- Toncoin volume indicators conflicted, but the higher timeframe trend remained bearish.

- The momentum and market sentiment recently signaled that further losses were likely.

Toncoin [TON] was trending downward across multiple timeframes. Recent reports found that the bearish momentum was gaining strength, but the Futures market data had presented some hope.

However, Bitcoin [BTC] faced bearish pressure after hopes of a bullish September were hurt. The market-wide sentiment saw TON fall out beneath the range it formed in early June.

Prices are headed below the $6 level

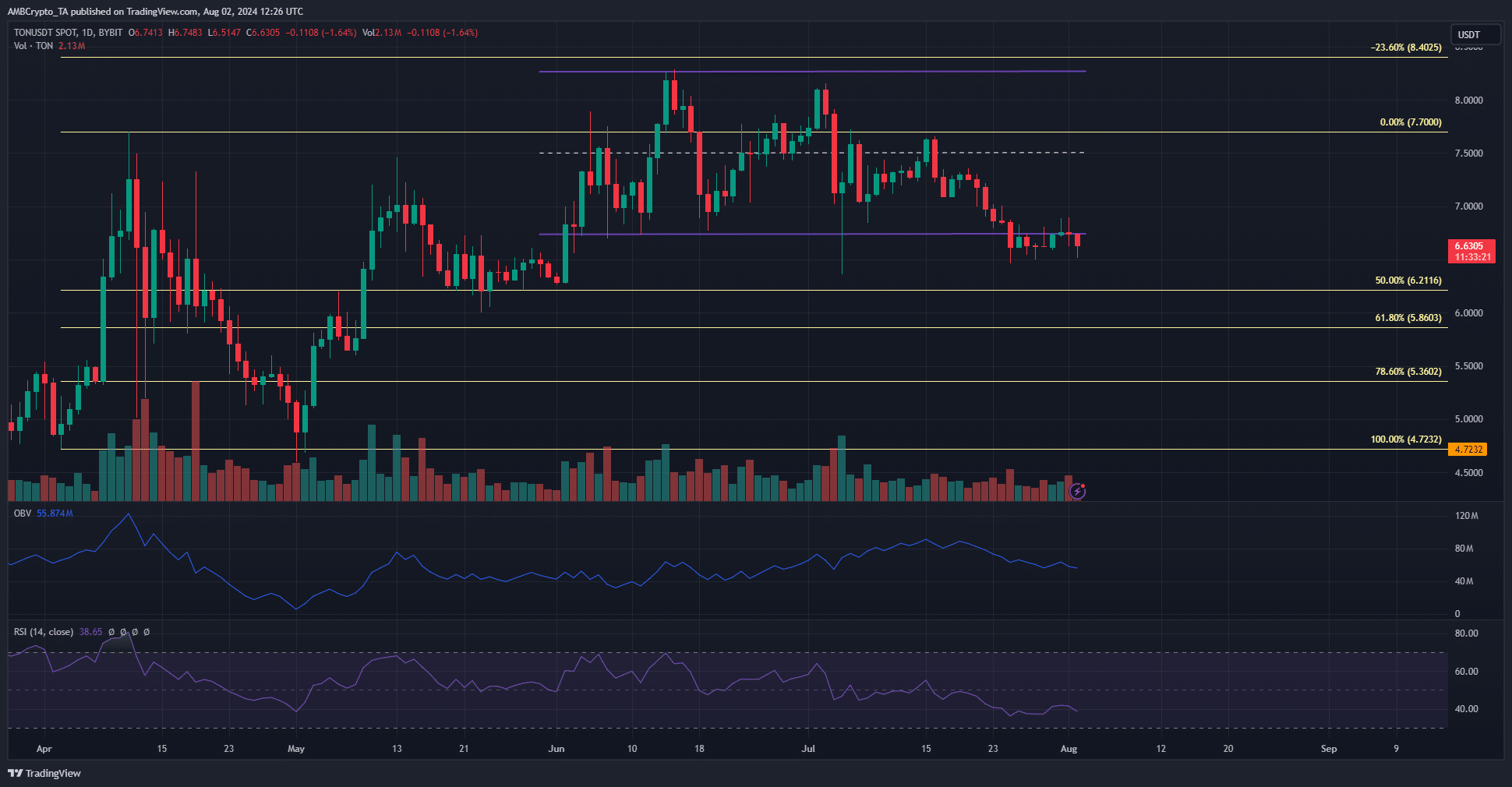

Source: TON/USDT on TradingView

Since early June, Toncoin has traded within a range that reached from $6.74 to $8.27. Over the past week, the lows of this range were breached and converted to a resistance zone.

On the back of this development, the OBV continued its downward slide. This was a strong sign that this wasn’t a deviation, but a continuation of the past month’s downtrend.

The daily RSI was also bearish. The Fibonacci retracement levels outlined the next support levels at $6.21, $5.86, and $5.36. The failure to defend the range lows meant a move below $6 was likely in August.

What will revive TON’s bearish bias?

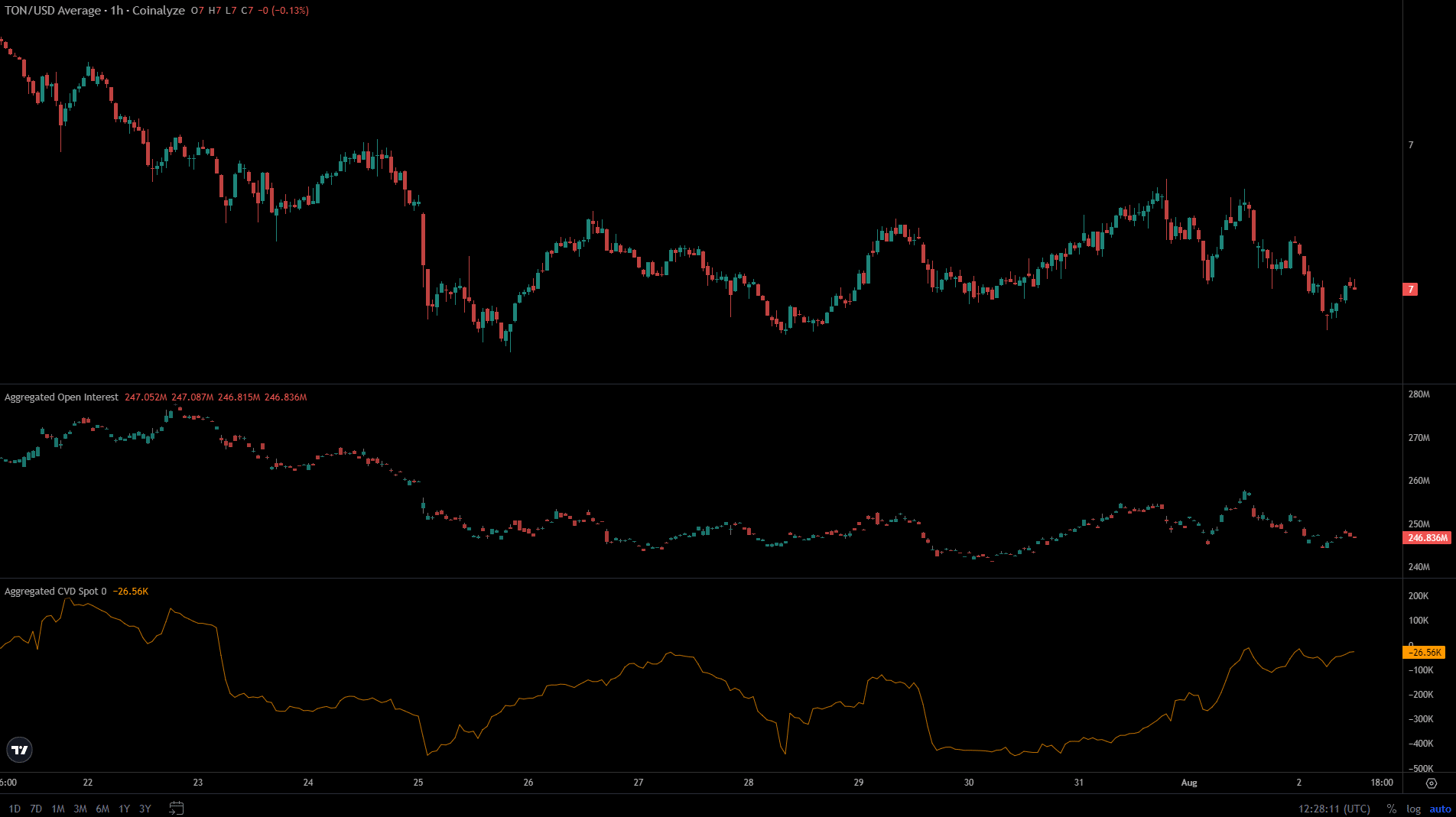

Source: Coinalyze

The Open Interest has fallen from $257 million to $246 million in the past two days. This came alongside a Toncoin rejection at the $6.84 short-term resistance, an area that served as resistance since the 26th of July.

Is your portfolio green? Check out the TON Profit Calculator

So far, all the factors outlined a bearish future for TON. However, the spot CVD was moving higher at a surprising rate.

Its findings opposed that of the OBV’s. This increased buying pressure over the past couple of days might not be enough to initiate a price recovery, but it could introduce a short-term move back toward the $6.8 region.

Disclaimer: The information presented does not constitute financial, investment, trading, or other types of advice and is solely the writer’s opinion.