- Tron secured a major win in November as the network with the highest stablecoin transfers.

- Tron network cooled down slightly as TVL outflows continued, amid a recent surge in sell pressure.

Tron [TRX] had a bullish November like most other networks, seeing robust activity.

However, it shone more than its rivals in terms of stablecoin transfers during the month, building on strong momentum from previous months.

A recent CryptoQuant analysis revealed that Tron’s USDT transfer volume soared as high as $587.2 billion in November. This was the network’s highest monthly volume ever recorded.

It also meant that Tron was the top network during the month in terms of stablecoin transfers. The network’s stablecoin transfer has been steadily growing over the months.

The Tron stablecoin milestone was backed by robust network activity during the month. However, things have taken a bit of a slower turn lately.

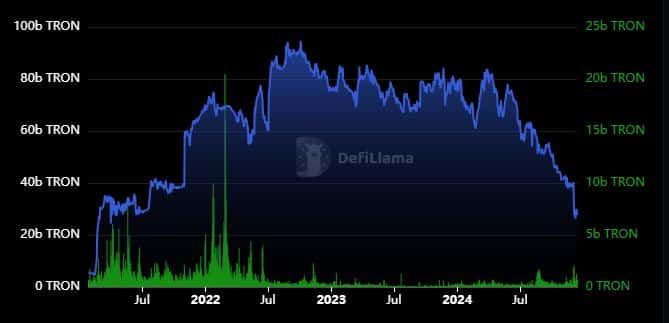

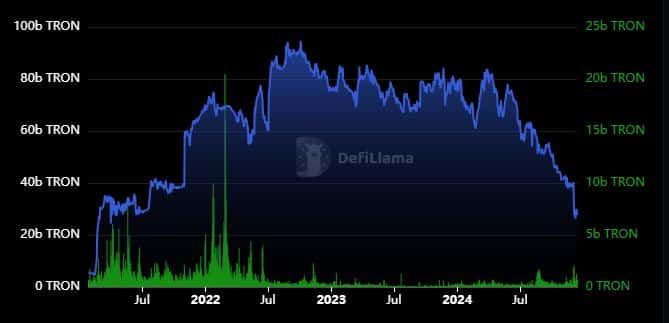

TVL has been on a steady uptick, reflecting the network growth and TRX price action.

A look at TVL in USD value reveals that it peaked at new ATH earlier this month. However, the TVL in terms of TRX value has been declining for months.

source: DeFiLlama

The network had 27.62 billion TRX in TVL as of the 13th of December, compared to the 83.70 billion peak in March this year.

The difference from the recent ATH in dollar value was because TRX price has been rallying alongside on-chain volume.

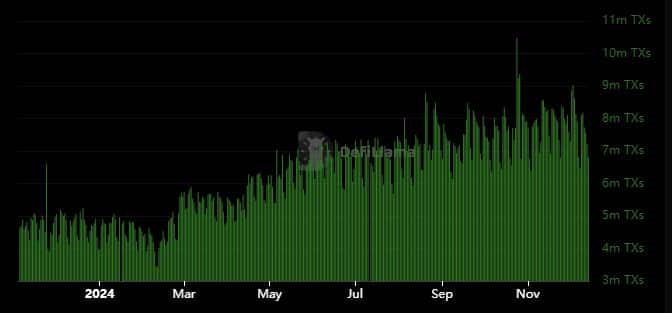

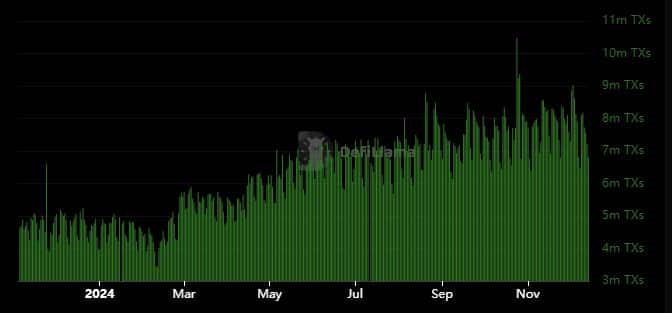

Tron daily transactions grew considerably in the last 12 months. However, transaction activity in December has been sharply declining from November highs.

source: DeFiLlama

For context, transactions peaked as high as 9.03 million transactions on the 3rd of December. They have since dipped to 6.81 TXS as of the 14th of December.

This decline may underscore the lower hype or activity now compared to November.

The state of demand and sell pressure

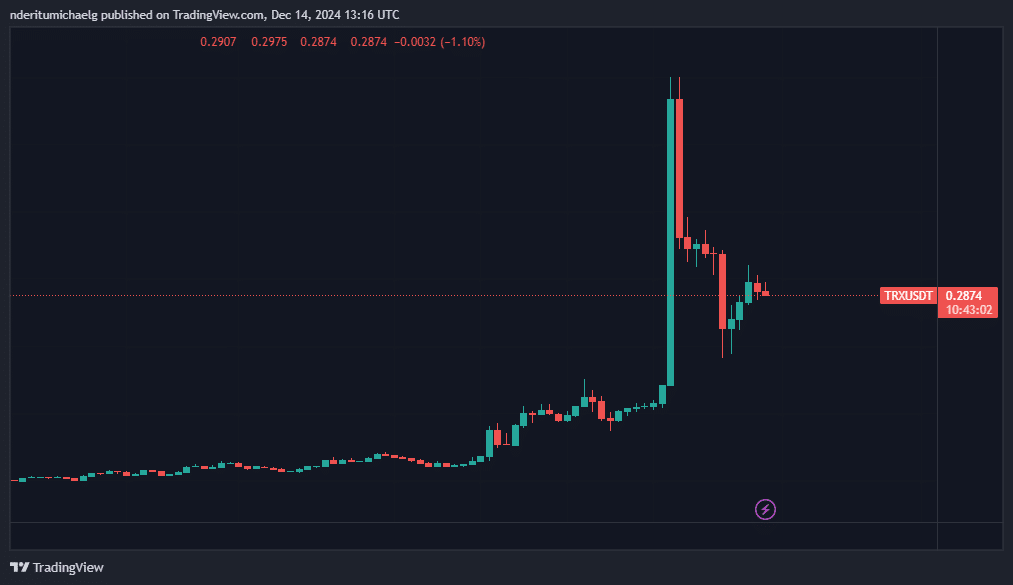

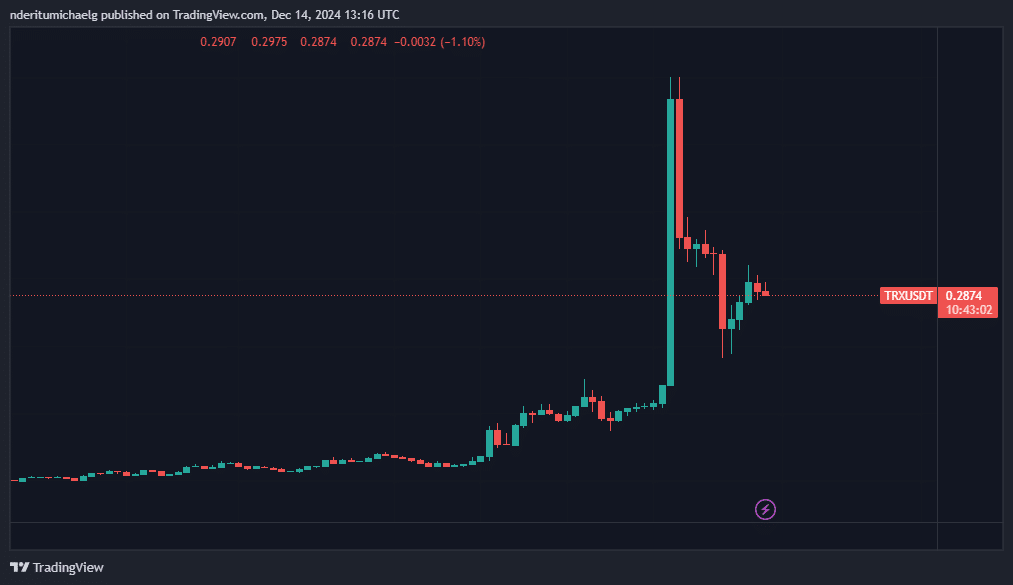

The dip reflects the latest TRX price action. Profit-taking was the name of the game for the last two weeks after the ATH on the 3rd of December.

The coin exchanged hands at $0.2878 at press time, which was equivalent to a 36% decline in the last two weeks.

Source: TradingView

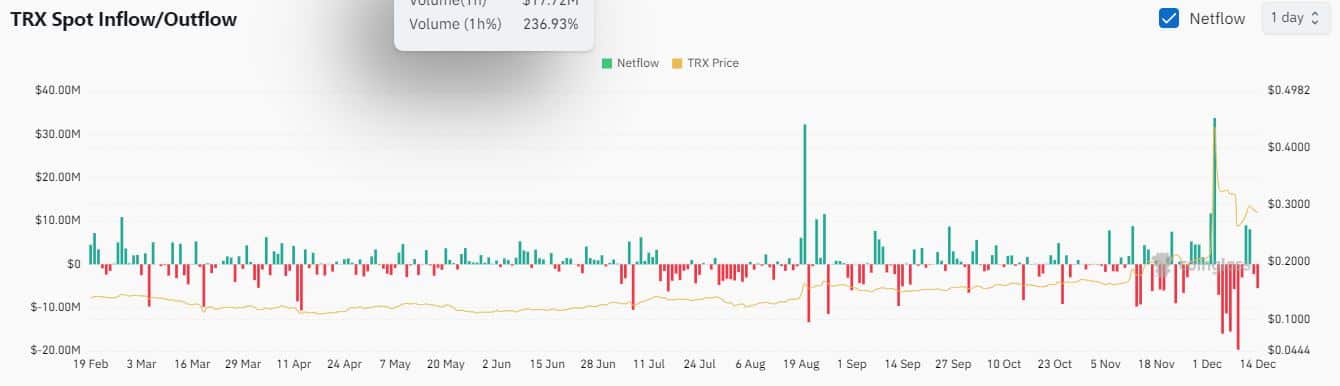

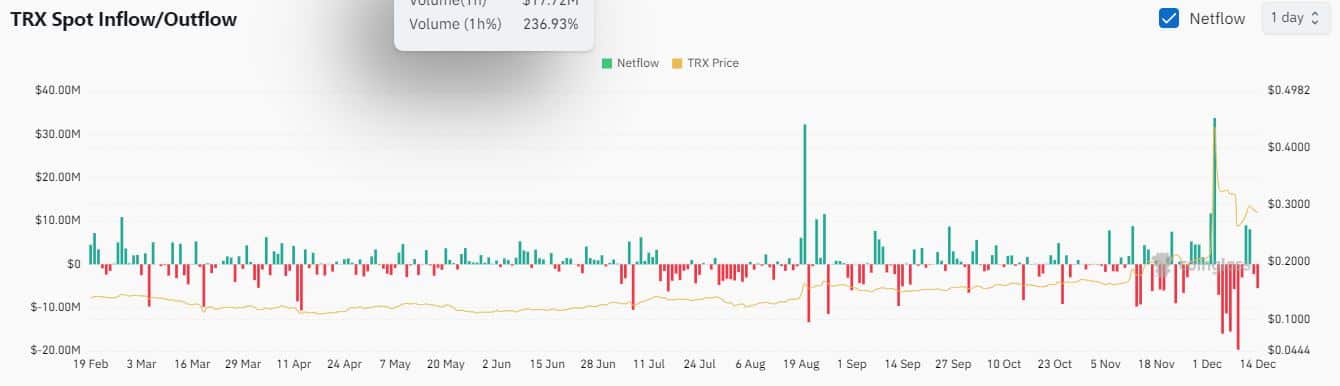

Can TRX resume its upside, or will the bears hunt for longer? According to Coinglass, TRX outflows dominated in the last two weeks, especially after the peak on the 3rd of December.

The Tron network has concluded the weekend with more outflows. Over $5.51 million in outflows were observed in the last 12 hours.

Source: Coinglass

Read Tron’s [TRX] Price Prediction 2024–2025

Open Interest also remained relatively high at $277.76 million, despite a significant decline in the last two weeks.

Funding Rates also remained positive, indicating that bearish expectations were relatively low despite the recent pullback.