- Ethereum is repeating 2016 pattern.

- Geopolitical tensions impact the broader crypto market.

Ethereum [ETH] continues to present mixed signals as the fourth quarter (Q4) of the year begins. Historically, a bullish close in September has often led to positive market movements, but Ethereum seems to be following a different trajectory.

ETH closed green in September, closely tracking its 2016 pattern, which could indicate a potential red Q4. If this pattern continues, Q4 might see a decline, followed by a recovery in the first quarter (Q1) of 2025.

Ethereum’s price dynamics are intriguing, with its historical performance worth monitoring to see if it deviates from previous trends.

Source: X

Whales taking profit and unstaking

Ethereum’s current price behavior mirrors its 2016 pattern, suggesting a possible bearish turn in Q4. This expectation is reinforced by large investors, or “whales,” who are unstaking their ETH and securing profits.

Recently, a whale unstaked 29,480 ETH, transferring it to Coinbase for a profit exceeding $2 million.

Source: Onchain Lens

This kind of behavior often signals that big players anticipate a downturn, increasing the likelihood of a red Q4 for Ethereum. These actions add pressure on ETH’s price, with investors watching closely for potential declines.

ETH ETF flow and market movements

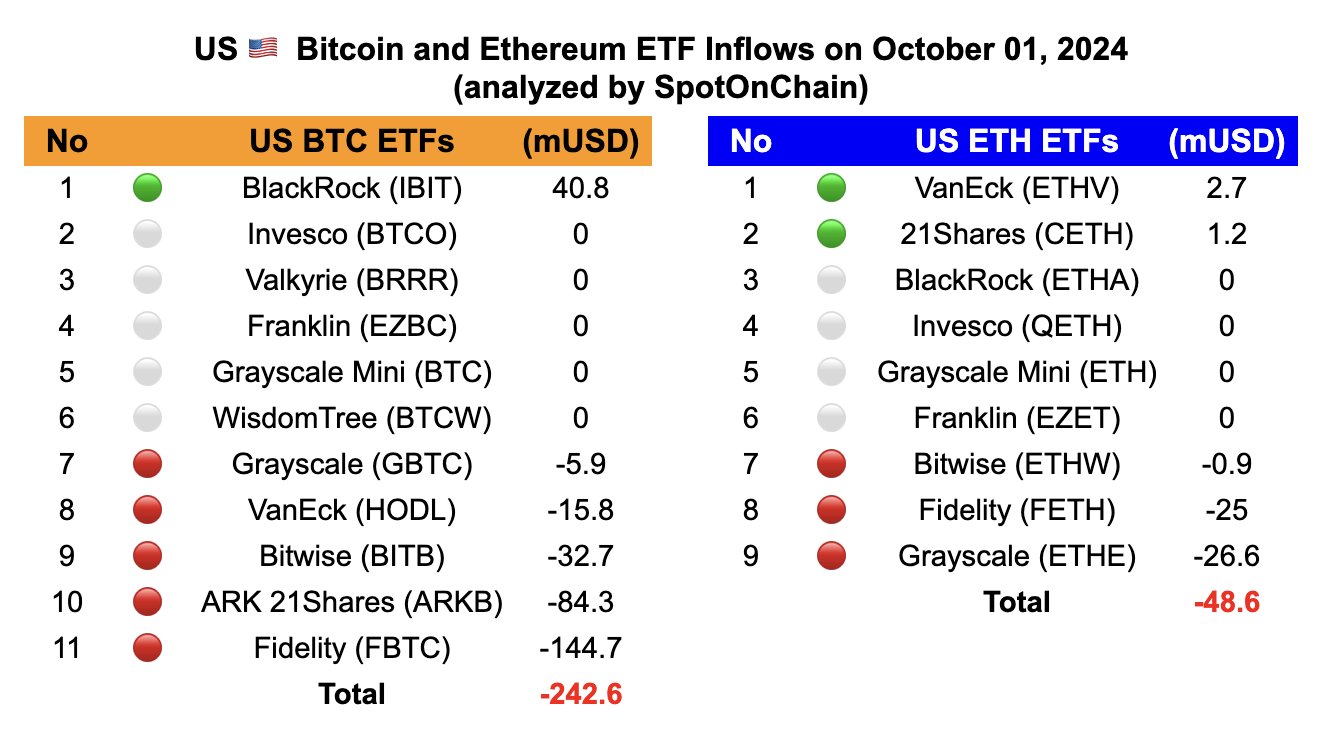

Ethereum has also experienced significant outflows from its exchange-traded funds (ETFs), further contributing to a cautious outlook. Since September 3, the market has seen its largest net outflows for both Bitcoin (BTC) and Ethereum ETFs.

ETH ETFs experienced outflows of $48.6 million, with major players like Grayscale and Fidelity witnessing large withdrawals. Although some smaller ETFs saw inflows, they were insufficient to offset the broader trend.

Source: SpotOnChain

This suggests that institutional investors may be positioning for a potential decline in Ethereum’s price in Q4, consistent with the broader market sentiment.

Geopolitical tensions impacting prices

The ongoing conflict in the Middle East has also affected the broader crypto market, including Ethereum. Both BTC and ETH experienced sharp declines, with ETH dropping below $2,500.

In the past 24 hours alone, 155,000 accounts were liquidated, amounting to $533 million, of which $451 million came from long orders.

These liquidations, especially in ETH, add further evidence to the possibility that Ethereum may follow its 2016 pattern of a red Q4.

Source: Coinglass

The combination of whale behavior, ETF outflows, and geopolitical tensions suggests that Ethereum may face challenges in Q4.

Read Ethereum’s [ETH] Price Prediction 2024–2025

While ETH’s price has shown strength, historical patterns and current market conditions indicate that it might experience a decline before potentially recovering in early 2025.

Investors should remain cautious and monitor these developments closely, as any deviation from the pattern could present both risks and opportunities for ETH in the months ahead.