- APT anticipates a token unlock on 11th September, which could lower the asset’s price due to an increase in supply.

- However, there remains significant buying pressure, suggesting that APT’s price may continue to rise.

Over the past month, Aptos [APT] has seen a price increase of 3.87%, with a daily gain of 3.44%, showcasing robust fundamentals not commonly found in many other cryptocurrencies that are struggling to stabilize post-market downturn.

However, these gains are at risk of being erased if traders react negatively to the upcoming increase in supply.

Token unlocks may intensify selling pressure

According to Token Unlocks, a significant volume of APT is scheduled to be released into the market on 11th September, thereby increasing its supply. This upcoming unlock will release 11.31 million APT, representing 2.32% of the circulating supply, valued at $66.05 million.

Token unlocks allow previously restricted tokens to become available for trading or transfer. In APT’s case, the beneficiaries of this unlock include the community, private investors, the Aptos Foundation, and team members.

While the specifics of this unlock have been previously noted, an increase in circulating supply often leads major holders to liquidate their positions to secure profits or minimize their holdings to avoid losses.

Should this influx of available tokens not be met with equivalent buying interest, the price of APT is likely to decline.

Bearish sentiment is gradually building

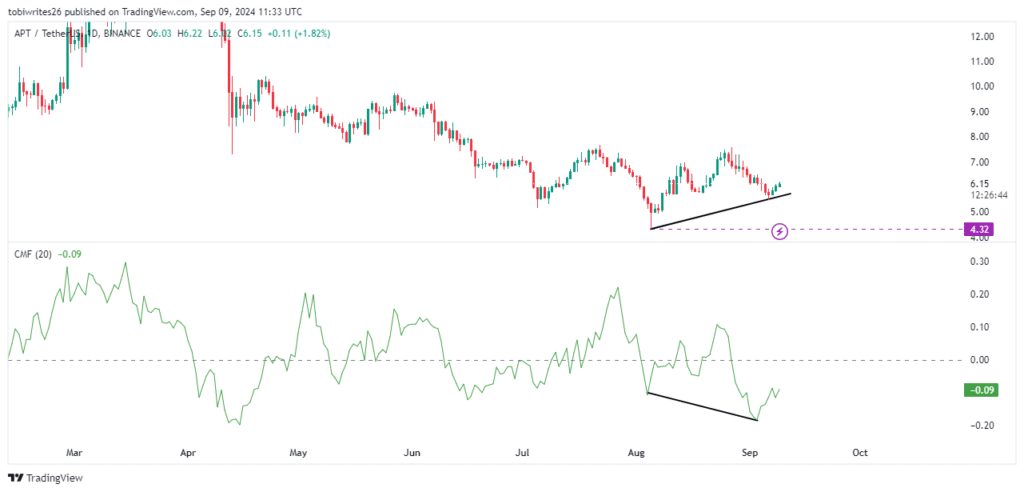

As the token unlock approaches, the bears are present. This was evident from the divergence between the price of APT and the Chaikin Money Flow (CMF).

The CMF is an indicator that measures the volume-weighted average of accumulation and distribution over a specified period. Essentially, it helps traders assess the flow of money into or out of an asset, signaling buying or selling pressure.

At press time, while the APT price has shown a significant upward movement (the black line trending up), the CMF has moved downward (the black line trending down), creating a notable divergence.

Source: Trading View

This divergence suggests that despite rising prices, there is diminishing financial support for these increases—indicating weak liquidity from buyers and growing selling interest.

This could potentially lead to a downturn in price as sellers begin to dominate over faltering buyer momentum. If this trend persists into the token unlock event, the price of APT will likely begin to trend lower.

However, AMBCrypto has identified conditions that might counteract this bearish outlook in the market.

The bulls are still a dominant force

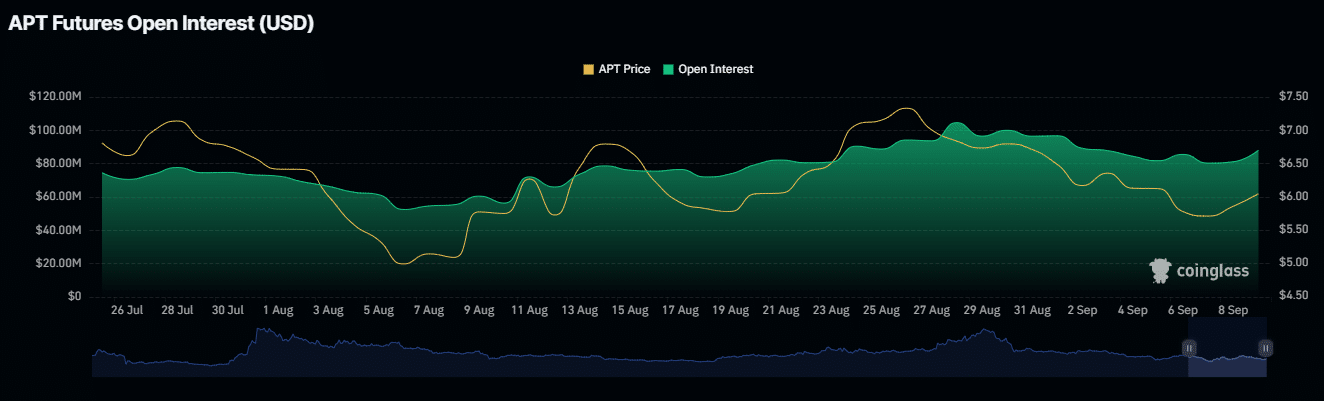

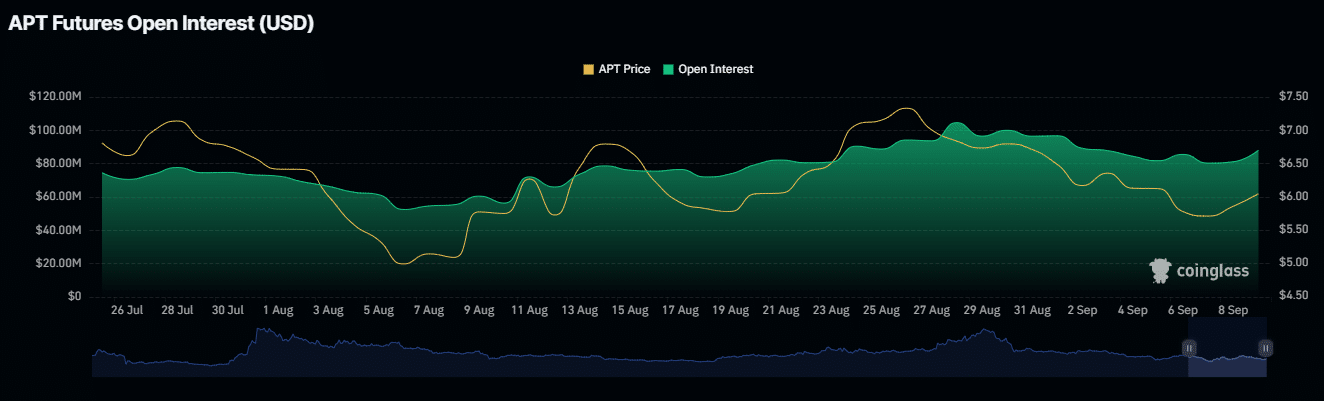

AMBCrypto’s analysis of Aptos price movements and on-chain Open Interest (OI) metrics suggest a potential rally as the token unlock approaches—and possibly beyond—if bullish forces maintain their strength.

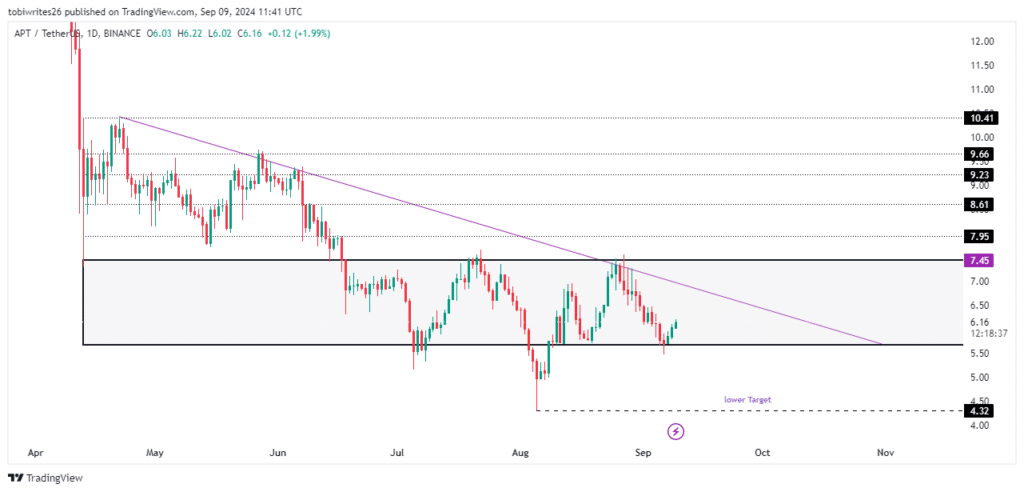

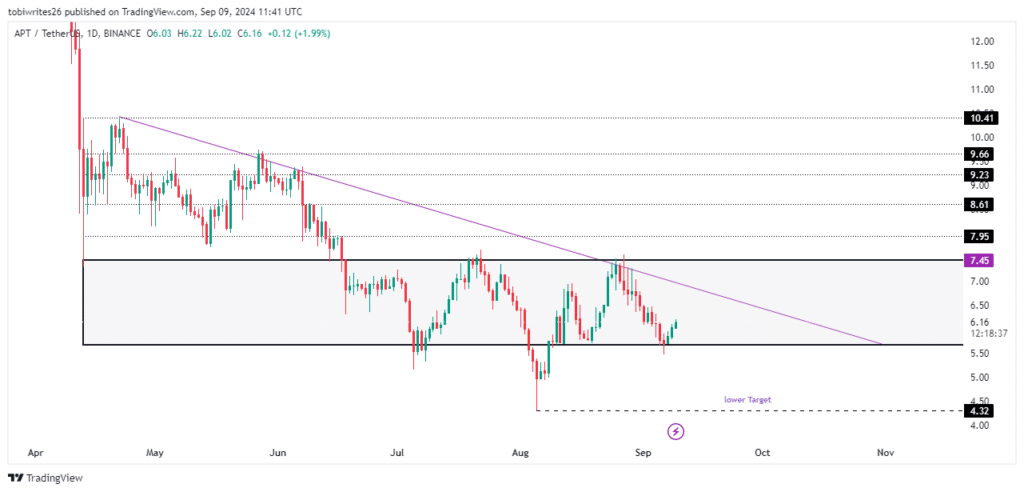

APT is currently displaying two major patterns: the price is consolidating within a rectangular range, oscillating back and forth while intersecting with a descending trendline.

This behavior indicates that investors are actively accumulating APT in anticipation of breaking out from both the descending line and the consolidation phase.

Should this breakout materialize, AMBCrypto has identified six key price targets: $7.45, $7.95, $8.61, $9.23, $9.66, and $10.41.

Source: TradingView

Read Aptos’ [APT] Price Prediction 2024-25

Open Interest data on Coinglass reinforces this optimistic scenario, showing a significant uptick—OI has risen by 8.59%, driving it to $90.64 million.

Source: Coinglass

Conversely, if bearish pressures gain the upper hand, APT could potentially plunge below the consolidation channel’s lower boundary, potentially reaching down to $4.32 from an initial $5.73.