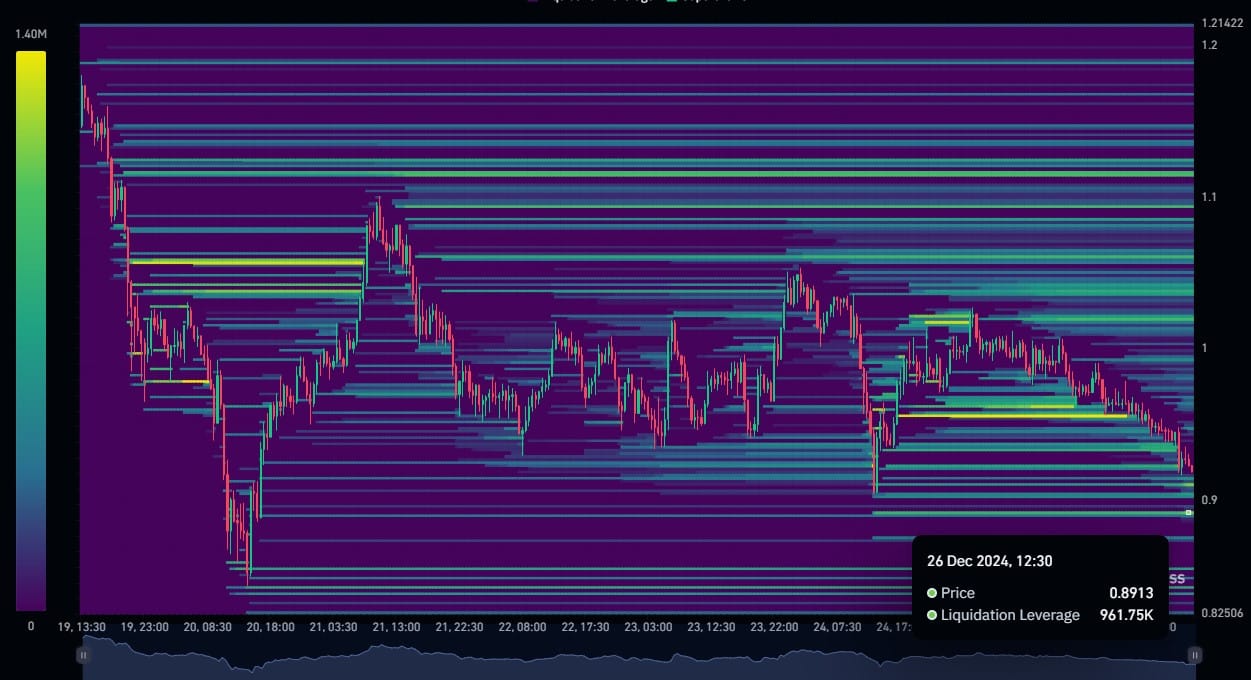

- Fantom’s $961k liquidation pool pointed to a pivotal test at the $0.88 price level

- Altcoin exchange outflows have dropped sharply, raising concerns about market confidence

Fantom’s (FTM) price is at a crucial point right now, with the altcoin consolidating within a demand zone on the charts. In fact, the $961K liquidation pool tied to the $0.88 price level makes this area one to watch closely. At the time of writing, the altcoin seemed to be trading above the support of an ascending triangle – A pattern often linked to potential upward movement.

The significance of this price level cannot be ignored.A close above $0.88 could boost buyer confidence and probably ignite a rally.

Conversely, any penetration will trigger liquidation orders, adding to the selling pressure that might destabilize the price further.

Source: Coinglass

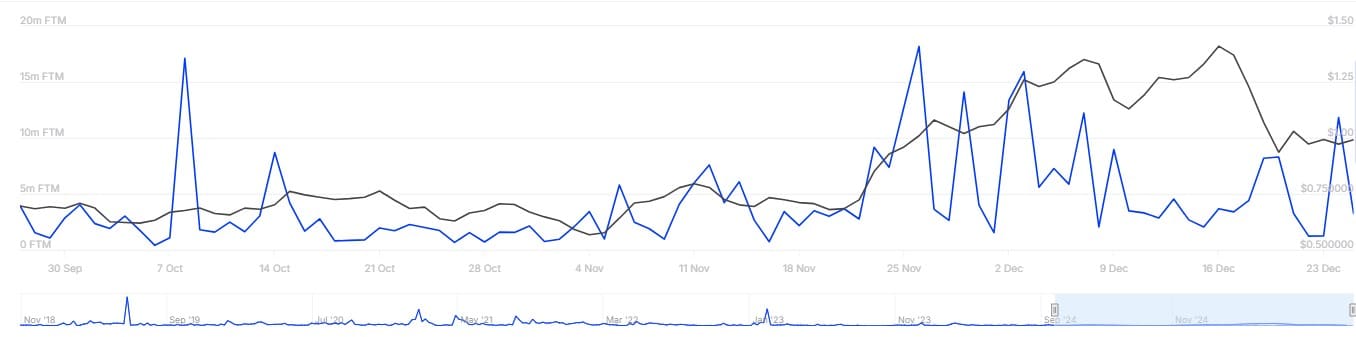

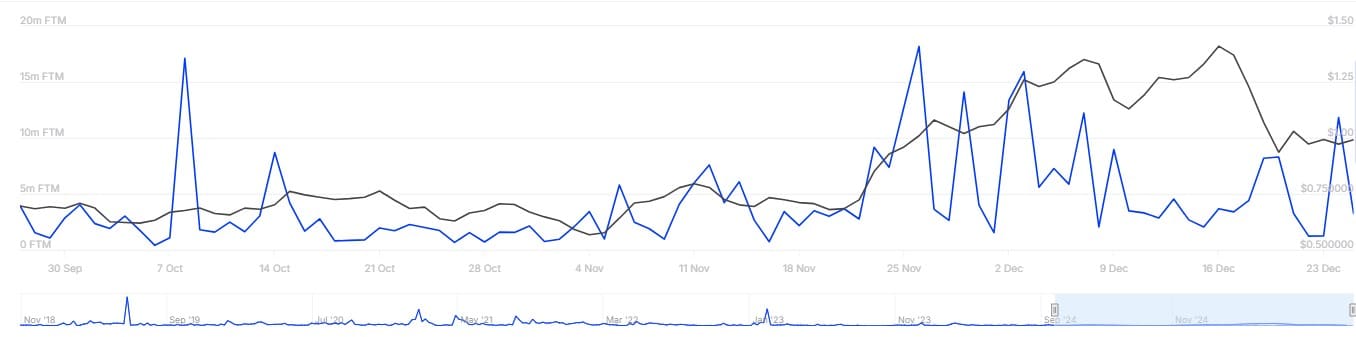

Exchange outflows reflect shifting sentiment

In the last 24 hours, Fantom has seen a sharp decline in exchange outflows. This metric, which tracks the movement of tokens from exchanges to private wallets, usually reflects the confidence level of investors.

A decline like this suggests that fewer traders are moving their holdings off exchanges, indicating hesitation over the token‘s near-term prospects.

This reduction of outflows corresponded to the prevailing consolidation and revealed that the market has been indecisive. Investors may actually be waiting for clearer signals before making their next move.

Source: IntoTheBlock

$0.88 emerges as a decisive price level for Fantom

The ascending triangle support and the liquidation pool at $0.88 create an interesting interplay, setting up this price level critical for Fantom’s next move.

A successful hold above this level would arguably validate Fantom’s triangle pattern and set up the stage for a bullish breakout. This could recover investor confidence and reverse the downtrend in exchange outflows.

However, if the $0.88 support fails to stand the bear’s pressure, the subsequent liquidation pressure could push the price down further.This could consequently disrupt the altcoin’s technical structure.

In this case, broader market sentiment and external factors will likely play a role in determining whether Fantom can sustain its position or not.

Source: TradingView

With FTM’s price consolidating near its key level, there is much at stake in both short-term trading and long-term investment.

The $0.88 level is setting up to be a key battle line between FTM’s bears and bulls. The direction of the break will spell either renewed bullish momentum or further declines on the charts.