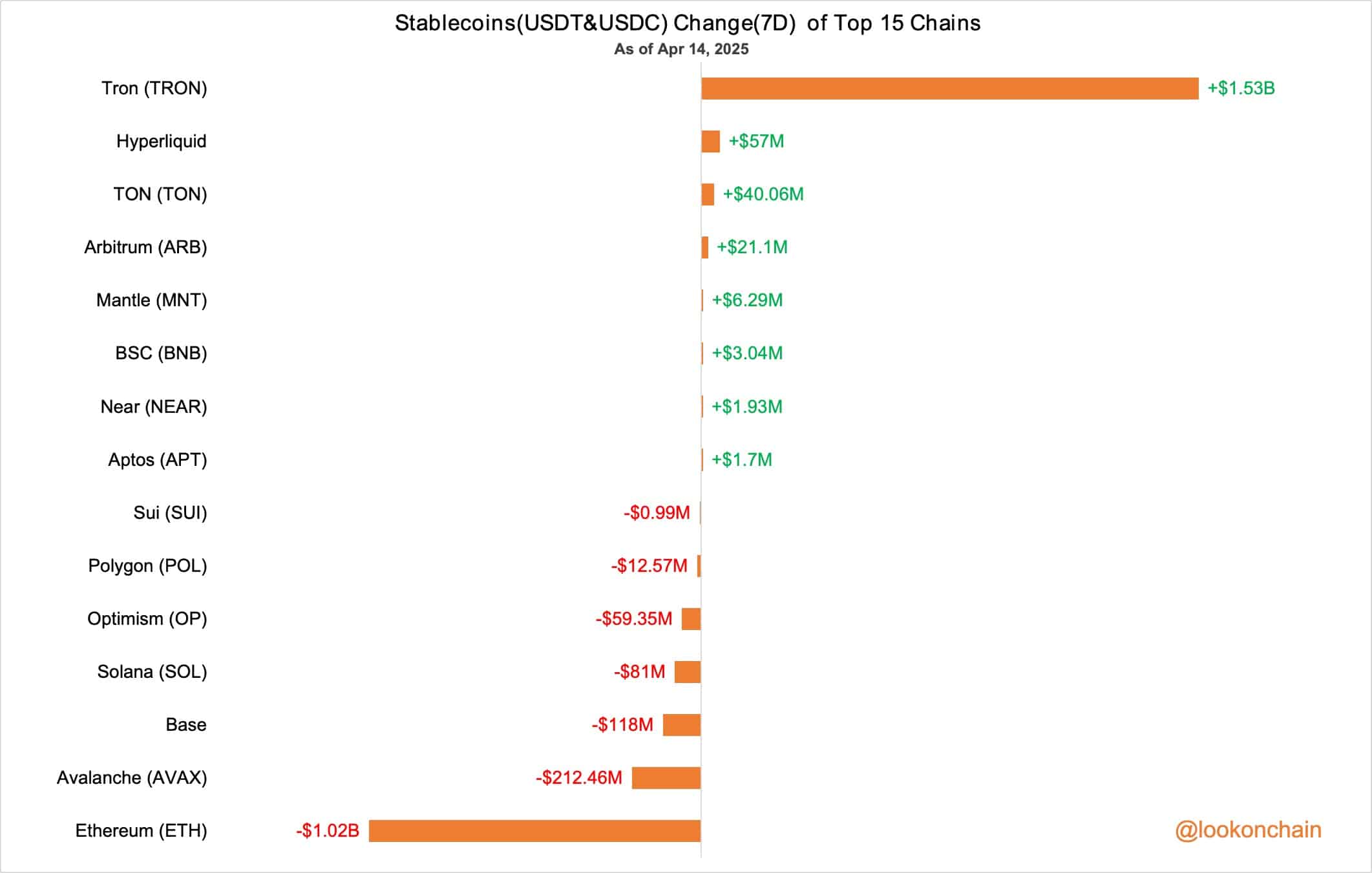

Over the past seven days, Tron received an impressive $1.52 billion in stablecoins, mainly USDT and USDC.

This surge places Tron well ahead of other blockchains in net stablecoin inflows. It also highlights a growing user preference for low-cost, high-efficiency networks.

In contrast, Ethereum experienced a net outflow of $1.02 billion, the sharpest decline among the top 15 chains.

Source: X

The data suggests a significant capital rotation as users become more cost-conscious due to Ethereum’s high gas fees and network congestion.

Benefiting from this trend are Tron, Hyperliquid [HYPE], Toncoin [TON], and Arbitrum [ARB]. Meanwhile, chains like Avalanche, Base, and Solana[SOL] are experiencing outflows.

These shifts reflect real-time changes in user behavior and capital allocation. Liquidity is increasingly moving toward platforms that offer streamlined, cost-efficient on-chain experiences, especially for stablecoin-heavy transactions.

The rise of non-USD denominated coins

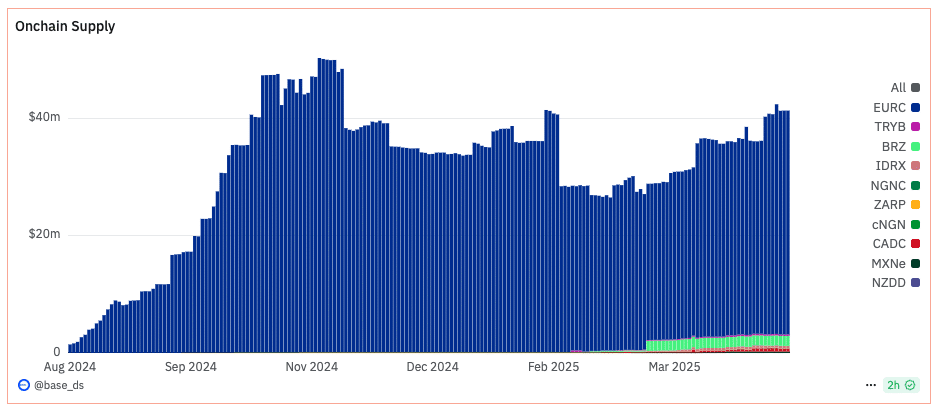

Alongside capital rotation to chains like Tron, the supply of non-USD stablecoins is quietly climbing — especially on cost-efficient chains.

Data from Base shows a recent uptick in stablecoins like NGNC, IDRX, and BRZ, with small but visible growth in CADC and MXNe.

Source: X

While USD-backed coins still lead, regional stablecoins are growing for FX hedging, payments, and commerce. As demand for multi-currency exposure rises, chains offering faster, cheaper execution are becoming the preferred rails for stablecoin diversity.

Capital is following utility. As users diversify away from Ethereum, chains like Tron are setting the tone for crypto’s next chapter.