 2, Petite Studio knew what the news meant: Soon, theyâd have to raise prices.

The New York-based womenswear label works closely with a factory in founder Jenny Wangâs hometown of Jiangshan, China for production, and as such is highly exposed to US tariffs on China, which are now up to 145 percent. Because Wang has a close personal relationship with the factory, she and her co-founder (and husband) Matthew Howell have been in talks with them to reduce costs. The have also been negotiating concessions with their stateside landlord and suppliers.

But still, price increases are inevitable: âAt 150 percent, thereâs no balance. If we donât [raise prices], then weâre toast,â said Wang.

Their shoppers, they know, wonât be thrilled. So to soften the blow, the brand decided to focus on manufacturing clothing made from natural fibres â consistently a top request from customers. If its products were more premium, they figured, it would help justify the jump in price.

âIf we need to increase prices, we want to show the customers that weâre listening to them and weâre giving something in return,â said Howell.

Going upmarket is just one tactic that brands are considering as they grapple with how to respond to Trumpâs tariffs, the most sweeping in nearly a century. Other brands are adding a flat fee to purchases and telling customers exactly why theyâre suddenly paying more. Sexual wellness brand Dame has included a $5 fee in customersâ carts called the âTrump tariff surcharge,â accompanied by a visual of the US Presidentâs hair.

âBusinesses should be putting a line item, calling it international trade tax,â said Charlotte Palermino, founder of the skincare brand Dieux, which is in talks with its contract manufacturer this week about which raw materials it sources for its products might be impacted. âCall it what it is.â

Transparency is another tactic, especially for brands that are waiting to see whether Trump goes ahead with higher tariffs on individual countries, currently subject to a 90-day pause. The hope is by showing customers theyâre doing everything they can â negotiating with factories, shipping extra inventory ahead of potential tariffs â customers will be more forgiving (or at least make a purchase before price increases kick in).

âFocus on what you can control, because so much is going to be out of your control, and lead with that,â said Lori Ruggiero, managing partner at public relations firm 5WPR.

Open Communication

Even if prices have not yet changed, itâs best to keep customers in the loop with frequent updates, to make sure they know a brand is doing what they can to keep products accessibly priced, even amid the potential impact of coming tariffs.

Skincare brand Cocokind, for instance, hosted an open âTariff 101â Zoom call last week in which Cocokind founder and CEO Priscilla Tsai and Carol Chan, the brandâs senior vice president of finance and operations, broke down how tariffs could impact their pricing models and profit, making clear the significant impact they could have on their bottom line. The brand also invited representatives from their logistics and packaging providers to discuss import rules, alternative sourcing and more. Anyone, from customers to competitors, could join and hear the brandâs insights on the current situation. The goal was to walk through different scenarios â and potential solutions â with their community, an attempt to deal with the situation collectively.

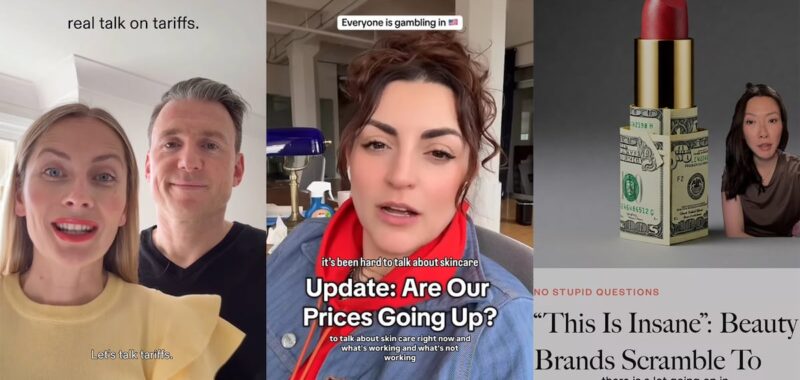

This type of transparency has been many brandsâ strategy as they adjust to a new reality, largely seen in the form of communications on social media about what brands do â and donât â know about how tariffs will impact their businesses. For example, Colette Laxton and Mark Curry, the founders of UK-based skincare brand The Inkey List, posted a video on the brandâs Instagram feed explaining that they would keep their customers up-to-date along the way as tariffs evolve, even if they donât have all the answers yet.

Itâs easier, of course, for a smaller business to have this kind of informal and direct line of communication with its customer base. For larger companies, Ruggiero suggested approaching communications with controlled transparency, rather than âfull open kimono,â she said â explaining the decision-making process and making clear that increasing prices was a last resort.

Regardless of the size of the company, if prices do need to change, the brand should highlight the value they bring to the table, and how increasing price is necessary to maintain quality. This is especially crucial for luxury brands.

âI wouldnât lead with, âWeâre raising our prices.â I would lead with the integrity of our product,â said Jhara Valentini, founder of advertising agency Valentini Media Group. âThe conversation you create has to be around the emotive component.â

A Hybrid Approach

In the meantime, however, brands are hoping to drive more purchases before increases come.

The end of the de minimis exemption â which will add duties to shipments below $800 â kicking in on May 2 is an initial hurdle. With that date in mind, leakproof underwear brand Knix kicked off its anniversary sale, which typically happens in May, last week. Rather than shaping ad messaging around the fact that the saleâs date was moved, however, the brand is highlighting the fact that âthese will be the best prices of the year,â said Nicole Tapscott, Knixâs chief commercial officer.

The hope is that more sales upfront will allow the brand to cushion its profitability during a transition period.

âThe last thing we wanted to do was to be sending millions of dollars of product across the border, and potentially having our customers get their product stuck as they start to roll out this very complex country of origin check,â said Tapscott. âThis was the best course of action forward to make sure we were able to fulfil those orders succinctly and also profitably for the business.â This summer, Knix will set up its own third-party warehouse in the US for local shipments, she said.

Brands also need to consider how theyâre spending their marketing dollars in the medium term. Lower-funnel conversion-driving opportunities, like moving up sales or offering rewards, rather than major brand building campaigns, are increasingly becoming a priority.

âIt has to get really ugly for people to want to pull money out of revenue driving dollars. During economically challenging times ⦠ad dollars, especially for brands who have a heavy e-commerce presence, end up shifting towards bottom of funnel and trying to drive revenue,â said Scott Sutton, chief executive officer of influencer marketing platform Later.

But this doesnât have to come at the expense of awareness, he said. For Laterâs clients, the goal is to âtake a hybrid approach, where we can leverage creators who both drive sales and awareness,â he said, with many focussing on performance-driven creator campaigns.

For luxury brands with deeper pockets, continuing to engage customers who may be more cautious with their spending through upper-funnel touchpoints is crucial to staying on shoppersâ minds once theyâre ready to spend again, according to Valentini. This can be through content on social media or engaging offline experiences, enabling the brand to keep connecting with the customer emotionally and sustaining a relationship in the long-term.

âWhen the pendulum swings back, make sure that … [the consumer] is thinking, âOkay, maybe I do want to buy something. Let me go to this brand, because theyâve been so consistent in their storytelling,ââ said Valentini.