- Massive inflow of ETH into exchanges as ICO continue to sell

- The Dencun upgrade has seen ETH lose some revenue going to L2s

Ethereum (ETH), the market’s second-largest cryptocurrency after Bitcoin (BTC), has been at the end of increasing selling pressure lately. Especially as traders move ETH to exchanges.

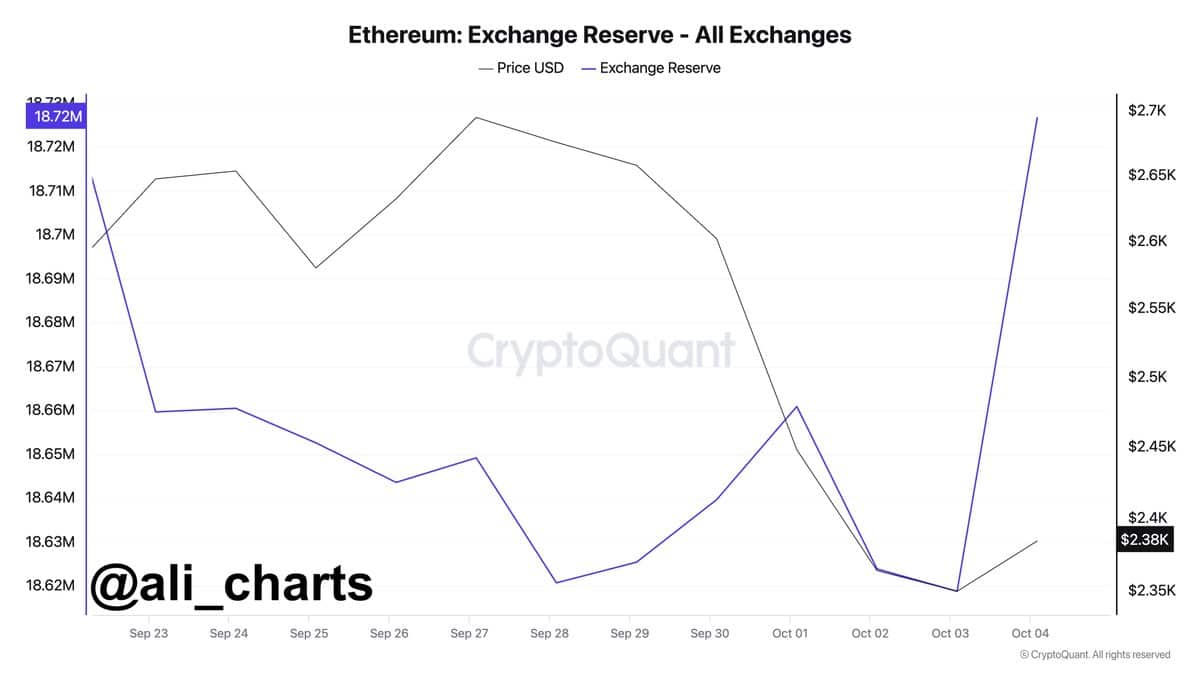

At press time, over 108,000 ETH, valued at roughly $259.2 million, had been sent to exchanges within a period of just 24 hours.

Such an influx often points to a potential decline in ETH’s price. This, because higher supply, combined with stagnant demand, tends to drive prices lower.

Source: Ali/X

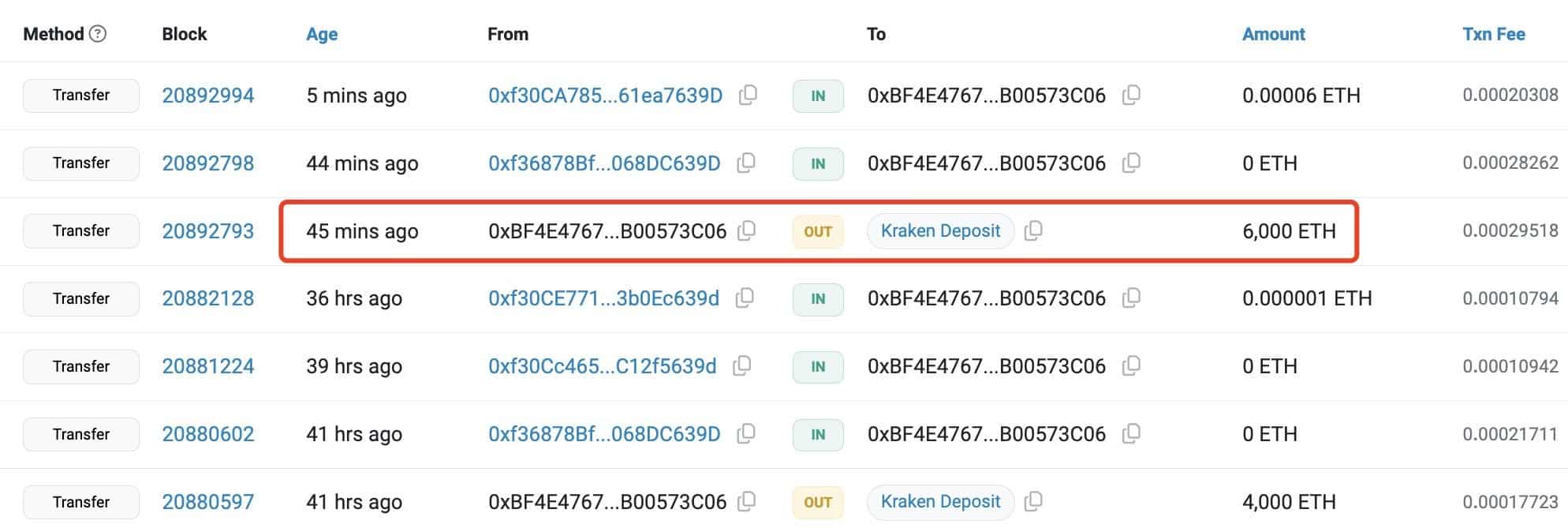

Additionally, an Ethereum Initial Coin Offering (ICO) participant has been steadily selling ETH lately.

Recently, they sold 6,000 ETH worth $14.11 million, bringing the total to 40,000 ETH sold since 22 September 2024. These sales were made at an average price of $2,525.

Despite these transactions, the ICO participant still holds 99,500 ETH, valued at approximately $238 million, indicating potential selling pressure in the future.

Source: Lookonchain

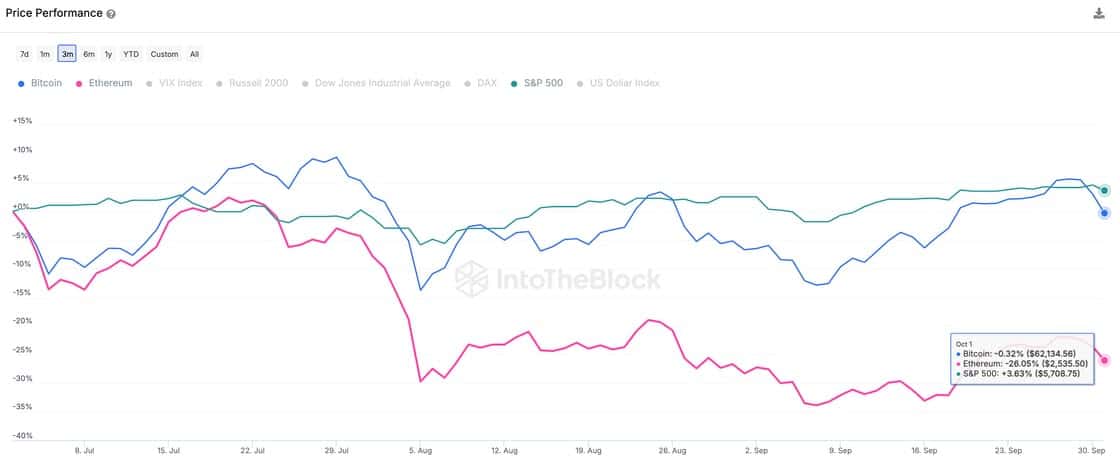

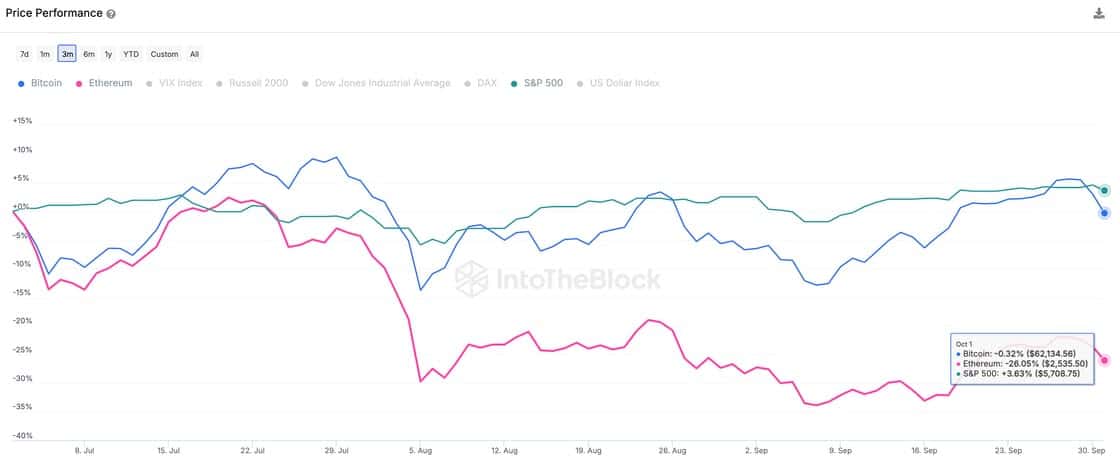

ETH’s price performance compared to other assets

ETH has also been underperforming, compared to other risk-on assets like Bitcoin and the S&P 500.

While BTC has seen a slight decline of 0.32%, and the S&P 500 has seen a positive change of 3.63%, ETH has dropped by a significant 26% over the past three months.

The total fees on the Ethereum network have also declined by 43.9%, reaching $247.6 million. The drop in fees is contributing to Ethereum’s struggles. Over the last quarter, on-chain activity on Ethereum’s Mainnet decreased too.

Source: IntoTheBlock

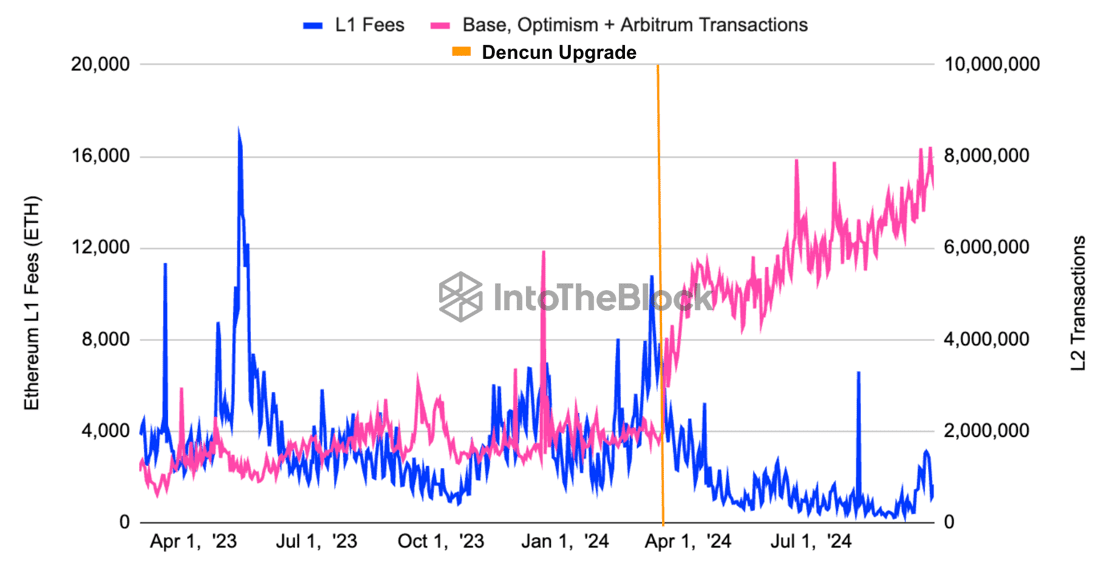

The Impact of the Dencun upgrade

The Dencun upgrade has also played a role in Ethereum’s underperformance. This update, which included EIP 4844, reduced Layer 2 (L2) transaction costs by over 10x, resulting in a boom in L2 activity.

As a result, ETH’s Mainnet fees have plummeted, reaching an all-time low. This has affected the amount of ETH being burned, making the cryptocurrency inflationary again after previously following a deflationary path.

Source: IntoTheBlock

The summer lull and sideways trading in traditional markets caused on-chain fees to drop to multi-year lows. Lower fees and less ETH being burned are similar to a company facing declining revenues and halting stock buybacks. With these changes, it’s not surprising that ETH’s price has struggled.

Additionally, the long-term benefits ETH can capture from L2s’ miner extractable value (MEV) are still uncertain.

L2s’ Influence on ETH and Optimism’s rise

Finally, Optimism (OP), one of the leading Layer 2 networks on Ethereum, has seen its governance token outperform others.

In Q3, the OP/ETH pair rose by 28%, benefiting from greater on-chain activity on L2s, meaning it is outperforming Ethereum.

Optimism’s rise, partly due to Coinbase’s Base L2 operating on the Optimism Superchain, underlines the growing dominance of L2s. This continues to affect Ethereum’s value.

Source: IntoTheBlock