- Ethereum’s leverage ratio and fund holdings signal rising trader and institutional confidence.

- Despite bearish indicators, Ethereum’s long-term potential remains supported by steady demand.

Following the U.S. election, Bitcoin [BTC] has enjoyed a notable bullish surge, capturing the spotlight. Meanwhile, Ethereum [ETH] has struggled to replicate this momentum, failing to reach a new all-time high despite its significant role in the blockchain ecosystem.

However, a closer look at Ethereum’s key metrics reveals a different story. Despite recent market corrections, several bullish indicators are emerging, suggesting that traders remain optimistic about the asset’s potential for future growth.

As Ethereum continues to evolve, its long-term outlook could be brighter than it appears at first glance.

Ethereum: What the metrics say

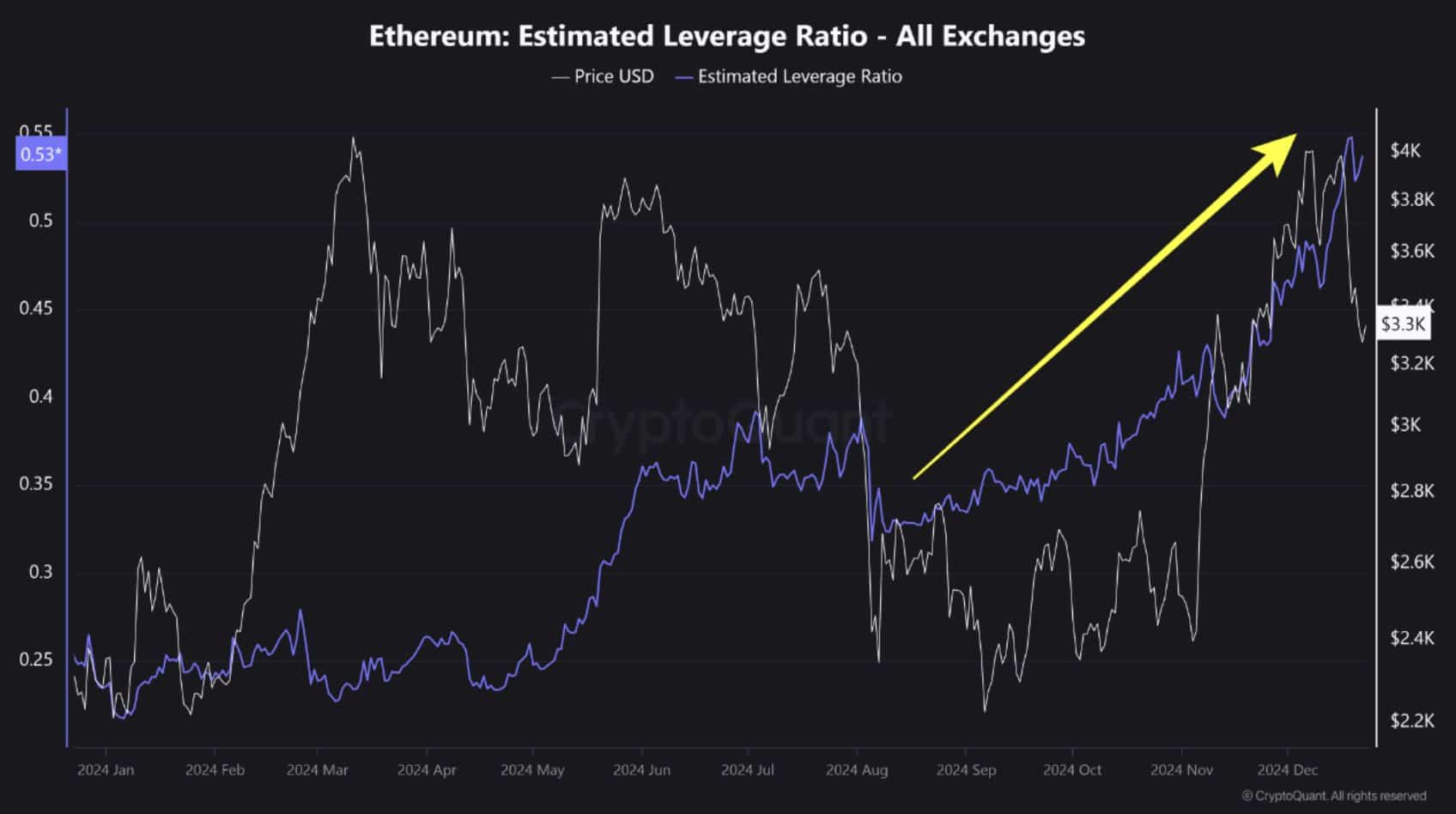

Source: Cryptoquant

Ethereum’s estimated leverage ratio has steadily risen, reflecting traders’ increased confidence in deploying leverage during bullish setups. This aligns with the metric’s peak levels, underscoring a sustained appetite for risk in derivatives trading.

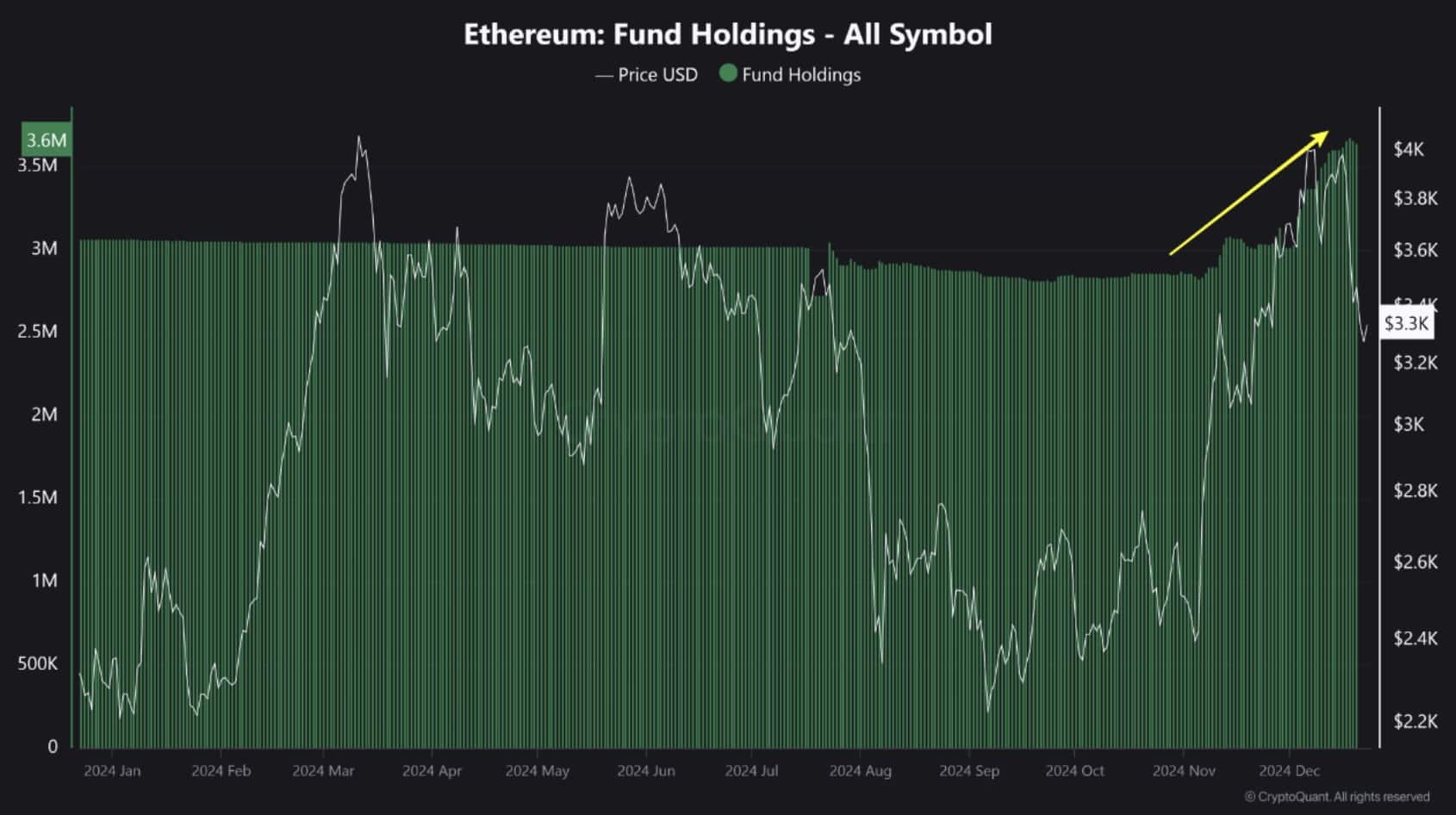

Source: Cryptoquant

Source: Cryptoquant

Furthermore, Ethereum fund holdings have surged to multi-month highs, reflecting strong institutional interest and continued confidence among both institutional and retail investors, even in the face of recent market corrections.