- Bitcoin’s price appreciated by 9.06% over the past week

- Bitcoin’s whale activity hiked over the past week, driving its most-recent rally

Over the past week, Bitcoin [BTC] has maintained its month-long bullish momentum on the price charts. At press time, it was trading at $68.3k on the back of 10% monthly gains and 9% weekly gains.

Despite the aforementioned gains, however, it’s worth pointing out that the crypto is still 7.27% below its ATH recorded earlier this year.

That’s not all though since as BTC recorded significant gains, whales were the driving force behind it.

Are Bitcoin whales driving the surge?

According to Santiment, the number of Bitcoin whales saw an exponential surge when BTC dropped to $59k on the price charts.

Source: Santiment

From 10 to 13 October, 268 more wallets began holding between 100-1k BTC. This analysis suggested that whales played a part in the prevailing rally that Bitcoin is a part of. What this means is that without capital inflows from whales, the weekly rally we have seen would most probably not have occurred.

Thus, during the dip, whales turned to accumulation, indicating their confidence in the crypto’s future value.

Usually, when whales increase their holdings, it signals a potential bullish trend. Therefore, the ongoing price movement was partly driven by a surge in whale activities.

What does Bitcoin’s chart say?

Whales play a vital role in any crypto’s price movements.

As such, a hike in whale accumulation is a sign of positive market sentiment, with experienced investors anticipating the crypto’s value to appreciate further.

Therefore, these prevailing market sentiments could set BTC for more gains on the charts.

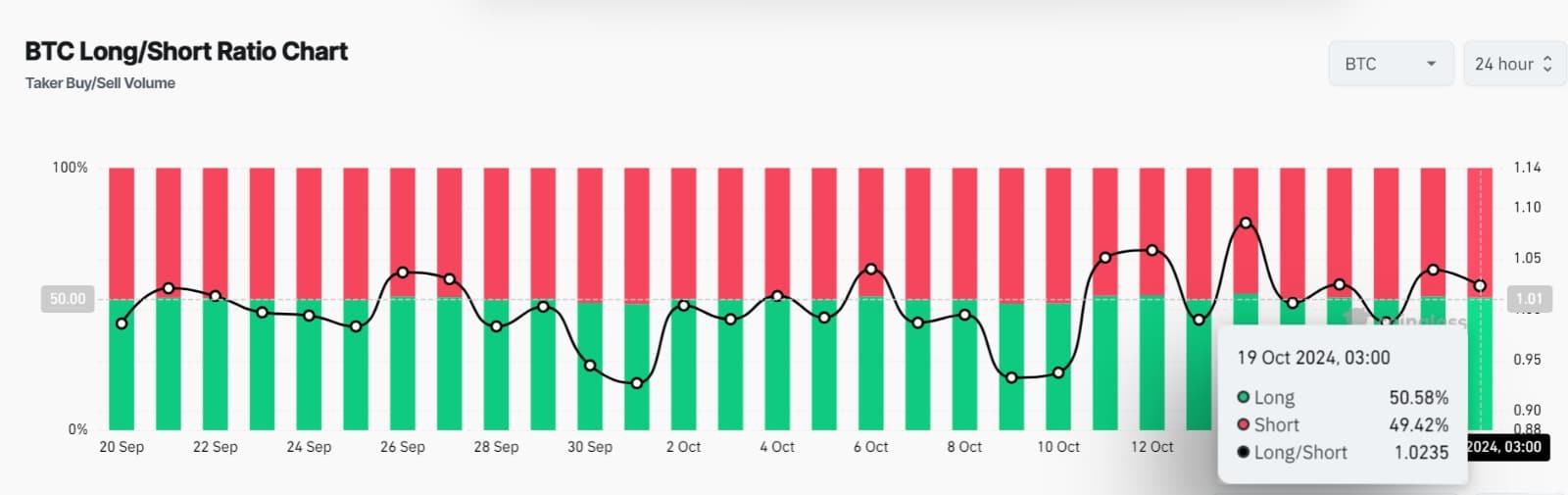

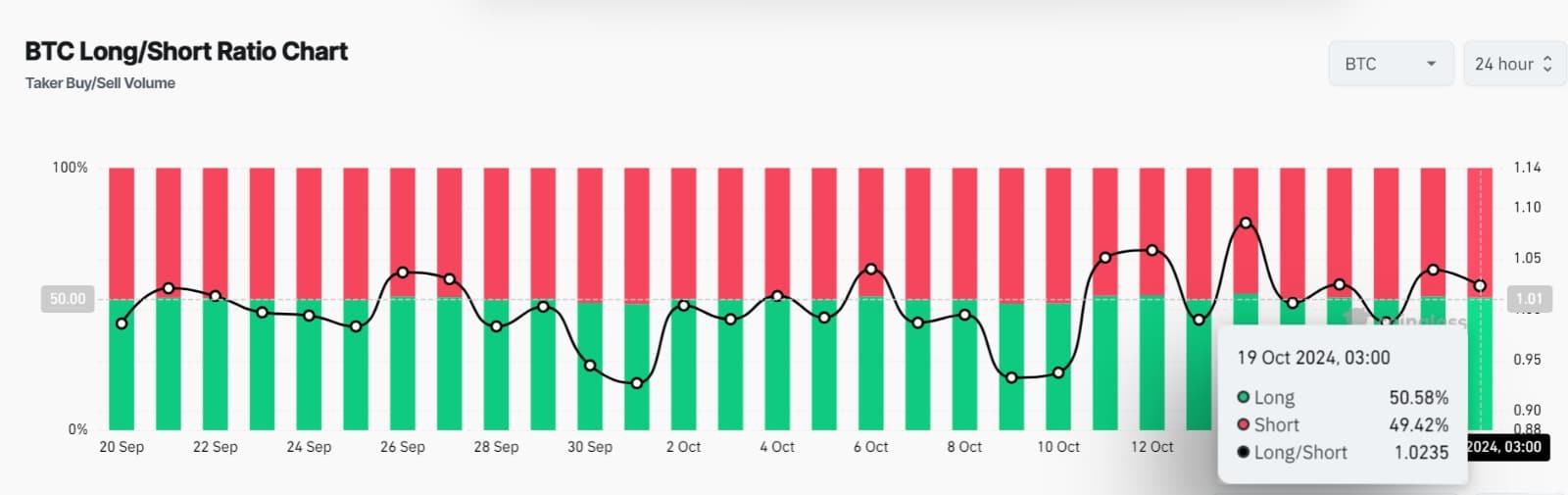

Source: Coinglass

For example, Bitcoin’s Long/Short Ratio has remained above 1 over the past 24 hours. At press time, this ratio had a reading of 1.023.

This implied that long-position holders have been dominating the market.

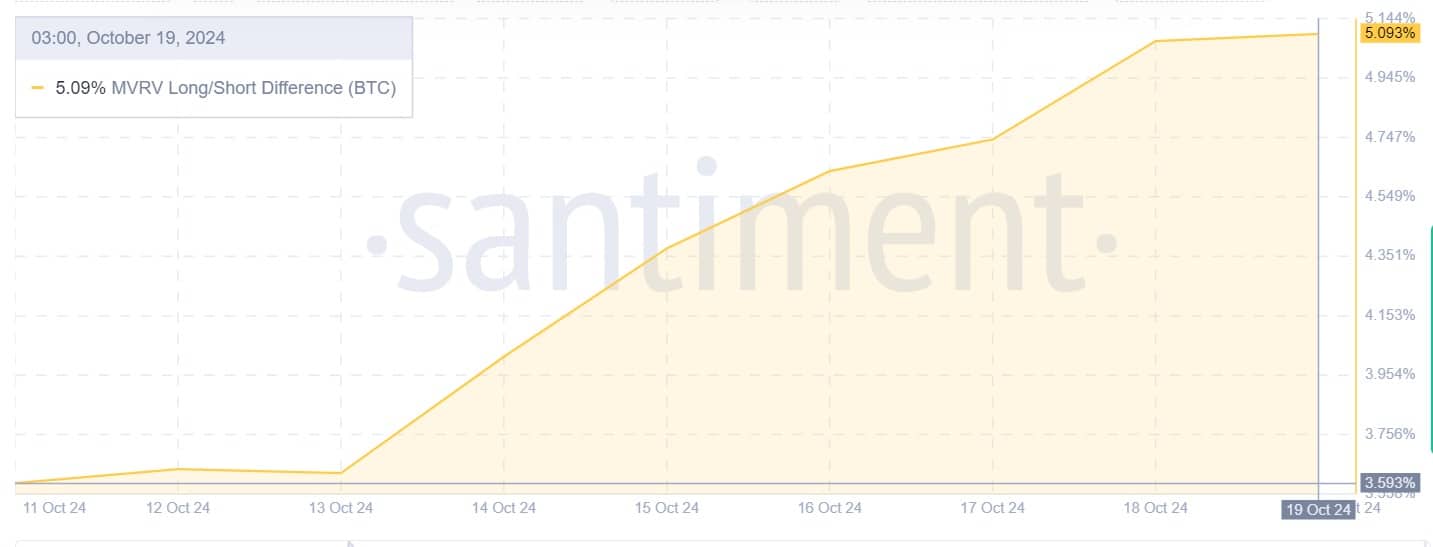

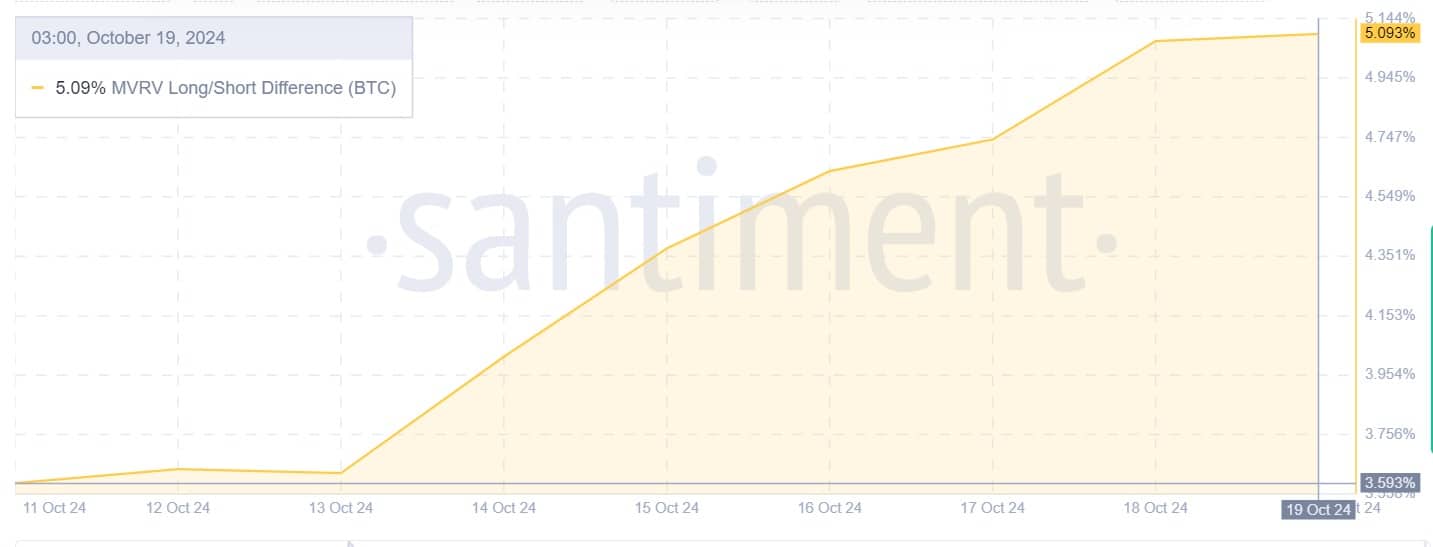

Source: Santiment

Additionally, Bitcoin’s MVRV Long/Short difference surged over the past week from a low of 3.59% to 5093%. This can be seen as a sign that long-term investors are in profit.

As the MVRV for long-term holders outpaced short-term holders, it underlined confidence in the market’s longer-term prospects.

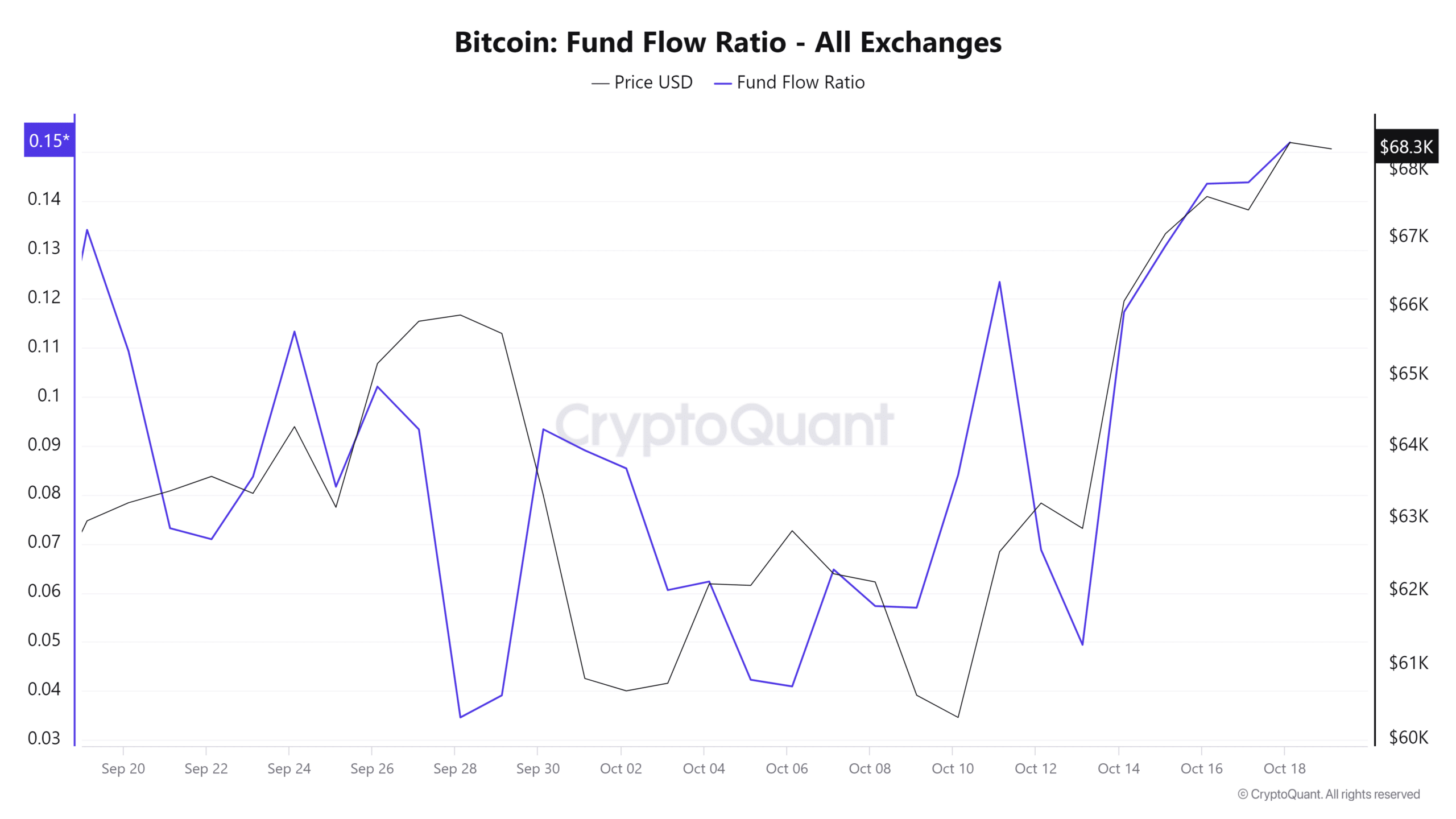

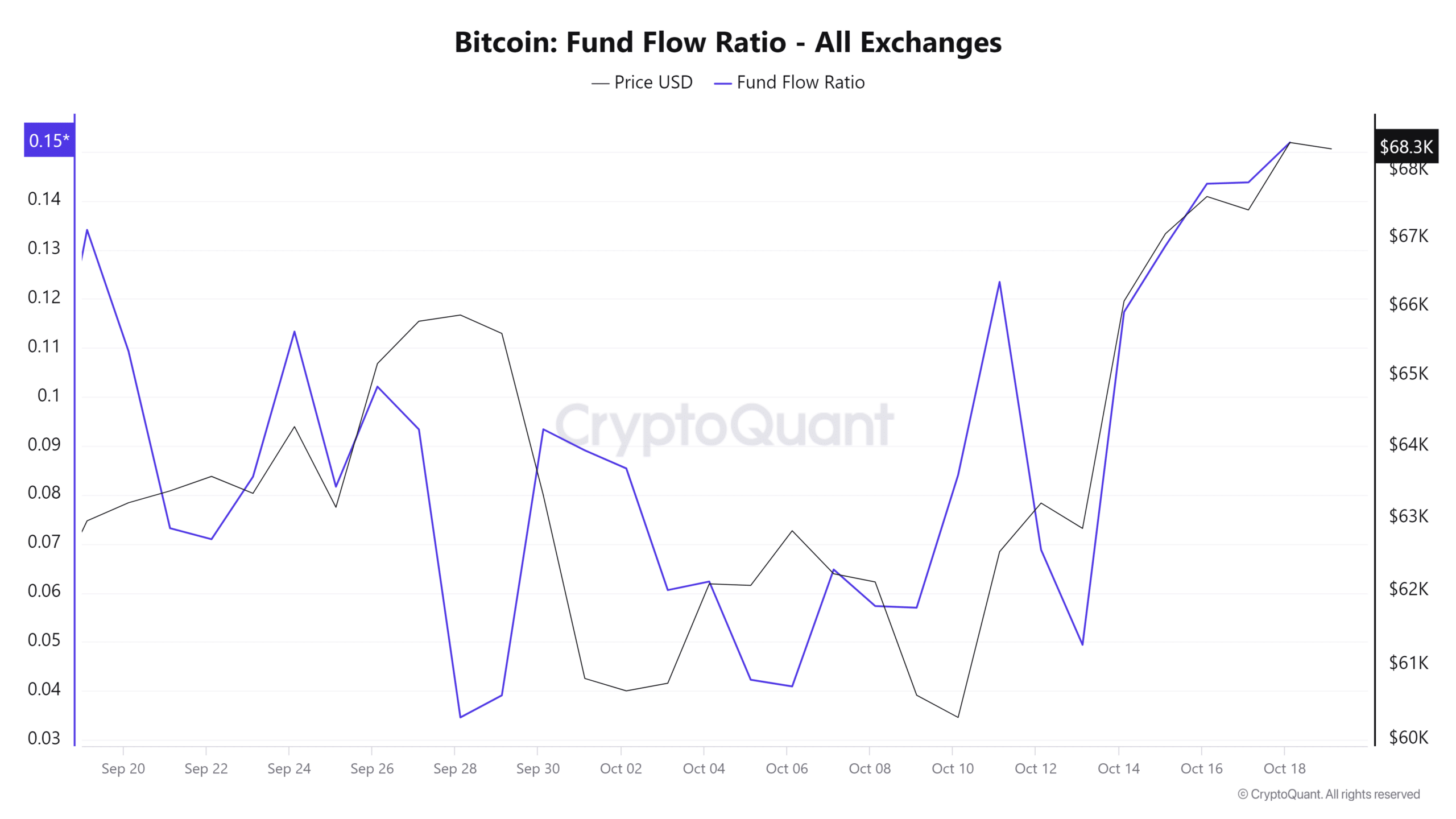

Source: CryptoQuant

Finally, Bitcoin’s Fund Flow Ratio hit a monthly high of 0.15. Simply put, this suggested that BTC is now enjoying a higher buying pressure than selling pressure.

Read Bitcoin’s [BTC] Price Prediction 2024–2025

Therefore, investors are accumulating BTC and expressing their confidence in the market.

Right now, in light of investors’ favourability and market sentiment, BTC is in a good position. If the trend holds, the crypto will reclaim $70k in the short term.