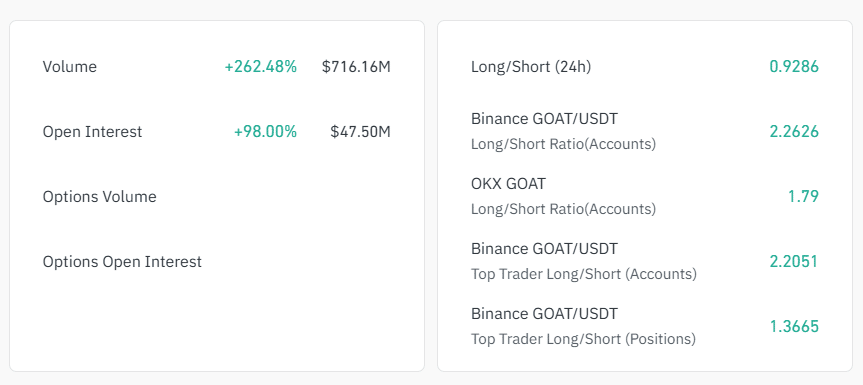

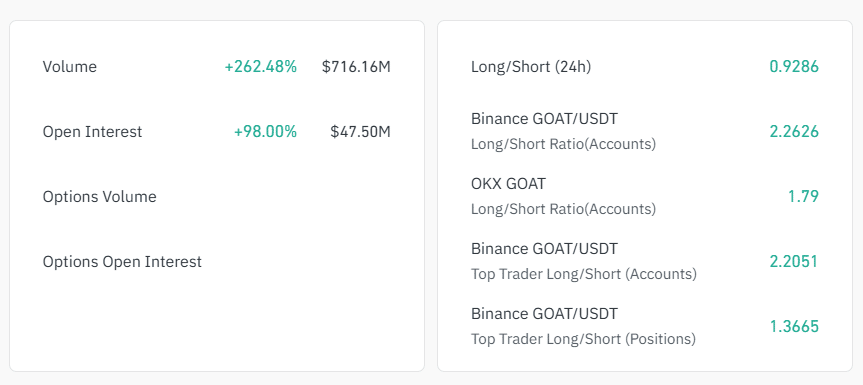

- GOAT’s Long/Short ratio stands at 0.928 at the time of writing, indicating strong bearish sentiment among traders.

- A combination of on-chain metrics and technical analysis indicates that bears are currently dominating the asset.

The popularity of Solana-based meme coins has resurfaced with the launch of Goatseus Maximus [GOAT]. This meme coin has attracted significant attention from crypto enthusiasts due to its impressive performance over the past few days.

Potential reason for GOAT price decline

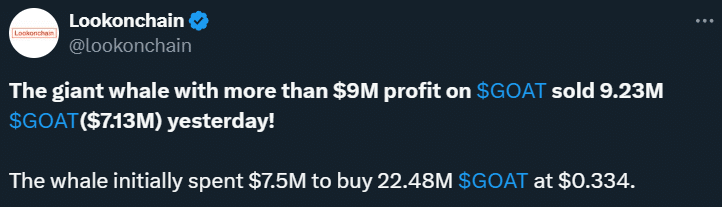

As this memecoin continues to rally, a crypto whale with an unrealized profit of over $9 million sold off their GOAT holdings.

On 24th October, when GOAT reached its all-time high, the whale seized the opportunity to offload their holdings, as reported by the blockchain transaction tracker Lookonchain.

Source: X

According to data, the whale offloaded 9.23 million of GOAT tokens worth $7.13 million. The whale initially spent nearly $7.5 million to buy 22.48 million GOAT meme coins at an average price of $0.334.

This might be the reason behind GOAT’s recent price decline. At press time, GOAT was trading near $0.632 and has experienced a price decline of over 22% in the past 24 hours. ‘

During the same period, its trading volume jumped by 34%, indicating heightened participation from traders and investors. This growth in trading volume is a positive sign for GOAT holders, as it shows continued enthusiasm despite the notable sell-off.

GOAT technical analysis and key-level

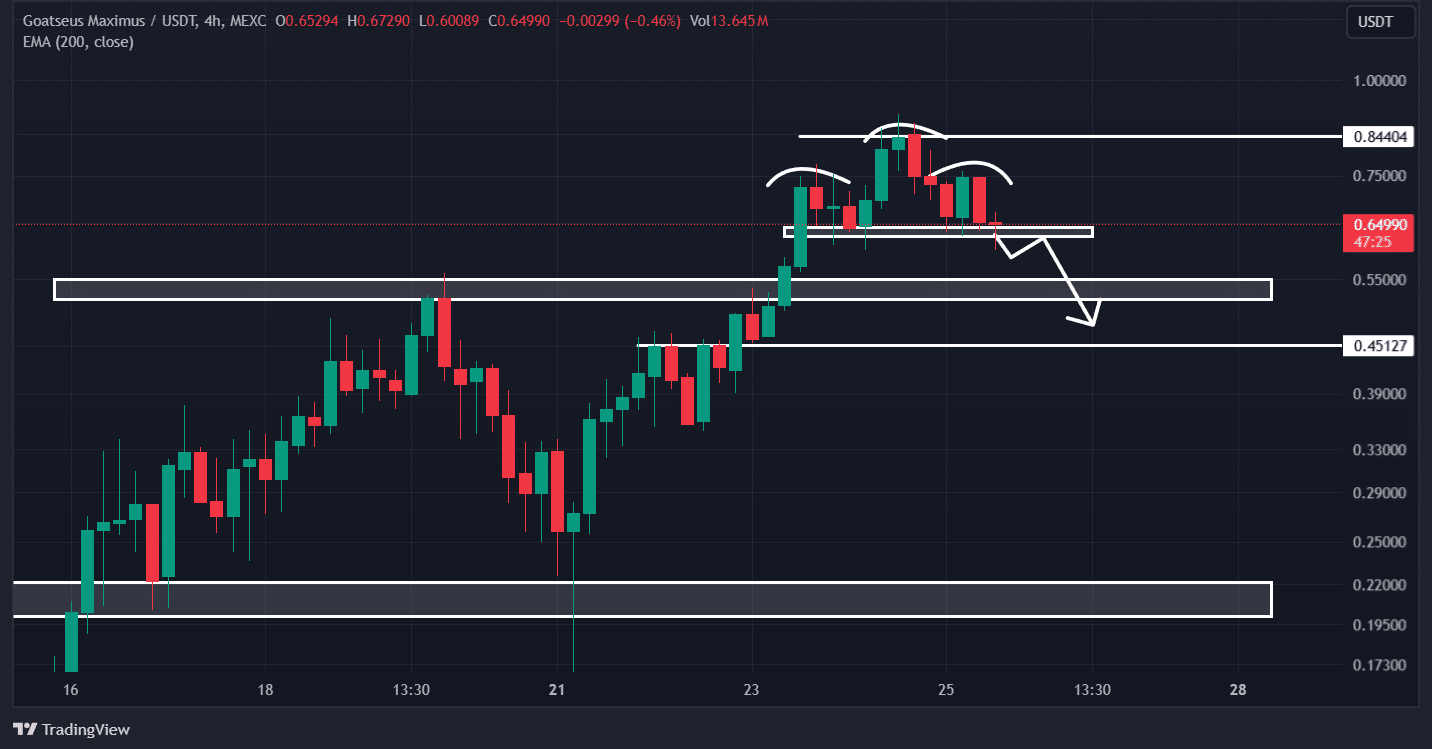

According to AMBCrypto’s technical analysis, GOAT appears bearish as it has formed a bearish head-and-shoulder price action pattern in the four-hour time frame.

In trading and investing, this pattern is often seen as a sell-off signal.

Source: Trading View

Based on the price action, if GOAT breaches the $0.60 neckline and closes a four-hour candle below it, there is a strong possibility it could decline by 16%, reaching the $0.51 level in the coming days.

Bearish on-chain metrics

GOAT’s negative outlook is further supported by on-chain metrics. According to the on-chain analytics firm Coinglass, GOAT’s Long/Short ratio stands at 0.928 at the time of writing, indicating strong bearish sentiment among traders.

Source: Coinglass

Read Goatseus Maximus’ [GOAT] Price Prediction 2024-25

Additionally, its open interest has skyrocketed by 99% over the past 24 hours and by 16% over the past four hours. This rising open interest indicates strong participation and a buildup of more positions compared to the previous day.

A combination of rising open interest and a Long/Short ratio below 1 is bearish, indicating that bears are currently dominating the asset.