- An RSI finding of 56 suggested UNI was trading below the overbought zone

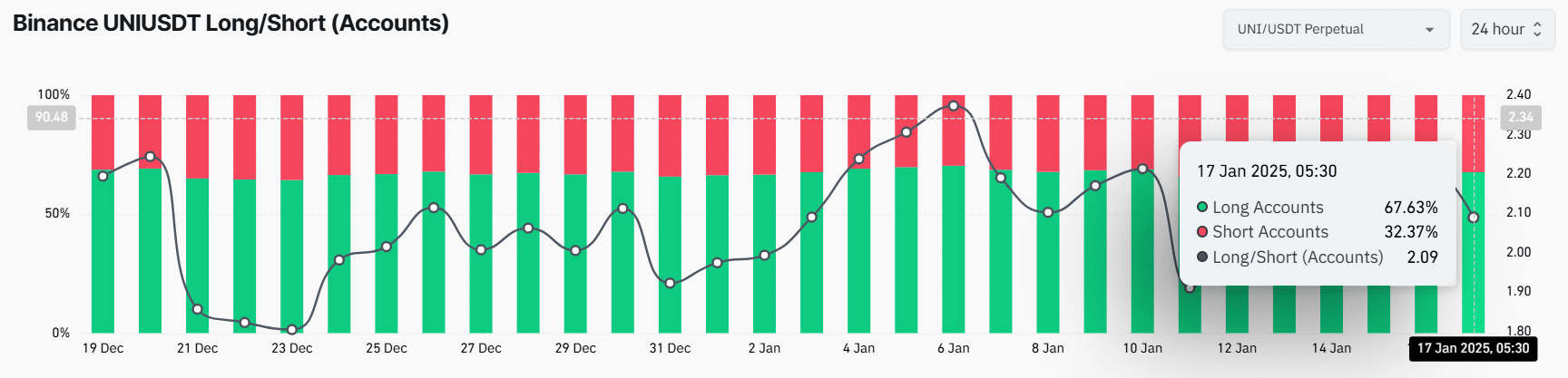

- At press time, 67.63% of top UNI traders on Binance held long positions, while 32.37% held short positions

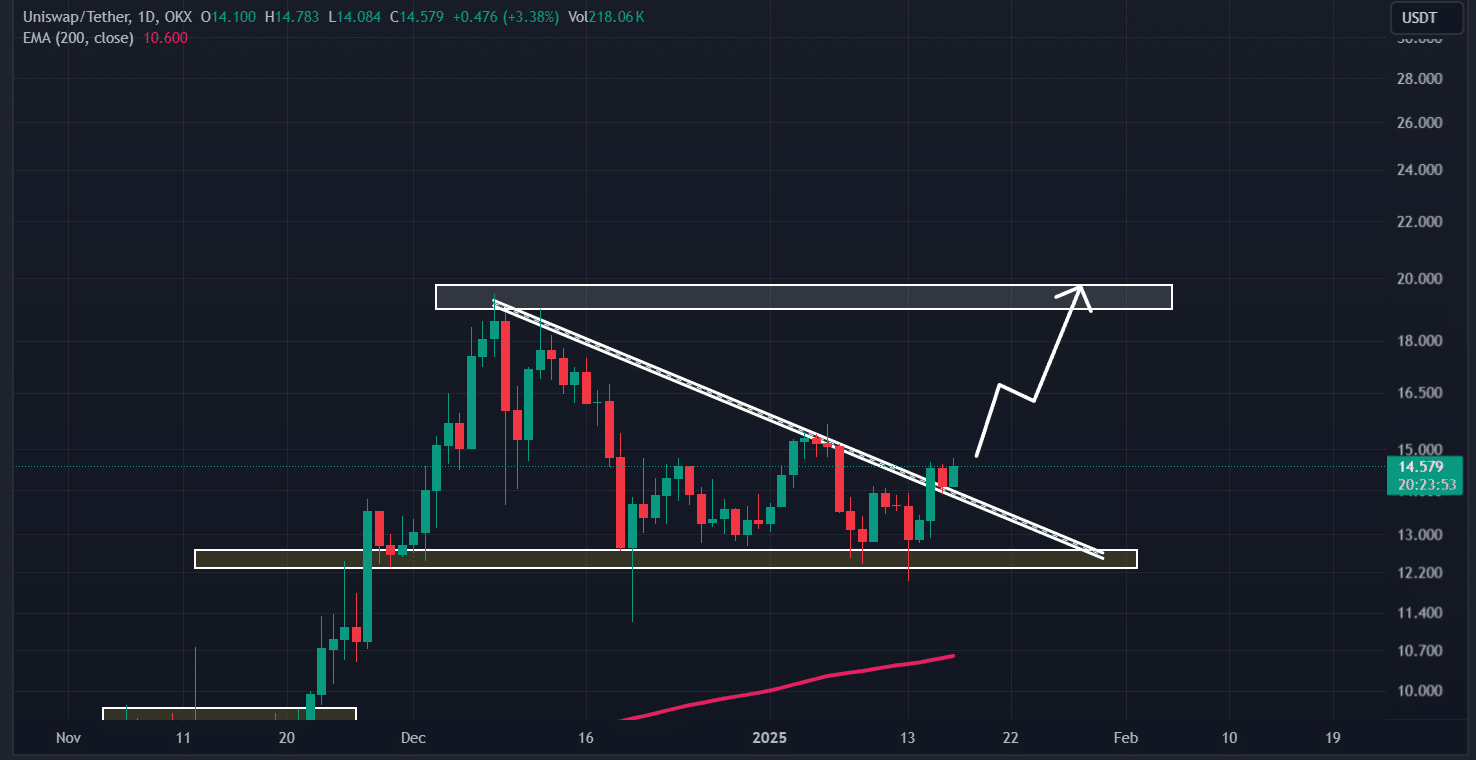

With the larger cryptocurrency market rebounding across the board, Uniswap’s native token – UNI – broke out from a bullish price pattern. This signaled a potential upside move, with this breakout coming after a prolonged struggle the asset has faced since December 2024.

Uniswap (UNI) technical analysis

According to AMBCrypto’s technical analysis, UNI broke out from a descending triangle pattern on the daily timeframe, hitting the resistance level of $15.20 for the third time since December 2024.

However, the crypto’s history did not favor the bulls as far as this resistance level was concerned.

Source: TradingView

UNI price prediction

Based on the altcoin’s recent price action, if UNI breaches the horizontal level and closes a daily candle above $15.50, there is a strong possibility that it could soar by 30% to hit the next resistance level of $20 in the near future.

However, UNI’s performance has been quite impressive over the past few days. In fact, data revealed that the asset surged by over 16% in the last three days alone.

Additionally, top assets like Bitcoin (BTC), Ethereum (ETH), and Solana (SOL) have also seen significant price surges of their own. These assets and their performances are having an impact on the broader market sentiment and by extension, UNI too.

On the positive side, with an RSI of 56, UNI seemed to be well below the overbought zone – A sign that there may be enough room for further gains.

67.63% of top UNI traders bet long

At the time of writing, it appeared that traders’ interest and confidence have skyrocketed in the last 24 hours, as revealed by the on-chain analytics firm Coinglass.

In fact, Binance’s UNI/USDT long/short ratio had a reading of 2.09 – Highlighting strong bullish market sentiment among traders.

Source: Coinglass

Additionally, 67.63% of top UNI traders on Binance held long positions, while 32.37% held short positions, further supporting the bullish sentiment across the market.

When combining these on-chain metrics with technical analysis, it would seem that bulls are currently dominating the asset. Hence, they can fuel UNI’s breach of its $15 hurdle to hit their predicted target.