- Nearly $3 billion in BTC and ETH options expire, with traders bracing for major volatility and key price action.

- Market makers reposition amid holiday trading lull as $98K BTC and $3,700 ETH levels dominate attention.

Bitcoin [BTC] and Ethereum [ETH] options contracts worth $3 billion were set to expire on the 13th of December. These expirations often lead to increased market activity, with traders closely watching potential price movements.

At press time, Bitcoin was priced at $100,073, while Ethereum was trading at $3,881.12, according to Coingecko data.

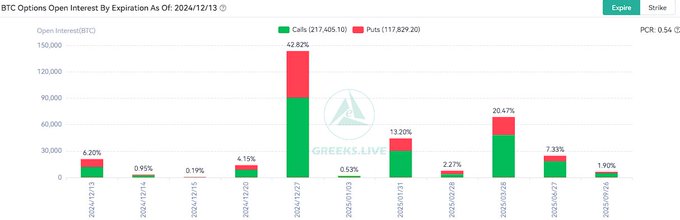

Bitcoin options worth $2.1 billion near expiry

Bitcoin has $2.1 billion in options contracts expiring. The put-call ratio stands at 0.83, indicating more call options (bullish bets) than puts (bearish bets).

The max pain point—the price level where most options will expire worthless—is $98,000.

Source: X

With Bitcoin’s market cap at $1.98 trillion and a circulating supply of 20 million coins, traders are monitoring its next moves.

The 24-hour trading volume for BTC has reached $94.48 billion, suggesting heightened activity as the expiration approaches.

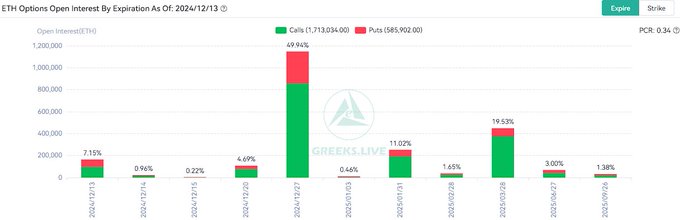

Ethereum options see $640M expire

Ethereum has $640 million in options expiring, with a put-call ratio of 0.68, showing even stronger bullish sentiment than Bitcoin. The max pain point for ETH is $3,700, a critical level that traders are watching closely.

Source: X

Ethereum’s trading volume over the past 24 hours stands at $44.47 billion, with a market cap of $467.65 billion and a circulating supply of 120 million ETH.

Though ETH has seen a slight 0.63% price decline in the last 24 hours, its week-to-week performance remains flat, reflecting a wait-and-see attitude among traders.

Market makers reposition as liquidity declines

According to Greeks.live, market makers are shifting their positions during this period of expirations, which coincides with reduced trading volumes during the holiday season.

Analysts have noted rising Implied Volatility (IV), indicating that markets are preparing for sharper price movements. “Lower liquidity during the holidays often magnifies market volatility,” said analysts at Greeks.live.

They also highlighted the growing correlation between crypto prices and U.S. stock markets, suggesting that equities’ price swings may influence cryptocurrency movements.

Economic data adds complexity

The expiration of these options comes after a week of economic developments in the U.S. November’s inflation rate increased to 2.7%, with core CPI at 0.3%, signaling ongoing inflationary challenges.

Read Bitcoin’s [BTC] Price Prediction 2024-25

While a Federal Reserve rate cut is expected, concerns remain about whether inflation will delay easing.

These factors, combined with the expiration of billions in crypto options, could create heightened market activity.