- Litecoin surged by 10.32% on the weekly charts, as analysts eyed a 40% rally.

- Whales transactions over the past seven days hit $17.3 billion.

In the last two weeks, the crypto market has experienced considerable volatility. Despite the fluctuations, Litecoin [LTC] has defied the trend to define its unique path.

Inasmuch, LTC’s price action has left analysts speculating a sustained bull run.

One major factor pushing LTC’s market sentiment is positive whale activities. Over the past three months, LTC has witnessed a sustained surge in large holders, hitting $3.6 billion in large holder transactions on daily charts.

Prevailing market sentiment

Litecoin’s current price movement has left analysts eyeing a major breakout. Analyst Crypto Whales similarly bet big on the altcoin, noting that,

“Litecoin has broken out of a falling wedge pattern on the intraday chart. This breakout signals the end of the previous downtrend. Expect a potential 40% bullish move following this breakout.”

According to his analysis, the altcoin will hit a $94.7 resistance level last witnessed on the 12th of April. However, other analysts such as Crypto Surf are using a historical cycle to make a future case for LTC.

Crypto Surf stated,

“Based on past cycles, LTC should start its bull run 15 to 19 months after its halving and 6 to 8 months after $BTC halving. So between Oct 2024 and Mar 2025.”

Litecoin: What price charts suggest

Litecoin was trading at $67.62 at press time, after registering 10.32% gains on weekly charts. However, the altcoin’s trading volume has declined on daily charts by 24.8% to $205.5 million.

However, despite the decline in trading, LTC was experiencing a strong upward movement.

Source: TradingView

The altcoin’s Advance Decline Ratio (ADR) was above 1 at 1.93, suggesting increased buying activity. This suggested that LTC was reporting more highs than lows, indicating a positive outlook among investors.

Also, the altcoin’s RVGI, at 0.31, was positive, suggesting strong upward price movements. This meant that closing prices are higher than the opening prices at press time, which is a bullish signal.

Source: TradingView

Additionally, the Aroon line showed a strong upward movement. The Aroon Up line at 100% was above the Aroon down at 7.14%, suggesting that the uptrend was strong and sustained.

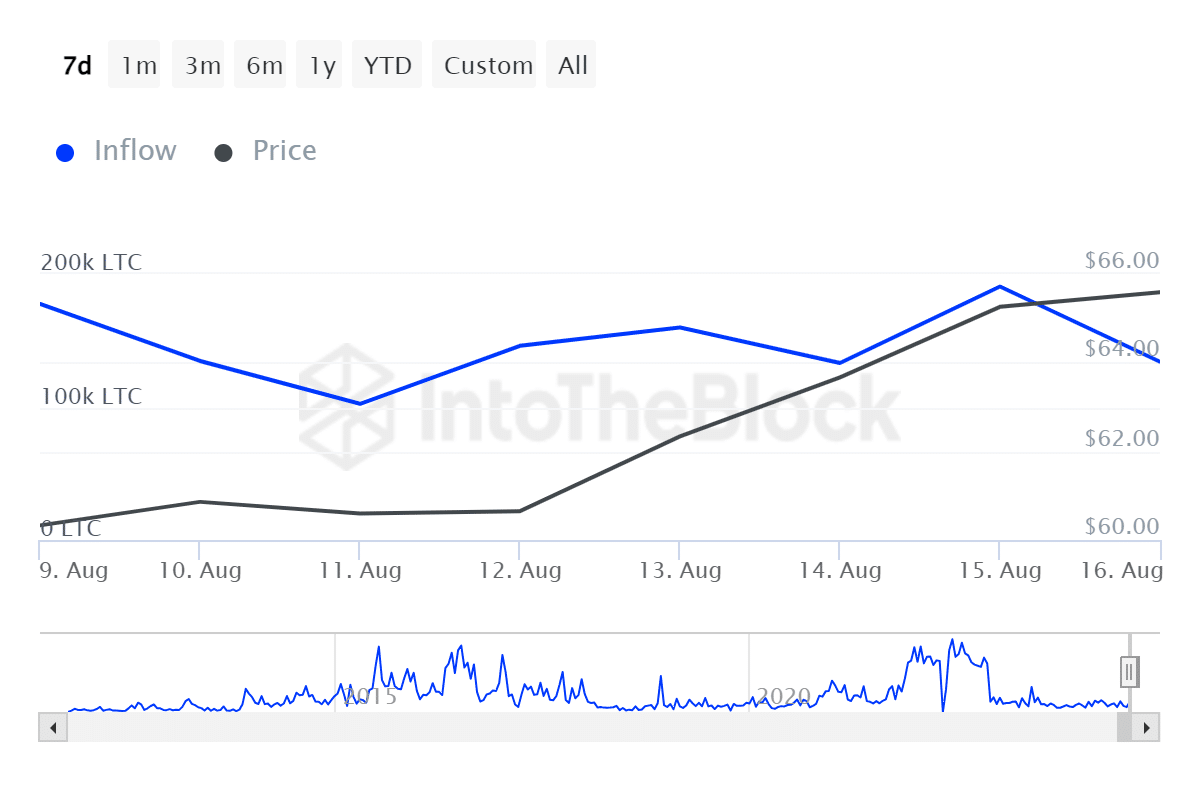

Source: IntoTheBlock

Looking further, LTC has enjoyed a considerable inflow from large holders, suggesting a positive sentiment among whales.

Data from IntoTheBlock showed that Litecoin’s large holders’ inflow on weekly charts has remained high, hitting a high of 190.5K tokens. These transactions have hit $17.3 billion over the past week.

So, there was increased confidence among whales in the future potential and trust in the direction.

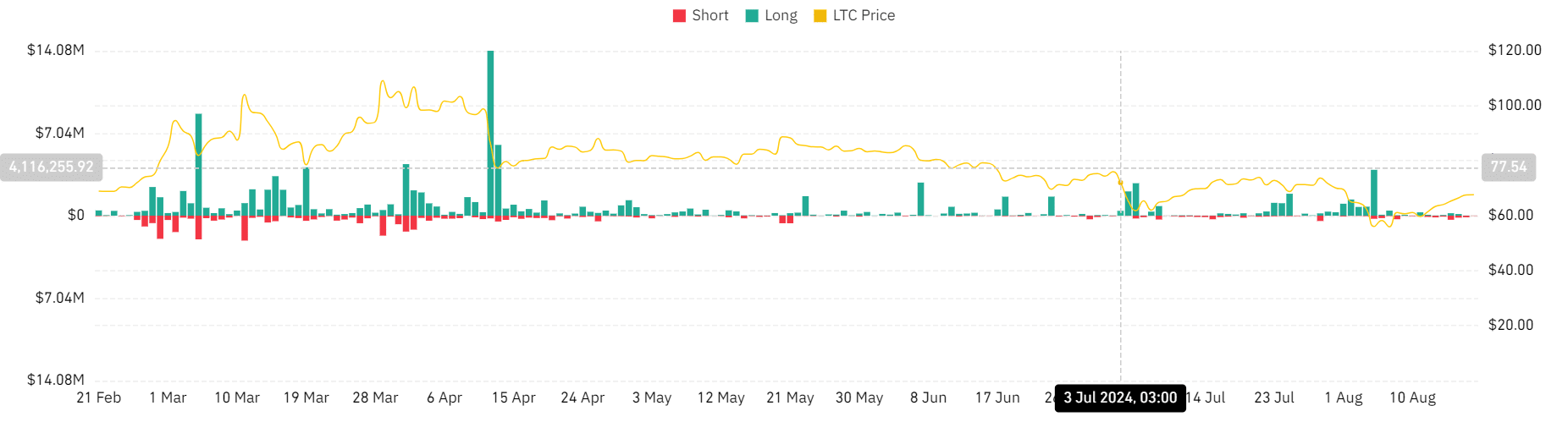

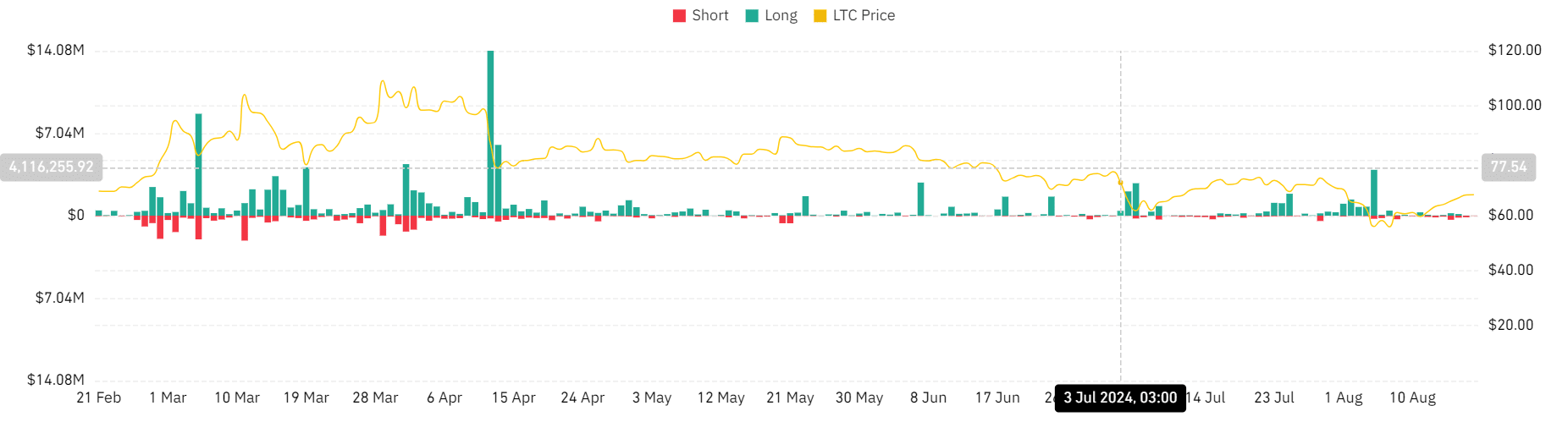

Source: Coinglass

Finally, AMBCrypto’s analysis of Coinglass data showed that the altcoin’s long position liquidation has declined over the past two weeks. Liquidation has declined from $3.9 million to $8.2K at press time.

Investors were confident with the altcoin’s direction, and lows could not liquidate their positions.

Is your portfolio green? Check out the LTC Profit Calculator

Therefore, LTC was enjoying positive market sentiment, accompanied by strong upward price movements.

In the case of a close on the daily candlestick above the $69.02 resistance level, the altcoin will breakout to the $76.67 resistance level.