- Ripple is accelerating plans to launch its RLUSD stablecoin

- It is facing competition from giants like USDT and USDC

Ripple recently unveiled further developments regarding the introduction of its stablecoin.

Despite this update, however, which generally might be viewed as a positive for the ecosystem, the response from the XRP market has been notably tepid so far.

Ripple begins stablecoin tests

Ripple has made progress in its stablecoin, Ripple USD (RLUSD), as detailed in a blog post dated 9 August. The company initiated beta testing of RLUSD on two major blockchain networks – The XRP Ledger (XRPL) and the Ethereum mainnet.

Additionally, Ripple has emphasized that RLUSD is pegged on a 1:1 ratio to the U.S dollar. Also, it is fully backed by a combination of U.S dollar deposits, short-term U.S government treasuries, and other cash equivalents. This backing is intended to ensure that the stablecoin maintains its value and stability in the market.

However, Ripple has also made it clear that RLUSD is not currently available for public purchase or trading. The stablecoin will only become available after the beta testing phase is completed and all necessary regulatory approvals have been obtained.

Ripple’s competitors

The stablecoin market, representing a multi-billion dollar sector within the cryptocurrency landscape, is highly competitive and dominated by a few major players. As Ripple prepares to launch its stablecoin – Ripple USD (RLUSD) – it faces the challenge of competing against well-established stablecoins like Tether (USDT) and USD Coin (USDC).

In fact, press time data from CoinMarketCap indicated that the total market capitalization of stablecoins exceeded $170 billion. Also, Tether (USDT) commands a majority of this market with a staggering market cap of over $115 billion, making it the most dominant stablecoin. Additionally, USD Coin (USDC) holds the second position, with a market capitalization of more than $34 billion.

Other stablecoins like DAI and First Digital USD (FDUSD) also hold considerable shares, with market caps of over $5 billion and $1.9 billion, respectively.

How XRP reacted to the news

Despite the potentially exciting news about Ripple, the market reaction of XRP appeared subdued.

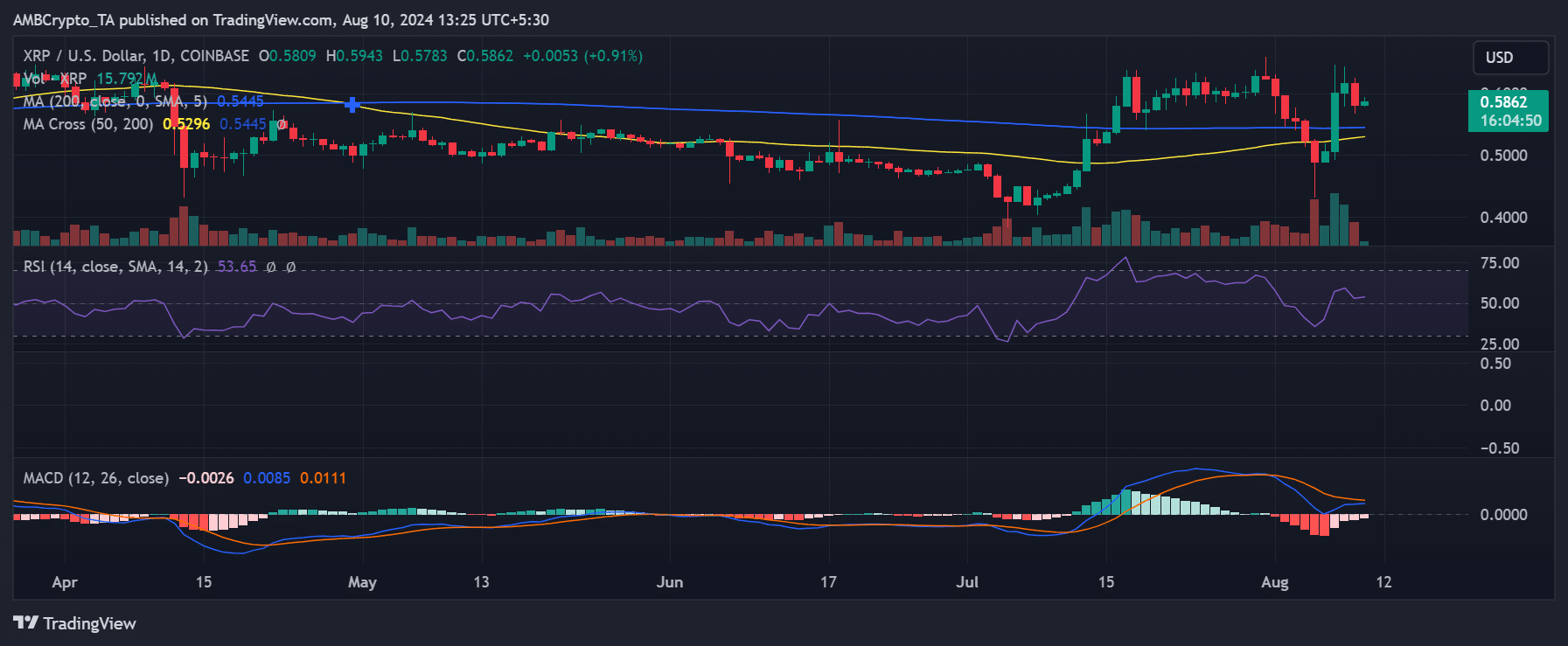

AMBCrypto’s analysis of the daily chart revealed that the price of XRP registered a significant decline of 5.81% by the close of trading on 9 August. This drop saw the price fall from approximately $0.61 to about $0.58.

Source: TradingView

At the time of writing, XRP was trading with a marginal hike of less than 1%, hovering around the $0.58 level. This lack of positive price suggests that the market is yet to fully absorb the potential implications of the new stablecoin.

It could also mean other market factors are overshadowing this development.

How derivative traders moved

The lack of enthusiasm among traders for XRP was further reflected in the funding rate data from Coinglass. At press time, XRP’s funding rate stood at -0.0030%, indicating bearish sentiment among market participants.

– Realistic or not, here’s XRP market cap in BTC’s terms

A negative funding rate typically means that shorts are paying longs to keep their positions open. This can also be interpreted as a sign that more traders are betting against the price of XRP, than are betting for it.