- POPCAT has fallen by over 10% over the past week, resulting in a healthy shakeout of weak hands

- However, a significant roadblock is still acting as resistance on the charts

Solana-based memecoin Popcat [POPCAT] started October strong, nearing a new ATH of $1.5 in the first two weeks. However, a sharp weekly drop of over 10% pulled it back to the $1.20 range.

Surprisingly, this pullback aligned with Bitcoin’s surge past the $66k ceiling, a move that typically drives liquidity into high-cap memecoins. However, despite POPCAT’s $1 billion market cap, it failed to gain traction.

As a result, analysts at AMBCrypto are questioning whether this correction was a strategic shakeout of weak hands, potentially setting up POPCAT for another ATH attempt.

THIS might prevent POPCAT from reaching a new ATH

Unlike early October, when Bitcoin saw a modest 2% hike over three days, pushing it to around $62k, this volatility sparked significant interest in newer memecoins that offered greater return potential.

Among them, POPCAT stood out, posting daily gains exceeding 10% and reaching a new ATH of $1.5.

However, with Bitcoin regaining bullish momentum and now trading around $67k, traditional memecoins reasserted their dominance. By doing so, they pushed newer coins to concede defeat, as illustrated by this chart.

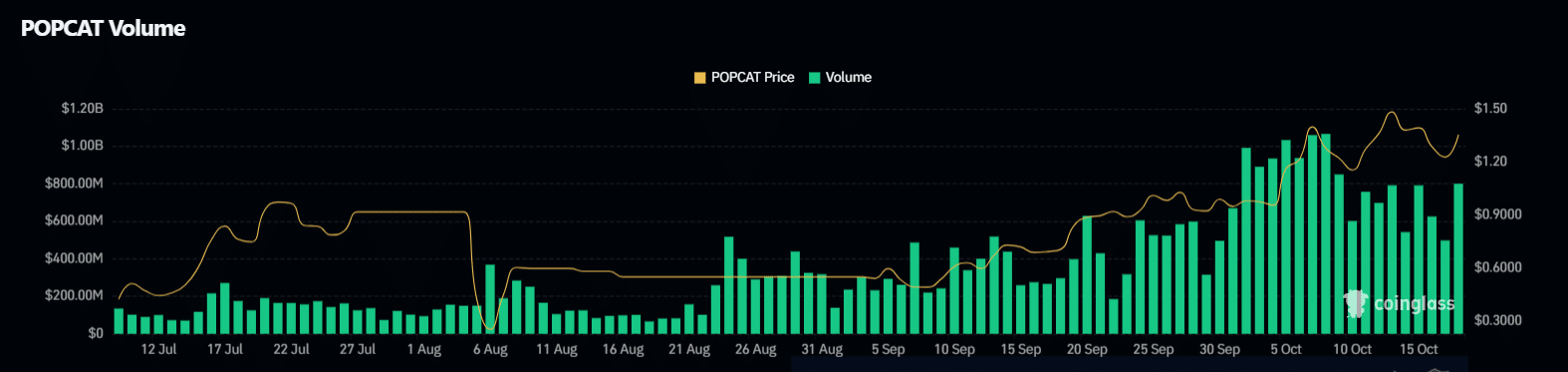

A decline in trading volume further reinforced this trend, dropping from a peak of $800 million to $500 million – Contributing to POPCAT’s recent 10% drop.

Source : Coinglass

In the past week, liquidity has flowed into older memecoins as Bitcoin holders redistributed their profits, resulting in liquidity outflows for POPCAT.

Nonetheless, it’s important to note that this recent decline might be a temporary blip, rather than a consistent trend in every bull cycle.

Additionally, the price drop came after a surge in whale purchases of POPCAT. This indicated that the recent decline may have been triggered as the coin hit its new high, leading weaker hands to exit the cycle.

While this shakeout might set the stage for POPCAT to achieve a new ATH by the end of this cycle, the increasing dominance of its rivals could pose a significant hurdle.

Traders seized profits from other memecoins

Typically, a local low forms after every pullback, creating an entry point for new buyers looking to capitalize on the dip to acquire assets at a discounted price.

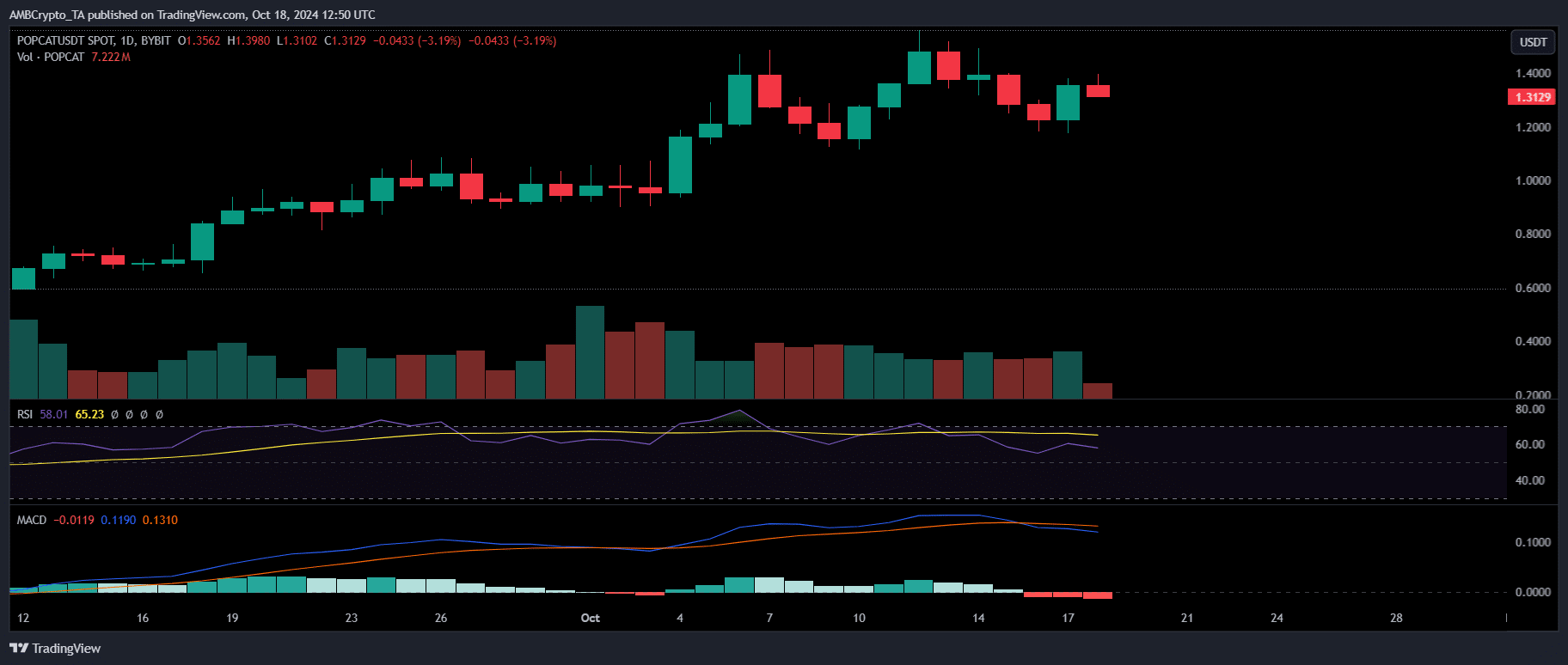

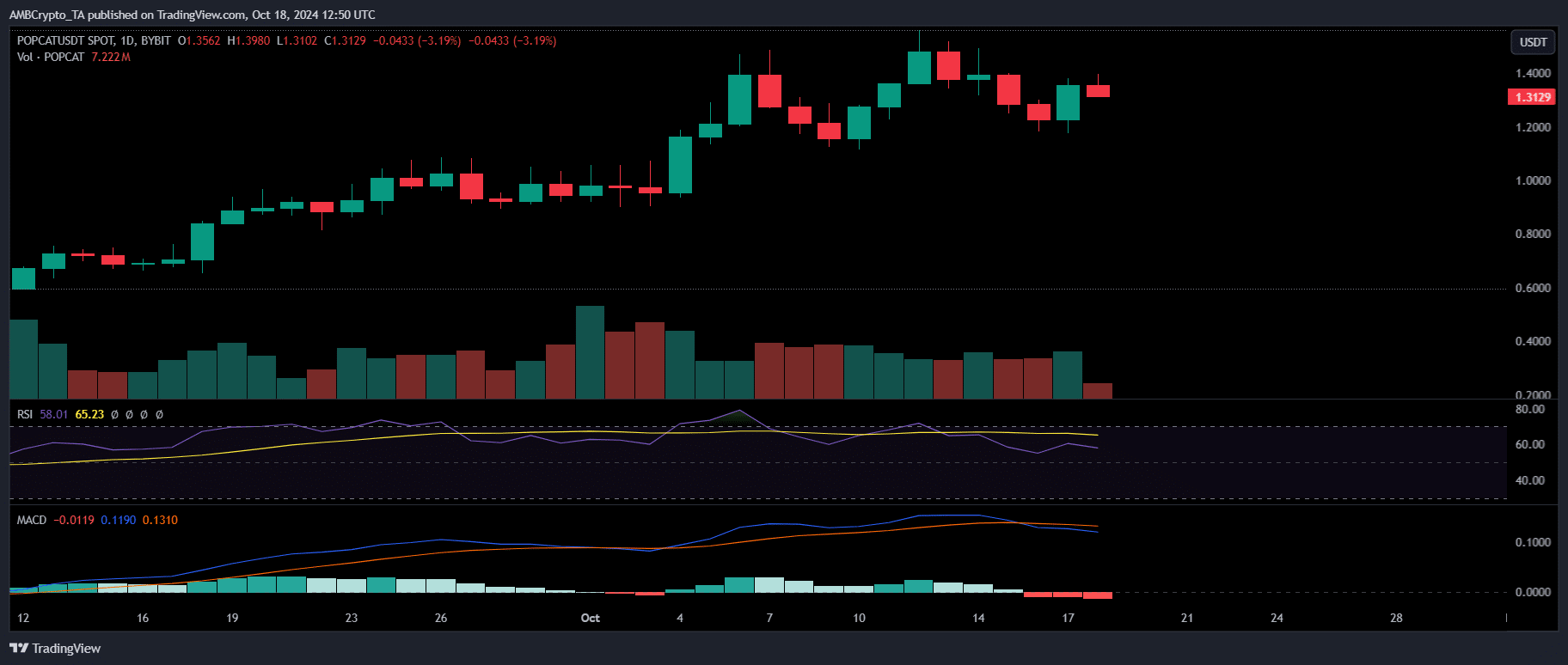

While a neutral RSI suggested there is still room for growth, other indicators did not show promising signs that $1.30 will serve as an opportunity for POPCAT to attract fresh liquidity.

Source : TradingView

The recent 10% drop in its value coincided with a bearish MACD crossover, indicating that the pullback may continue at least until Bitcoin hits a local low. This might mean potentially shifting attention back to POPCAT from other memecoins.

Is your portfolio green? Check the Popcat Profit Calculator

Otherwise, traders opting to capitalize on other memecoins, posting weekly gains of over 20%, might further dampen POPCAT’s ability to recover from its slump.

Therefore, careful monitoring of the memecoin market is essential. If other memecoins start to decline, it could present the right opportunity for POPCAT to attract liquidity. This will set the stage for a potential new ATH.