- Bitcoin saw record inflows, fueled by institutional inflows and regulatory clarity.

- Growing confidence in Bitcoin’s realized cap highlighted its shift from speculation to stability.

Bitcoin [BTC], once known for wild price swings, is now drawing $80 billion in capital every month.

Nearly half of all the capital ever invested in Bitcoin has flowed in just this past year. This surge signals a market shift, suggesting Bitcoin may be evolving from a high-risk asset to a more stable store of value. Institutional investors are viewing Bitcoin as a more stable investment.

As this transformation unfolds, one key question remains: What does this mean for Bitcoin’s long-term future?

What’s driving Bitcoin’s unprecedented inflows?

The recent surge in Bitcoin inflows, totaling $80 billion per month, reflects a confluence of macroeconomic and market-specific drivers.

Institutional investors are increasingly viewing Bitcoin as a hedge against inflation and a diversification tool amid financial market uncertainty.

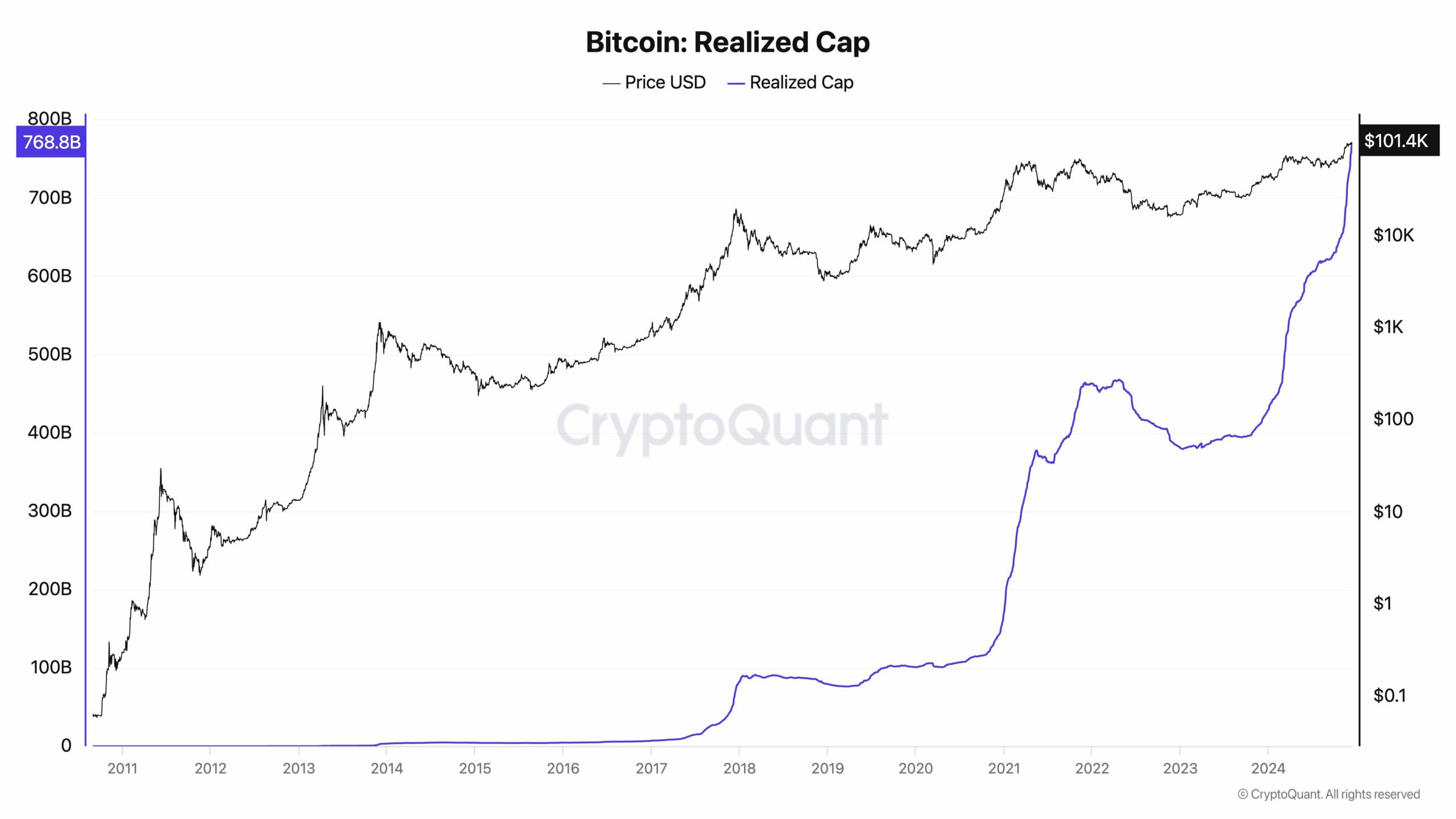

The sharp rise in Bitcoin’s realized cap to $768.8 billion shows growing confidence in its long-term stability. Fresh capital from whales and long-term holders is accumulating near all-time high price levels.

Source: CryptoQuant

Notably, regulatory clarity in major jurisdictions and the anticipation of Bitcoin ETF approvals have further legitimized its appeal.

Coupled with a strengthening dollar and declining yields on risk-free assets, these factors signal that Bitcoin is no longer the domain of speculation but a cornerstone in the evolving financial ecosystem.

Impact of the inflow on market cap and how the latter impacts BTC price

BTC’s market cap, now edging toward $2 trillion, owes much of its recent growth to the influx of institutional capital.

This capital inflow amplifies liquidity, stabilizing price movements and reducing the risk of sharp corrections, a shift from Bitcoin’s earlier volatility. As the realized cap reaches $768.8 billion, it signifies a robust base of confident long-term holders.

Historically, market cap expansion correlates directly with higher price potential. More capital creates a positive feedback loop, attracting new investors and increasing demand.

This dynamic is evident in BTC’s ability to sustain all-time high prices without significant pullbacks, bolstering its reputation as a reliable store of value.

Read Bitcoin’s [BTC] Price Prediction 2024–2025