- SOL’s network activity remained high last month.

- The token’s technical indicators suggested a price decline to $127.

Solana [SOL] has witnessed a major inflow of funds into the network that reflected the rise in the blockchain’s adoption and usage. This development can be considered to be optimistic as it indicates that investors’ trust in Solana is increasing.

But will this episode have any positive impact on the token’s price?

Solana’s new milestone

IntoTheBlock recently posted a tweet highlighting an interesting development in the Solana ecosystem. As per the tweet, over $100 million has been bridged from all other chains to Solana in the last 7 days. This also included more than $70 million from Ethereum.

Since this seemed to be a large inflow of funds into the network, AMBCrypto checked Artemis’ data to find out more about the blockchain’s network activity.

As per our analysis, after a short dip, Solana’s daily active addresses once again started to rise. Its daily transactions also remained pretty stable over the last 30 days, reflecting its high usage and adoption once again.

Apart from that, Solana’s state in the DeFu space looked optimistic as its TVL increased last month.

Source: Artemis

However, despite the new money flowing in, SOL’s performance in the captured value front did drop over the last few days or weeks. This was evident from the decline in its fees. Because of that, the blockchain’s revenue also started to plummet.

Will SOL be affected?

Since a lot happened in the blockchain’s ecosystem, AMBCrypto then planned to look at SOL’s state to see whether all factors were having any impact on the token’s price action.

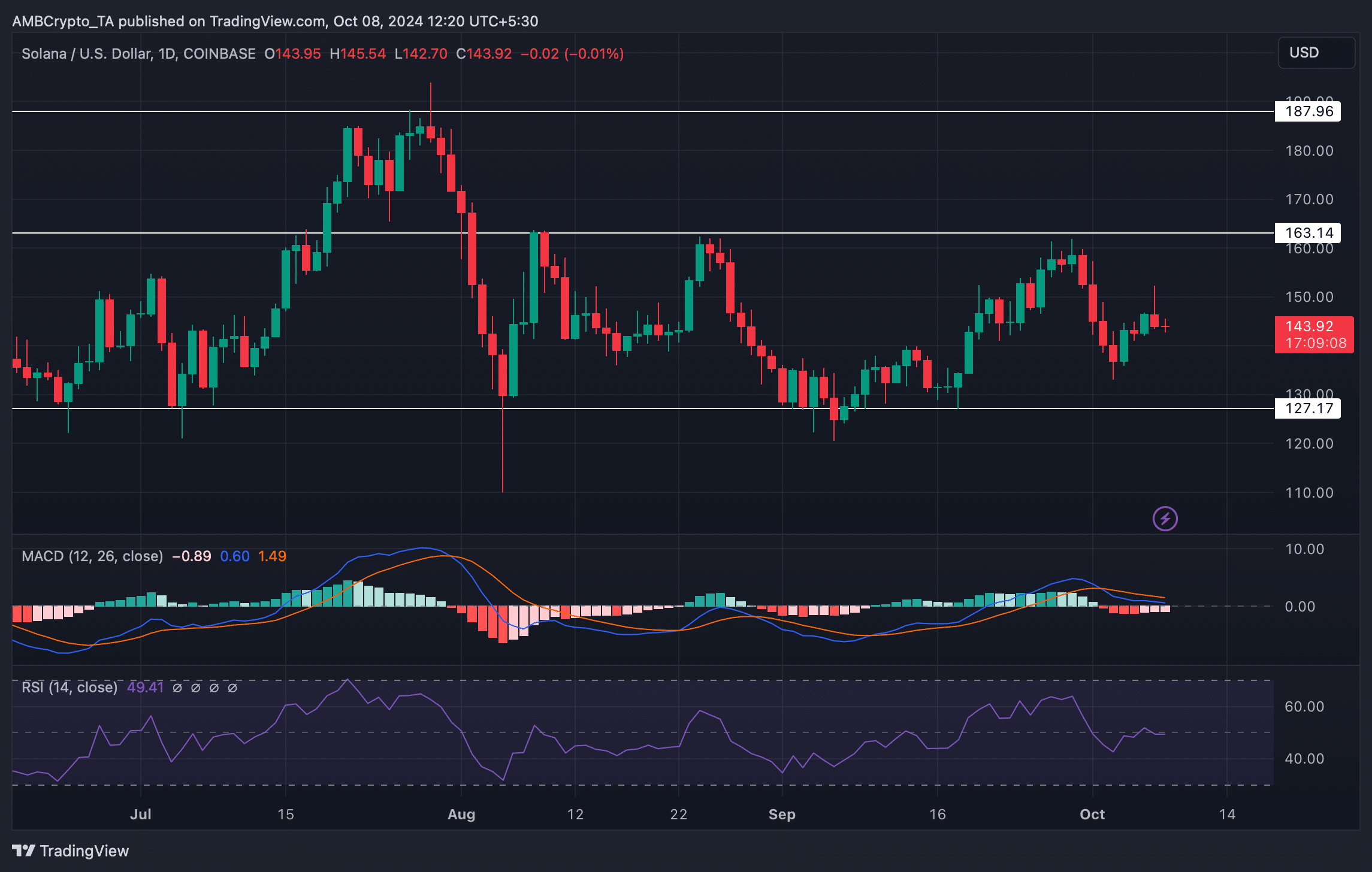

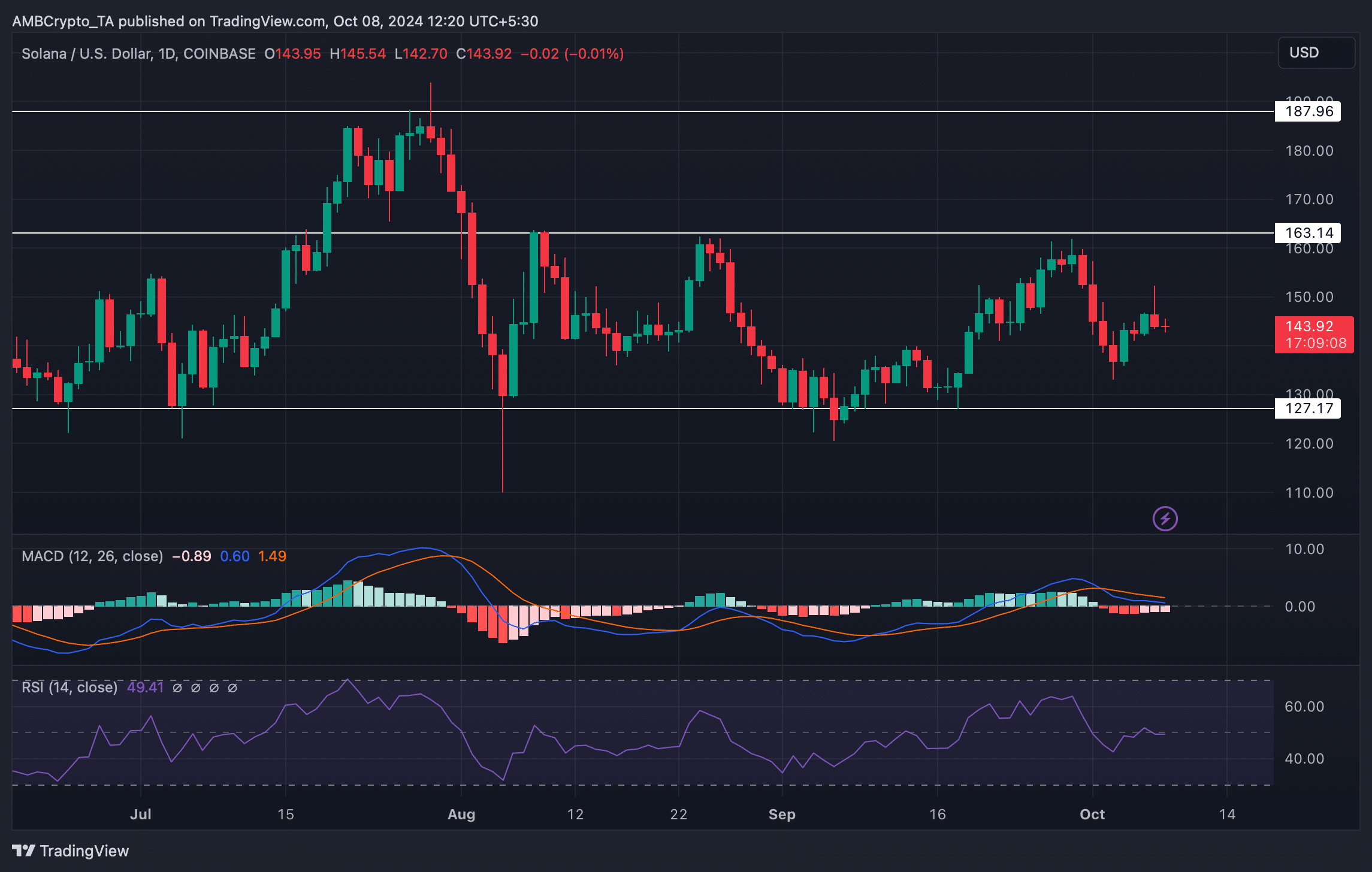

We found that SOL bears were dominating the market. The token’s price dropped by over 7% last week. In fact, in the last 24 hours alone, the token witnessed a 3% price decline.

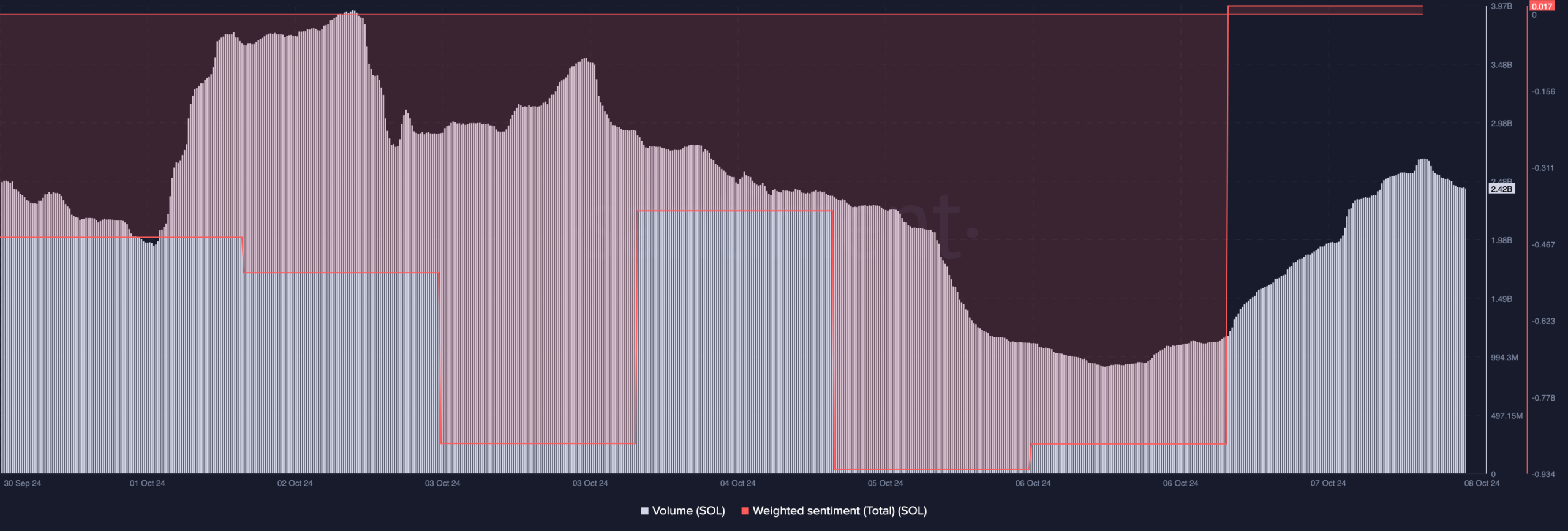

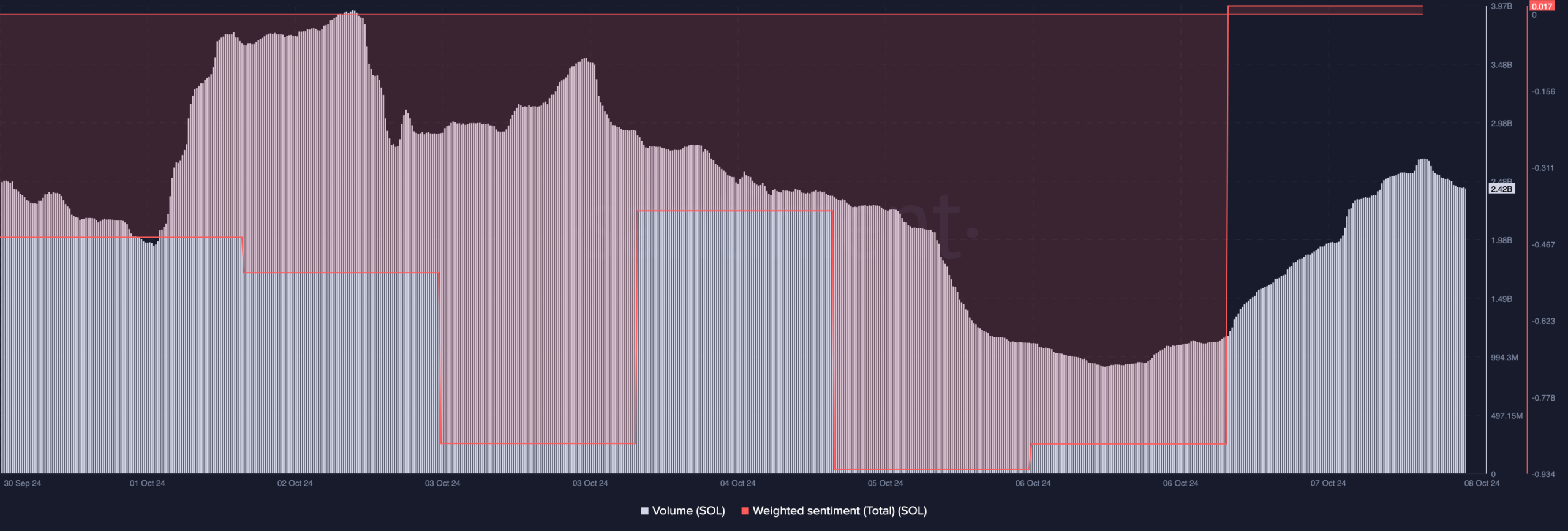

At the time of writing, Solana was trading at $144.03 with a market capitalization of over $67 billion. The bad news was that while SOL’s price dropped, its trading volume increased by over 40%, hinting at a continued price decline.

Nonetheless, investors’ confidence in the token increased. This was the case as SOL’s weighted sentiment moved into the positive zone, indicating a rise in bullish sentiment.

Source: Santiment

Read Solana’s [SOL] Price Prediction 2024–2025

Therefore, we checked Solana’s daily chart to find out more about where the token was headed. Despite the bullish sentiment rising, the technical indicator displayed a bearish advantage in the market.

The token’s Relative Strength Index (RSI) also registered a downtrend. These indicators suggested that SOL might drop to $127 in the coming days.

Source: TradingView