- WIF exhibited signs of a potential bounce to the upside, aiming for a new monthly high.

- Charts showed mixed signals, with derivative and spot traders adopting differing stances.

In the past 24 hours, dogwifhat [WIF] experienced a massive plunge, losing 18.98%. This sharp drop was catalyzed by a broader market downturn.

Selling pressure was weakening at press time, as WIF began to move upward. However, some market cohorts remained bearish, slowing the momentum of the potential rally.

On the path to a bounce back

According to one analyst, WIF appeared well-positioned for a potential rebound as it traded within a parallel channel.

A parallel channel represents a phase where the price fluctuates between defined zones of support and resistance. At the time of writing, WIF had reacted to the support level and was trending higher.

However, the chart pattern suggested that extended consolidation may continue near the lower support level before a significant move to the upside.

Source: TradingView

If WIF can break out of this phase, its next target would be a new high of $5, a level last reached in November 2024.

For now, market sentiment is mixed, with some participants favoring an upward move while others anticipate a potential downtrend.

Buyers keeping WIF steady

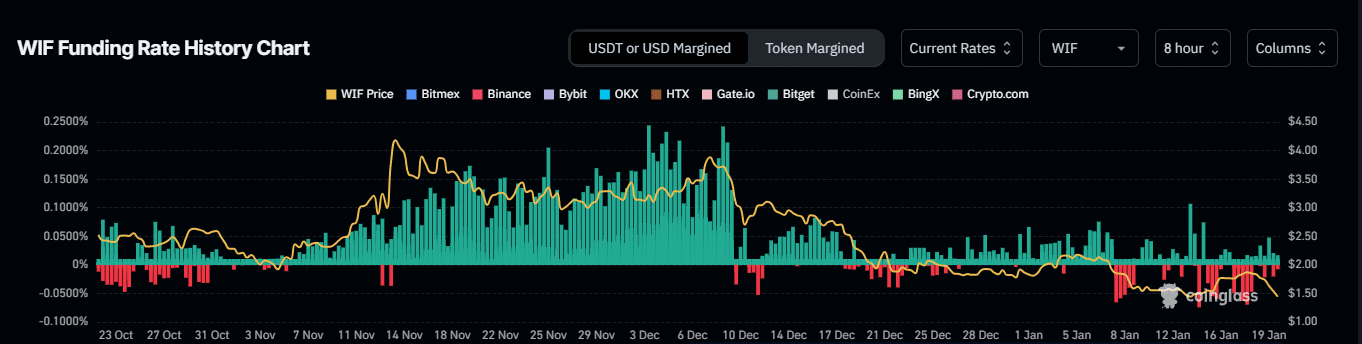

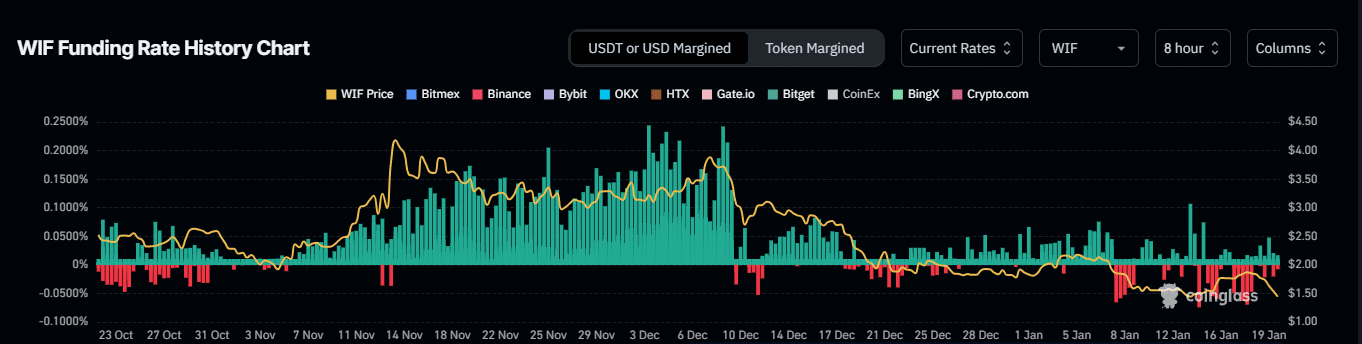

WIF has seen a gradual increase in its Funding Rate over the past eight hours, standing at 0.0044% at press time.

A positive Funding Rate indicates that the market is favoring long-position traders, with this group paying a premium to maintain their positions.

Source: Coinglass

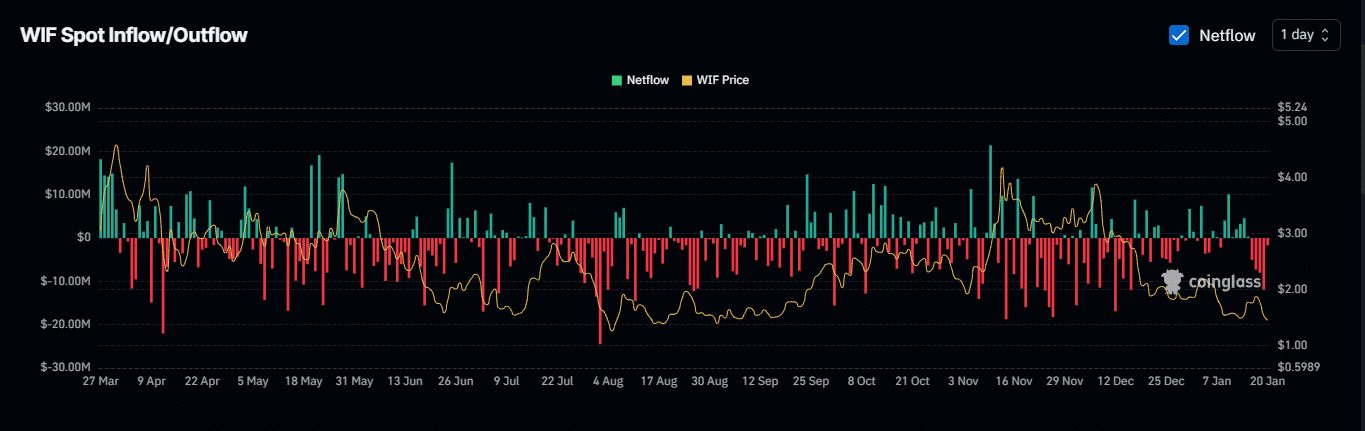

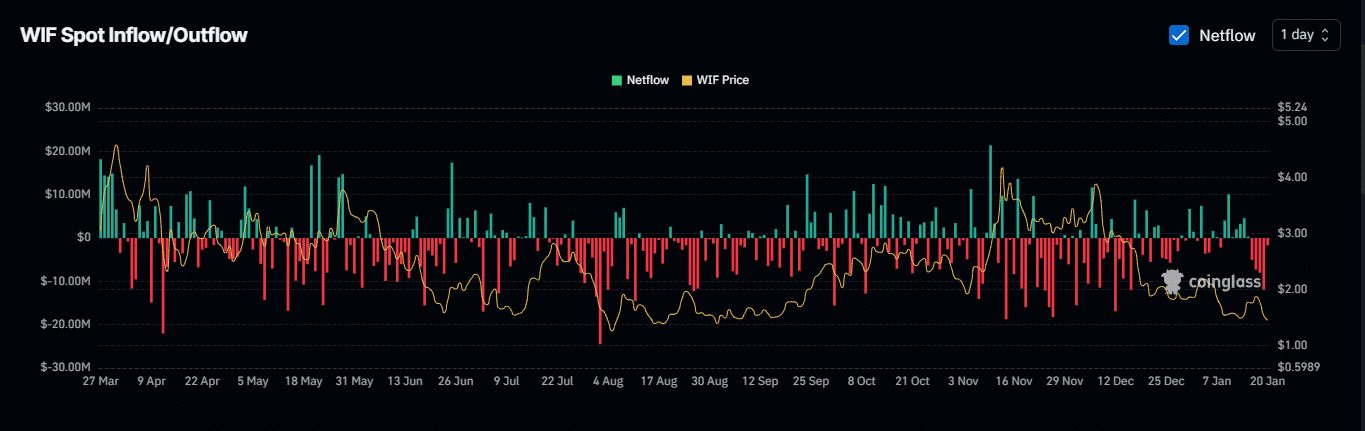

Among spot traders, there has been a significant outflow of funds. In the past 24 hours alone, $1.67 million worth of WIF has exited the market, increasing the likelihood of a price move higher.

This marks the fourth consecutive day of withdrawals, with the most substantial outflow—$11.88 million—recorded the previous day.

Source: Coinglass

Significant withdrawals from the market often suggest that participants are moving tokens off exchanges, potentially to sell.

Sellers could push WIF lower

Sellers remain active in the market, applying downward pressure on WIF. One key indicator, Open Interest, has turned negative, declining by 10.01% to $403.15 million.

A drop in Open Interest suggests that derivative traders are closing their contracts rather than keeping them open, a sign of gradual loss of confidence in the market rally.

Additionally, $8.51 million in liquidations occurred over the past day, with the majority impacting long traders. Long positions accounted for $8.05 million in losses, compared to just $459,950 for shorts.

Source: Coinglass

When the disparity between long and short traders is this significant, it typically reflects a bearish market sentiment, indicating a higher likelihood of further price declines.

Read dogwifhat’s [WIF] Price Prediction 2025, 2026

Given the Open Interest decline and liquidation data, the previously predicted consolidation phase on the chart appears likely to continue, keeping WIF subdued for the time being.

However, when combined with bullish narratives from on-chain indicators, WIF could find new catalysts to push toward $5 in the future.