- Crypto adoption reached record levels, driven by surging blockchain activity and stablecoin usage.

- Political interest in crypto rises, with regulatory clarity gaining bipartisan momentum in the U.S.

Crypto adoption has surged in the past year, marking 2024 as a pivotal year for the industry.

The newly released 2024 State of Crypto Report highlights this rapid transformation, highlighting that crypto activity has reached record levels.

a16z crypto report revelation

Just two years ago, digital assets were not a priority for policymakers. Bitcoin [BTC] and Ethereum [ETH] ETPs hadn’t yet received SEC approval, and ETH was still operating on its energy-intensive proof-of-work model.

Today, the crypto landscape reflects remarkable progress, underscoring its evolution from niche to mainstream. This signals its growing influence on both financial markets and regulatory agendas.

Remarking on the same, the report noted,

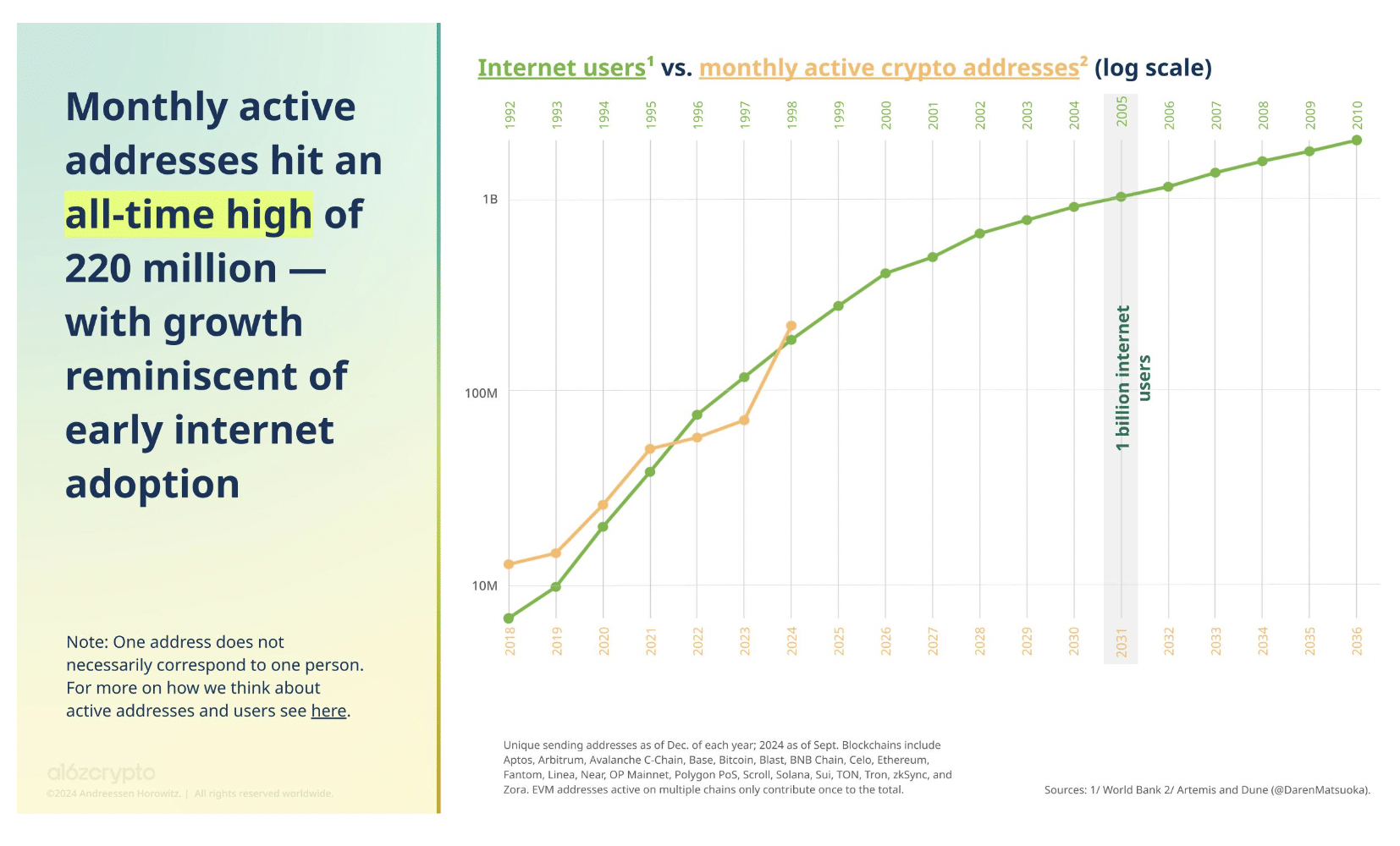

“There have never been more monthly active crypto addresses. In September, 220 million addresses interacted with a blockchain at least once, a figure that has more than tripled since the end of 2023.”

Source: a16zcrypto.com

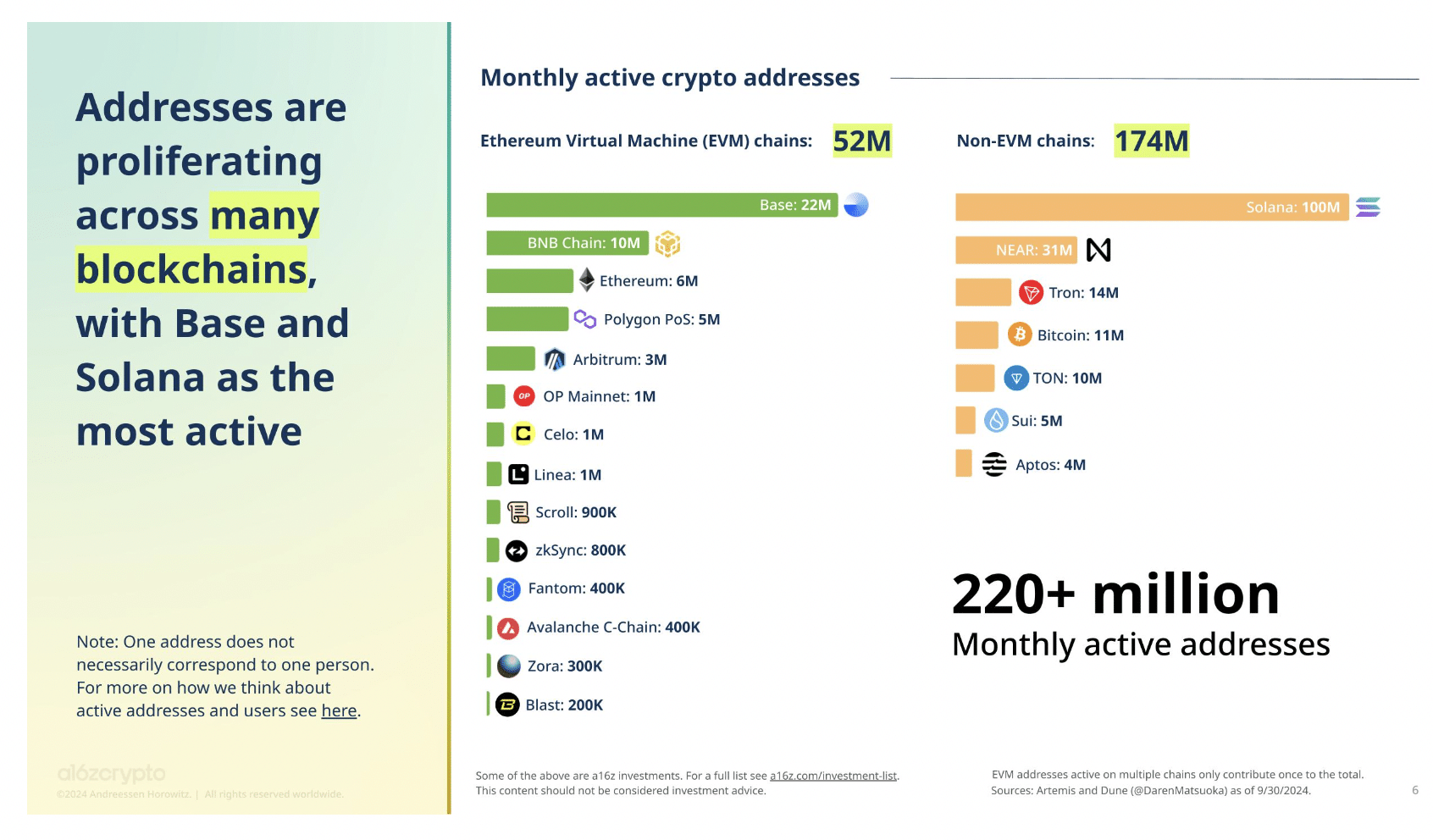

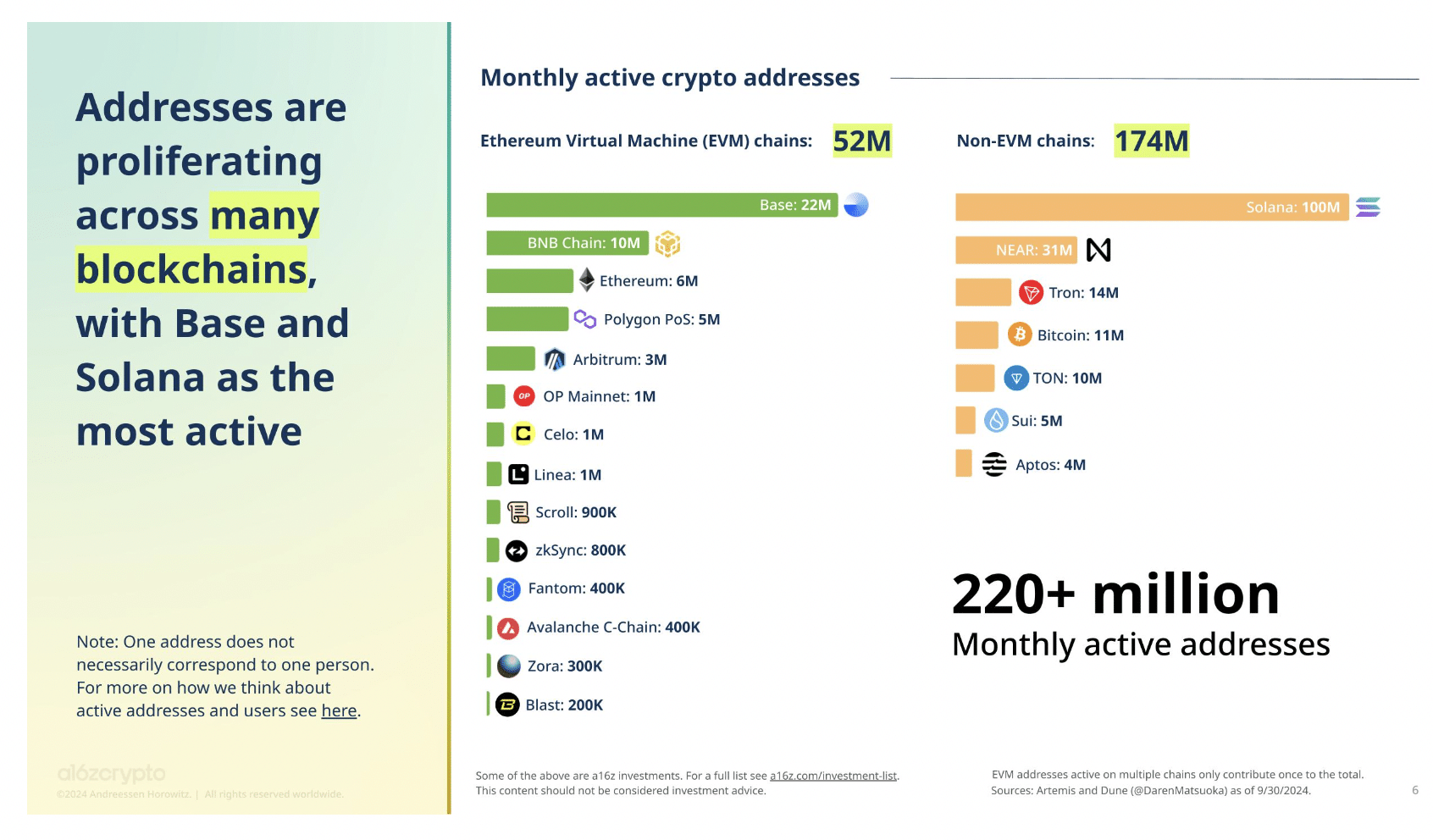

The report further shows that Solana [SOL] is leading the surge in blockchain activity, with more than 100 million active addresses in September alone.

Emerging blockchains like NEAR and Base have also become increasingly popular, attracting 31 million and 22 million active users, respectively.

Source: a16zcrypto.com

In contrast, some of the more established networks, including Tron and Bitcoin, reported 14 million and 11 million active addresses, respectively. While Ethereum, though still influential, only saw around 6 million active addresses.

This growth across both newer and established networks highlights the evolving preferences of crypto users.

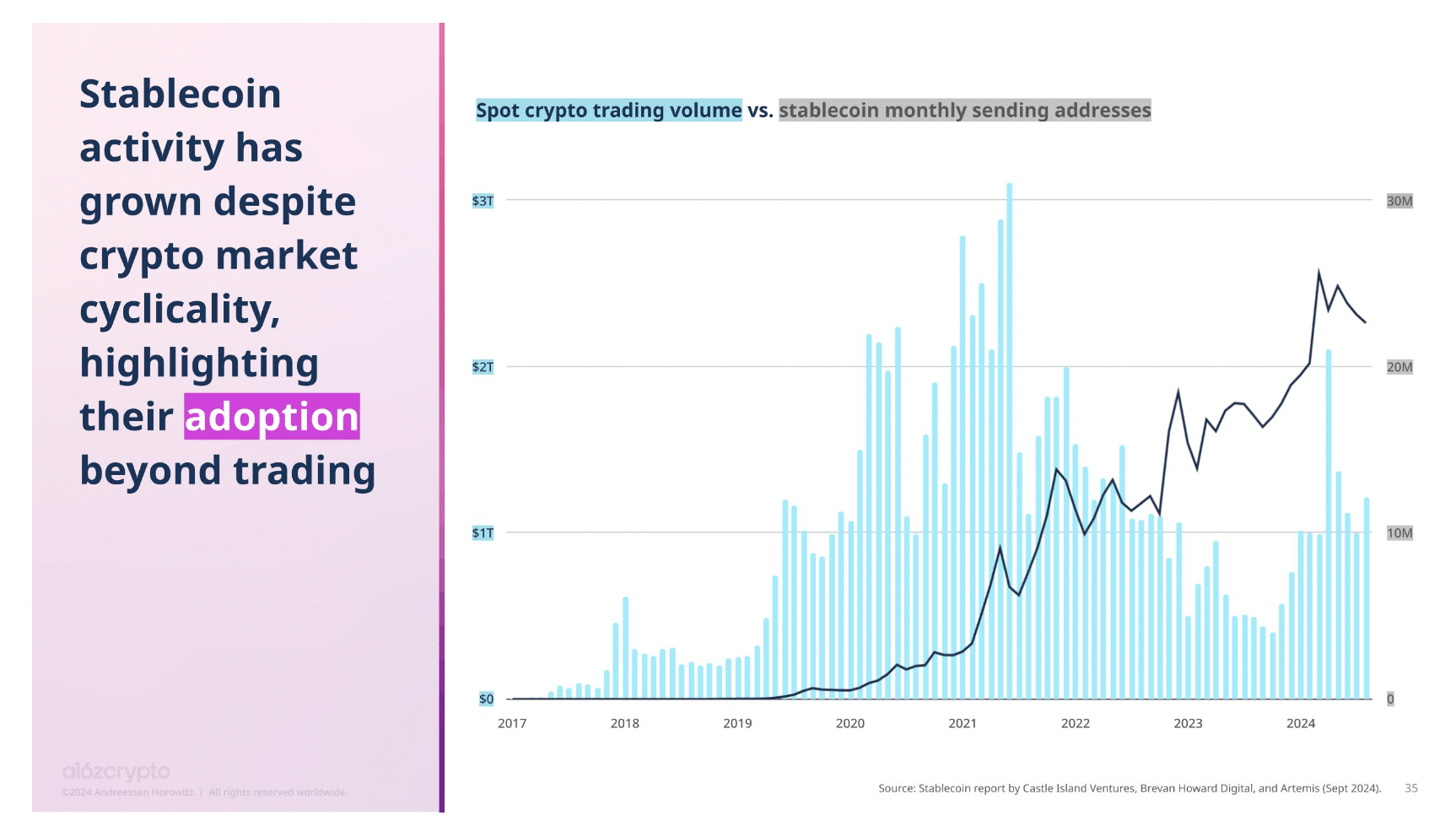

The role of stablecoins and elections

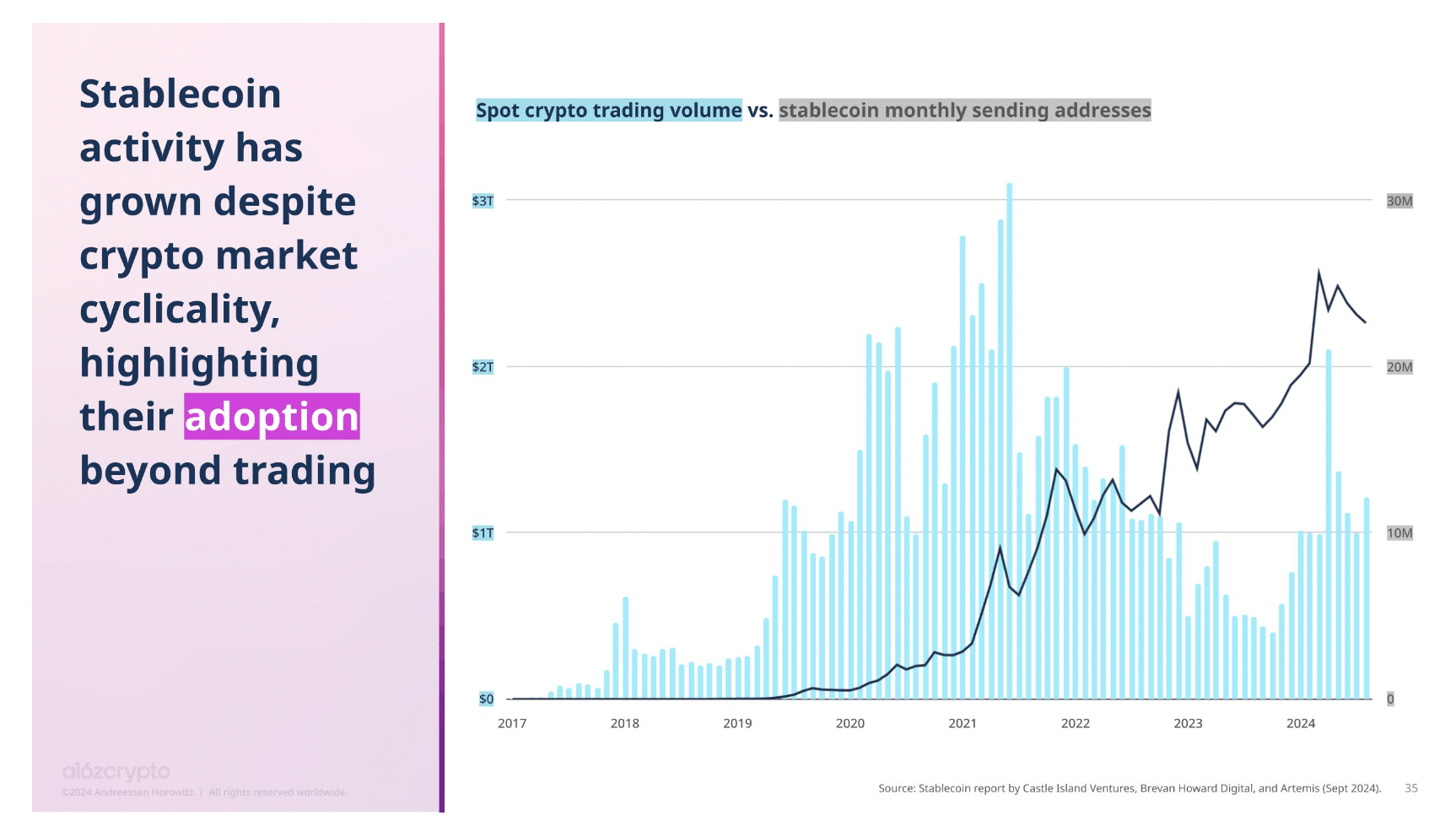

The report also highlights stablecoins as a pivotal force behind crypto’s rapid growth. These U.S. dollar-pegged assets seeing significant adoption alongside decentralized finance [DeFi].

Even though DeFi currently leads in daily active addresses at 34%, stablecoins closely followed at 32%, underscoring their increasing role in the ecosystem.

Source: a16zcrypto.com

Infrastructure also maintains a solid position, accounting for approximately 14% of active addresses.

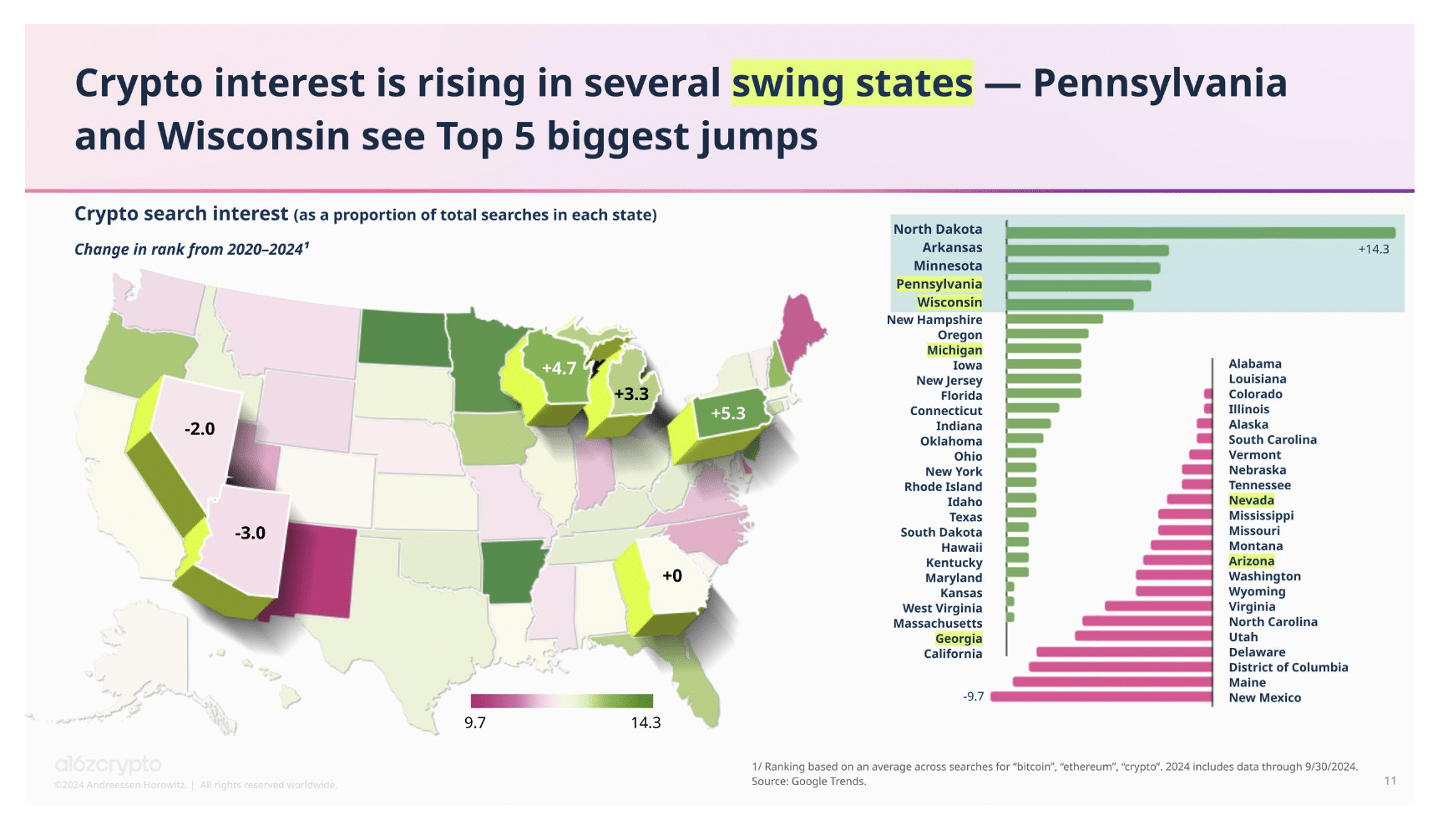

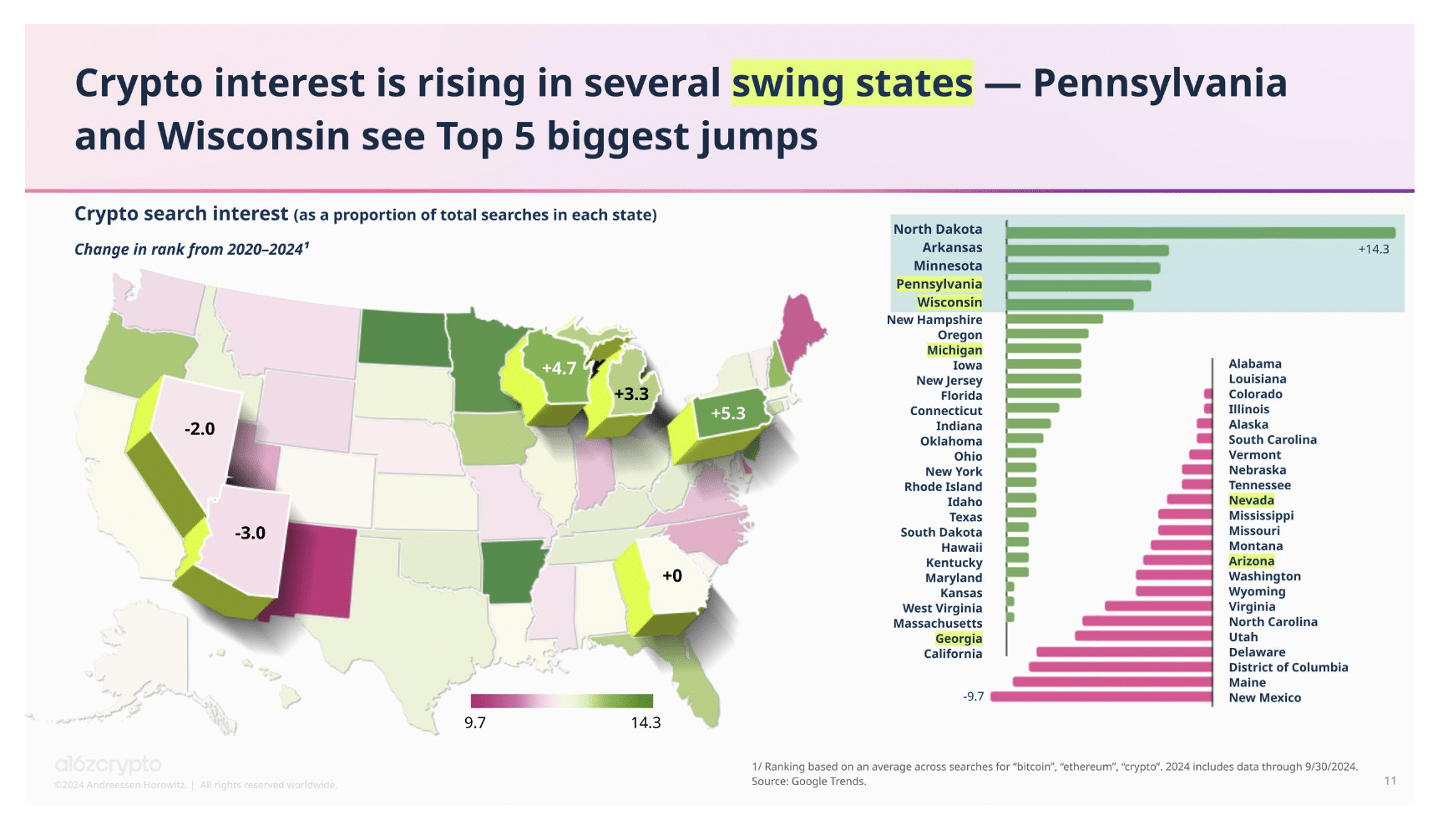

Notably, crypto interest has been growing in politically influential swing states, such as Pennsylvania and Wisconsin, since the last election.

“Crypto has become a key political issue ahead of the U.S. election,” said 16z.

In previous reports, a16z consistently emphasized U.S. regulatory uncertainty as a key obstacle. However, this year’s analysis brings crypto’s growing role in political discourse to the forefront.

The report revealed increasing bipartisan efforts toward regulatory clarity. This signifies a shift in government approach as crypto gained traction in critical swing states like Pennsylvania and Wisconsin.

Source: a16zcrypto.com

What’s more to it?

All in all, this development highlights crypto’s evolving influence not only in the tech and finance sectors but also within the political sphere, where clear guidelines are becoming essential for future grow

However, despite some declines in core indicators, such as active and interested developers, a16z’s ‘State of Crypto Report’ suggests a robust outlook for the industry.

By prioritizing and weighing specific progress metrics, the index indicates that crypto’s overall advancement is close to record highs.